Embracing disruption

Unlocking India’s energy transition: opportunities and challenges

Coal reliance and renewable ambition

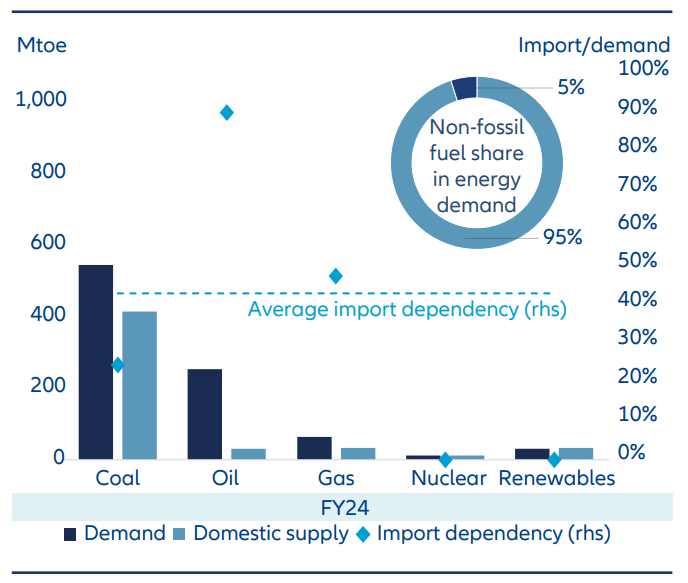

India’s energy landscape presents a striking paradox. On the one hand, coal consumption has surged in the postpandemic period. In FY24, the country produced 997.2 million tonnes of coal, a 12% year-on-year increase. And coal-fired power plants still generate around 70% of India’s electricity, highlighting a deep reliance on fossil fuels.

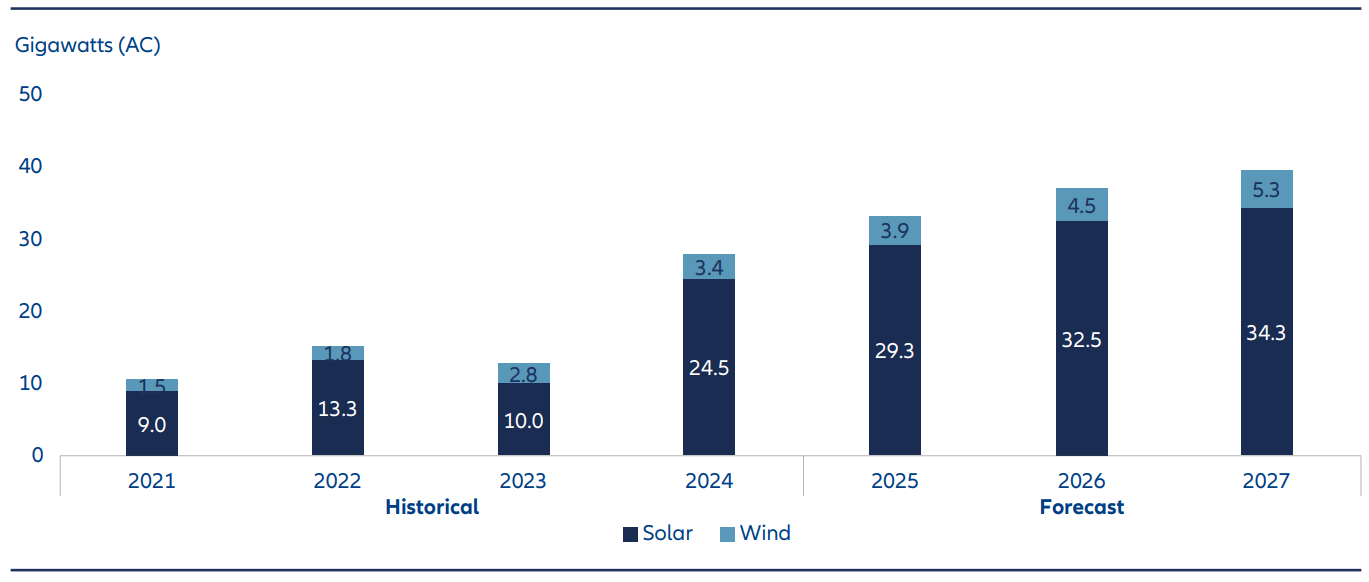

On the other hand, India is rapidly emerging as a major force in renewable energy. It now ranks fourth globally in total installed renewable capacity and became the third-largest solar power producer in 2023, behind only China and the United States. The growth in solar energy has been especially remarkable – between 2014 and 2023, India’s installed solar capacity expanded more than 25-fold.

How can a country be seen as both a major polluter and a clean energy leader? This article explores the complex dynamics behind India’s energy transition and outlines key investment opportunities from this dual-track trajectory.

Balancing growth with sustainability and energy security

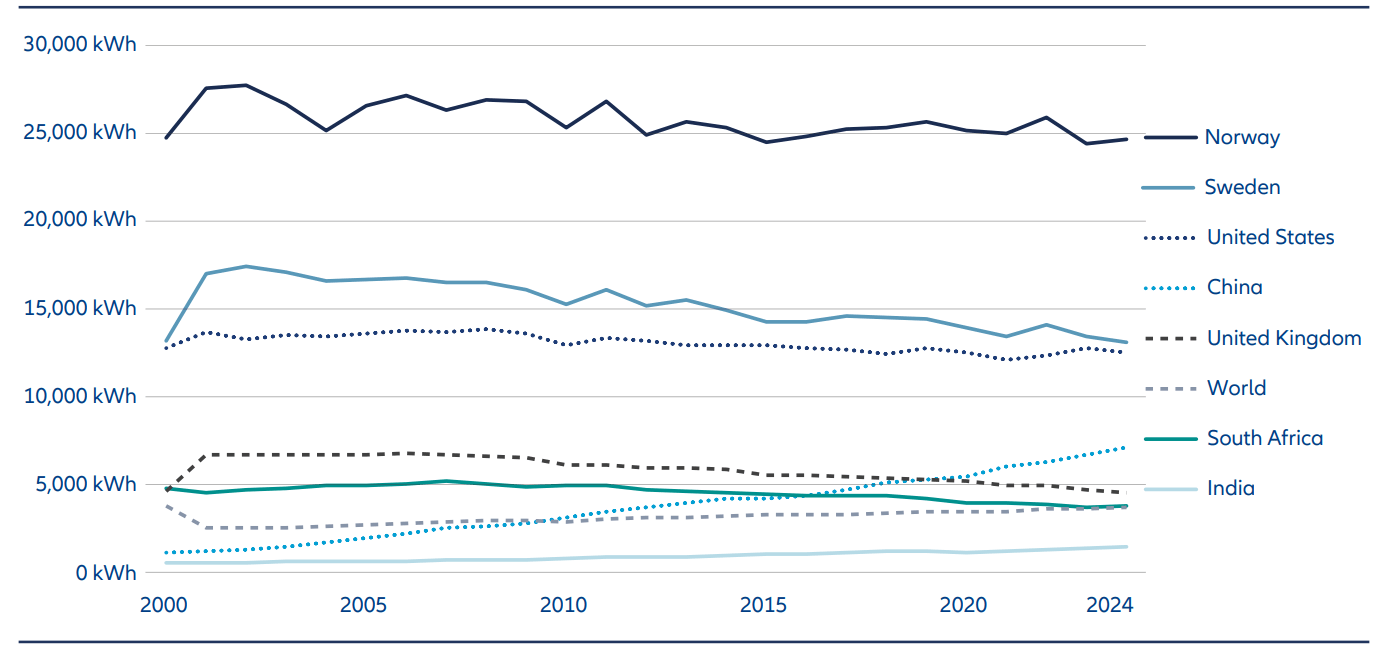

India is the most populous country in the world, yet its per capita energy consumption is just one-third of the global average – and only about one-thirteenth that of the United States. With India’s rapid economic growth and rising living standards, total energy demand is set to grow dramatically. The widespread adoption of refrigerators, air conditioning, electric vehicles, and industrialisation will require a power supply that is not only reliable but also continuous and abundant.

For emerging economies like India, energy access is more than a development target – it is a foundational driver of economic growth and a better quality of life.

Like China, India remains heavily dependent on fossil fuel imports. In recent years, the country has imported around 90% of its crude oil needs. This reliance poses both economic and strategic vulnerabilities. However, India’s natural endowments offer a path toward greater energy security through renewable sources such as solar and hydroelectric power.

Exhibit 1: Per capita electricity demand – kWh

Data source: Ember (2025); Population based on various sources (2024). OurWorldinData.org/energy | CC BY

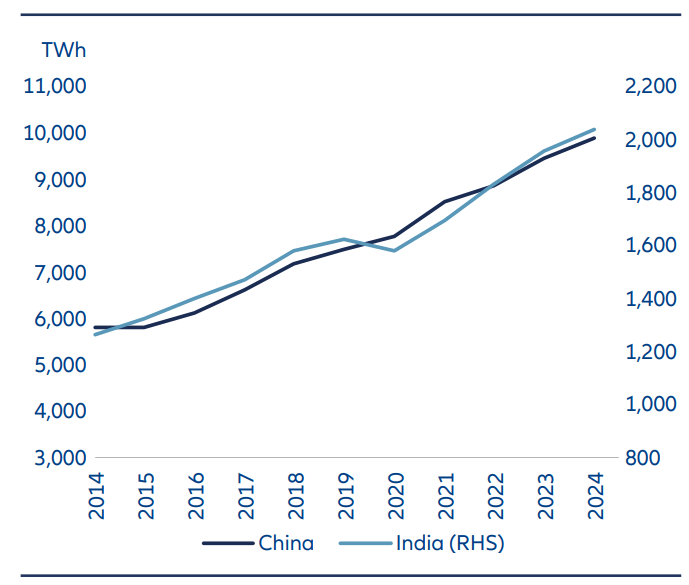

Exhibit 2: Electricity demand growth in the past decade

Source: BP Energy Statistics, Barclays Research

Exhibit 3: India’s energy surge: Balancing growth, decarbonization and energy security

Source: BloombergNEF 2025

Exhibit 4: India’s solar and wind additions, historical and forecast

Source: BloombergNEF

Geographically, much of India lies within the tropical zone, receiving sunlight for approximately 300 days a year. This solar exposure translates into an estimated theoretical potential of about 5,000 trillion kilowatt-hours annually across the country’s landmass, potentially making India one of the most solar-rich nations in the world. Additionally, India’s extensive river systems and mountainous regions – particularly in the Northeast and the Himalayas – provide a strong foundation for hydroelectric power. Yet, only about 29% of its estimated hydro potential has been harnessed so far, leaving significant room for future development.

The Indian Government pledged to generate about 40% of electricity from non-fossil sources by 2030 during the 2015 UN Climate Change Conference in Paris (COP21). Progress has been encouraging so far – over the last 5 years, around 80% of India’s newly installed power capacity has been renewable (solar/wind/hydro). Meanwhile, coal’s share of installed capacity has dropped from 61% in 2015 to 47% in 2025.

Looking ahead, to meet its surging energy demand without compromising energy security or grid stability, India will need to pursue a balanced strategy that includes both traditional and renewable energy sources. A diversified energy mix will be essential to ensuring reliability, affordability and sustainability as the country powers its future and transitions to a greener economy.

A (slightly) later mover advantage

The development of a green energy system is an extremely complex undertaking. It requires coordination across power generation, electricity transmission, distribution and trading, as well as intricate supply chains. In these areas, China is several years ahead of India in its energy transition. This presents an opportunity for India to learn from its neighbour’s experience – and potentially leverage China’s advanced manufacturing capabilities to accelerate its own progress.

Take solar energy as an example. While China’s renewable capacity expansion has largely been driven by top-down, KPI-focused mandates, India’s trajectory has followed a more market-driven path. In fact, India has already benefited from China’s well-known overcapacity in renewable equipment manufacturing. As of 2024, China had over 1,000 GW of domestic solar manufacturing capacity, far exceeding global demand which stood at around 600 GW. This oversupply led to a sharp drop in solar panel prices, making solar projects increasingly attractive from a commercial standpoint.

When combined with the predictable internal rate of return (IRR) offered under power purchase agreements mandated by the Indian government, this price decline has accelerated the rollout of solar farms across the country.

Another key lesson India can draw from China is the challenge of electricity transmission. Renewable energy is inherently variable and intermittent. Moreover, regions rich in renewable resources are often located far from major consumption centres – a challenge faced by both India and China. To address this, smart, flexible, and resilient grid systems, along with robust energy exchange platforms, are essential. These systems must be capable of efficiently transmitting gigawatts of power across 1,000-2,000 km corridors with minimal energy loss, while dynamically managing power flows to stabilise frequency and voltage. We anticipate that future waves of investment in India will focus heavily on electricity infrastructure.

Active stock selection to navigate the challenges

India’s energy transition comes with a set of unique challenges. These include difficulties in land acquisition, which can delay project execution; financial stress among some publicly backed electricity distribution companies; and the nascent state of its domestic renewable equipment supply chain, among others.

At Allianz Global Investors, we take an active approach to investing. By leveraging our global expertise in analysing energy transitions and combining it with a deep understanding of India’s domestic policies and industry dynamics, we aim to identify companies best positioned to lead - and benefit from - India’s green energy transformation.

Reference:

https://mnre.gov.in/en/solar-overview/

https://x.com/soicfinance/status/1804822670976180485

Solar Modules: Historic dip in Chinese solar module prices set to boost India’s solar capacity addition, ET EnergyWorld