A vast and diverse investment universe

Emerging Market Debt (EMD) is a vast and diverse investment universe. It represents a rapidly evolving asset class that aims to offer investors diversification benefits, enhanced yield, and return potential. The increasing importance of emerging market countries to global trade and GDP elevates the attraction of EMD. History shows us that investors can benefit from the higher return provided by Emerging Markets relative to Developed Markets for a given unit of volatility. We believe EMD should be an integral part of investor portfolios.

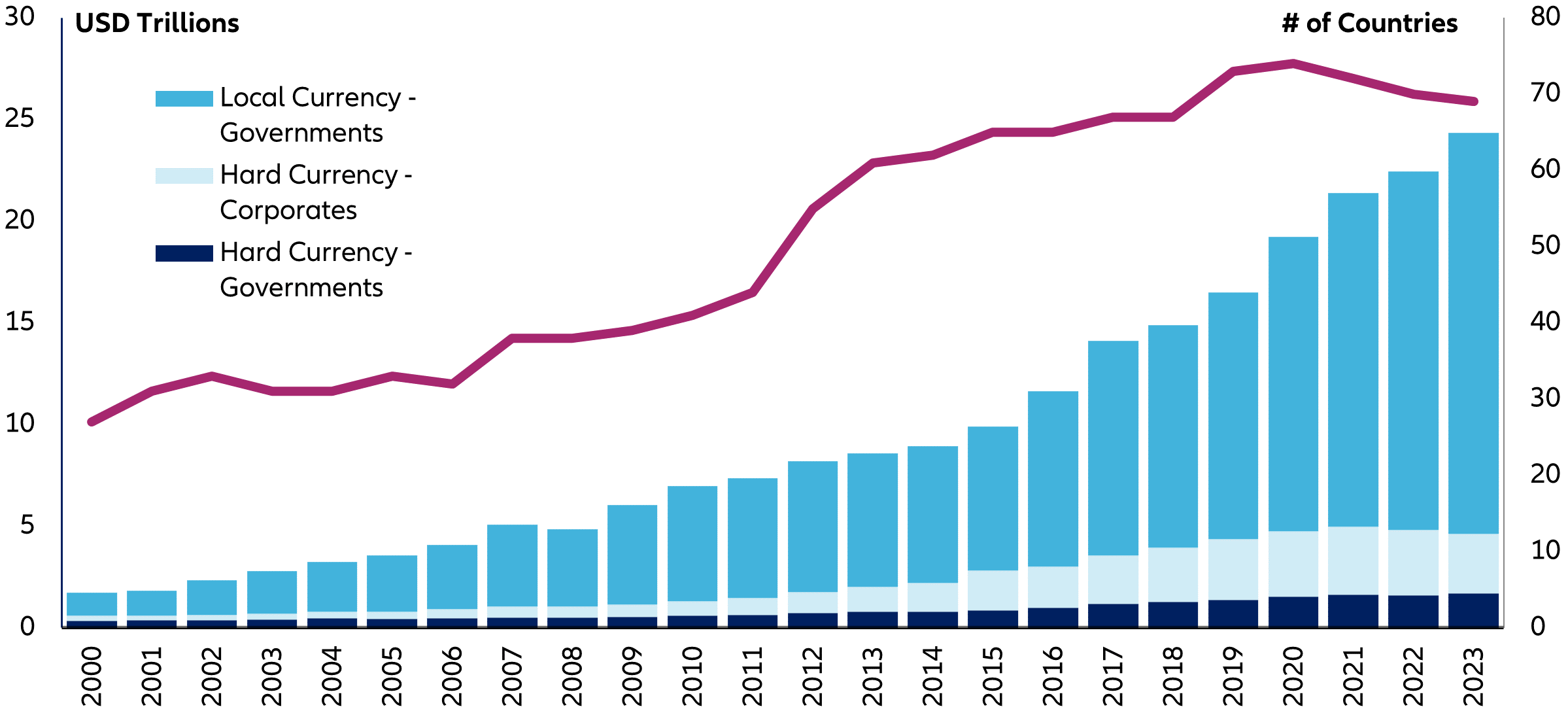

Total Emerging Market Debt Outstanding (USD Trillions)

Source: BofA Global Research, BIS, Bloomberg, J.P. Morgan.

Why emerging market debt?

In a world of diverging growth and shifting rate cycles, Emerging Market Debt (EMD) stands out as a resilient and rewarding opportunity. Despite persistent scepticism and a history of global crises; from the Asia crisis to COVID-19, EMD has consistently outperformed traditional fixed income assets like US High Yield and Treasuries over the past three decades.

As the global rate cycle peaks and developed markets face slowing growth, we believe that EMD offers attractive yields, improving fundamentals, and diversification benefits. The data tells a compelling story: even amid volatility, EMD has delivered strong, long-term returns, defying the myth of fragility.

We believe that EMD should be reconsidered, not as a risk, but as a resilient performer in a fixed income strategy.

Note: Total Return of J.P. Morgan EMBI Global Diversified Composite Index (JPEIDIVR Index), ICE BofA US Cash Pay High Yield Index and ICE BofA US Treasury Index, for a $100 original investment since 1993.

EM External Debt: JPEIDIVR Index, US High Yield: J0A0 Index, US Treasuries: G0Q0 Index.

Source: BofA Global Research, Bloomberg, J.P. Morgan EMBI Global Diversified Composite Index, ICE Data indices, LLC. Data as of 31 December 2024.

Past performance does not predict future returns.

Why AllianzGI for Emerging Market Debt?

At Allianz Global Investors, we aim to harness the potential for extra return in emerging economies. Our global team is guided by EM Debt CIO, Richard House. Our strategies are designed to effectively navigate the complexities of emerging markets. We manage a broad suite of emerging markets strategies ranging from pure hard currency sovereign bond and corporate bond strategies to blend strategies that allocate across the segments. EM bonds, as an asset class, represent a large and diverse opportunity set that can help investors achieve their risk-return objectives. Investing in EMD hard currency sovereign debt can be considered a long-term strategic allocation within fixed-income portfolios to boost portfolio returns.

A performance of the strategy is not guaranteed and losses remain possible.

Emerging Market Debt: growth and misconceptions

Emerging Market Debt has evolved significantly over the years, yet misconceptions continue to cloud investor understanding. In this video, we address some of the most common myths that persist in the market and examine how EM debt has transformed, highlighting key structural changes, diversification and resilience.

Meet the experts behind the strategy

Our dedicated EMD team brings together individual specialities and strengths.

Richard House

Asset Class specialism: Sovereign Credit, Local markets

Research Focus: CIS, Special situations

Eoghan McDonagh

Asset Class Specialism: Sovereign Credit, Corporates

Research Focus: Middle East, Central Europe

Daniel Ha

Asset Class Specialism: Corporates, Sovereign Credit

Research Focus: Asia

Alexander Robey

Asset Class Specialism: Corporates, Sovereign Credit

Research Focus: Latin America

Giulia Pellegrini

Asset Class Specialism: Sovereign Credit, GSS Bonds

Research Focus: Africa, Turkey

Source: Allianz Global Investors, as of December 2024.

|

Richard House

CIO, Emerging Market Debt, London

31 years experience

|

|

Giulia Pellegrini

Lead PM, London

19 years experience

|

|

Eoghan McDonagh

Senior PM, London

20 years experience

|

|

Daniel Ha

Senior PM, Hong Kong

18 years experience

|

|

Alexander Robey

PM, London

8 years experience

|

|

Evangelia Pournara

Senior PS, London

20 years experience

|

Related Insights

Funds

Allianz Emerging Markets Sovereign Bond - WT (H2-GBP)

Performance Chart

...

...

Calculation basis: Net asset value (excl. front-end load); distributions reinvested. Calculation according to method as defined by BVI, the German Fund Companies Association. Past performance is not a reliable indicator of future results. Any front-end loads reduce the capital invested and the performance stated. Individual costs such as fees, commissions and other charges have not been taken into consideration and would have a negative impact on the performance if they were included.

Allianz Emerging Markets Select Bond - WT (H2-GBP)

Performance Chart

...

...

Benchmark history

- until 26/02/2023: J.P. MORGAN Emerging Markets Blended (JEMB) Equal Weighted Total Return (hedged into GBP)

Calculation basis: Net asset value (excl. front-end load); distributions reinvested. Calculation according to method as defined by BVI, the German Fund Companies Association. Past performance is not a reliable indicator of future results. Any front-end loads reduce the capital invested and the performance stated. Individual costs such as fees, commissions and other charges have not been taken into consideration and would have a negative impact on the performance if they were included.

Allianz Emerging Markets Short Duration Bond - WT (H2-EUR)

Performance Chart

...

...

Benchmark history

- until 30/09/2021: LIBOR USD 3-Month (hedged into EUR)

- until 28/11/2019: EURIBOR 3-Month (in EUR)

- until 09/06/2019: No Benchmark

Calculation basis: Net asset value (excl. front-end load); distributions reinvested. Calculation according to method as defined by BVI, the German Fund Companies Association. Past performance is not a reliable indicator of future results. Any front-end loads reduce the capital invested and the performance stated. Individual costs such as fees, commissions and other charges have not been taken into consideration and would have a negative impact on the performance if they were included.

Investment Philosophy

Our philosophy is a prudent, active, high conviction, macroeconomic based approach and is underpinned by the below characteristics:

- Macro drivers ultimately determine asset price performance

- ESG is an important part of our investment analysis

- Avoiding underperformers is as important as picking outperformers

- Prudent position sizing will prevent performance impairment

- Liquidity is of paramount importance

The schematic below illustrates the above characteristics inherent in our approach.

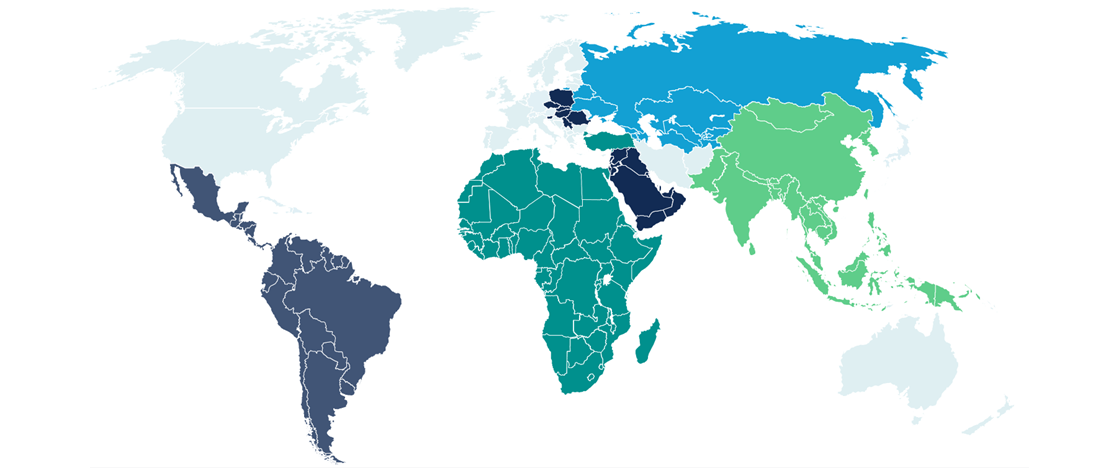

- We sub-divide the 80-countries comprising the asset class into different groups

- Macro & Environmental, Social and Governance (ESG), deep analysis provides a direction of travel outlook across groups

- We undertake relative value (RV) analysis within groups

- We combine direction of travel and relative value into a high conviction approach - portfolios typically comprise half of the 80 country universe

- We apply strict risk budgets based on beta & liquidity regardless of conviction

Find out first about our latest insights

Subscribe to receive our regular newsletter with the latest updates on the markets.

-

Investing involves risk. The value of an investment and the income from it may fall as well as rise and investors might not get back the full amount invested. Investing in fixed income instruments may expose investors to various risks, including but not limited to creditworthiness, interest rate, liquidity and restricted flexibility risks. Changes to the economic environment and market conditions may affect these risks, resulting in an adverse effect to the value of the investment. During periods of rising nominal interest rates, the values of fixed income instruments (including positions with respect to short-term fixed income instruments) are generally expected to decline. Conversely, during periods of declining interest rates, the values of these instruments are generally expected to rise. Liquidity risk may possibly delay or prevent account withdrawals or redemptions. Allianz Emerging Markets Sovereign Bond is a sub-fund of Allianz Global Investors Fund SICAV, an open-ended investment company with variable share capital organised under the laws of Luxembourg. The value of the units/shares which belong to the Unit/Share Classes of the Sub-Fund that are denominated in the base currency may be subject to an increased volatility. The volatility of other Unit/Share Classes may be different and possibly higher. Past performance does not predict future returns. If the currency in which the past performance is displayed differs from the currency of the country in which the investor resides, then the investor should be aware that due to the exchange rate fluctuations the performance shown may be higher or lower if converted into the investor’s local currency. This is for information only and not to be construed as a solicitation or an invitation to make an offer, to conclude a contract, or to buy or sell any securities. The products or securities described herein may not be available for sale in all jurisdictions or to certain categories of investors. This is for distribution only as permitted by applicable law and in particular not available to residents and/or nationals of the USA. The investment opportunities described herein do not take into account the specific investment objectives, financial situation, knowledge, experience or specific needs of any particular person and are not guaranteed. The Management Company may decide to terminate the arrangements made for the marketing of its collective investment undertakings in accordance with applicable de-notification regulation. The views and opinions expressed herein, which are subject to change without notice, are those of the issuer companies at the time of publication. The data used is derived from various sources, and assumed to be correct and reliable at the time of publication. The conditions of any underlying offer or contract that may have been, or will be, made or concluded, shall prevail. The duplication, publication, or transmission of the contents, irrespective of the form, is not permitted; except for the case of explicit permission by Allianz Global Investors GmbH.

For investors in the United Kingdom

For a free copy of the sales prospectus, incorporation documents, daily fund prices, Key Investor Information Document, latest annual and semi-annual financial reports, contact the issuer at the address indicated below or regulatory.allianzgi.com. Please read these documents, which are solely binding, carefully before investing. This is a marketing communication issued by Allianz Global Investors UK Limited, 199 Bishopsgate, London, EC2M 3TY, www.allianzglobalinvestors.co.uk. Allianz Global Investors UK Limited, company number 11516839, is authorised and regulated by the Financial Conduct Authority. Details about the extent of our regulation are available from us on request and on the Financial Conduct Authority's website (www.fca.org.uk). The duplication, publication, or transmission of the contents, irrespective of the form, is not permitted; except for the case of explicit permission by Allianz Global Investors UK Limited.