Navigating Rates

Bond market view: smooth landing in sight?

The US Federal Reserve’s policy pivot has ushered in a new investment regime that should help cushion the slowdown in the US economy and provide a near-term floor for risk sentiment. We think the Fed’s move can ensure favourable conditions for bond markets – and see opportunities within yield curve steepeners and duration, as well as defensive options in case the economic outlook darkens.

Key takeaways

- We think the timing of the Fed’s move can help cushion the US economy’s slowdown at a time of a softening in labour markets, and signals an about-turn in the “higher-for-longer” policy messaging earlier in the year.

- Markets are pricing in a smooth landing and the macro and monetary policy backdrop makes us believe a soft landing is achievable – but risks ranging from higher oil prices to the US election outcome may disrupt the benign outlook.

- We are positive on the outlook for sovereign bond returns, given the current global macro and policy backdrop and are overall constructive on duration, but prefer to be positioned for yield curve steepeners, rather than outright duration, in the US and Europe.

- We see value in having some allocation to inflation, given the reflation risks stemming from the degree of policy easing currently being priced and think bond markets may be too quick to dismiss the risk of a more severe slowdown; we see scope for adding duration risk opportunistically, as yields back-up.

A month has passed, but September’s interest rate cut by the US Federal Reserve (Fed) still feels like a pivotal moment for the economy and bond markets. The jumbo size of 50 bps signalled the Fed’s wish to act pre-emptively, learning lessons of previous monetary cycles where higher rates stayed in place for too long, causing unnecessary damage to the economy

We think the move carries significant repercussions for bond markets – and should open up a broader opportunity set for investors. In our view, the cut – and the prospect of more – increases the likelihood of a soft landing for the US economy. But the risk of a hard landing is underpriced in markets – and we think defensive options should be considered in a dynamic environment.

Fed chair Jay Powell described its dual mandate of price stability versus full employment as “in balance”, signalling an effective willingness to underwrite the US labour market with further front-loaded rate cuts if required. In our view, the stance provides a near-term floor for risk sentiment (already reflected in equity and credit valuations).

We think the timing of the Fed’s move can help cushion the economy’s slowdown at a time of a softening in labour markets, and signals an about-turn in the “higher-for-longer” policy messaging earlier in the year.

Macro backdrop: slower growth but watch out for the risks

We see some cracks in the US economy but it is still relatively robust. The labour market is loosening but from a tight position, meaning demand for workers has been strong and unemployment has been low. On the whole, wage growth and spending patterns do not point to a sharp slowdown. Corporate profitability in aggregate also remains healthy, apart from pockets of stress among smaller and midcap US firms more sensitive to interest rate changes. Fiscal policy remains loose and four years of higher interest rates have likely been less successful at cooling the economy than policy makers originally expected, given the Fed’s admission that the “neutral rate” is much higher now than before Covid-19.

But we stay responsive to the risk that historically a weakening in labour data has been hard to suddenly reverse. When economic downturns hit they’re usually swift and non-linear, meaning they’re difficult to spot in the preceding months of employment data.

In contrast to economic cycles of the past 20 years, driven largely by credit availability, the current cycle has been characterised by its robust growth in household incomes. US private sector debt levels have remained generally stable over the last decade, especially among households. If the bursting of a credit cycle isn’t a risk now, what shocks might increase the risk of a hard landing? Here are four that come immediately to mind:

US private sector debt levels have remained generally stable over the last decade, especially among households. If the bursting of a credit cycle isn’t a risk now, what shocks might increase the risk of a hard landing? Here are four that come immediately to mind:

- Higher interest rates – while the Fed seems set on cutting rates, any reversal in this stance risks plunging the economy into recession. But we think monetary tightening is unlikely in the near term given the Fed’s latest actions.

- Lower public spending – significant fiscal restraint in the US is unlikely regardless of November’s election outcome. But we expect the government’s purse strings to be tighter under a divided government (where neither party wins both the White House and control of Congress) than under single-party control.

- Supply shocks – a sharp rise in oil prices is a key risk. Recent geopolitical events in the Middle East have pushed oil prices higher and a significant and sustained price rise risks squeezing households’ real incomes. Still, in the absence of any escalation in the conflict, we note that the outlook for oil demand is mixed. Global manufacturing is sluggish, as manufacturing PMIs struggle to register any expansion in activity. Another potential dampener for oil prices may be Saudi Arabia’s recent abandonment of its USD 100 a barrel price target in favour of greater supply to capture market share.

- Trade wars – any rise in tariffs under an incoming US administration risks significant consequences for the US and global economies. Higher tariffs could lead to an escalating spiral of tit-for-tat measures that would likely push inflation higher and hit global growth.

Globally, we are also cognisant of the risk of a sharper growth downturn given the uncertain outlook in the euro zone and China. But we see this risk diminishing. The faltering euro zone economy may pave the way for faster rate cuts by the European Central Bank, which would help support growth. In Asia, sentiment has been boosted by China’s recent liquidity injection – on a par with the 2020 Covid-19 stimulus in percentage-of-GDP terms.

Overall, the macro and monetary policy backdrop makes us believe the US economy can achieve a soft landing – even when history tells us this is a rare outcome after a period of higher rates. We see the outcome of the US election as possibly the biggest disruptor to this benign macro narrative.

Reading the fault lines in market pricing

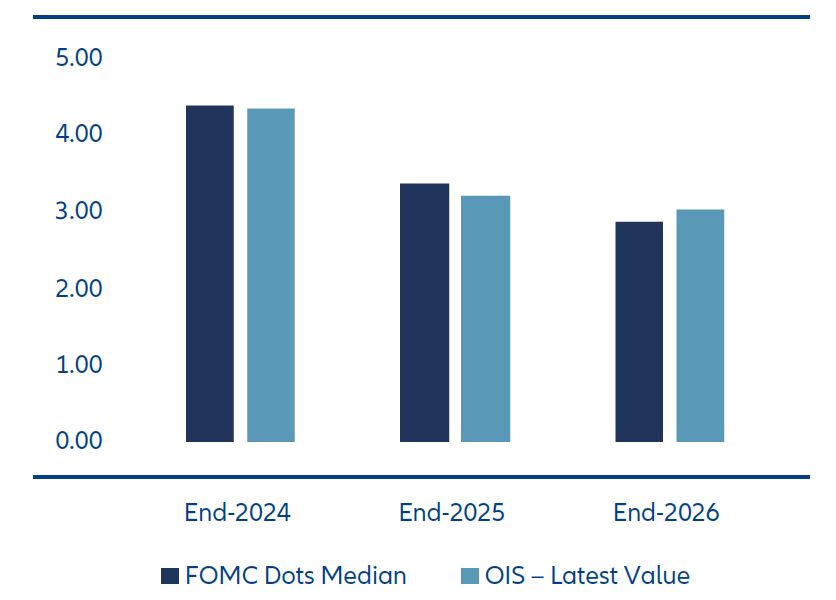

The latest Fed dot plot projections show a median forecast of 50 bps in cuts remaining this year and a further 100 bps in 2025 (see Exhibit 1). We consider this a fair assumption of what the soft-landing policy rate outcome is likely to be. Interest rate forward markets moved to broadly mirror this outcome after September’s blockbuster employment data pointed to a resilient economy. In effect, front-end US rates are now priced for a soft landing. We think this backdrop can provide opportunities within Treasury yields. Any sharper slowing of data that increases the probability of a hard landing would leave room for the market to price more aggressive cuts and a lower terminal rate. In contrast, continued signs of economic resilience may push forward markets to question the extent to which the Fed needs to lower rates – potentially pricing out some 2025 cuts.

Overall, we believe there is scope for hard landing probabilities to rise, which leads us to position for adding duration risk opportunistically, as yields back up.

We think yield volatility is likely to stay elevated near-term and we expect Treasuries to trade in a wide range. We prefer to be positioned for steeper yield curves in the US, given that the easing cycle is now underway and long-end bonds still face the challenges of a huge fiscal deficit as well as potential uncertainties around spending and inflation after the election.

Exhibit 1: Pricing for US Fed Funds (%)

Source: Bloomberg. Data as at October 2024.

We believe market pricing of risk asset valuations is too rich. For example, US investment grade corporate credit spreads are currently around 90 bps, flagging as around one standard deviation pricier than their long-term spread history. Current valuations indicate that credit markets are pricing in a more than 90% probability of a soft landing.

We think this is too optimistic and there is room for hard-landing fears to resurface. For that reason, we stay defensive on credit allocations in general.

In our view, long-term inflation expectations also look too optimistic. The 10-year breakeven inflation rate in the US is anchored around 2.20-2.25%, ie, very close to the Fed’s 2% policy target. We think that level may not take account of reflationary risks. The rate cuts set to be delivered in the US have allowed financial conditions to ease and therefore increase the risk of higher-than-anticipated inflation. And several structural drivers may create long-term inflation uncertainty in the future. Inflation risks stemming from increased defence spending, near-shoring supply chains and climate transition all look underpriced. We believe 10-year breakevens would look fair closer to 2.5% in a soft-landing outcome.

Opportunities in a more bond-friendly world

We are positive on the outlook for sovereign bond returns, given the current global macro and policy backdrop.

- Duration: we are overall constructive on duration but country selectively is key. In the US, we prefer to stay tactical, with a bias to add risk on any jump higher in yield if the market becomes complacent on the probability of a hard landing. We favour countries offering better risk and reward dynamics such as the UK, New Zealand, Norway and Australia.

- Yield curve steepeners: we prefer to be positioned for yield curve steepeners, rather than outright duration, in the US and Europe, given that central banks are lowering rates and long-end term premia risk can rise further.

- Inflation protection: we see value in having some allocation to inflation protection given the reflation risks stemming from the degree of policy easing currently being priced.

- Defensive options: we think a defensive spread risk allocation is prudent as the valuation backdrop does not fairly reflect the balance of macro risks.

The start of rate-cutting cycles in the US and many other major economies should provide a further tailwind to fixed income markets already boosted by a more bond-friendly environment from lower inflation and diverging performance across different economies. But with interest rate expectations for future Fed cuts likely to shift, investors may need to consider an active and tactical approach to managing bond portfolios.

1 Donald Trump pledges to impose sweeping tariffs on imported cars, Financial Times, 15 October 2024