Achieving Sustainability

Energy transition: time to clear the air

Significantly increasing investment in clean energy is essential. But the energy transition is more complex than simply replacing fossil fuels with renewables. While shifts in markets, climate models and geopolitical landscapes present challenges, multiple pathways to achieving energy goals may also create multiple potential investment areas.

Key Takeaways

- Energy transition is one of six important elements that will support climate transition.

- The energy transition is more complex than simply moving from fossil fuels to renewables, and the shift creates new opportunities for investment.

- With renewable energy capacity still at low levels, total investment in the energy transition must grow rapidly to reach USD 4.5 trillion annually.

- While there are headwinds, not least in terms of a lack of policy alignment globally, there are some distinct areas of potential investment such as those critical infrastructure projects that enable the transition.

Energy transition refers to the global shift from traditional energy sources that emit high levels of carbon dioxide (CO2 ) to low or zero-emitting sources. This transition is crucial for mitigating climate change and achieving net-zero emissions by 2050.

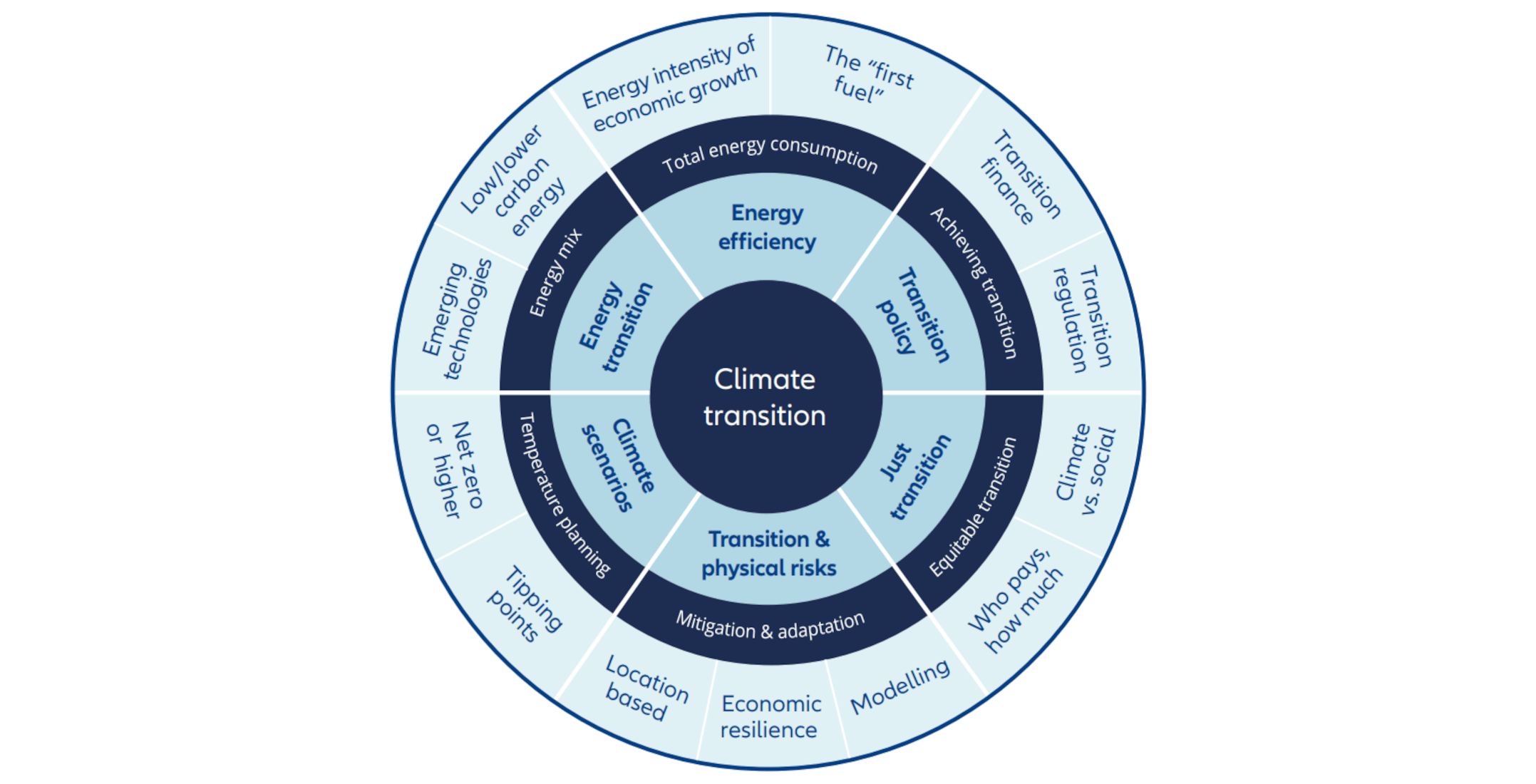

Often energy transition and climate transition are viewed as the same, but energy transition is one of six key elements required to support the wider issue of climate transition. We define climate transition as: what is needed for limiting the rise in future global temperatures, and the environmental and social risks of each additional 0.1°C of warming as shown in the inner circle of Exhibit 1.

Exhibit 1: Six elements needed to support climate transition

Source: Allianz Global Investors Sustainability Research

In this paper, we focus on the progress of energy transition, identifying where there may be risks and the potential for investment opportunities.

Energy transition – a moving target?

Energy transition used to be seen in binary terms: coal and oil would gradually be replaced by renewable energy sources such as wind and solar power. While the end goal of substantially reducing CO2 emissions remains a priority, today there could be multiple pathways to achieving it. In addition, the energy transition faces significant emergent challenges: first, securing adequate financing for the transition and, second, navigating policy uncertainties and establishing a unified approach to climate action.

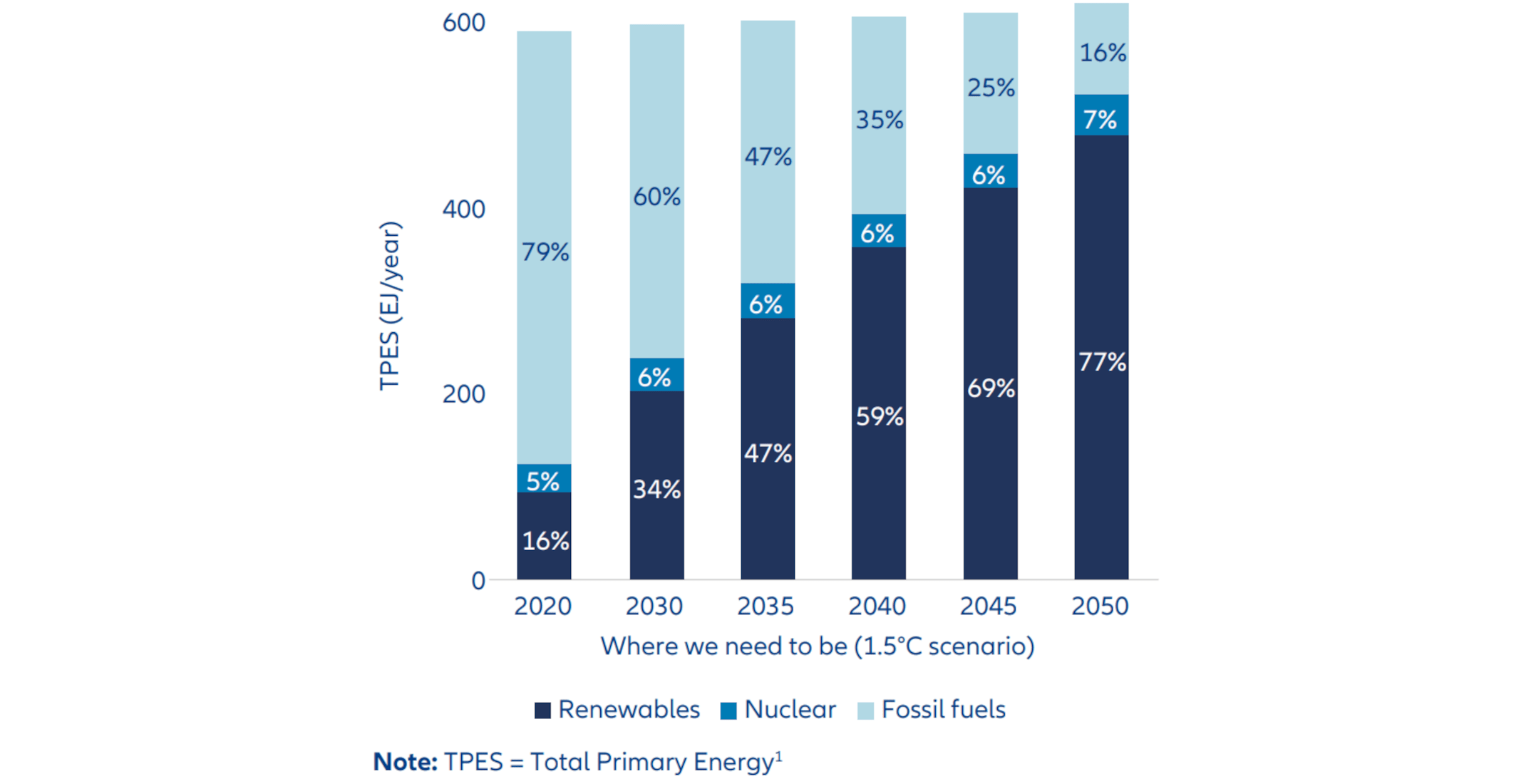

Let’s address the challenges in turn – starting with the shortfall in funding for the energy transition. Given the scale of change in energy sources required to align with the 1.5°C scenario of the Paris agreement – as set out in Exhibit 2 – significant upfront investment is needed to prevent even greater financial, environmental and social costs in the future.

Exhibit 2: Required change in total primary energy supply to align with the 1.5°C scenario

Source: IRENA World Energy Transitions Outlook 2023

Progress to date is moving in the right direction, but there’s a long way to go in little time. Global renewable energy capacity grew by 50% from 2022-2023, reaching over 500GW of additional capacity driven largely by solar photovoltaic (PV). This growth has been led by China, with record increases in Europe, the US and Brazil,2 indicating that progress remains on track to achieve a tripling of global renewable energy capacity by 2030.

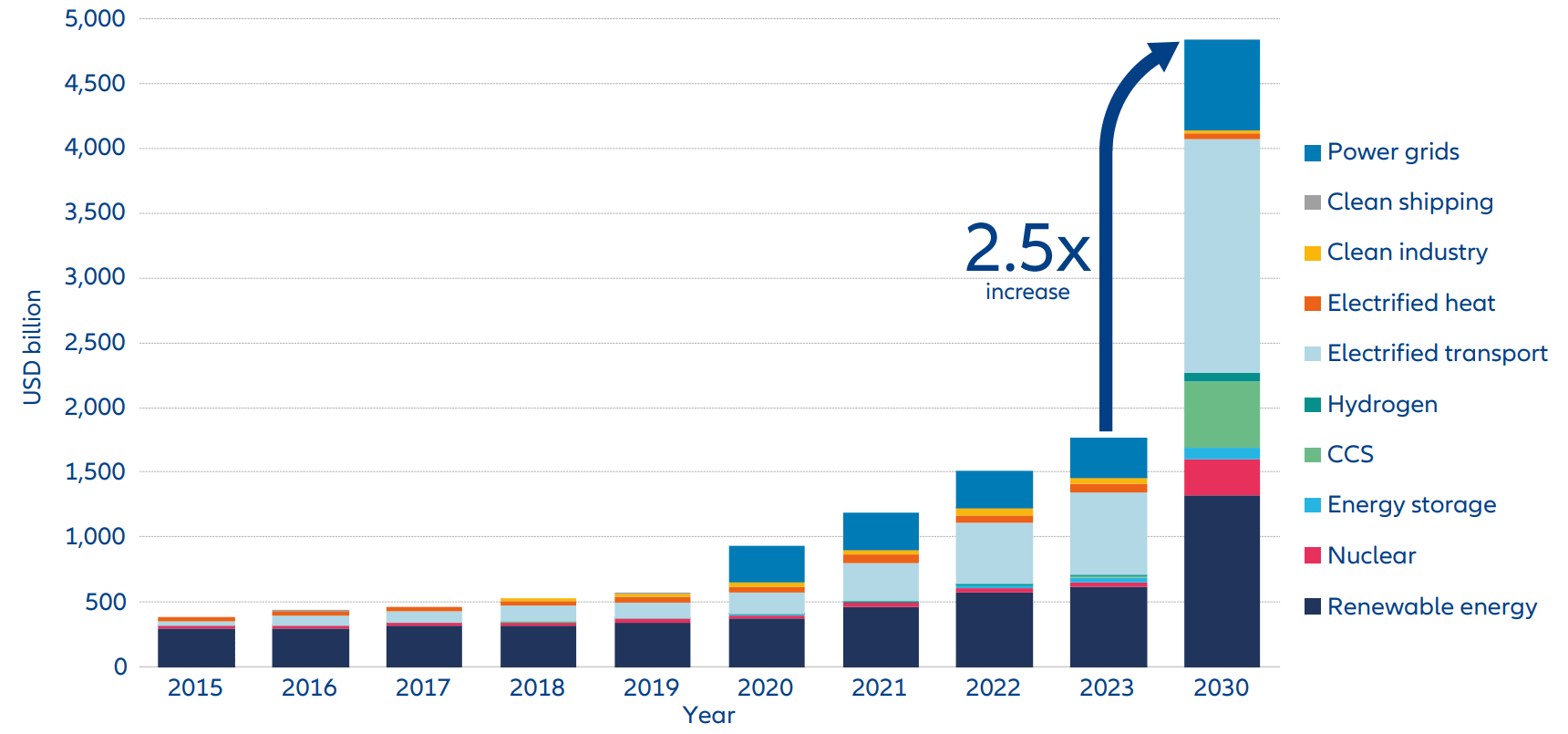

This has been funded through a 17% increase in global investments into renewables to reach the record figure of USD 1.8 trillion.3 Of this total, around half has been raised for climate tech and energy transition projects, mostly supporting renewable energy and electrified transport. There have also been significant investments and progress in several areas important for reducing carbon emissions, including:

- Technologies for capturing and storing carbon (CCS).

- Advancements in nuclear and hydrogen energy.

- Improvements in electrical grid infrastructure.

- Better planning (eg, demand simulation) for the use of electric vehicles and heat pumps.

Despite this momentum, renewable energy capacity remains low, for example, only 5% of global energy currently comes from wind and solar power, while coal usage is at record levels. Reaching the 2030 target of USD 4.5 trillion investment would generate an estimated 1,000GW of annual capacity additions.4 Furthermore, although investment in energy storage increased by 77% in 2023, it is still only 2% of total spending.

For context, the current annual additional capacity being added in nuclear and renewables is projected to help meet global electricity demand growth over the next three years, but is insufficient to meaningfully address the transition from high-emitting energy sources.

The way forward requires the right mix of energy sources which must be supported by enabling services and infrastructure. Annual investment in energy transition needs to scale up from 2% of global GDP to 4% by the early 2030s, an increase from USD 1.8 trillion to USD 4.5 trillion. 5

What might this mix look like?

The energy transition will not take one form only. Fossil fuels will remain within the global energy mix albeit at much-reduced levels as shown in Exhibit 2. Renewables will likely be complemented by reduced use of fossil fuels and nuclear energy sources according to local needs, available resources and political will. This will vary from one geographical location to another.

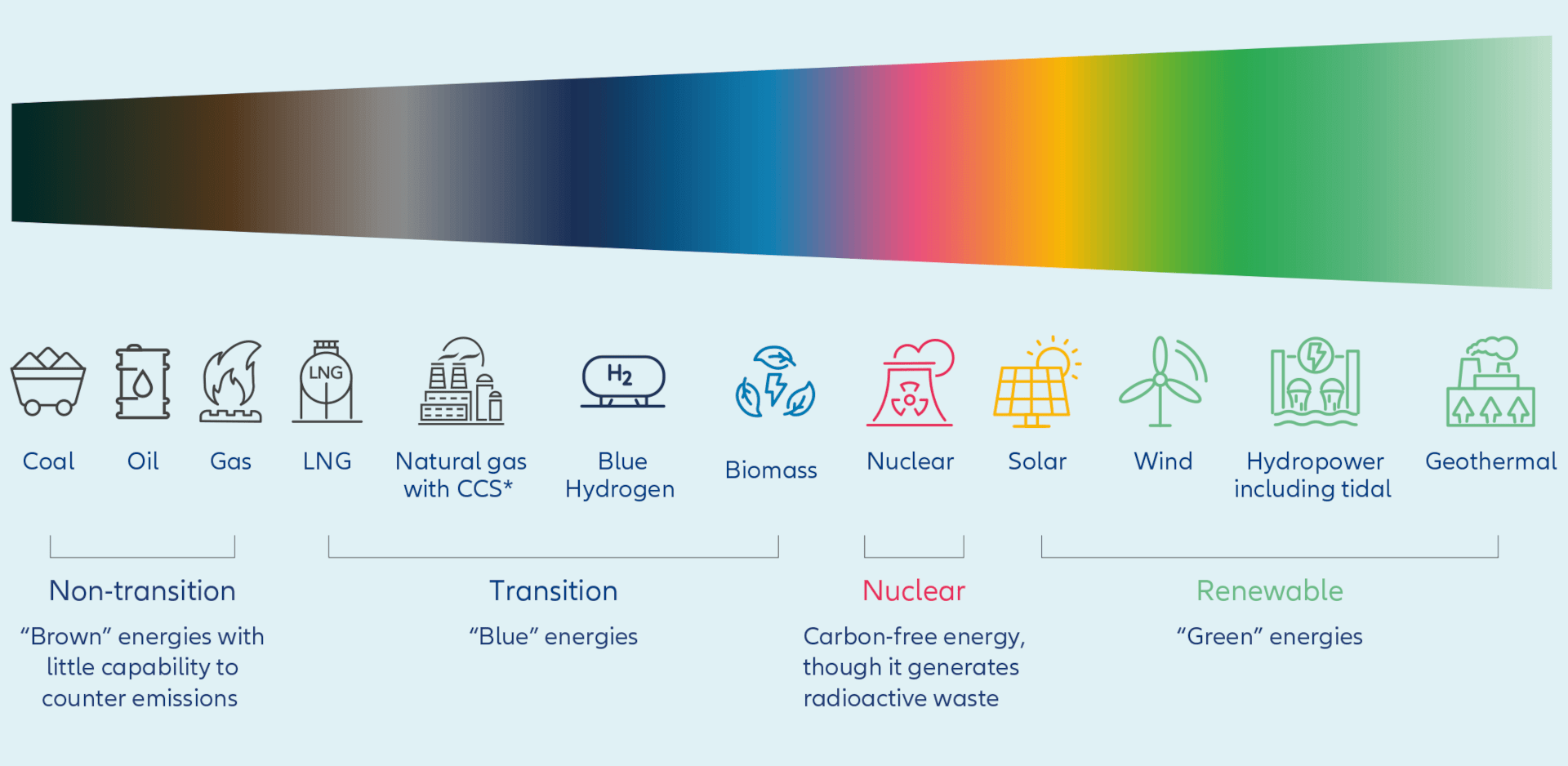

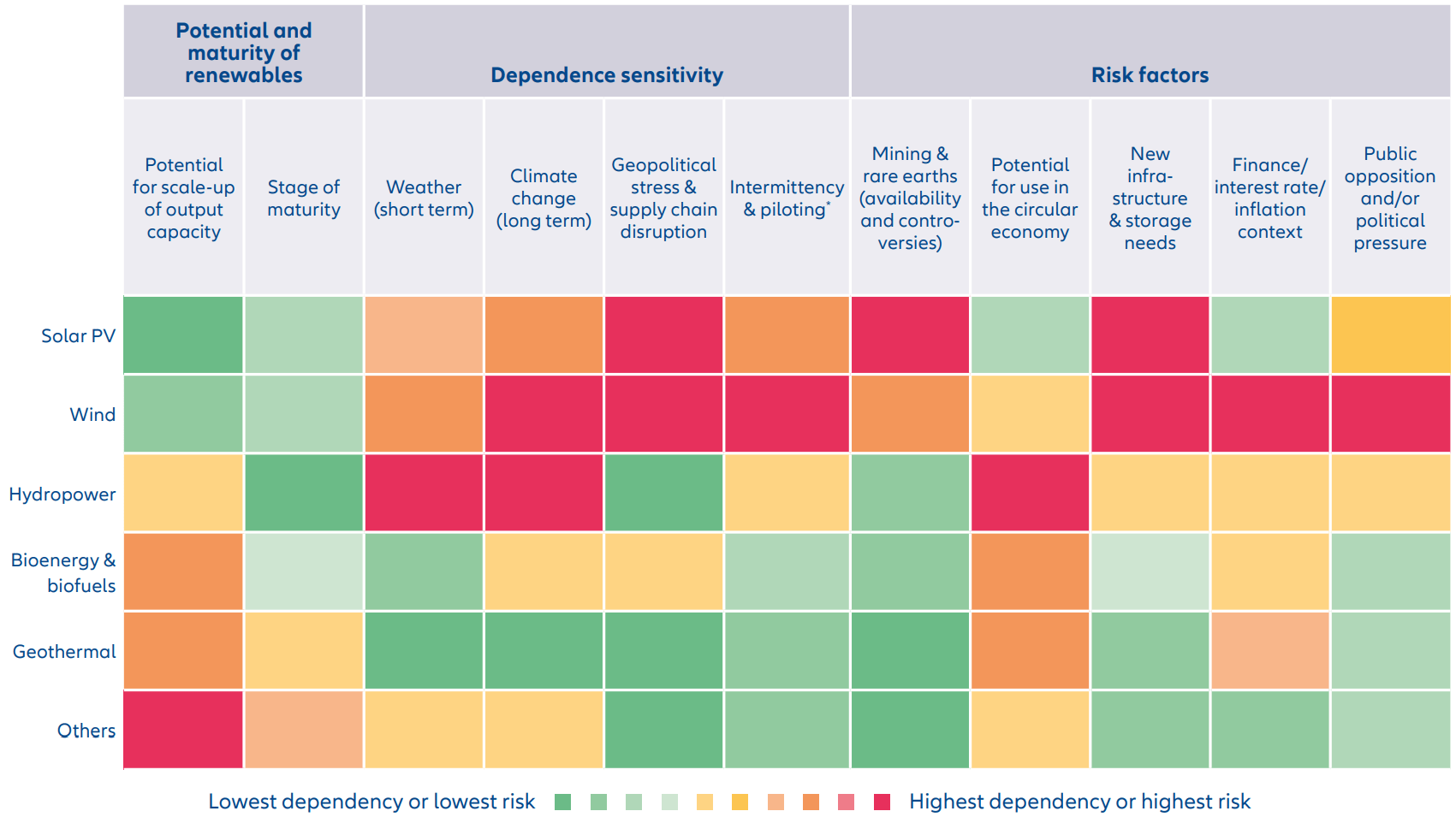

Energy sources can be viewed on a spectrum (see Exhibit 3) and each has unique opportunities and risks.

- Non-transition energies – eg, coal, oil and gas – vary in their environmental impact.

- Transition energies – eg, natural gas, blue hydrogen (when not derived from greenfield fossil fuel projects), and some (not all) biomass.

- Nuclear energy – emissions free but concerns remain over safety and social impact of radioactive waste.

- Renewable technologies – eg, solar, hydro, wind – have associated emissions from their production and installation.

Exhibit 3: Energy’s colour spectrum

*CCS = carbon capture and storage.

Source: Allianz Global Investors, June 20246,7,8

Investment needs policy alignment

This ramp-up of investment coincides with the second issue mentioned earlier: these are uncertain times, both economically and politically. Policy uncertainty around emissions reduction and disunity on climate goals prevail in this intense election year. The global alignment on policy and regulation required to support both green and transition frameworks is limiting progress around the three pillars of the “energy trilemma”:9

- Energy security: geopolitical events are pushing climate down the agenda for governments, a trend that is compounded by elections in more than 60 locations this year which could significantly impact the future of climate regulation, policy and investment. Political influence on climate is substantial, ranging from recognising the urgency of climate change to establishing formal climate adaptation and mitigation frameworks.10

- Energy equity:11 inflationary pressures are ongoing, but there is potential for fiscal and tax policies to support innovative climate solutions.

- Energy sustainability: economic growth is uncertain, but there is potential to redefine the economic opportunities in areas not traditionally associated with energy evolution.

Greater coordination to refocus on energy goals is critical in defining the most likely climate scenario for the rest of this decade and the next.

Three approaches to investing in energy

As the transition has evolved, we have developed our thinking around the substantial potential to invest in cleaner energy and the need for accelerating the rate of financing. Below we outline three ways for investors to consider contributing to the future of energy.

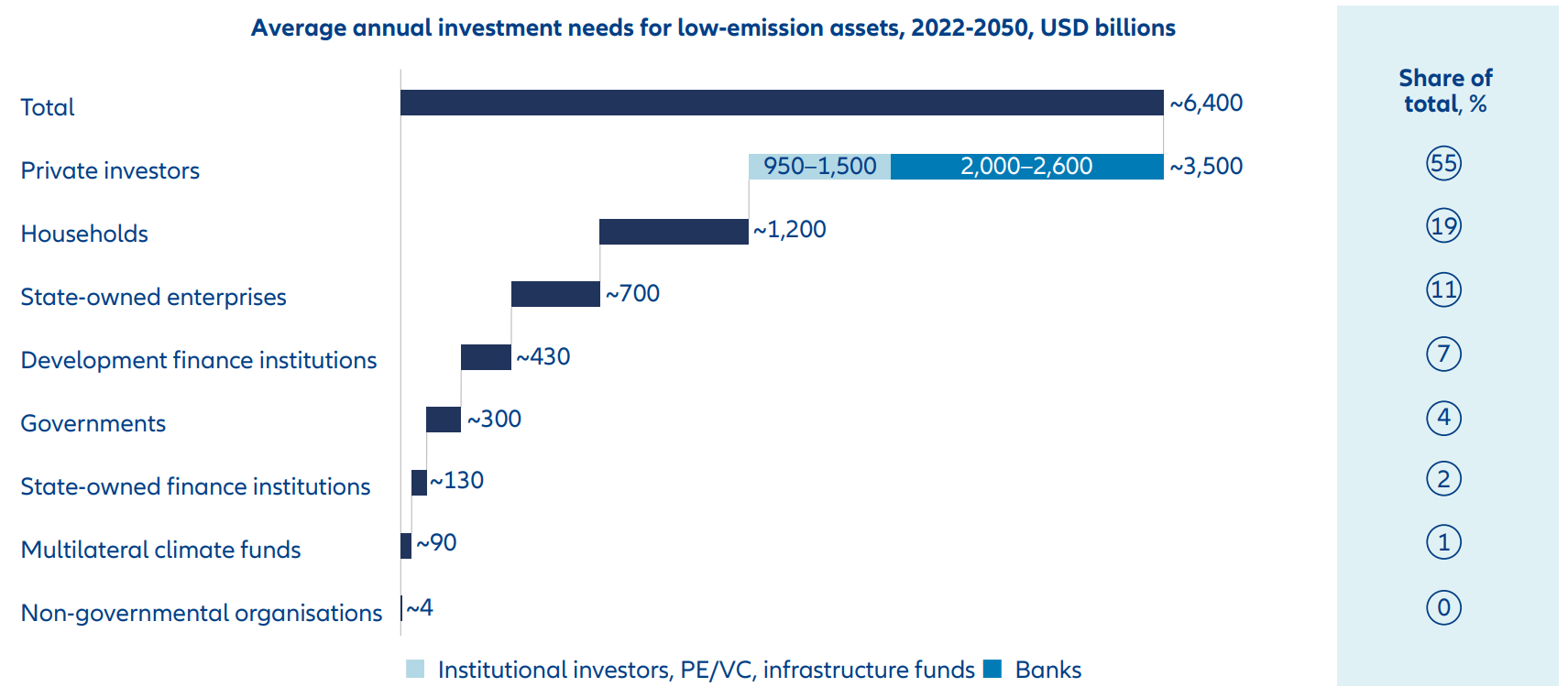

The significant scale of investment required will need buy-in from public and private investors (see Exhibit 4), including retail, institutional and government investors. This also means use of both traditional and innovative financing structures. The financing likely encompasses expansion of:

- Corporate and sovereign climate goal-orientated labelled debt

- Venture capital (VC), private equity (PE)

- Investment into small and medium enterprises (SMEs) innovative solutions

- Development finance institutions

- Green bonds and sustainability-linked bonds

- Climate-focused mutual funds and ETFs

- Impact investing funds

- Public-private partnerships

- Green banks and credit facilities

- Energy-as-a-Service models

Exhibit 4: Private financial institutions could finance about 55% of net-zero investment needs

Source: McKinsey, Financing the net-zero transition: From planning to practice, January 2023

Looking at how investments in energy transition have evolved since 2015 there has been a relatively steady increase in investments in nuclear and renewable energy sources complemented by accelerated investment in key areas in energy adaptation, eg, clean shipping (see Exhibit 5).

Exhibit 5: Global investment in clean energy, 2015-2023, with a forecast for 2030

Source: BNEF12, Allianz Global Investors, and Visual Capitalist13

To reach the USD 4.5 trillion annual spend needed by 2030 to meet cleaner energy goals, we anticipate significant contributions from several areas in addition to accelerated investment in renewables and nuclear. These include the development of large, smart and repurposed infrastructure networks, the expansion of electrification, the implementation of carbon capture solutions, and the advancement of transport energy technologies.14

|

Only 5% of global energy use comes from wind and power. Altogether, renewables account for 16% of global energy. Meanwhile, coal usage is at record levels. |

The last few years have demonstrated the vulnerability of low or lower-emitting energy sources to external factors. Cost inflation, supply chain issues and even climate change have exposed key areas of dependence sensitivity that need to be resolved if the global energy mix is to achieve a smooth and resilient transition. Investors can play a role in reducing these risks, eg, by considering infrastructure investments to accelerate the deployment of solar and wind power.

In a previous thematic paper, we presented a heat map (see Exhibit 6) of renewable energy sources, grading the dependence sensitivity of each energy source against key indicators to address current concerns about rising costs of renewable projects and volatile investment returns. Highlighting the potential risks also reveals where there are opportunities to enable the energy transition with new solutions and technologies. Underpinning this is the need for a concerted effort to increase the “skills for a resilient green and digital transition,”15 which in turn would generate both economic and social positive outcomes.

|

Annual investment in energy transition needs to scale up from 2% of global GDP to 4% by the early 2030s, an increase from USD 1.8 trillion to USD 4.5 trillion.16 |

Exhibit 6: Future potential for renewable energy sources and their risks measured by key indicators

*Piloting: controlling the generation of electricity according to demand.

Source: Allianz Global Investors Sustainability Research, IEA, IRENA, June 2023

Multiple energy pathways will support climate transition

In summary, energy transition is not one path to a single destination supporting climate transition. While the political backdrop remains challenging, it is becoming clear that the way forward requires a complementary mix of energy sources while accelerating emissions reduction. Demand for solutions is rising as is investor demand to be part of the solution, all driven by a combination of escalating costs, visible climate change impacts, and evolving regulatory frameworks. Now, the focus is on rapidly scaling-up investments in these solutions. As the transition becomes more integrated into targeted financing outcomes, the opportunity is ripe.

1 Global total primary energy supply (TPES) refers to the total amount of energy that is produced and consumed in various forms around the

world. It includes all the energy sources that are used to produce electricity, power transportation, heat buildings, and homes, and power

industrial processes. Renewables include hydro, solar, wind, bioenergy, geothermal and ocean energy

2 IEA, Massive expansion of renewable power opens door to achieving global tripling goal set at COP28 – News – IEA, January 2024

3 BloombergNEF, Global Clean Energy Investment Jumps 17%, hits $1.8 trillion in 2023, January 2024

4 IRENA, World Energy Transitions Outlook 2023 (irena.org)

5 IEA, Net Zero Roadmap: A Global Pathway to Keep the 1.5 °C Goal in Reach, September 2023

6 IEA, Carbon Capture, Utilisation and Storage - Energy System - IEA , April 2024

7 World Economic Forum, Grey, blue, green – the many colours of hydrogen explained, July 2021

8 EIA, Biomass explained - U.S. Energy Information Administration (EIA), June 2023

9 World Energy Council, World Energy Trilemma Framework 2024: Evolving with Resilience and Justice, 2024

10 Allianz Global Investors, Politics in 2024 - risking the climate? | AllianzGI, February 2024

11 Energy equity may also be referred to as energy affordability

12 BNEF, Energy Transition Investment Trends 2024: Countries Annex, 2024

13 NPU, The $3 Trillion Clean Energy Investment Gap, Visualized (visualcapitalist.com), March 2024

14 IEA, Clean energy investment must reach $4.5 trillion per year by 2030 to limit global warming to 1.5°C | World Economic Forum (weforum.org), September 2023

15 OECD, OECD Skills Outlook 2023 : Skills for a Resilient Green and Digital Transition | OECD iLibrary (oecd-ilibrary.org), November 2023

16 IEA, Net Zero Roadmap: A Global Pathway to Keep the 1.5 °C Goal in Reach, September 2023