We believe a thematic approach to SDG-aligned investing can most effectively capture the opportunities that arise.

We have identified eight static SDG-based themes, which are built on the Sustainable Development Goals and underlying targets. Sitting under these themes are detailed and evolving SDG topics which represent concrete solutions – these topics will grow further as new technologies, or sometimes entire business segments, develop, evolve and mature into viable, effective and economical solutions that bring desired positive outcomes.

Overview SDG themes - Proprietary SDG themes with selested underlying topics and SDG-alignment1

Underlying SDG topics are an evolving pool of focused investable solutions

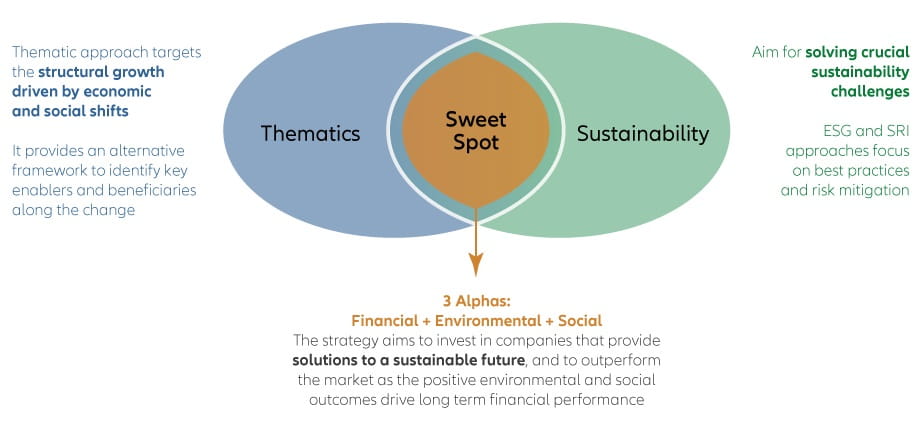

Why thematic investing?

All of our SDG funds follow our thematic investment approach, built on a solid understanding of secular drivers, and the ability to identify companies with long-term potential. These companies have greater growth potential, are more resilient to macroeconomic and political volatility, and benefit from regulatory tailwinds.

The team actively selects companies based on a combination of fundamental research and the analysis of the contribution of each company to the SDGs. We seek out the most promising companies within a topic. Companies engaged in controversial business practices or activities are excluded from the portfolio.2

We invest in the Key Enablers of the SDGs

SDG-aligned investment strategies invest in companies that we call key enablers of the SDGs. These companies enable others to act, as they provide goods or services that allow others to lower or minimise their footprint. These key enablers therefore have a multiplier effect: they not only manage their own footprint but have a potentially much larger effect through their impact on others.

How a company’s Handprint takes its Footprint one step further

A company’s footprint measures the impact on the environment and society that their activities produce. Frequently measured footprint categories include, for example, the carbon footprint (the amount of carbon dioxide emitted) or the water footprint (the fresh water consumed and/or polluted). Traditional sustainable investment strategies focus on the improvement or even minimisation of the footprint of invested companies.

SDG-aligned investment strategies go one step further by investing in companies that are key enablers of the SDGs. These companies enable others to act, as they provide goods or services that allow others to lower or minimise their footprint. The handprint describes this impact. These key enablers therefore have a multiplier effect: they not only manage their own footprint, but have a potentially much larger effect through their impact on others.

Explore our capabilities

Learn more about our strategies, process and gain further insights from our experts.

1Source: Allianz Global Investors.

Allianz Global Investors supports the UN Sustainable Development Goals (SDG)

2Allianz Global Investors, August 2020. A performance of a strategy is not guaranteed and losses remain possible. This is for illustrative purposes only and discussion on a new strategy idea.

ESG: Environmental, Social and Governance. SRI: Sustainable and Responsible Investing

Investing involves risk. The value of an investment and the income from it may fall as well as rise and investors might not get back the full amount invested. Investing in fixed income instruments may expose investors to various risks, including but not limited to creditworthiness, interest rate, liquidity and restricted flexibility risks. Changes to the economic environment and market conditions may affect these risks, resulting in an adverse effect to the value of the investment. During periods of rising nominal interest rates, the values of fixed income instruments (including positions with respect to short-term fixed income instruments) are generally expected to decline. Conversely, during periods of declining interest rates, the values of these instruments are generally expected to rise. Liquidity risk may possibly delay or prevent account withdrawals or redemptions. The volatility of fund unit/share prices may be increased or even strongly increased. Past performance does not predict future returns. If the currency in which the past performance is displayed differs from the currency of the country in which the investor resides, then the investor should be aware that due to the exchange rate fluctuations the performance shown may be higher or lower if converted into the investor’s local currency. This is for information only and not to be construed as a solicitation or an invitation to make an offer, to conclude a contract, or to buy or sell any securities. The products or securities described herein may not be available for sale in all jurisdictions or to certain categories of investors. This is for distribution only as permitted by applicable law and in particular not available to residents and/or nationals of the USA. The investment opportunities described herein do not take into account the specific investment objectives, financial situation, knowledge, experience or specific needs of any particular person and are not guaranteed. The Management Company may decide to terminate the arrangements made for the marketing of its collective investment undertakings in accordance with applicable de-notification regulation. The views and opinions expressed herein, which are subject to change without notice, are those of the issuer companies at the time of publication. The data used is derived from various sources, and assumed to be correct and reliable at the time of publication. The conditions of any underlying offer or contract that may have been, or will be, made or concluded, shall prevail. The duplication, publication, or transmission of the contents, irrespective of the form, is not permitted; except for the case of explicit permission by Allianz Global Investors GmbH.

For investors in Europe (excluding Switzerland)

For a free copy of the sales prospectus, incorporation documents, daily fund prices, key investor information, latest annual and semi-annual financial reports, contact the issuer at the address indicated below or www.allianzgi-regulatory.eu. Austrian investors may also contact the facility and information agent Erste Bank der österreichischen Sparkassen AG, Am Belvedere 1, AT-1100 Wien. Please read these documents, which are solely binding, carefully before investing. This is a marketing communication issued by Allianz Global Investors GmbH, www.allianzgi.com, an investment company with limited liability, incorporated in Germany, with its registered office at Bockenheimer Landstrasse 42-44, 60323 Frankfurt/M, registered with the local court Frankfurt/M under HRB 9340, authorised by Bundesanstalt für Finanzdienstleistungsaufsicht (www.bafin.de). Allianz Global Investors GmbH has established branches in the United Kingdom, France, Italy, Spain, Luxembourg, Sweden, Belgium and the Netherlands. Contact details and information on the local regulation are available here (www.allianzgi.com/Info). The Summary of Investor Rights is available in English, French, German, Italian and Spanish at https://regulatory.allianzgi.com/en/investors-rights.

For investors in Switzerland

For a free copy of the sales prospectus, incorporation documents, daily fund prices, key investor information, latest annual and semi-annual financial reports, contact [the Swiss funds’ representative and paying agent BNP Paribas Securities Services, Paris, Zurich branch, Selnaustrasse 16, CH-8002 Zürich - for Swiss retail investors only] or the issuer either electronically or by mail at the given address. Please read these documents, which are solely binding, carefully before investing. This is a marketing communication issued by Allianz Global Investors (Schweiz) AG, a 100% subsidiary of Allianz Global Investors GmbH. The Summary of Investor Rights is available in English, French, German, Italian and Spanish at https://regulatory.allianzgi.com/en/investors-rights.