Navigating Rates

Higher for longer: the demise of the “zombies”?

With “higher for longer” now being accepted as consensus, the reality is sinking in for many corporates and investors. While higher rates are actually benefiting some companies – for instance, those larger cap players that previously secured financing at very low rates – the reality is different for many other that are taking the brunt of elevated borrowing costs. However, the higher for longer environment is also leading to a major shift in the corporate ecosystem – after over a decade of ultralow rates, some poor-quality companies – with, perhaps, low margins, weak cash generation, or unstable balance sheets – may now struggle to survive. Indeed, many of these companies may now struggle to find adequate funding and thus be vulnerable to bankruptcy or acquisition.

The zombie emergence

The term “zombie” company first become popular in Japan during its “lost decade” in the 1990s. However, despite the term being common currency for some time now, there is no consensus on the definition of such firms. Zombies have a hard time serving their debt. Crucial for the identification of a zombie is thus interest payments exceeding earnings (EBIT), but additional screening needs to distinguish growth firms – that need time to become profitable – from real zombies.

In addition to questions of definition, computing the share of “zombification” is complicated by differences across sectors and geographies. However, recent research has revealed some robust observations. For instance, a recent Bank of International Settlements (BIS) paper showed that the number of zombie firms has grown significantly since the 1990s, with elevated levels around the great financial crisis and Covid pandemic, while also showing that small- and mid-sized firms are more affected.1 Several approaches seek to explain this trend. Aside from the ultra-low-rate environment and misguided easy government money, it is believed that some weaker banks have shown reluctance to write off poor performing loans from Zombies as doing so would eat into their own thinning capital buffer.

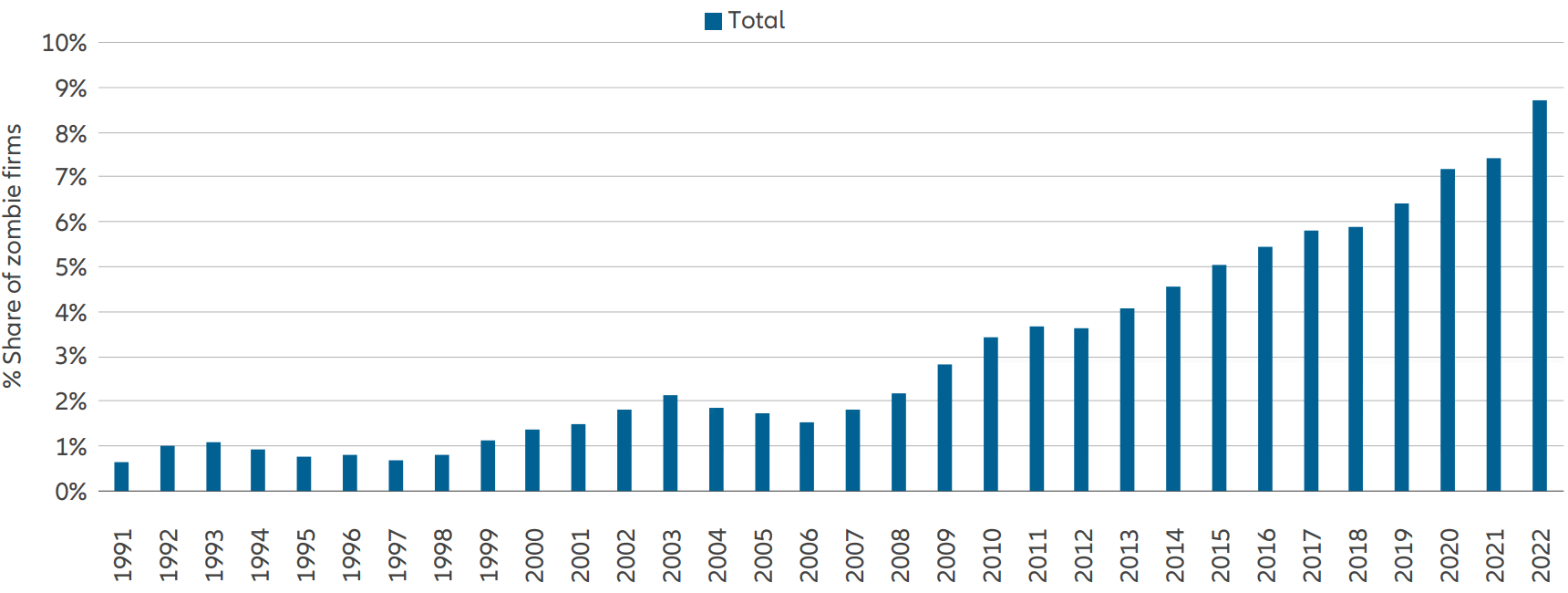

Our own research sheds further light on the history of zombie companies and the sectors in which they are more or less likely to proliferate. For instance, we see here that, according to certain criteria, the ratio of zombie companies has increased severalfold since the late 1990s.

Exhibit 1: Evolution over time – share of zombie firms

Source: Allianz Global Investors, as at 31 October 2023

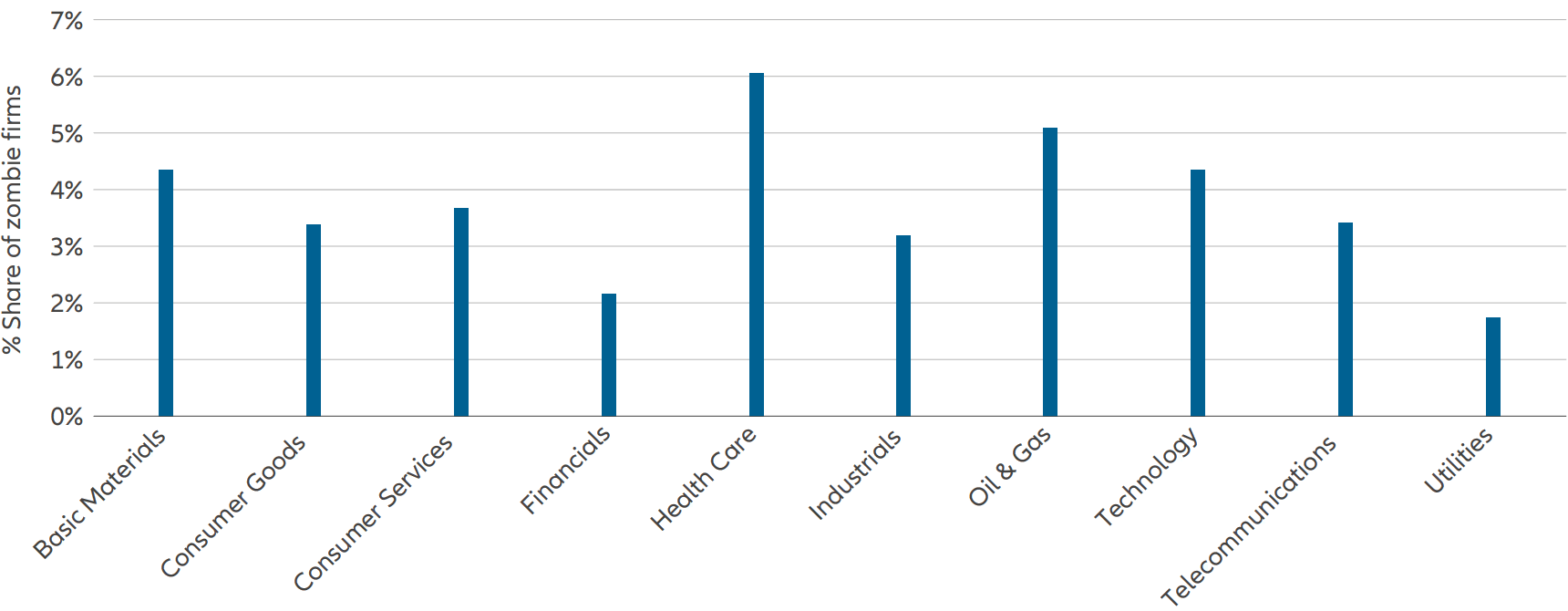

And the following chart shows the breakdown of zombies across sectors.

Exhibit 2: Industry classification – share of zombie firms

Source: Allianz Global Investors, as at 31 October 2023

Here, we see the usual suspects from the basic materials and oil and gas industries are accompanied by health care companies, perhaps still waiting for their first blockbuster.

Should investors be concerned?

While zombification is clearly an issue for affected companies and their shareholders, the impact of this problem might go further. For instance, zombie companies weaken overall economic performance, locking up resources and crowding-out growth in more productive companies. Indeed, their existence lowers overall margins, making investment in their more efficient peers seem less attractive. While the scale of these “congestion” effects is actively discussed, any spike in corporate bankruptcies due to companies’ inabilities to refinance will likely have a measurable impact on economic growth. On the other hand, the number of employees working with, and the total amount of credit given to, zombies is presumably not large enough to trigger a recession in a scenario of elevated levels of corporate bankruptcies.

On a more practical level, investors should be wary of those sectors where zombification seems to be at its highest. It is here that we may find an uptick in bankruptcies in the coming years, and investors should seek to navigate these sectors – which remain highly attractive for other reasons – with the required expertise. However, as long as a commitment to quality is maintained throughout the portfolio and across investing styles, equity investors should not have too much to fear.

Indeed, the demise of the zombies should not be lamented – while entailing short-term pain, the end of low profitability and growth firms is a sign of the proper functioning of capital markets, rather than a symptom of some underlying problem.