Embracing Disruption

Update on India valuations: an attractive entry point?

In our previous note, we outlined the reasons why we believe India warrants a premium valuation among global equity markets. Since then, India’s relative valuations have fallen to an all-time low. Given this sharp pullback, we want to articulate why we see a potentially compelling entry point for investors.

First, we view the recent correction in Indian equities as being largely driven by policy-induced liquidity tightening and an unintended slowdown in government spending. While policymakers intended to curb overheating in credit growth, the resulting impact turned out to be more pronounced than expected. This appears to be a self-inflicted slowdown rather than a sign of structural weakness.

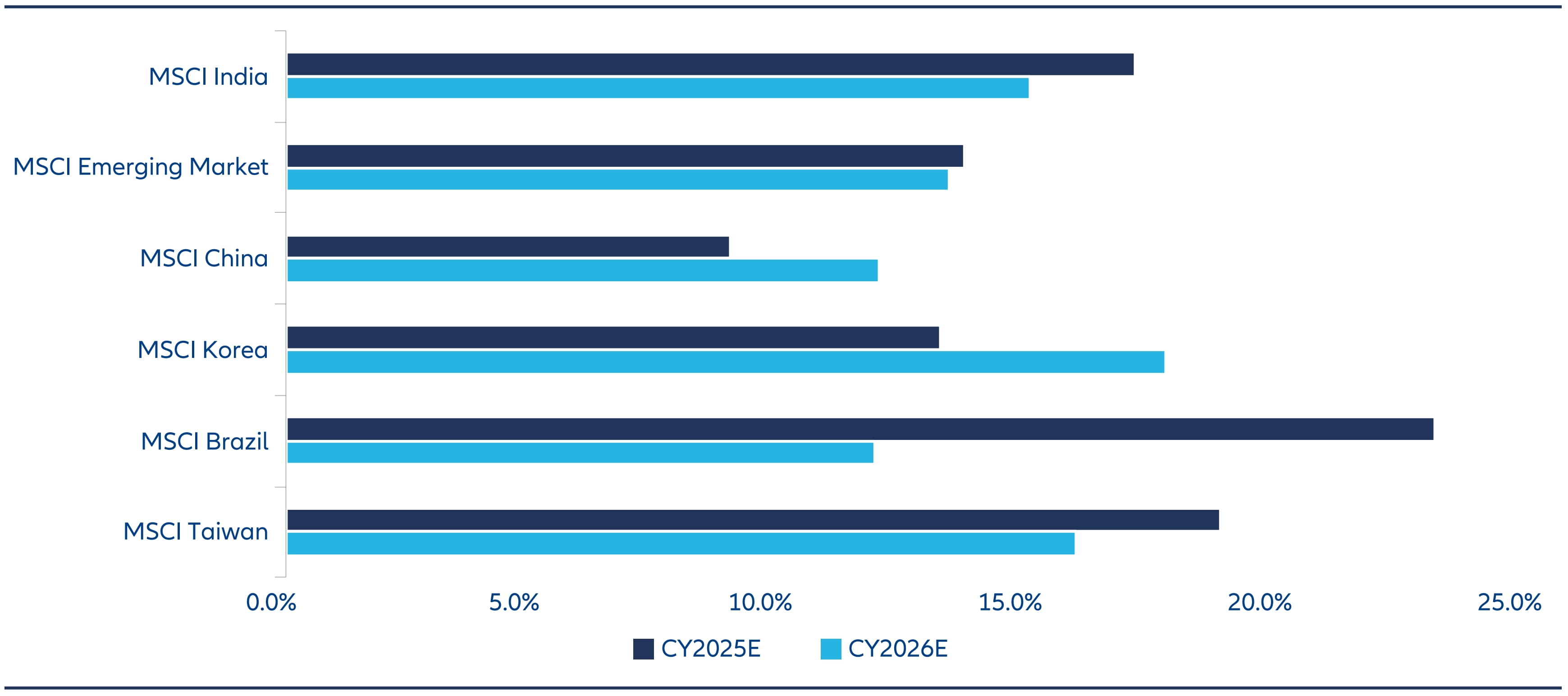

Encouragingly, there is now a visible shift in policy focus towards reviving growth, with active steps being taken to ease liquidity conditions. Measures such as interest rate cuts and tax reductions underscore the government’s strong commitment to reigniting economic momentum. Consequently, we expect a reacceleration in economic growth and corporate earnings over the next two quarters, with positive spillover effects well into 2025 and 2026. Even before this anticipated recovery, consensus earnings expectations for Indian equities remained robust, reflecting the inherent strength of corporate India.

Chart 1: EPS Forecasts among Emerging Markets

Source: Morgan Stanley, as of 24 February 2025

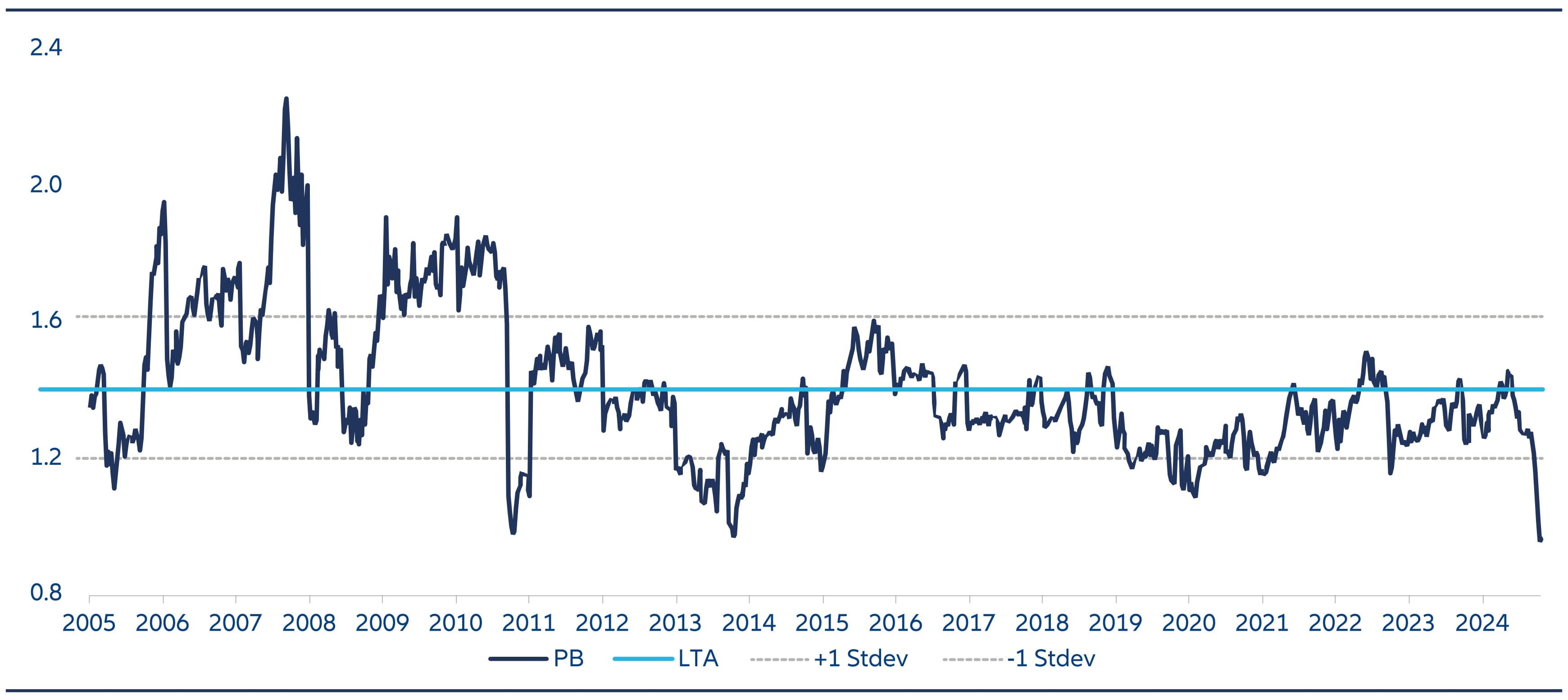

From a valuation standpoint, MSCI India’s price-to-book (P/B) ratio relative to the MSCI All Country World Index has fallen nearly two standard deviations below its historical average, marking its lowest level in the past 15 years.1 We think this discount presents an attractive entry point for long-term investors. Additionally, if inflation continues to moderate and the Reserve Bank of India (RBI) further eases liquidity and interest rates, market sentiment is likely to improve, attracting renewed interest from global investors.

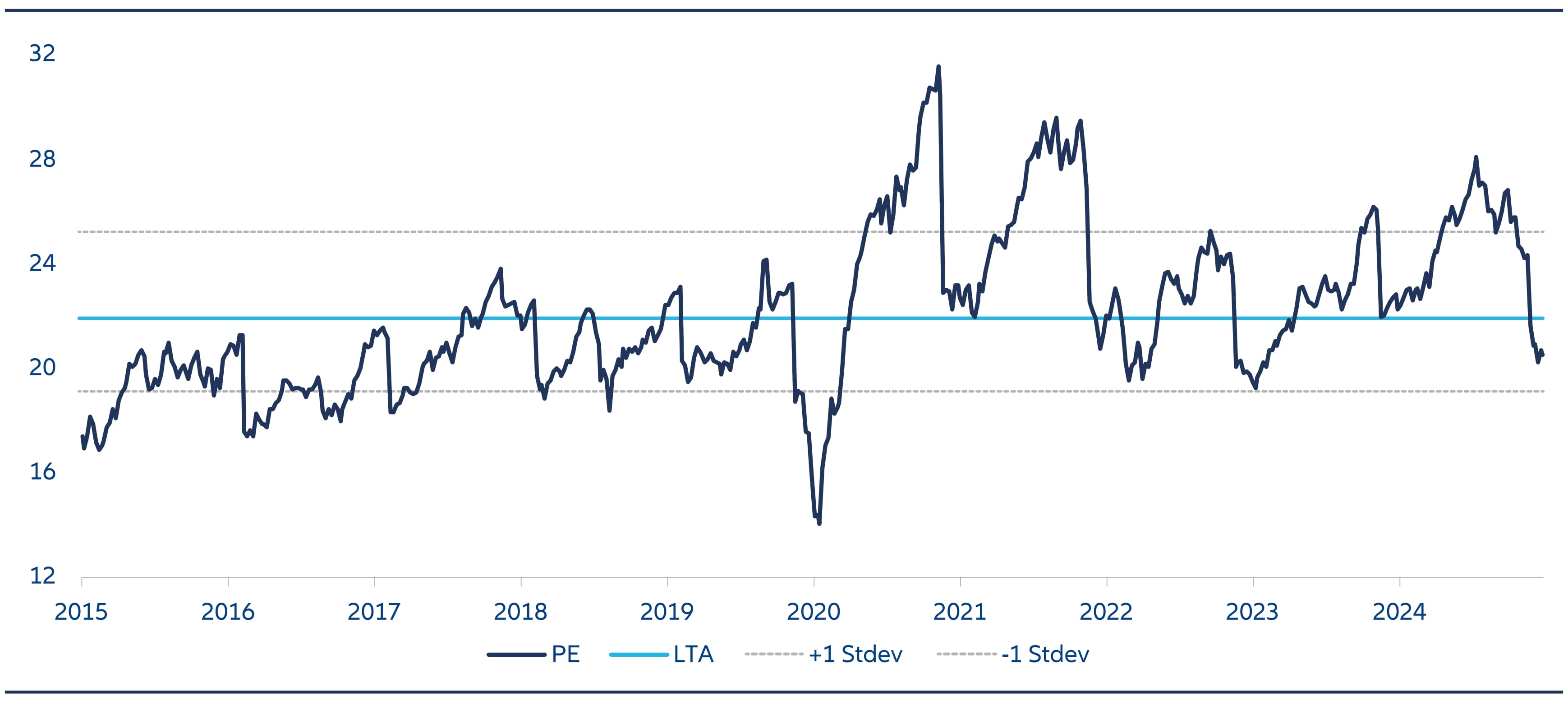

Given this backdrop, we have been using the recent market correction as an opportunity to express conviction in Indian equities. Historically, waiting for a clear and sustained recovery in markets has often led to missed opportunities. Notably, over 85% of the BSE 500 stocks are currently trading below their 200- day moving average, signaling a broad-based correction. Meanwhile, relative to India’s own history, current valuations are below the 10-year long-term average price-toearnings (P/E) ratio, reinforcing the current attractiveness.1

Chart 2: MSCI India relative to MSCI ACWI Price-to-Book (P/B) ratio

Source: Bloomberg, as of 11 March 2025

Chart 3: MSCI India Price-to-Earnings (P/E) ratio

Source: Bloomberg, as of 11 March 2025

To capitalize on this market dislocation, we remain focused on high-quality stocks that have undergone significant share price corrections despite demonstrating resilient earnings growth. Our approach is anchored on maintaining portfolio diversification while selectively increasing exposure across sectors. We continue to find opportunities in stocks where earnings estimates have been revised upwards, yet valuations remain suppressed, creating asymmetric risk-reward opportunities. Additionally, even in sectors that have temporarily fallen out of favor, such as industrials, we are identifying promising sub-segments—particularly in the power supply chain, where companies continue to exhibit strong growth potential. Similarly, within the consumer discretionary space, companies that have leveraged technology to drive disruption are seeing margin normalization at higher levels, making them increasingly attractive from a valuation standpoint.

Overall, we believe India’s current valuation reset represents a potentially opportune moment for long-term investors who have been hesitant due to past valuation concerns. With the structural growth story intact and a more supportive policy backdrop unfolding, we see a strong case for sustained investor interest in Indian equities.

1 Morgan Stanley, as of 4 March 2025