Going round in circles – the value of waste

A scarcity of raw materials and an abundance of waste are significant challenges for the planet. A circular economy could be a transformative solution, but it will require a radical rethink of the existing take-make-waste economy and the entire product lifecycle that goes far beyond recycling. What are the opportunities for investors?

Key takeaways

- The circular economy centres on conserving resources through extended product lifecycles and the reintegration of materials into production.

- Circular business models can help reduce costs, minimise environmental impact and mitigate critical raw material supply issues

- Industries will adapt circular economy principles differently based on their unique characteristics and challenges.

- Investors can play an important part by backing innovators, supporting companies in transition and integrating circular economy thinking into their own investment processes.

Why are we talking about the circular economy now?

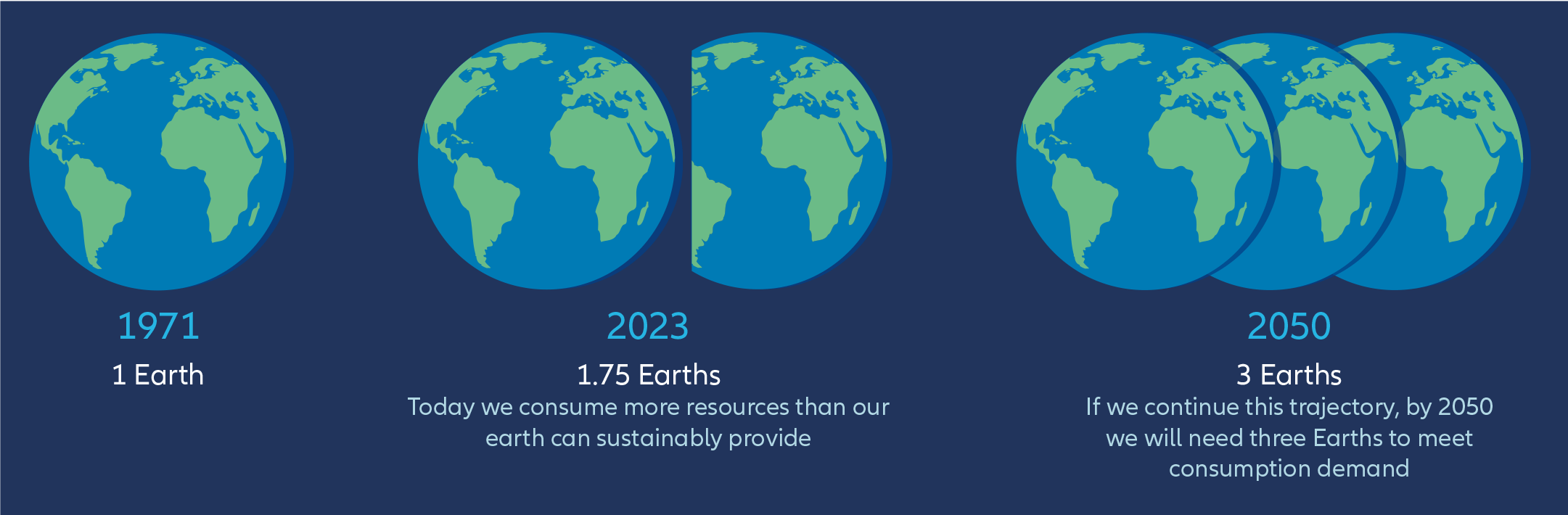

The world is running out of resources, and dealing with all the waste produced is getting incredibly expensive. By 2050, global demand for natural resources is projected to exceed the capacity of three Earths.1 The rates of consumption of vital resources such as biomass, fossil fuels, and minerals are on track to double within the next four decades, with forecasts indicating a 70% surge in waste generation.2

Earth’s population has surged in the last 50 years, causing a tripling of material extraction and a quadrupling of total gross domestic product.4 The surge has also resulted in accelerated extraction and processing of natural resources, a practice accountable for over 90% of biodiversity loss and water stress, and about half of all climate change impacts.5 This trajectory of consumption and extraction is unsustainable given the planet’s finite resources (see Exhibit 1).

Did you know?

The world economy has consumed half a trillion tonnes of virgin materials (minerals, ores, fossil fuels and biomass) in just six years, with only 8.6% of all used products being recyled.3

Exhibit 1: The unsustainable trajectory of consumption and extraction

Source: Global Footprint Network, Allianz Global Investors, November 2023

What is a circular economy?

What is the benefit of a circular business model?

For firms, a circular business model can address concerns around the supply and price volatility of raw materials, reduce costs, and lower their environmental impact and import dependency. Producing new products exerts a greater environmental toll than the continued use of existing ones. The CE reduces reliance on raw materials. This is particularly relevant for critical raw materials essential in the production of climate-critical technologies like batteries and electric engines.

The environmental impacts of resource extraction are already immense and they will escalate as rising demand requires pushing further and harder for more raw materials. Examples of these impacts are biodiversity loss, pollution, and loss of ecosystem services – all of which have significant financial costs. Current extraction trends are unsustainable, and a CE is a core tool in addressing the supply-demand gaps.

Where is the circular economy needed?

Did you know?

If a circular approach were adopted in just five sectors (steel, aluminum, cement, plastic, and food), a global saving of 9.3 billion tonnes of CO2 e could be realised in 2050, equivalent to eliminating global transport emissions.6 Adopting CE principles in Europe in mobility, the built environment, and food could offer annual benefits of EUR 1.8 trillion by 2030.7

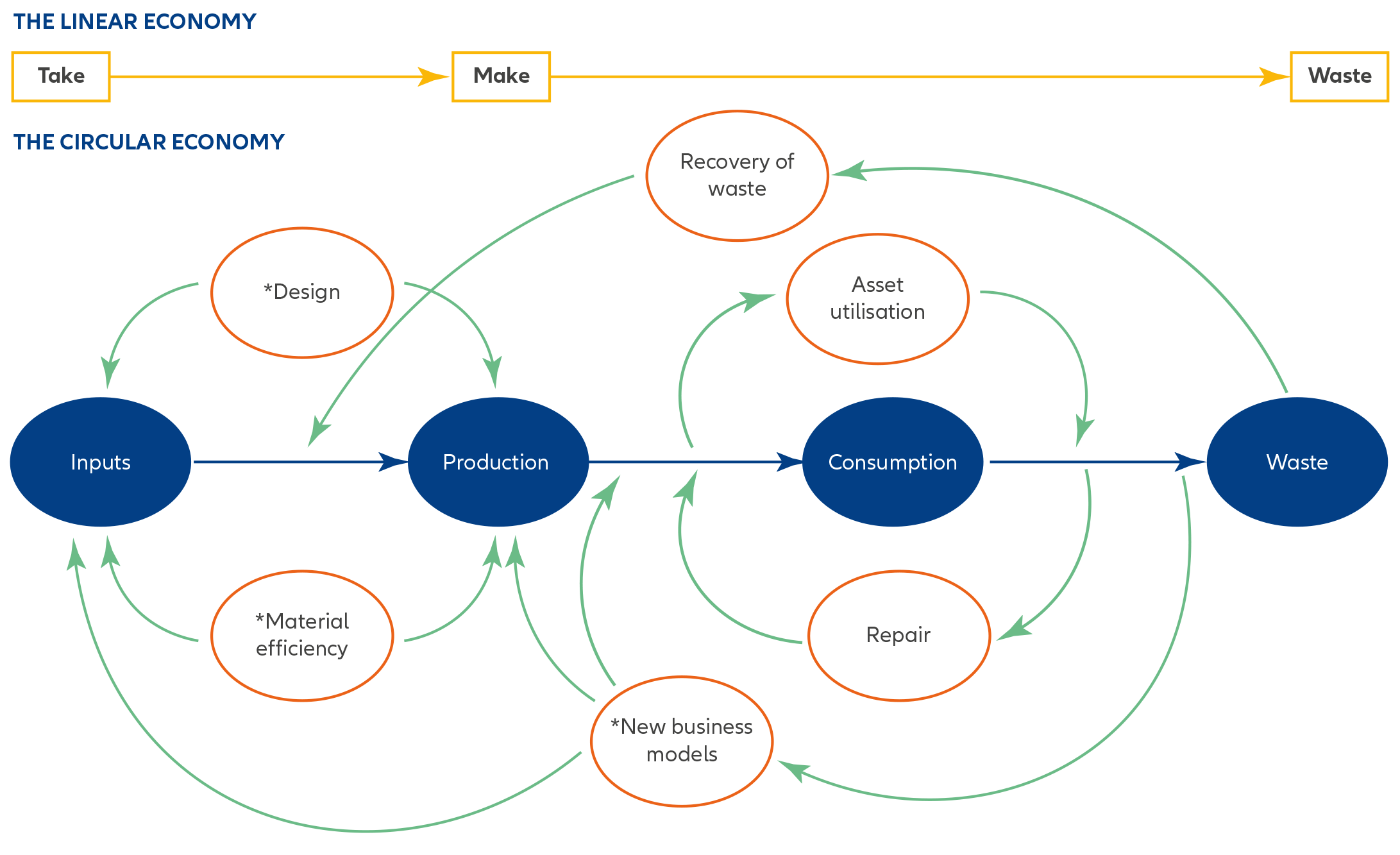

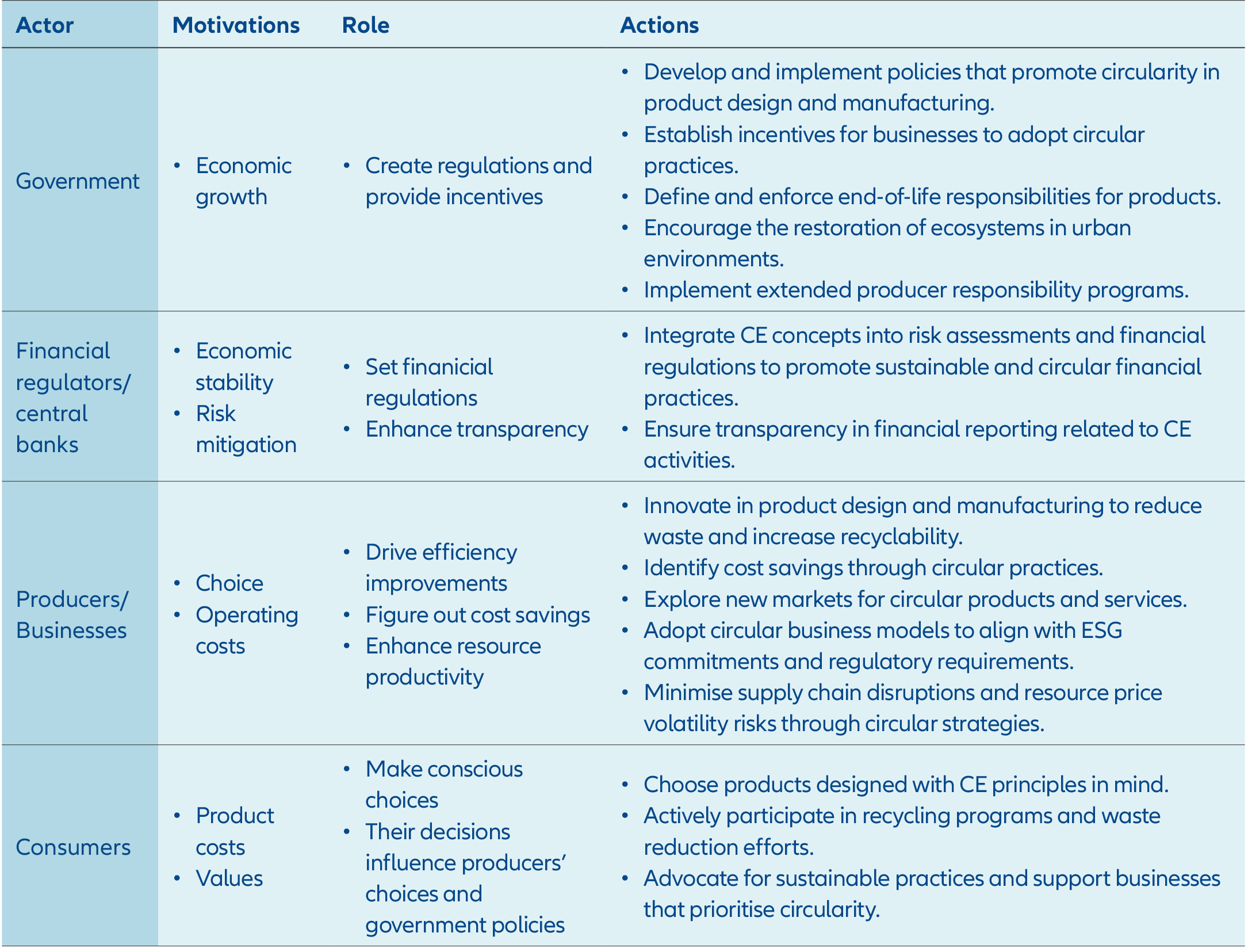

Exhibit 2: The circular economy life cycle

*CE principles such as new business models, design, and material efficiency can be applied at various stages of a product’s life cycle.

Source: Allianz Global Investors, Ellen MacArthur Foundation, November 2023

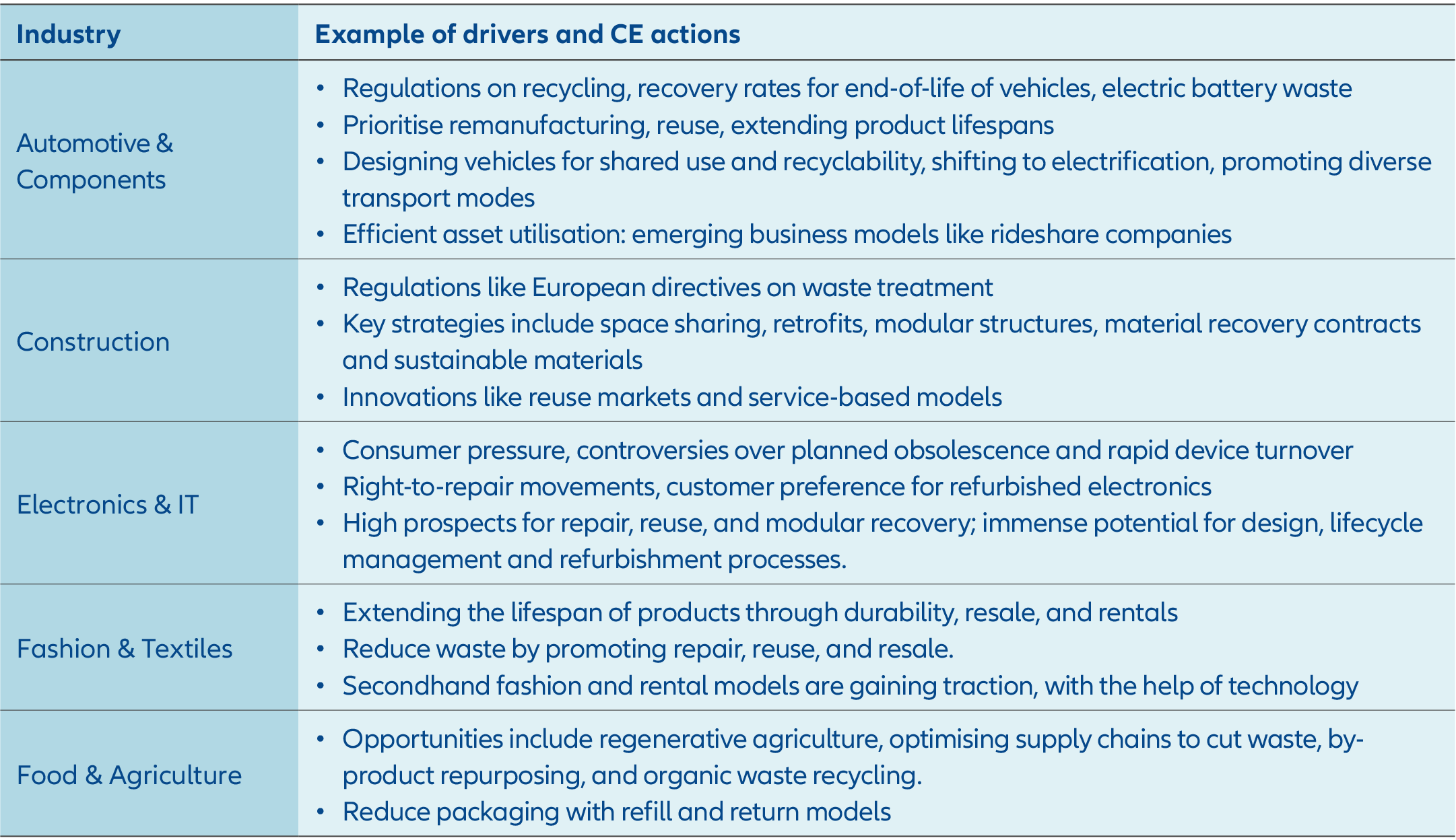

Industries can adapt circular economy principles differently based on their unique characteristics and challenges (see Exhibit 3). One example of a success story is in fashion, where the support of circularity roadmaps and legislation across several economies means clothing resale is projected to overtake fast fashion by 2029.8

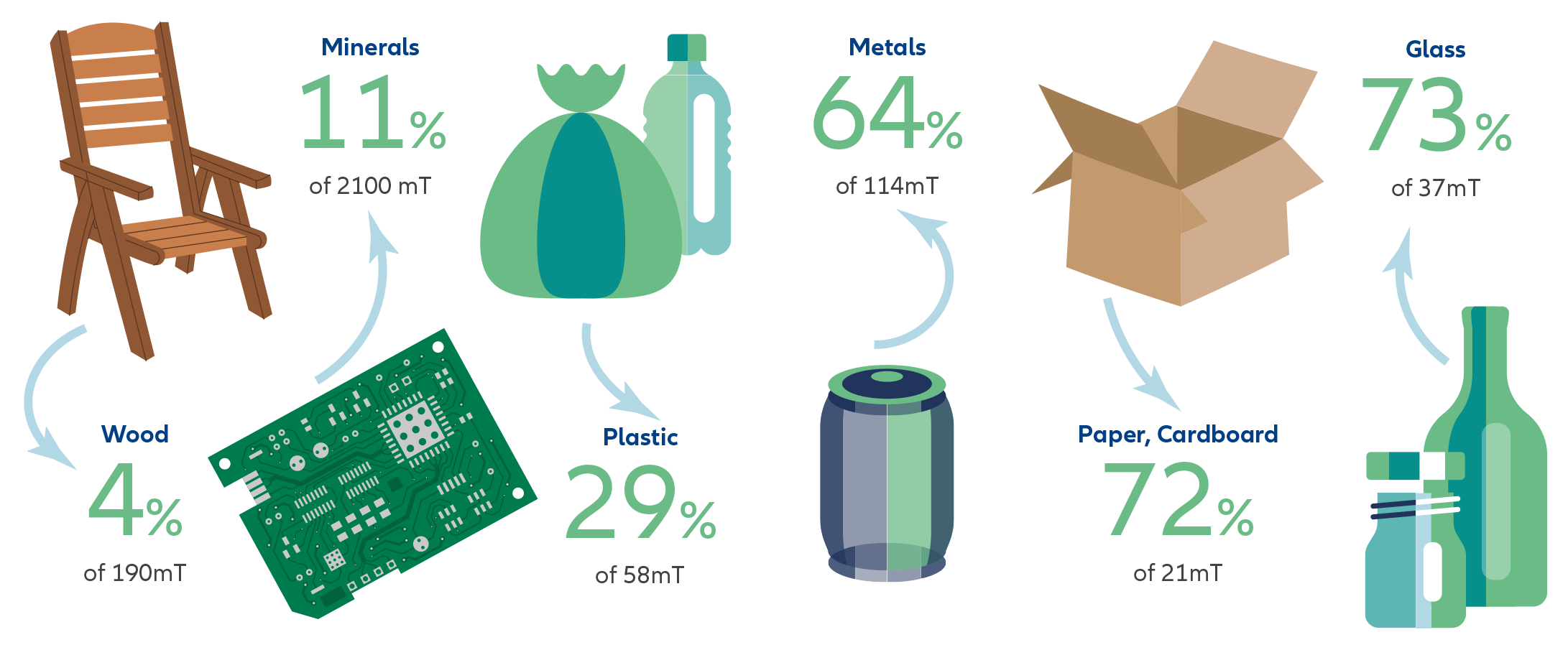

Circularity has never been so fashionable and demonstrates a pragmatic approach with sizeable financial and nonfinancial benefits. As Exhibit 4 shows, recycling rates vary dramatically for different materials and there is huge potential for growth in materials with low rates.

Exhibit 3: Industry summary of drivers and CE actions

Source: Allianz Global Investors, November 2023

Exhibit 4: Recyling of selected materials in the European Union

Source: Renewi plc Annual Report and Accounts 2022

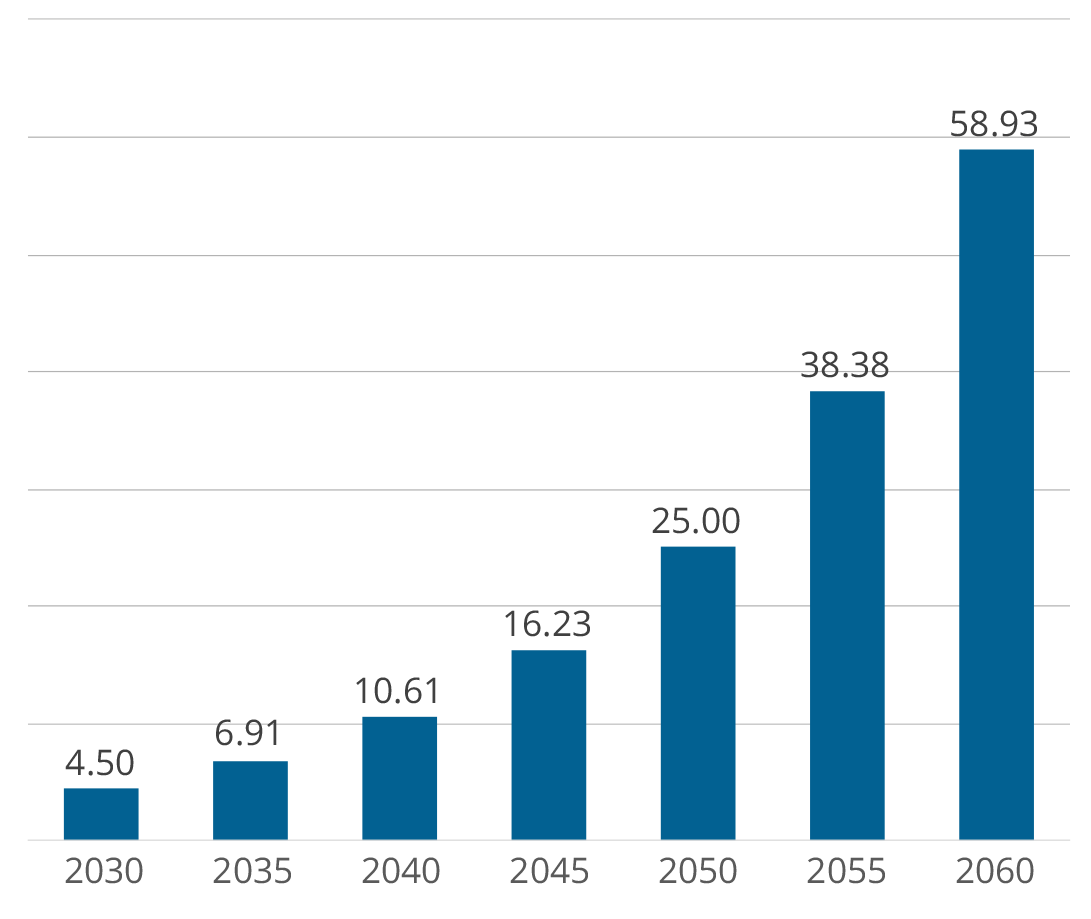

Given the vast potential for the application of CE principles across industries, circularity could be worth USD 4.5 trillion to the global economy by 2030 and USD 25 trillion by 2050 (see Exhibit 5).

How do industries move towards circular business models?

We believe regulatory frameworks are critical to the evolution of the CE. Frameworks vary by region, but we identify four key policies that can promote circularity:

- Recycling targets

- Extended producer responsibility (EPR)9

- Landfill bans

- Incineration taxes

Exhibit 5: Expected global economic growth due to the CE

USD trillion

Source: Accenture, Waste to Wealth 2015

In line with broader European Union (EU) climate goals, including carbon neutrality by 2050, investors should be aware of regulations that mandate sustainability.

We anticipate that an increasing number of regulations mandating net zero or sustainability will encompass the need for more resilient business models.

CE policies have gained momentum, with the EU 2020 Circular Economy Action Plan a leading example.10 This initiative targets industries with high resource intensity such as electronics, plastics, textiles and construction. This has been supported by the EU Parliament push for stricter recycling rules and binding 2030 targets for material use and consumption. Product adaptation to meet EU USB-C standards – to provide a common charger for all portable devices – highlights how regulation can drive competitive forces. Away from Europe, China’s designation of vehicle manufacturing as a strategic sector is another example.

Furthermore, CE features prominently in the EU Taxonomy classification system for sustainable economic activities. Coupled with the World Benchmarking Alliance and Global Reporting Initiative evaluations, identifying and measuring adherence to CE principles is developing rapidly

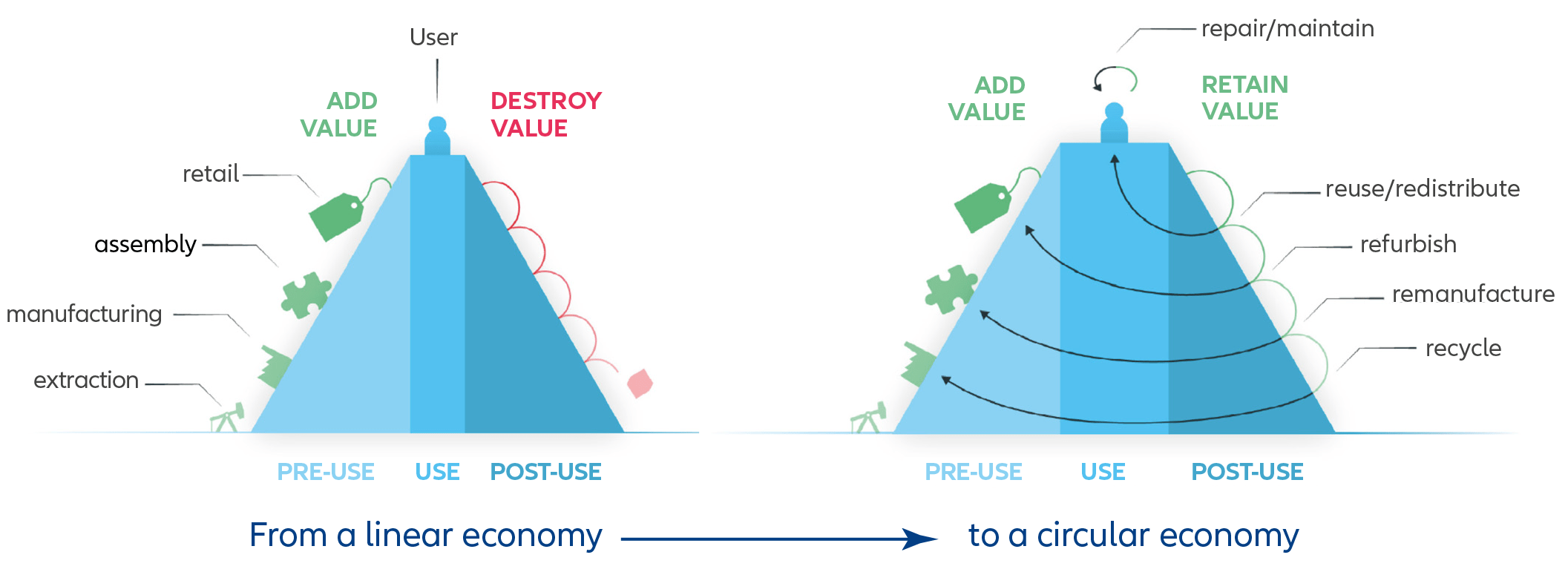

How do different stakeholders contribute to the CE?

Transition towards a CE requires responsible collaboration between governments, regulators, businesses and consumers.

Exhibit 6: Roles of government, producers and consumers in the CE

Source: Allianz Global Investors, November 2023

The European Commission has made it clear that the EU’s strategy for limiting economic impact on the planet cannot be achieved without a CE.11 Having launched its CE Action Plan in 2020, it will require 50,000 EU companies to disclose CE performance from 2024.12 Improved transparency will help direct capital specifically to circular activities.

The importance of this last point on data cannot be overstated. Integration and harmonisation of circularity metrics into reporting frameworks such as CDP, SBT, SASB, TCFD13 and the EU Non-Financial Reporting Directive is critical. For example, a multinational automotive corporation operating across the EU illustrates the importance of harmonising data reporting within established frameworks. This integration streamlines sustainability reporting, enabling easier compliance, greater transparency and enhanced support for circular initiatives, ultimately benefiting investors and stakeholders in assessing the company’s CE efforts.

Investment opportunities in the circular transition

The CE represents an opportunity for investors to mitigate risks and promote genuine economic adaptation to climate, biodiversity and social challenges through a radical reimagining of the product lifecycle.

For investors looking to align to the UN Sustainable Development Goals (SDGs), SDG 6 (clean water and sanitation), SDG 7 (affordable and clean energy), SDG 8 (decent work and economic growth), SDG 12 (responsible production and consumption) and SDG 15 (life on land) are all aligned with CE.14

Exhibit 7: The circular economy value hill

Source: Circle Economy Foundation, September 2016

However, we believe investors can also look to capture meaningful value from the CE transition.

In addition to companies already engaged in circular activities, focusing on those moving away from a linear take-make-waste economic model could also lead to positive impact.

Promoting the CE can add value to companies by protecting valuable resources and minimising waste (see Exhibit 7). An analysis by Bocconi University of over 200 listed European companies across 14 industries showed firms with greater circularity exhibited lower default risk and higher risk-adjusted returns.15

In the financial landscape, innovative products are emerging to facilitate investment in the CE:

- Sustainability-linked debt with key performance indicators (KPIs) linked to the transition to more sustainable and circular business models.

- Green loans and bonds with use of proceeds fully dedicated to the financing or refinancing of circular projects.

- Financing new circular business models such as sharing or product-as-a-service (PaaS) business models.

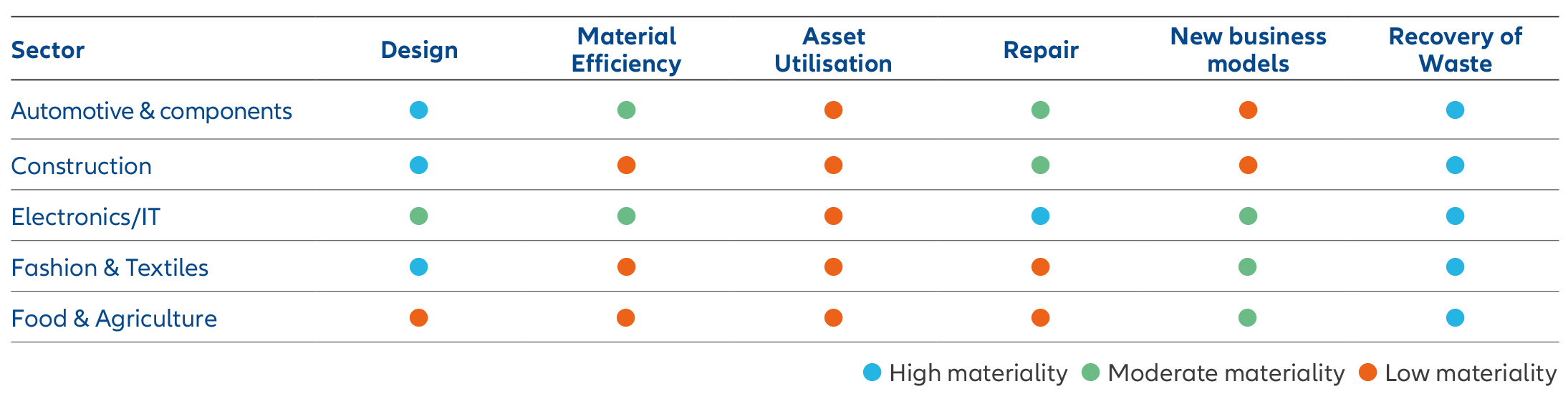

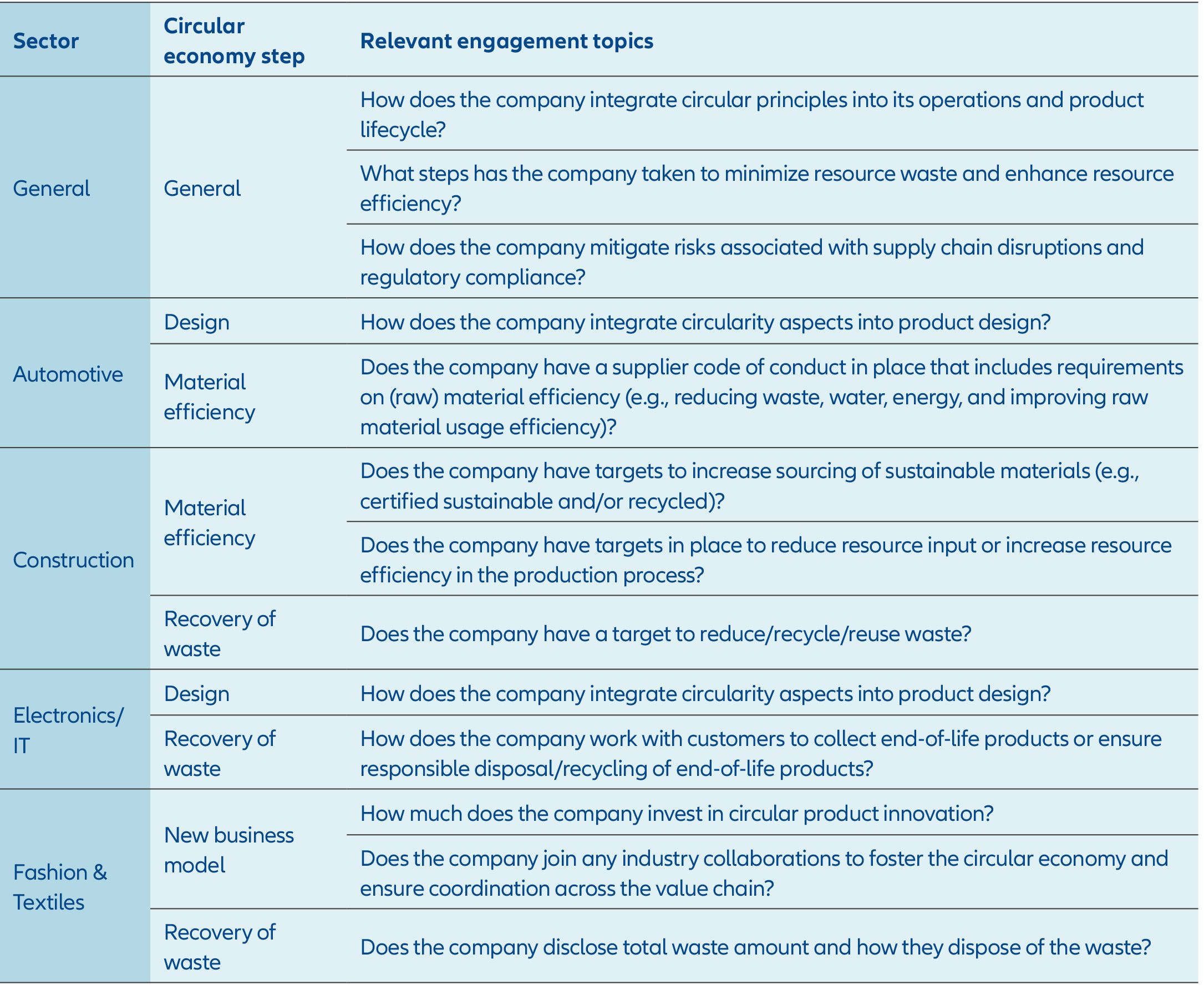

We recognise that factors vary by sector and this prompts our tailored approach – we look at the different components of the CE lifecycle and consider which have the most potential and/or impact for each sector (see Exhibit 8). Risks and opportunities are tied to a company’s supply chain, the location of its activities and its risk governance.

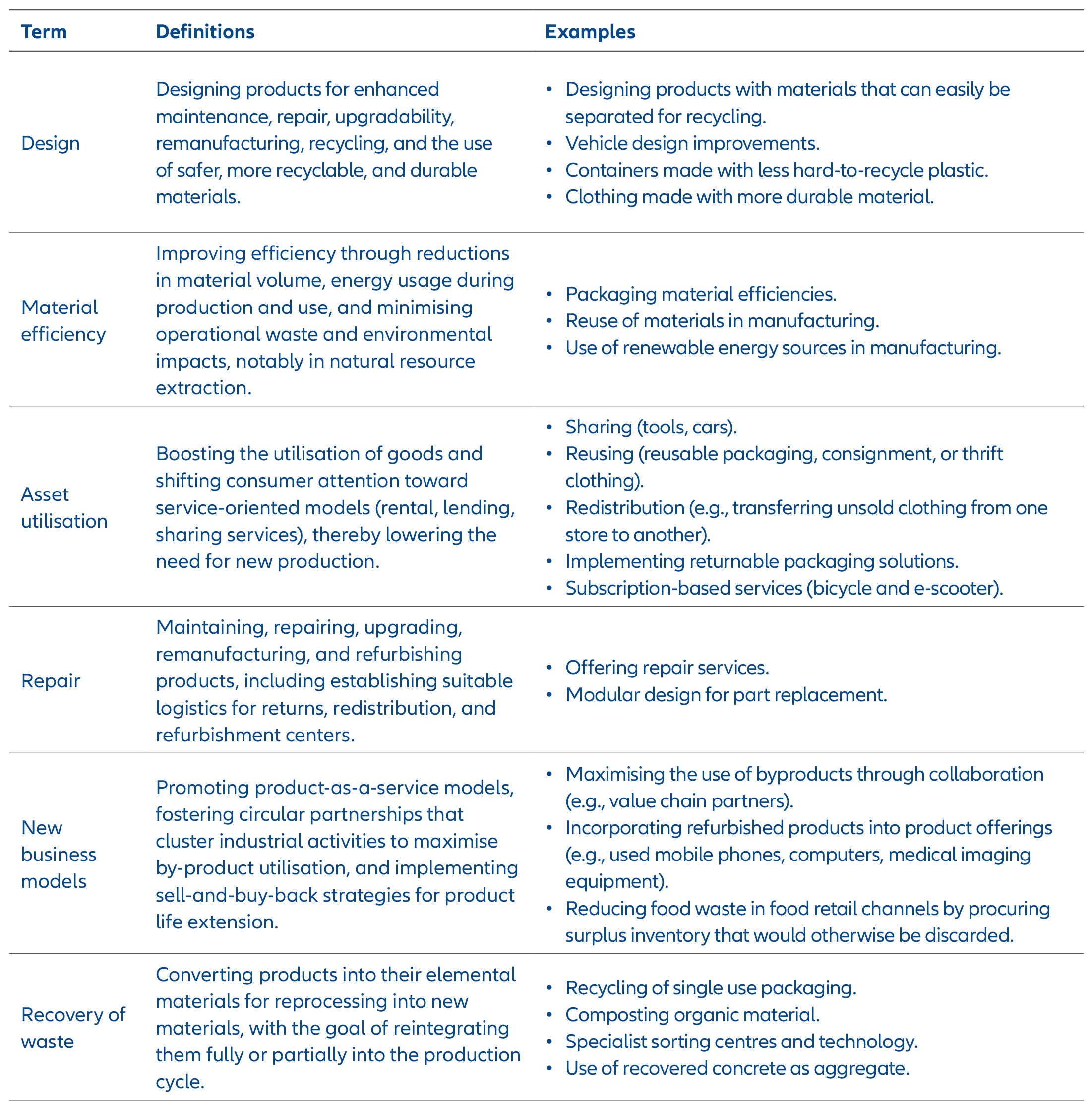

Given we are still in the early stages of circularity data and reporting, we also believe active investor engagement with companies is essential to assess their understanding of and commitment to CE (see Exhibit 9) and identify business models where the greatest efficiencies can be generated.

Exhibit 8: Materiality of the components of the CE for select sectors

Source: Allianz Global Investors, November 2023

Exhibit 9: Examples of engagement questions on the CE for select sectors

Source: Allianz Global Investors, November 2023

Sectors like electronics and textiles have the highest risk, but also the biggest opportunity to add value by embracing circularity. We expect increasing EU and global regulation will combine with consumer demand to propel momentum in CE innovation, which should further broaden the opportunity set for investors.

Appendix 1: Definitions and examples of key components of the CE

Source: Allianz Global Investors, November 2023

1 UN Sustainable Development Goals, 2023 https://www.un.org/sustainabledevelopment/sustainable-consumption-production/

2 Siemens and Reuters Events, June 2023 “Towards a circular economy for industrial electronics”

3 PACE, The Circularity Gap Report, 2022

4 Global Resources Outlook, 2019 https://www.resourcepanel.org/sites/default/files/documents/document/media/gro_2019_fact_sheet.pdf

5 Global Resources Outlook, 2019 https://www.resourcepanel.org/sites/default/files/documents/document/media/gro_2019_fact_sheet.pdf

6 Ellen MacArthur Foundation, Growth within: A circular economy vision for a competitive Europe (2015) https://www.ellenmacarthurfoundation.org/ growth-within-a-circular-economy-vision-for-a-competitive-europe

7 Accenture Strategy, 2015, The Circular Economy Advantage https://www.palgrave.com/gp/media-centre/press/waste-to-wealth/10264126

8 Ellen MacArthur Foundation, 2020, Financing the circular economy: Capturing the opportunity https://circulareconomy.europa.eu/platform/en/ financing/financing-circular-economy-capturing-opportunity

9 An EPR scheme is a regulatory measure which involves setting fees so companies pay for the costs associated with the end-of-life management of their products.

10 The 2020 Circular Economy Action Plan promotes sustainable product design, waste reduction, and consumer empowerment, including a “right to repair”.

11 European Parliament, May 2023, Circular economy: definition, importance and benefits https://www.europarl.europa.eu/news/en/headlines/economy/20151201STO05603/circular-economy-definition-importance-and-benefits

12 https://eco-act.com/tcfd/csrd-non-financial-disclosure-in-eu/

13 Definitions: Carbon Disclosure Project, Science Based Targets, Sustainability Accounting Standards Board, Task Force on Climate-Related Financial Disclosures

14 Schroeder, Anggraeni, Weber, 2019 The Relevance of Circular Economy Practices to the Sustainable Development Goals https://ideas.repec.org/a/ bla/inecol/v23y2019i1p77-95.html

15 Ellen MacArthur Foundation, 2020, Financing the circular economy: Capturing the opportunity https://circulareconomy.europa.eu/platform/en/ financing/financing-circular-economy-capturing-opportunity