Sustainability | ~4 min read

Sovereignty - a growth catalyst?

Once associated mainly with defence, “sovereignty” has expanded into a broader investment theme in Europe encompassing the ability to self-govern. We examine how it could fuel growth in the region.

The concept of “strategic autonomy” was first coined in the early 2010s as the capacity to act autonomously in strategically important policy areasi and was closely linked with European Union (EU) defence policy.ii The pandemic, war in Ukraine and evidence of geoeconomic fragmentation have been catalysts for the broadening scope of this definition.

Subsequently, in 2020, the term “strategic sovereignty” was introduced in the European Parliament as the “ability to act autonomously, to rely on one’s own resources in key strategic areas.” iii The recent geopolitical and economic turbulence has highlighted the significance of these strategic areas of priority and the need for a deeper understanding of how nations can stand on their own two feet and achieve resilient economic growth and social cohesion.

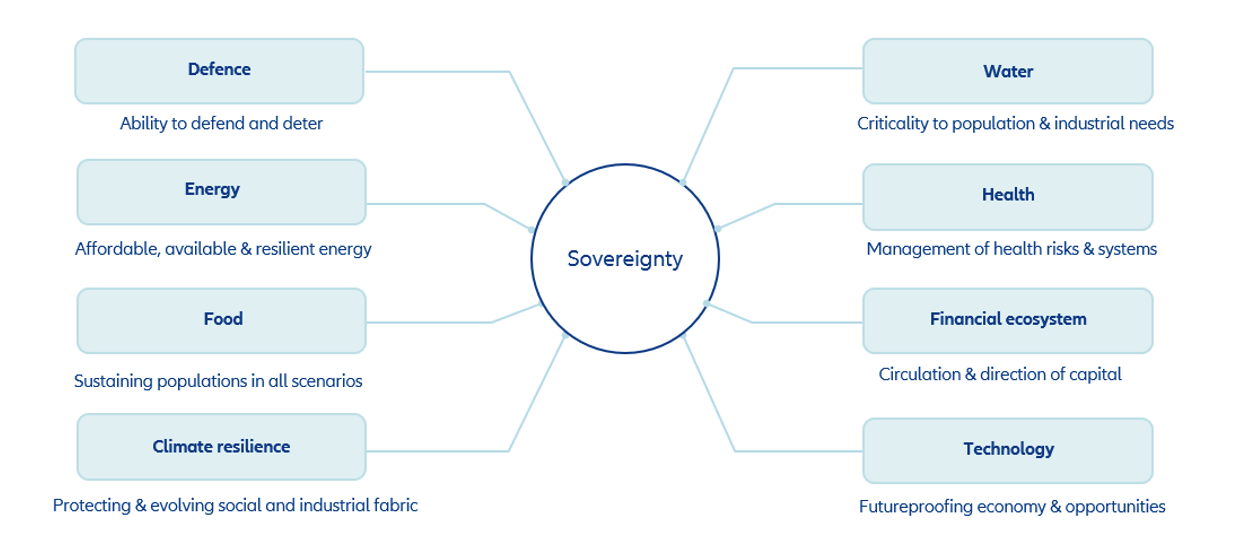

European leaders have recently become vocal on individually and collectively striving for greater resilience in energy, security and innovative technologies. Meanwhile, the EU and European Parliament explicitly highlight themes of climate, energy, food, health and water as critical to retaining economic autonomy, while also recognising the bloc’s dependency on well-functioning financial services and technology sectors. This new way of thinking about growth and prosperity marks a shift towards strategic sovereignty – underpinned by eight factors that we see in Europe.

Eight factors impacting European sovereignty

Source: Allianz Global Investors Sustainability Research, 2025

Multi-dimensional growth engine

There are significant overlaps between these eight factors. For example, technology is a fundamental lever for growth across each of the other factors. This allows for the possibility of highly efficient capital deployment to achieve greater autonomy. The market opportunity across these priority areas has been estimated by BCG as EUR 500 billion for non-defence activities in the next four years, particularly across software and systems, aerospace, automotive, electronics, telecoms and logistics.iv

Existing policy-led mechanisms will help lead the way to a more resilient Europe, such as the European Green Deal, the 2023 European Chips Act and Food 2030, which provide structure and coordinated action in the areas of climate, tech and sustainable food respectively.

Another dimension is the role that individuals’ savings can play in funding future growth. Offering wider access to simple and lower-cost investmentsv via capital markets could build household wealth – plugging the expected gaps in pension provision – while financing the eight factors outlined above.vi

In our view this is a key turning point for Europe as the journey of investing in European sovereignty begins.

Read more on this from our Equities Team: European sovereignty as opportunity | Allianz Global Investors

i European Parliament, EU Strategic Autonomy Monitor, July 2022

iiEuropean Papers, Strategic Autonomy: A New Identity for the EU as a Global Actor, July 2023

iii European Parliament, Strategic sovereignty for Europe, September 2020

ivBCG, A €500 Billion Opportunity for Nondefense Firms, June 2025

v European Commission, Savings and investments union: better financial opportunities for EU citizens and businesses, March 2025