Navigating Rates

Silver lining: how a recession may help economies and investors reset

The short-term data may look relatively benign, but we think recession is a very real prospect in the US and European economies over the coming months. Is that bad news for investors? While any downturn may create challenges in the short term, it may be a necessary way to tame persistent inflation – and offer potential new entry points for investors.

Key takeaways

- Markets may have ruled it out for now, but we think a recession in the US and Europe is on the horizon, starting later this year or early next year.

- With price pressures proving sticky, a downturn may be unavoidable as central banks keep interest rates higher for longer to help stem persistent cyclical inflation and bring it closer to their targets.

- Recession brings challenges for financial markets, but it may also present opportunities as risk assets typically start to outperform during a downturn.

- With focus in the US and Europe on where interest rates will peak, we expect Asian central banks to start lowering interest rates in the coming quarters.

The prospect of recession may not seem welcome news. As officially defined – ie, two or more quarters of shrinking growth – recession can squeeze companies, raise unemployment and impact financial markets. But we think a recession may be both unavoidable – and necessary – to help the major economies reset after the lingering repercussions of the Covid-19 pandemic and the Ukraine war. The good news? A downturn may offer potential entry points for investors as equity market valuations adjust and economies begin to recover.

Should investors prepare for a soft landing or bumpy ride?

Our base case: we anticipate a recession in the US and Europe, starting later this year or early next year.

In the short term the economic data looks relatively benign. While purchasing managers’ indices for the US, the euro zone, UK and China are all weakening, they do not yet signal an imminent recession. Meanwhile, headline inflation for the first three economies is easing more quickly than expected. Looking at these factors in the round, investors may be forgiven for thinking the major economies may be able to avoid recession. This, at least in part, accounts for this year’s strength in equity markets and relative stability in bond yields. More recent market moves have undone some of the gains in equities and pushed yields on long-term US government debt to multi-year highs.

We think caution may be warranted. The global economy is navigating a delicate balance between near-term strength and increasing fragility in the medium term.

Price pressures may have eased but annualised core inflation remains significantly above central banks’ targets of 2%. Headline inflation could also stabilise higher due to the impact of the Ukraine war and the El Niño climate pattern, among other factors, on food and energy supplies. Central banks will want to see solid evidence of slowing price increases before they ease back on interest rates. Money markets have been ruling out the likelihood of the US Federal Reserve (Fed) raising rates beyond the current level of 5.25% to 5.50%, before lowering to 4% within the next two years. We see the former as a possible scenario but think markets may start to price in less rate cuts in 2024 before a slowdown emerges. Policymakers will hope that, by keeping rates higher for longer, they can engineer a so-called soft landing whereby inflation sustainably returns to target and the economy survives relatively unscathed. In practice, this outcome is likely to prove extremely difficult. History provides few consolations: whenever central banks have raised rates to high levels to fight inflation, the outcome is almost always a recession.

It can be helpful to think of recession as a pressure relief valve that reduces the risk of economies overheating. Importantly for investors, it could create conditions for a revival in risky assets.

Should investors fear recession?

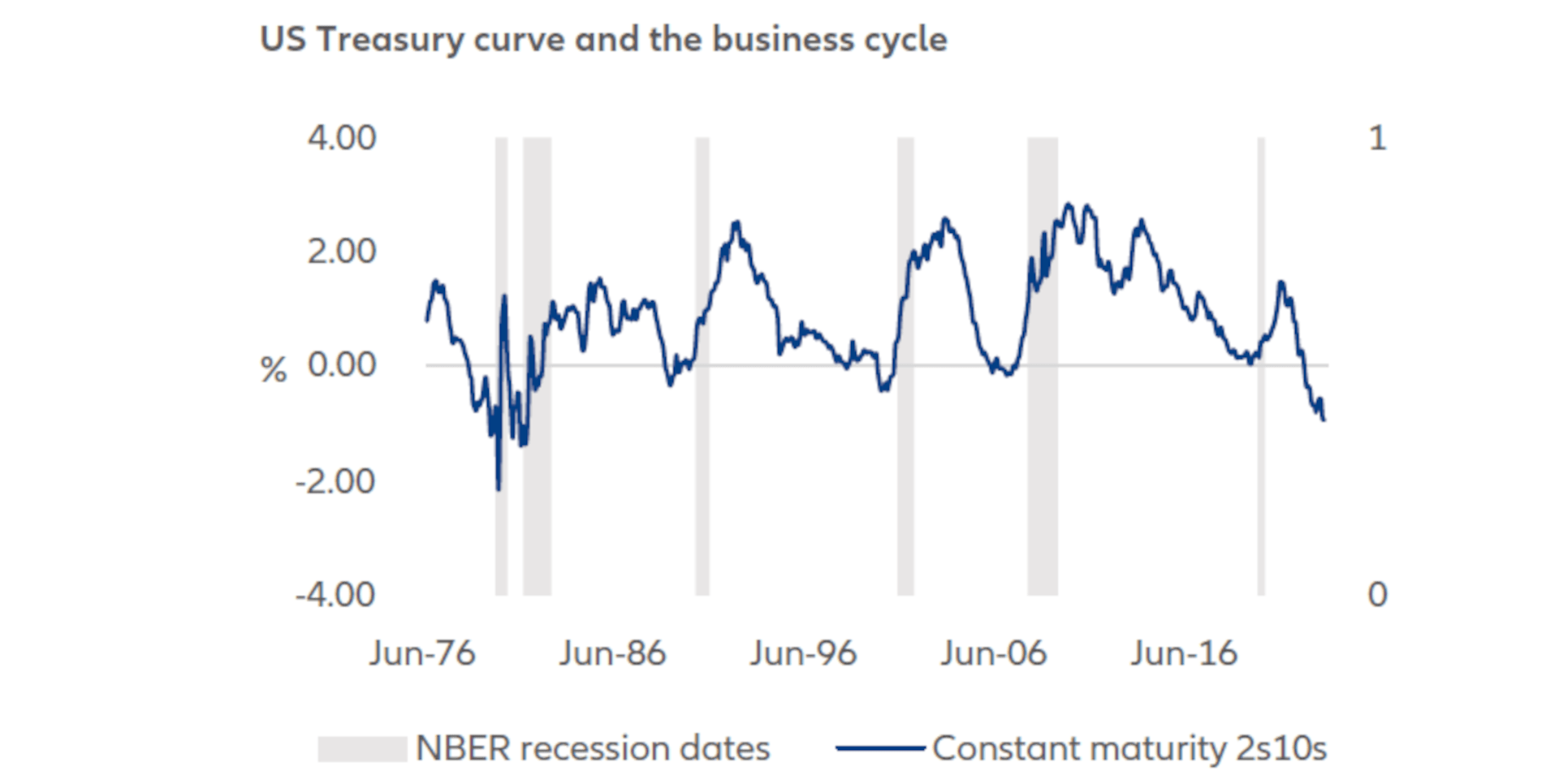

Various leading indicators are consistent with our recession call. Perhaps most significantly, yield curves are inverted. This is unusual and it means short-term bonds are yielding more than longer-term instruments of the same credit risk profile. In other words, investors expect a fall in longer-term interest rates because economic conditions are set to worsen. An inversion in the US government bond yield curve has regularly been a harbinger of recession in the world’s largest economy (see Exhibit 1), although the exact timing of the subsequent downturn varies.

Exhibit 1: US recessions have been regularly foreshadowed by an inversion of the US yield curve

Note: SD = standard deviation. Assumption underlying recession window based on start of recent inversion (July 2022), average historical lead time (15 months) and standard deviation of historical lead time (7 months)

Source: Allianz Global Investors Global Economics & Strategy, Bloomberg, Refinitiv (data as at 1 August 2023)

But what kind of recession is likely?

It is too early to tell from the data the length and severity of a possible downturn. But we see several factors as to why a downturn is more likely than the consensus scenario of a soft landing or no landing, where the economy remains resilient.1 The chances of interest rates staying high for a longer period, and thereby slowing economic growth, have been reinforced by strong recent US retail data and signs of continuing wage pressures. Moody’s downgrade of several midsized US banks2 was a reminder that financial instability risks may re-emerge after the challenges that faced the sector earlier in 2023. Consider another factor: the real estate market is slowing as a period of price rises comes to an end. If property prices fall faster than expected, the result could be a more marked economic slowdown than markets anticipate.

What should investors do in the face of recession? Consider the following:

- Be patient: recessions often require patience from investors. Also consider how to manage risk as the economic cycle begins to turn. In the medium term, a recession represents a challenge to companies as economic growth slows and then shrinks. Such a scenario is typically negative for equities but firms that are more resilient may be able to prosper.

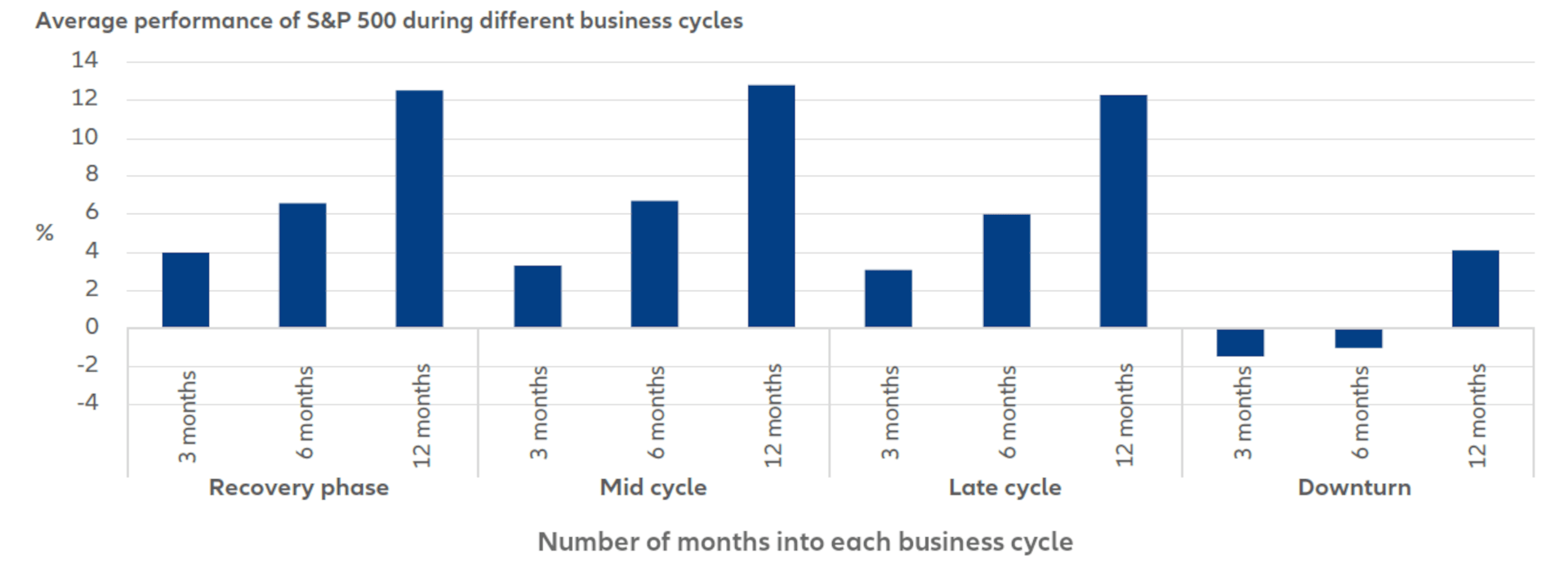

- Watch earnings: downturns may provide opportunities to add to portfolios. Earnings expectations generally reach the bottom during a downturn. That point could provide a potential entry for investors as stock prices “climb a wall of worry” even in the face of market negativity. After initially falling, risk assets, such as equities, typically start to outperform during a recession (rather than ahead of it) as investors begin to focus on expectations of a future recovery in the economy (see Exhibit 2).

- Look out for a rebalancing: for now, some US equity valuations, as measured by the cyclically adjusted Shiller price/earnings (P/E) ratio, may appear high by historical standards. A recession could help in rebalancing valuations, presenting possible buying opportunities.

- Keep an eye on rates: with the Fed getting closer to the final level in its current cycle of rate rises, we see potential within US government bond markets to extend duration risk, ie, the sensitivity of portfolios to interest rates.

Exhibit 2: Equities generally start to recover during the latter stages of a recession

Source: Allianz Global Investors Global Economics & Strategy, Refinitiv Datastream. Data as of January 2020. Results since then are intentionally not shown because the post-Covid-19 pandemic cycle appears to differ from the norm. Past performance is not a reliable indicator of future results. Forecasts are not a reliable indicator of future results.

Decoupling: how Asia is diverging from the US and Europe

Christiaan Tuntono, Senior Economist, Asia Pacific

Senior Economist,

Asia Pacific

While in the US and Europe market focus is on where interest rates will peak, we expect Asian central banks to start lowering interest rates in the coming quarters, helping support flagging economic growth. In effect, they will “decouple” from US and European policymakers continuing to combat persistent inflation.

Broadly, we see three reasons why Asian central banks will make the cuts:- Weaker global growth. Lower global growth is slowing demand for Asia’s goods and services. Domestic consumer spending is also waning after a surge during the recovery from Covid-19. Lower rates should help support loan growth and weaken local currencies, boosting local activity and exporters’ margins.

- Falling inflation. Inflation is falling faster in Asia than in the US and Europe as Asian countries did not provide as much fiscal and monetary stimulus for their economies in the wake of the pandemic. In fact, China’s economy fell into deflation in July, meaning consumer prices dropped for the first time since February 2021.

- Rising real rates. When you factor in falling inflation, real interest rates in effect rise – so central banks have to cut rates simply to keep them steady.

Lower interest rates should help support economic growth by making it less costly for consumers and businesses to borrow, meaning they have more money to spend.

What do lower interest rates in Asia mean for investors?

We see opportunities in Asian local currency fixed income in anticipation of disinflation and the decoupling of Asian central banks from the Fed’s rate hike cycle. Still, the timing will be important as Asian currencies and bonds denominated in local currencies are likely to remain pressured by US dollar strength until the Fed decisively breaks with its cycle of interest rate rises.

In equities, we see potential value in less export-oriented economies like Japan, India and Indonesia in anticipation of their central banks either starting to lower rates or keeping them lower. A larger-than-expected stimulus from the Chinese government may present tactical long-term opportunities in China.

1 Investors least bearish since February 2022 - BofA

, Reuters, 15 August 2023

2 Moody's downgrades US banks, warns of possible cuts to others, Reuters, 8 August 2023