Navigating Rates

CIO roundtable: what can investors learn from a super-election year?

Going into the year, 2024 was always set to be an intense election period, with polls in more than 60 countries. It turned out to be even more action-packed than anticipated, with snap elections in France and Japan giving investors even more to focus on, in addition to the US election. What are the implications of one of the busiest years in election history? We asked our global CIOs how investors could position themselves in a shifting political terrain.

Key takeaways

- Given the global election supercycle, we’ve brought together our global CIOs to understand the market implications of issues ranging from geopolitics to globalisation, as well as the potential investment opportunities in a dynamic political environment.

- Market volatility should be anticipated at a time of elevated political risk, while investors will be closely watching incoming governments’ fiscal and trade policies, particularly in the US; any spending splurges could face a bond market backlash.

- Lower interest rates and slower but still resilient growth should help cushion markets from further political uncertainties and provide opportunities within equities and fixed income; investors may also consider defensive options to ensure portfolios are balanced.

- Our CIOs see opportunities to benefit from diverging glide paths for growth and inflation across different economies, as well as from pockets of relative calm such as the UK.

Q: 2024 has been a critical year for elections worldwide, with more than 50% of the population heading to the polls. Has politics created a new landscape for investors?

Gregor MA Hirt, Global CIO Multi Asset: First, most of the elections due in 2024 have taken place already, removing significant uncertainty and providing more visibility for investors. The big exception is the US, which could have wide-ranging impacts on asset markets. The elections in France and Japan – not on the calendar at the start of the year – and their outcome are a reminder that political risk may linger over the coming quarters, creating potential volatility, particularly in bond markets. We also see political risks in Germany as we get closer to the federal elections in September 2025.

Post elections, fiscal discipline will be carefully watched by markets as many governments have large deficits that will need financing while debt levels have continued to balloon after Covid-19. Another “Liz Truss moment”, akin to what we saw in the UK, cannot be ruled out elsewhere.

Finally, the ramifications of election results for globalisation are still unfolding. Are we moving into an age of centrism or populism redux? The UK result may have been a win for centrism but the far-right performed strongly in the European elections and most recently in Austria – that will be something to watch in future national elections. The US vote will also have a global impact with the policies of both candidates promising more protectionist policies.

Q: What are some of the other broader implications for the global economy and markets?

Virginie Maisonneuve, Global CIO Equity: Markets are balancing overlapping political and economic cycles. The political cycle has been dominant at many points in recent months – and that will be true as we approach November’s US election. But we expect the economic cycle to come into greater focus after the elections. Uncertainty around different region’s glidepaths in terms of inflation and growth for the coming months will be an increasingly important topic. While rates are coming down, the relative pace of deceleration of both inflation and growth are much more difficult to predict. We should expect to see growth slow as inflation eases, but this situation does not necessarily mean a bearish scenario for markets in a context of declining rates.

The political direction pursued by incoming governments, particularly the US, will have a bearing on geopolitics, including events in the Middle East and Ukraine. Markets have so far remained relatively sanguine about the risks of broader escalation from current conflicts. Overall, while we expect some market turbulence ahead of November, the medium- to long-term outlook for equities is positive and promising entry points to markets remain.

Q: Turning to the US election, voters generally say the economy is their number one issue. How would you assess the health of the economy?

Michael Krautzberger, Global CIO Fixed Income: Growth and inflation are slowing markedly, but so far that is positive as you could call it a normalisation from very high levels. It remains to be seen if the labour market and growth slows more than expected, but to date we don’t see the flashing warning lights of impending recession in the world’s largest economy.

The US Federal Reserve (Fed) made a long-anticipated interest rate cut in September – its first in more than four years – and surprised markets with the scale of the cut. With quite some distance to a neutral policy rate of around 3%, we expect more to follow. We think the size of the cut, 50 basis points, makes sense given fading inflationary pressures and a weakening in the labour market. The Fed’s dual mandate of maximum employment and stable prices is tantalisingly within reach. The way the economy is heading supports our base case scenario of a soft landing, rather than a hard one.

Taking a step back to consider how the economy has performed under Joe Biden’s watch, growth has recovered faster from the Covid-19 pandemic than in many other big economies and inflation has come down to around 2.5% – but it is still higher than when Donald Trump left office. Of course, what matters for the US election outcome is how voters see the health of the economy and their overall cost of living.

Q: What market impact might the US election have?

GH: While uncertainty around the result of the US election may have dampened investor sentiment in the near term, longer-term, market direction will be steered much more by the economy and earnings. If one party manages to win both chambers of the Congress, as well as the presidency, any potential effects may be more marked because they will be able to enact their policy programme unhindered. Our analysis shows that a second Mr Trump presidency may cause bigger market ripples. We would expect Kamala Harris to take a similar policy approach to Joe Biden in some areas, so the impact on asset valuations may be more neutral.

Trade relations will be a particular area of focus. Any rise in tariffs is likely to have an economic impact. In the short term, it is like a one-off tax on consumption which could lead to higher inflation. Another will be fiscal policy, where both candidates have generous plans. At current debt levels, it could well be that there’s a return of bond vigilantes – those investors who sell bonds as a protest at monetary or fiscal policies – especially if Mr Trump moves to undermine the Fed’s independence.

Active management can help investors home in on the opportunities. There’s a temptation to sit on the sidelines at times of political uncertainty – but the important thing is to stay invested for the longer term.

Eric Stein, Head of Investments and CIO, Fixed Income, Voya Investment Management: In terms of which candidate might win, investors don’t seem to be committing much capital in either direction yet. That could change as we get closer to election day, and you could have some volatility if it looks like a sweep one way or the other, meaning one party wins both the White House and control of Congress.

There’s also a huge focus on who will control Congress because of the 2017 tax cuts that will expire in 2025. If all the provisions are allowed to fall off, we estimate GDP growth would take a 1% hit. I don’t think that will happen, but it means the makeup of Congress will have a big impact on the fiscal impulse for growth in 2025 and 2026. It makes sense that gold is breaking out despite a coin-toss presidential race, since fiscal spending is going to be high either way.

Every time US Treasuries sell off 50 or 100 basis points, I get questions about whether bond market vigilantes might return, but then the issue goes away. The US gets the benefit from the rest of the world’s problems and the relative attractiveness of the safe haven status and liquidity of Treasuries. We’ll have to do a lot more damage before that becomes an issue!

Q: What might the US election mean for equity markets?

VM: Even though he’s served as president before, Donald Trump may be more of an unknown quantity for markets than Ms Harris. We think a second Trump administration would look very different to the first. We are at a different point in the economic cycle than when he was elected in 2016 and we don’t expect a repeat of his deregulation and higher fiscal spending drive. That might mean less of a boost for US equities.

One area where we may see some continuity is tariffs. A proposed 60% tariff on Chinese goods – in addition to a 10% universal tariff – could cause wide-ranging ripples for some US and international stocks. We expect a more isolationist US, particularly if Mr Trump wins, accelerating a battle for supremacy in tech with China. Expect more regional nearshoring and onshoring as companies diversify their manufacturing bases and supply chains.

Q: How should fixed income investors prepare for the US election after an intense cycle of elections elsewhere in the world?

MK: As markets begin to turn their attention to the US election, bond volatility may well remain elevated, so we think it is a good idea to tactically trade duration along the way, with a bias to add some inflation protection in portfolios.

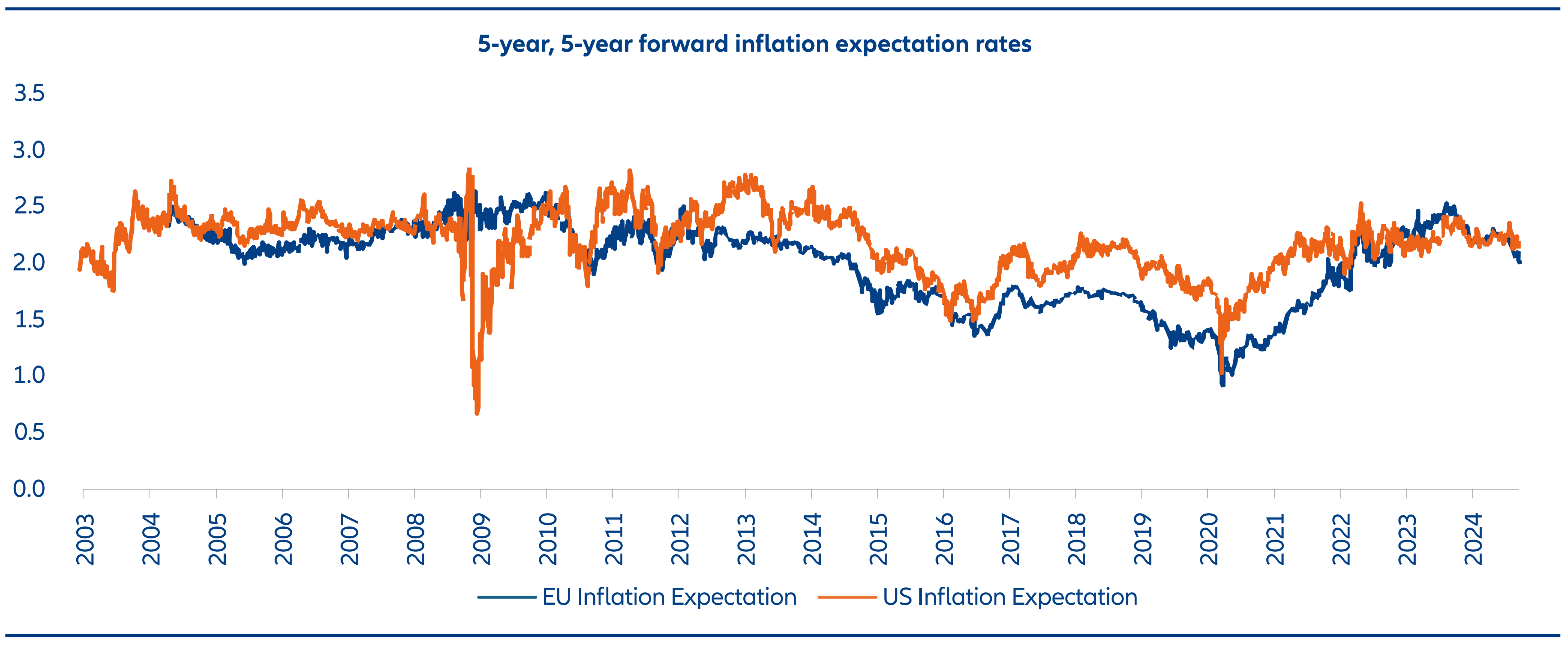

We think inflation protection and positioning for steeper yield curves may serve as a useful election hedge. The prospect of higher tariffs under Mr Trump would probably lead to depressed growth and maybe even higher inflation than markets are expecting (see Exhibit 1), so a steepener and inflation protection could do well in that environment. The 50 basis points move by the Fed was good for yield curve steepeners as it brings the front-end yields down more than expected.

We are constructive on the outlook for sovereign bond returns, given the current global macro and policy backdrop and think current conditions are favourable for fixed income. We anticipate further rate cuts, regardless of November’s result – and that could be good for bonds as they’ve typically outperformed other assets during previous rate-cutting cycles.

Many emerging markets – Mexico, India and Indonesia to name a few – have passed through an important political period with few bumps in the road. In fact, we see reasons to like emerging market local currency bonds as inflation falls, spreads between local bond yields and US Treasuries make for a compelling carry opportunity, and emerging market growth looks resilient.

Exhibit 1: Are markets too optimistic about inflation falling further?

Sources: Bloomberg, Allianz Global Investors; the indices in the chart are calculated using inflation swaps (for the euro area, data 27 April 2004–16 September 2024) and inflation-adjusted Treasury securities (for the US, data 2 January 2003–16 September 2024). Past performance does not predict future returns.

Q: What are the major potential investment opportunities to consider in the wake of elections in the US and elsewhere?

ES: Volatility might go up on either side of election day in the US. You could see the yield curve change slightly. But a key point is that the trajectory to the economy might get better in certain outcomes, but not worse.

If you think the Fed cuts 150 basis points over the next 12-18 months with GDP around 2%, that’s quite an attractive environment for fixed income. Bond investors don't like 5% growth and we don't like 0% growth. When it’s right in the middle, rate volatility goes down, and bond markets tend to respond well.

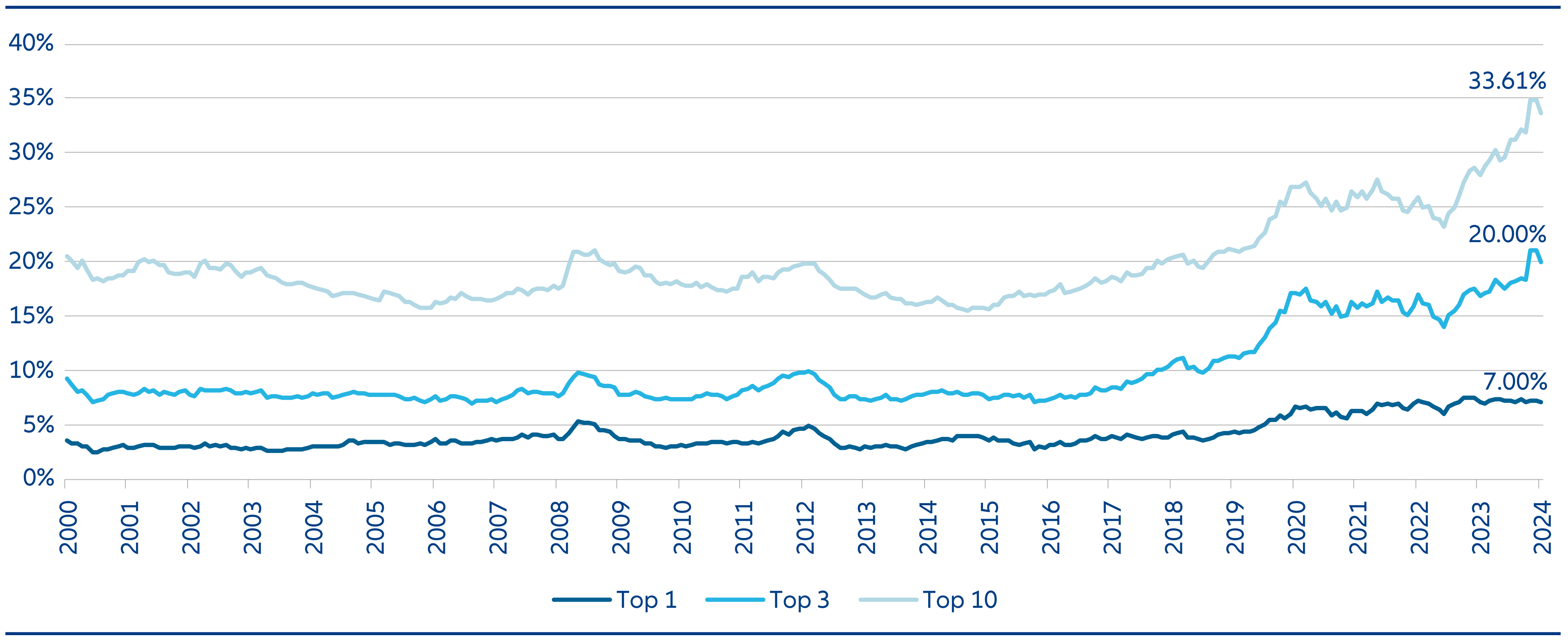

GH: I agree it is worth keeping an eye on volatility – we see a return of a degree of structural volatility as we head into 2025. In terms of where we see opportunities, we’d highlight the merit of an equal-weighted approach to investing in US stocks. US equity market concentration is at its highest level for decades (see Exhibit 2) and an equal-weighted approach can offer diversification that may reduce single-stock risks.

Geopolitical uncertainties should also continue to support gold as a diversifier, even though the yellow metal has already had quite a run recently. Finally, if the independence of the Fed is undermined under a Trump presidency, investors could turn away from the US dollar and favour other safe-haven currencies like the Japanese yen and the Swiss franc.

VM: Picking up the theme of volatility, a sensible approach as November comes into focus is to look selectively to defensive options to make sure portfolios are balanced. In an environment of slower economic expansion, we expect quality and growth to come to the fore. As the glide path created by inflation and rates comes down, we think these investment styles will outperform in the coming months.

Overall, we continue to favour Asia as a region. After the recent strong drawdown in Japan and ongoing structural reforms, Japan equities look enticing. In China, recent stimulus measures and a stabilisation in the property market should support stocks. And in India, we see the valuation premium as more than compensated for by strong growth.

MK: With political worries elevated in the US and Europe, there may be value in areas of relative calm, such as the UK where election risk has passed. We like UK Gilts on a relative value, cross-market basis against German Bunds. We believe that interest rate markets are insufficiently pricing Bank of England rate cuts over the next six to nine months in comparison to the European Central Bank and Fed.

More broadly, as touched upon before, we favour a long interest rate duration stance in several markets and prefer to be positioned for steeper yield curves, especially in the US and euro zone as central banks lower rates. In contrast, we see opportunities to prepare for a flatter yield curve in Japan as the Bank of Japan gradually raises rates.

Exhibit 2: Is the US stock market too concentrated?

Source: Datastream, S&P500 as of 13 August 2024