The benefits of multi asset strategies in an inflationary environment

Investors are witnessing unprecedented market conditions. Within a turbulent market environment characterised by a high inflationary pressure, a shift from global to “glocal” trade patterns and a fading era of cheap energy, how can an active and agile multi asset approach be best placed to deliver returns?

Key takeaways

- Fundamental shifts in monetary, energy and trade policy are driving the markets

- With both equities and fixed income having a very rough ride so far, many investors and market participants cannot help feeling that there is currently nowhere to hide

- An active and agile multi asset approach can help investors to exploit pockets of significant outperformance even under this unprecedented market circumstances.

We are currently experiencing a unique market environment, with few parallels in financial history. Not only have recent months seen a tectonic shift in both geopolitics and the economics and politics of energy supply, but we are also undergoing a huge and brutal reversal in the massive monetary support initiated in the wake of the 2007-2008 financial crisis and more recently accelerated due to Covid.

Here, we take a look at current and possible future market environments, as well as discuss how an active multi asset strategy is best placed to deliver returns under these conditions.

The market view – nowhere to hide?

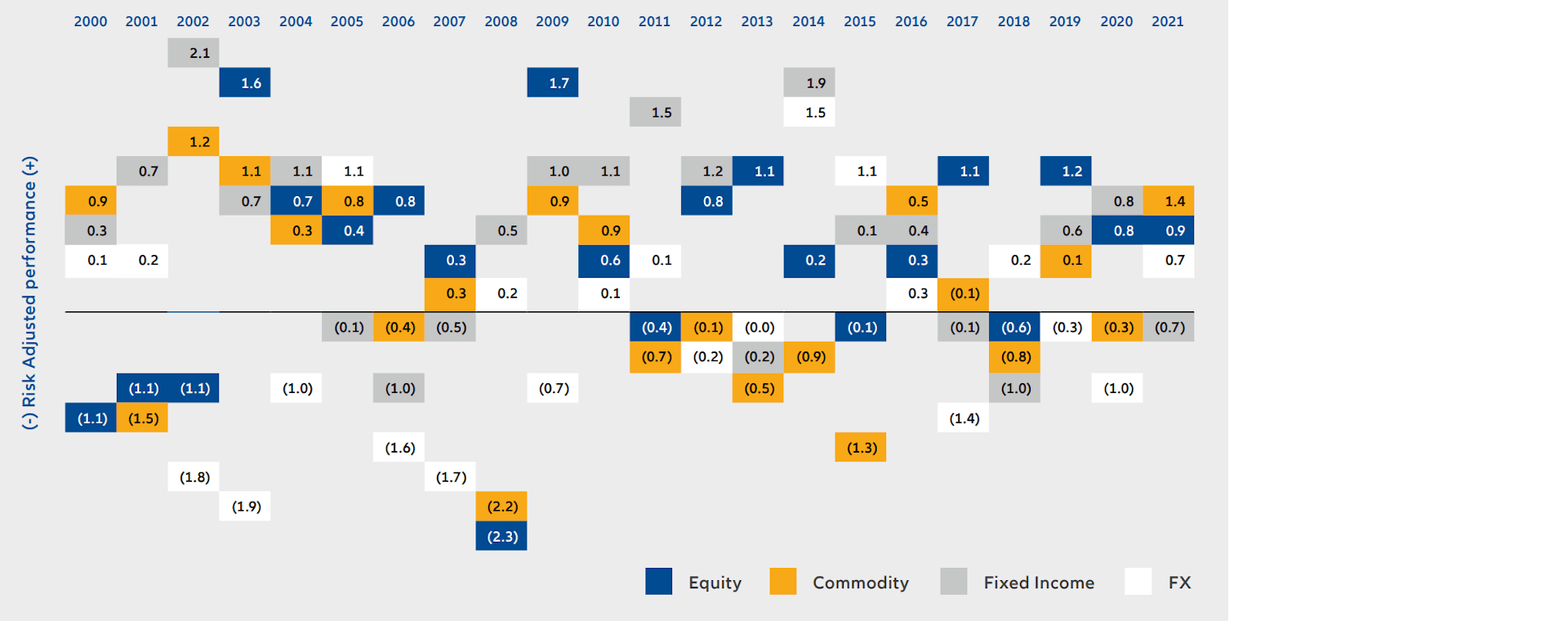

Turbulent market environments can often lead to situations where one asset class or another performs very well, on a risk adjusted basis. For instance, around the time of the end of the tech bubble in 2000 and 2001, equities, of course, performed poorly, yet bonds did very well, showing elevated Sharpe ratios throughout this period.

However, in 2022, we are so far seeing both equities and fixed income having a very rough ride. While the performance of equities has been more expected, the trajectory of the bond market has taken some by surprise – indeed, the “traditional” 60/40 equity/bond split preferred by many US investors, and the 30/70 portfolio favoured by Europeans, have exhibited disastrous returns this period and even a risk parity portfolio has struggled.

Given this unusual correlation between equities and fixed income, many investors and market participants must be feeling that there is currently nowhere to hide.

Exhibit 1: Historical calendar year Sharpe Ratios

Source: AllianzGI

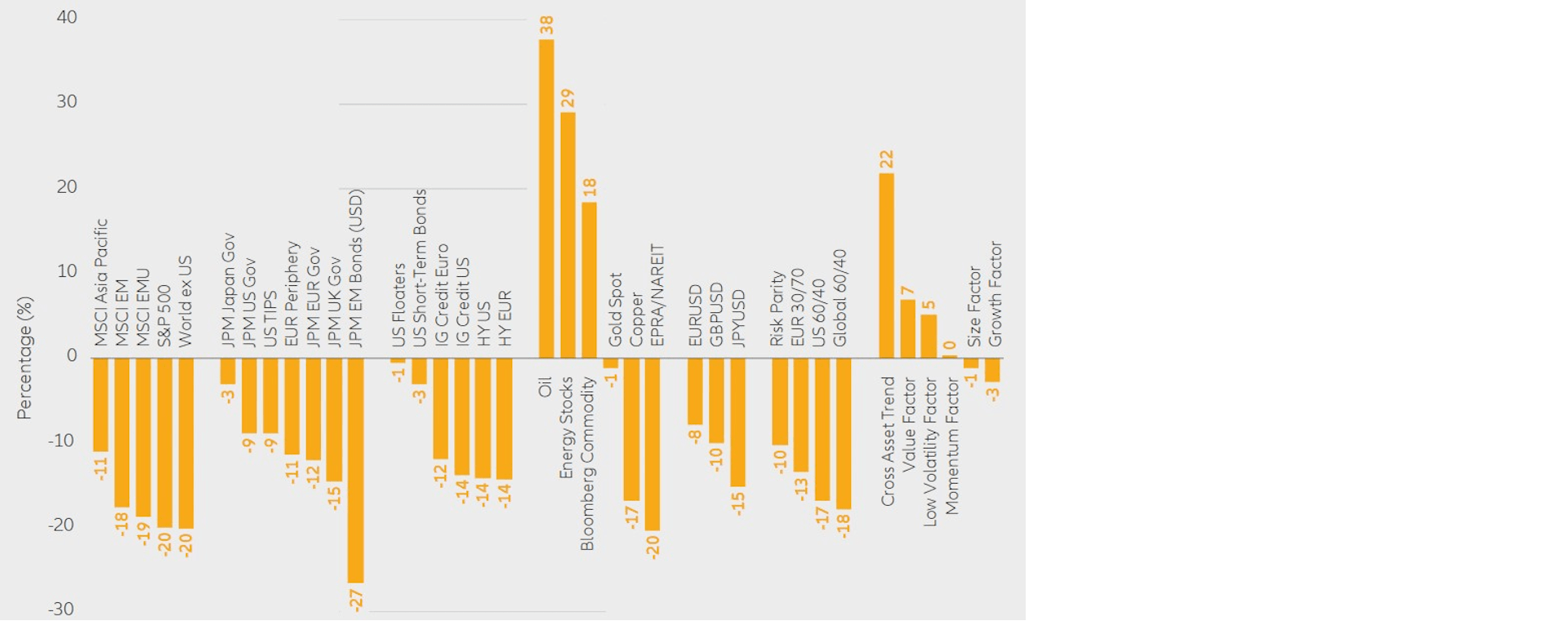

Pockets of significant outperformance

But is this really the case? If we dig a little deeper, we see that, even under such unprecedented conditions, there remain pockets of significant outperformance. Indeed, commodities and energy stocks, for instance, show that there are still good ways of diversifying portfolios, despite the overall performance of equities and fixed income.

These pockets of outperformance point to the benefits available from adopting a flexible multi asset strategy; by combining asset classes with different risk profiles – assets that react differently depending on economic developments and the trajectory of key financial indicators – one can profit from diversification effects and achieve an elevated risk-adjusted return.

Before taking a closer look at some practical examples of a multi asset approach, it’s worth returning to the current market environment and, more specifically, the question of whether the existing high level of correlation between equities and bonds will endure for an extended period, or is it an anomaly that will soon come to an end?

Our message here is a mixed one. The monetary policy reversal we are experiencing is a genuine shock. What started during the financial crisis, and even increased during Covid, is now being rapidly adjusted in an effort to check rising and potentially out of control inflation. So, liquidity is being taken out of the system and there is less cheap money to borrow. This not only affects the bond market, but also equities as it become more expensive for corporates to borrow for investment and future growth. The effects of this shock could endure for some time.

Alongside these changes, we are possibly also experiencing a regime shift. After decades of increasing global trade, things are changing. We’re now heading towards what some call glocalisation – supply chains are shortening, and production is moving to more regional setups. Indeed, this is something that began before the armed conflict in Ukraine, with the trade issues between the US and China, but has begun to accelerate in 2022. Capital and labour are becoming less efficiently allocated, and growth potential is reduced. And if the result is corporates having less ability to access cheap labour, then prices will increase. These trends may be somewhat offset by productive increases thanks to, for instance, robotisation, but the overall effect is still a net negative and likely inflationary.

At the same time, the Russian invasion has drawn attention to underinvestment in energy producing capabilities – a situation catalysed by the war in Ukraine, but that has been apparent for some time. And we also have a policy direction that involves rapidly increasing the use of green energy. Combined, these trends mean that the era of cheap energy that we’ve enjoyed for several decades could be challenged, for now at least

Exhibit 2: Relative return patterns in the first six months of 2022 by asset class or factor

Source: Bloomberg, AllianzGI

Opportunities for effective diversification

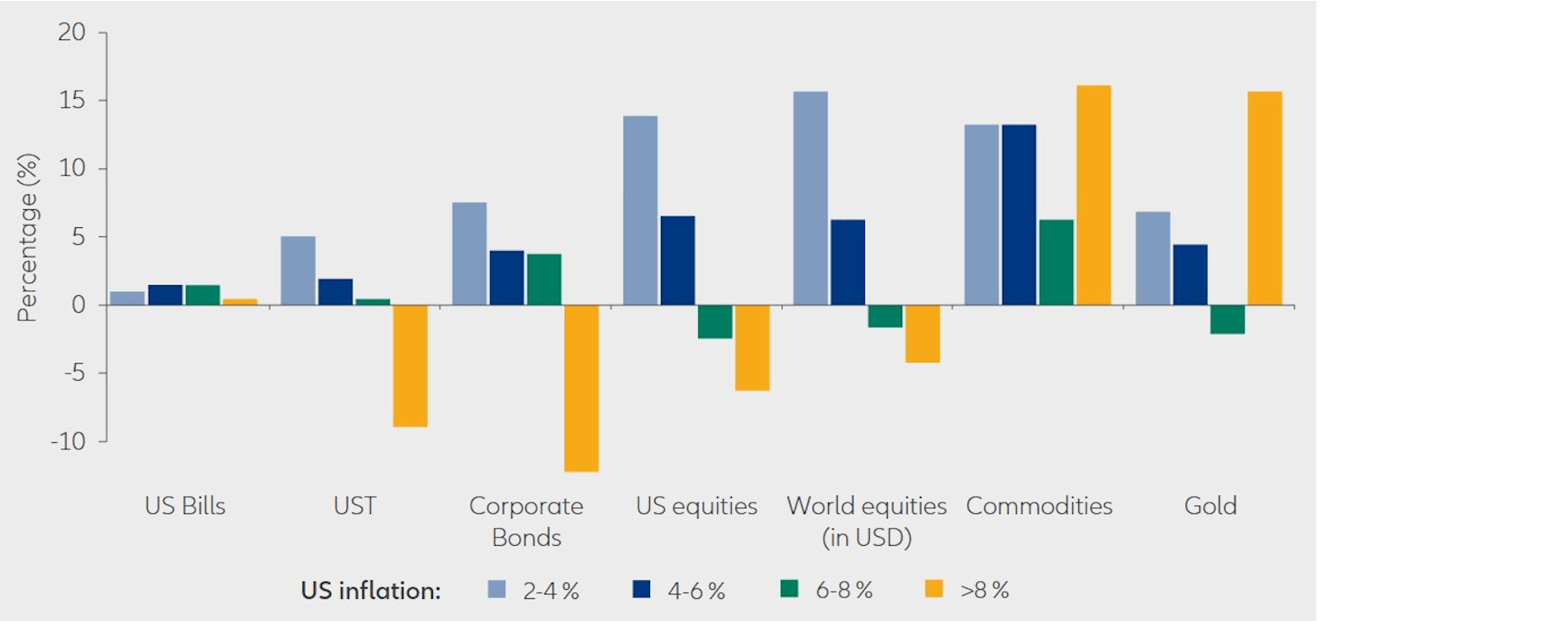

Glocalisation and more expensive energy mean higher inflation. While inflation is clearly a concern for market participants of all types, it has a particular significance for multi asset investors as it is highly determinant of how individual asset classes will perform. For instance, we can see that, if we expect high inflation, then investing in commodities is likely to be a favoured option for many.

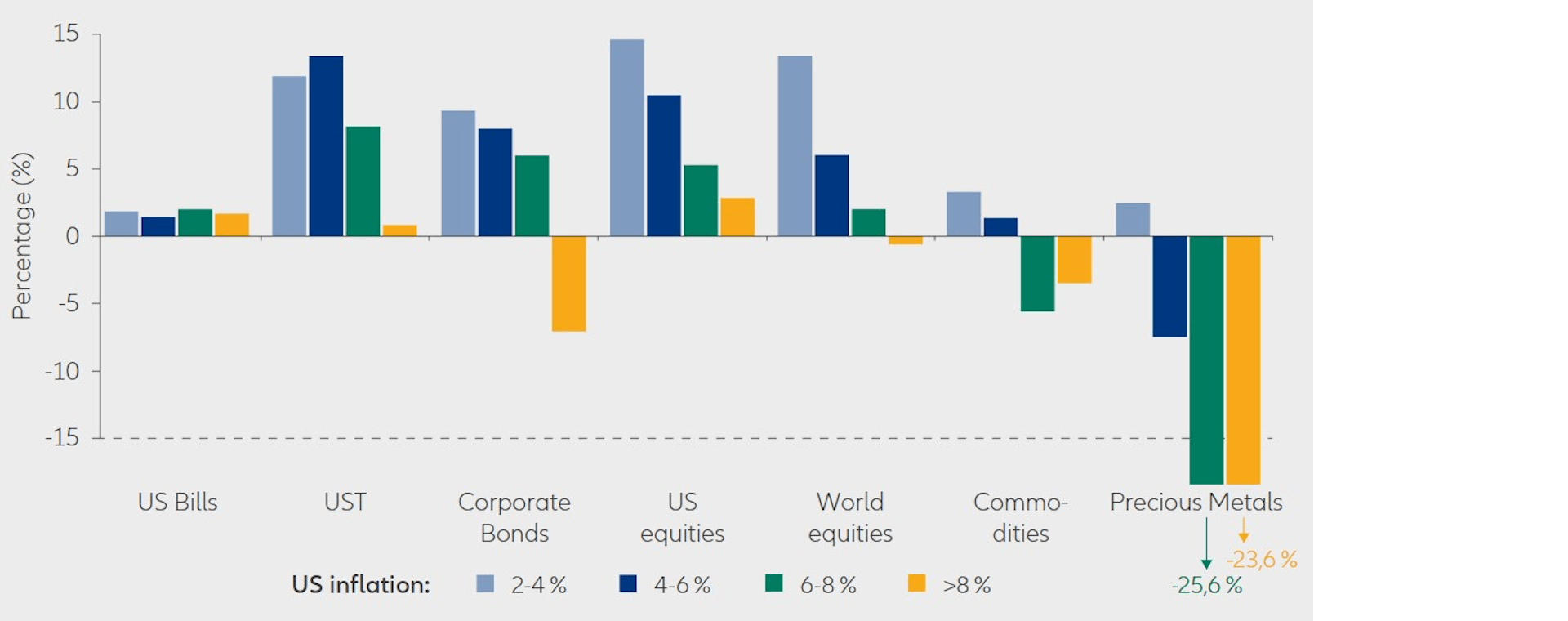

However, what is just as important as the actual rate of inflation is its expected trajectory. For instance, we can also see that, when inflation is high but set to fall, then commodities are no longer where investors want to be. This is key in terms of sequencing – knowing when to move from one asset class, in this case commodities, to another, perhaps bonds.

How does this affect a multi asset approach in practice? It means that, whatever the market conditions, there are always opportunities to effectively diversify – even pockets of opportunities within asset classes that, overall, might not be performing well. Indeed, we are convinced that an agile multi asset strategy is currently the right approach.

Exhibit 3: Average annual real asset returns since 1971 in times of positive inflation surprises and inflation >2%

Sources: Allianz GI, Global Financial Data, Refinitiv, data as at 4/2021. Legend: inflation surprise defined as change in inflation (yoy) >0%;numbers show arithmetic average returns for periods in respective inflation buckets and increases in yoy-inflation rates

Exhibit 4: Average annual real asset returns since 1971 in times of US inflation >2% and falling

Source: Allianz GI, Global Financial Data, Refinitiv, data as at 4/2021. Legend: yoy change in annual inflation <0%; numbers show arithmeticaverage returns for periods in respective inflation buckets and increases in yoy-inflation rates

The benefits of an active multi asset approach

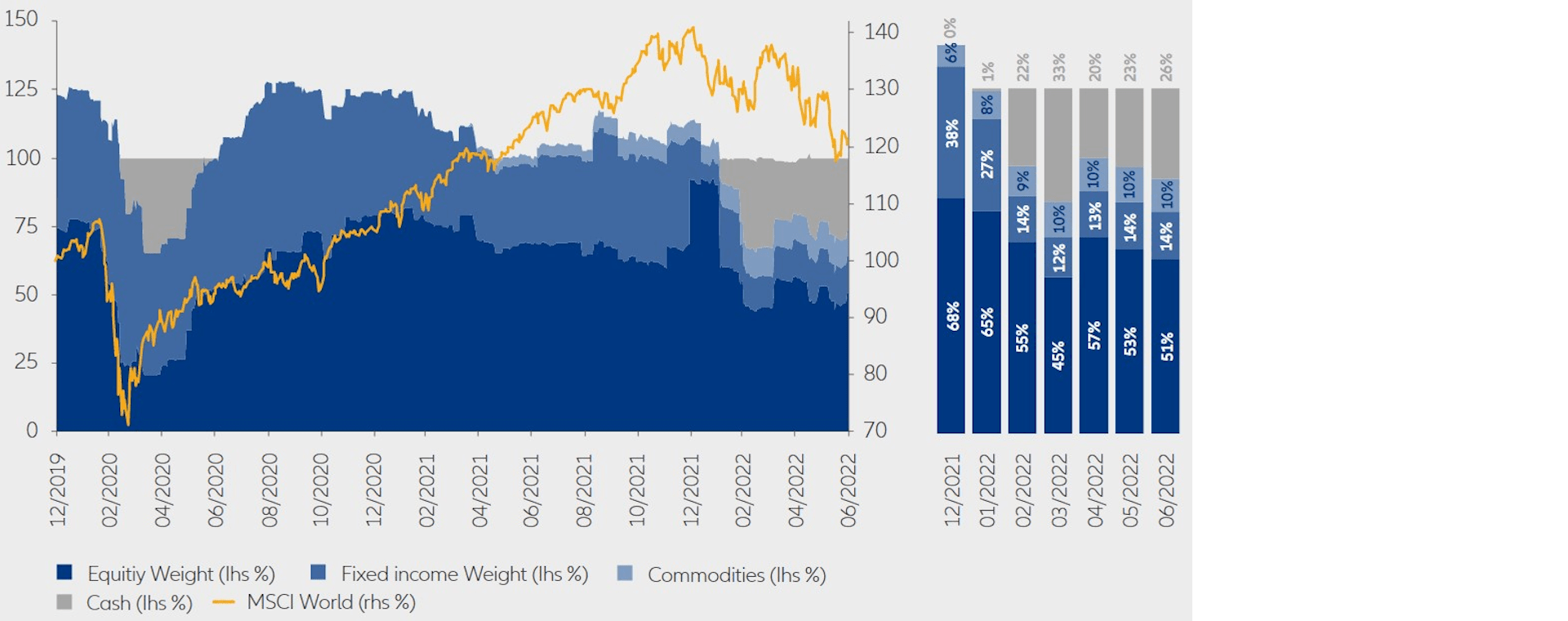

The below chart shows a sample multi asset portfolio as a representative example of how a multi asset approach can work during the types of market conditions we are currently experiencing.

Here, we see that, since January 2020, there have been significant shifts in the portfolio’s allocations. In times of market correction and a high correlation between equities and fixed income, the cash position can be rapidly increased – as happened in April 2020, due to the onset of the pandemic, and in early 2022 when it became apparent that fixed income and equities might underperform – and be ready to rerisk when the time is right. The chart also shows how the fixed income position shrank considerably in late 2021 and early 2022 in anticipation of the shift in central bank policy. A change such as this is relatively straightforward to foresee, so the portfolio adopted a defensive position.

But what about the opportunities? Commodities performed well in H2 2021 and H1 2022 up to May, so there are relatively high allocations to commodities during this period. In this respect, having the freedom to move quickly and harvest opportunities for clients is key. In addition to commodities, there have been more satellite themes and specific pockets of growth that a sample portfolio could have utilised during the first half of 2022, such as selected equity markets in Latin America, cross-asset trend following strategies similar to “CTAs” and, towards the middle of the year, selected equity markets in Asia, which offered good potential to generate absolute performance contributions for multi asset portfolios.

Indeed, compared to a less dynamic and constrained strategic asset allocation, an actively managed multi asset approach, can increase return potential over a market cycle and provide significant mitigation of downside risk, even though losses remain possible and a success cannot be guaranteed.

It should also be noted that active multi asset strategies approaches incur higher fees than passive approaches, and that multi asset strategies in general have a lower return potential than equity strategies.

What is key for active multi asset strategies is being agile – reading the market and being prepared and able to make the necessary moves at short notice.

Exhibit 5: Asset allocation for an actively managed Multi Asset sample portfolio

Source: IDS GmbH, AllianzGI