AllianzGI targets directors of high emitting companies lacking credible net zero targets

- Executive pay is again the biggest area of concern

- In the UK AllianzGI voted on 21 management sponsored climate-related resolutions and supported all but two

- AllianzGI will hold directors accountable if the company does not have credible net zero targets in place

London, 21.02.2023. Allianz Global Investors (AllianzGI), one of the world’s leading active investment managers, has today published its annual analysis of how it voted at AGMs around the globe, based on its participation in 10,205 (2021: 10,190) shareholder meetings and voting in more than 100,000 shareholder and management proposals.

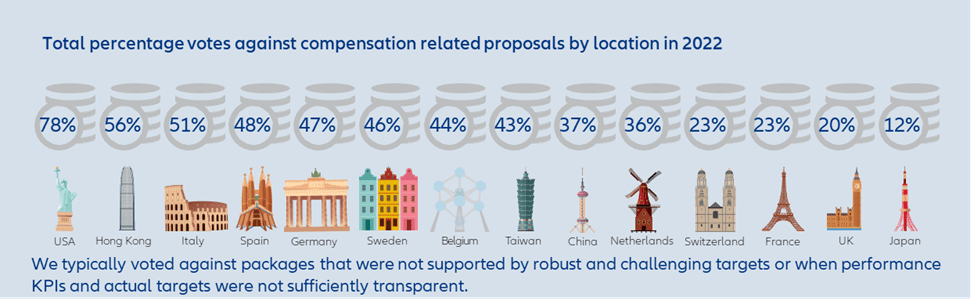

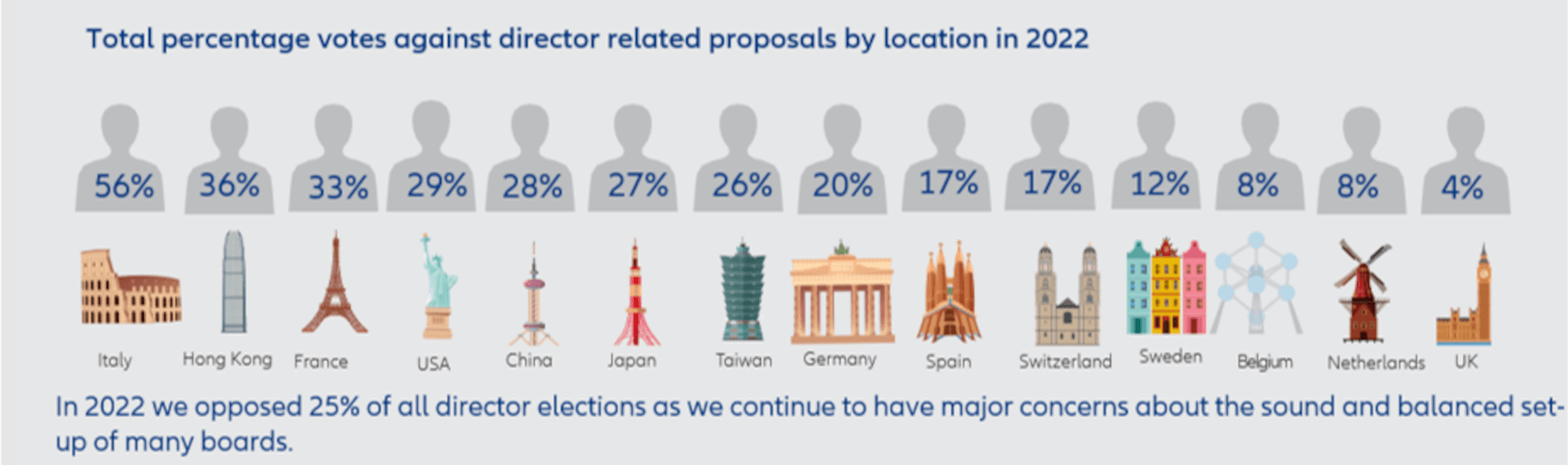

AllianzGI voted against, withheld or abstained from at least one agenda item at 69% (2021: 68%) of all meetings globally. It opposed 16% of capital-related proposals, 23% of director-related proposals and 43% of remuneration-related proposals globally.

Commenting, Matt Christensen, Global Head of Sustainable and Impact Investing at Allianz Global Investors, said:

“From our viewpoint as a responsible, long-term investor, two topics really stand out: greater accountability with regards to credible climate transition targets and continued scrutiny of remuneration. Throughout 2022 we continued to utilise our proxy voting power, to influence companies – this remains one of the most powerful tools we have to effect change. As we look towards the 2023 voting season, we will continue to utilise this form of influence to help to shape a more sustainable future for the companies and society, in the best interests of our clients.”

The biggest cause for disagreement was once again the compensation of management teams. AllianzGI voted against 42.9 % of compensation-related resolutions proposed by management. Many companies fail to adopt long-term incentives that are truly aligned with the interest of shareholders by rewarding outperformance, not merely market movement.

In several markets, companies had to put remuneration reports to shareholder vote for the first time in line with EU regulation. Kimon Demetriades, Stewardship Analyst at Allianz Global Investors commented:

“We often had concerns on transparency, in particular when it came to clearly disclosing the link between performance and pay-out, as well as discretionary pay components that were not backed by performance as well as high pension payments.” For example, in the US AllianzGI voted against 77.8 % of compensation-related resolutions, in the UK against 28% and abstained on another 8%.”

In light of current economic conditions, in particular high inflation rates in many countries, AllianzGI will carefully evaluate generous pay packages taking into account how they relate to pay increases of the wider workforce and consider whether companies underwent significant layoffs, restructuring or cut dividends.

Demetriades added: “We generally vote against if we consider pay packages overly generous taking these aspects into account. As of 2023, we further strengthen our voting guidelines with respect to sustainability aspects: we expect European large-cap companies to include environmental, social and governance key performance indicators into their remuneration and would vote against pay policies if this is not implemented. We already had a number of conversations on the topic in 2022 with companies where we felt there was a gap.”

Corporate governance shaping sustainability outcomes

In 2022, the second largest focus area, according to Kimon Demetriades, is “Say on Climate”. AllianzGI has written a specific paper on the topic explaining the idea as a long term trend even if it has taken off only in few European countries at this moment of time, mostly in France and the UK : “We’ve seen only 52 climate-related proposals from management. We expect in particular that high emitters implement a net zero strategy and share it with their owners. Investors should have a Say on Climate!”.

AllianzGI continues to support shareholder proposals addressing climate change issues. Demetriades continued: “We are ready to vote alongside independent shareholders including NGO’s if this helps the cause. There is no “opt out” from climate change for any company.” AllianzGI supported 70 of 87 shareholder proposals on climate.

Going forward AllianzGI will hold directors accountable if the company does not have net zero targets in place and a credible strategy for how to achieve them. As of 2024, depending on the set-up of the board AllianzGI will vote against the Chairperson of the Sustainability Committee, the Strategy Committee or the Chairperson of the Board of certain high-emitting companies if the net zero ambitions or the Climate-related Financial Disclosures are deemed dissatisfactory. Concerns are high with a number of US companies which are often less advanced than their European peers.

Country specific

Climate-related resolutions coming to the fore

In the UK AllianzGI voted on 21 management sponsored climate-related resolutions (Say on Climate) and supported all but two.

As in prior years, 2022 again saw a small number of shareholder resolutions in the UK. In general, the majority of these proposals related to climate change and emissions targets; and management received our support following internal engagement programmes with our portfolio companies.

In the UK remuneration remains a bone of contention

Overall, AllianzGI voted against 4% of all resolutions in 2022 (in line with 2021) as corporate governance standards are high in the UK market. In general, votes against management resolutions are low (and have been declining in recent years) as boards are well supported. Across all key governance topics, voting outcomes were very consistent from the prior year with remuneration continuing to be the only area of major contention for us in the UK market.

AllianzGI voted against 20% of all remuneration-related proposals which has been in line with the outcome for 2021. Executive pay is generally well-formed in the UK, however areas of dissent in 2022 included insufficient remuneration disclosure, short performance or holding periods, or increases to salaries which were not linked to material changes within the business or responsibility of directors. AllianzGI also voted 84 resolutions seeking approval of remuneration policy and we voted against 23%, mainly driven by elements around sufficient performance targets or periods. Remuneration Committees not operating within the parameters of their policies; and level of disclosures.

This overall level of dissent is in line with the longer-term trends and has recovered following a temporary decline through COVID-19 where heightened uncertainty (and increased flexibility) led to higher levels of management support.

Source: AllianzGI 2022 proxy voting data

Source: AllianzGI 2022 proxy voting data

Source: AllianzGI 2022 proxy voting data

Notes for the editorial offices:

For more information on AllianzGI’s approach to active stewardship, please visit:

https://www.allianzgi.com/en/our-firm/esg/active-stewardship

For further information please contact ukmedia@allianzgi.comAbout Allianz Global Investors:

Allianz Global Investors is a leading global active asset manager. Our range includes equity, fixed income, private market and multi-asset strategies. Our expertise ranges from developed to emerging markets, from single country to global strategies, from thematic to sector portfolios. Through active asset management, we want our clients to feel well taken care of - everywhere and regardless of their investment needs.

Active is: Allianz Global Investors