Navigating Rates

Impact of Trade Disruptions

Disruptions to global trade are in the news almost every week. How do these disruptions impact trade finance investors? What drives deal flow activity for such investors?

Disruption everywhere

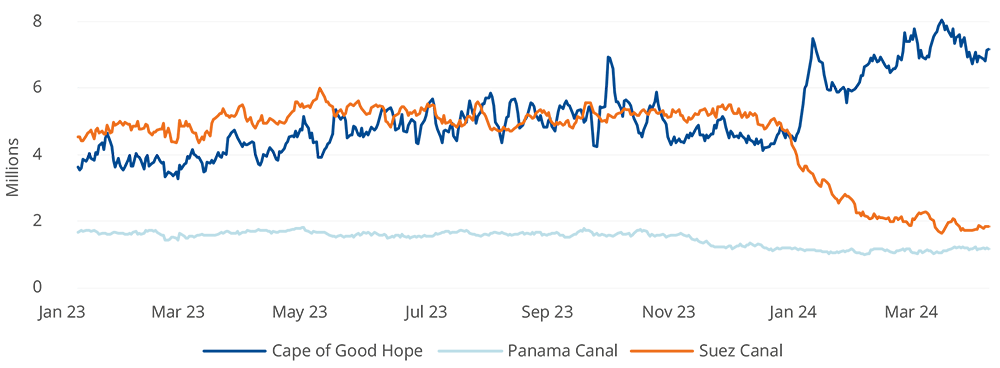

Recent months have been full of headlines about how global trade gets disrupted. Attacks by Houthi rebels on merchant ships passing through the Red Sea have led to a 50% drop of ships passing through the Suez Canal, forcing ships to take the longer route around the Cape of Good Hope. Passages through the Panama Canal are also down by a third due to a severe drought and a recent shipping accident in the Baltimore port has cut off shipping routes for some EU car manufacturers to their US customers.

Exhibit 1: Daily transit trade volume

Note: Million metric tons, 7-day moving average; Source: UN Global Platform, IMF PortWatch.

Unequal impact

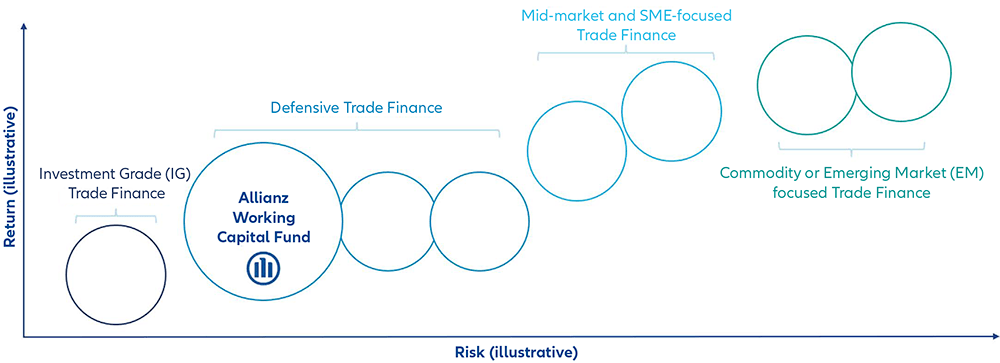

Exhibit 2: Trade Finance: the risk/return spectrum

Note: For illustrative purposes only (no specific unit of risk/unit of reward). Source: Allianz Global Investors, as of April 2024.

Commodity trade finance will be the market segment where the impact will be most felt. Goods are mostly in transit and any delay will force commodity trading houses to hold working capital for longer which means they need more working capital to ship the same quantity. In this space disruptions can severely harm traders which can lead to higher defaults for investors.

Small and medium-sized enterprises (SMEs) trade finance would also be affected by trade disruption but companies in this space will have more leeway to buffer adverse working capital requirements compared with smaller trading houses.

Large-cap oriented trade finance strategies should be least affected as their companies typically have large working capital lines from banks or commercial paper programs to buffer these delays. Here the impact will be more on the revenues rather than on the companies’ solvency.

Sensitivity to trade disruptions

| High | Medium | Low | |

|---|---|---|---|

| Trade Finance Segment | Commodity Trade Finance where the dependency on the goods is highest and often the main source of repayment. Delays in shipment times have severe negative impact on commodity trading companies’ working capital. | SME Trade Finance, where SME companies have less ability to absorb adverse working capital trends due to longer shipment times, on cashflow. Emerging Market Trade Finance, any importing EM companies will have to absorb the working capital impact, any exporters will most likely be less affected. |

Diversified Trade Finance, where the bulk of the portfolio consists of global large cap companies. Corporates typically have market access mean there is no meaningful impact on capacity and willingness to repay short term trade finance. |

Macro Trends

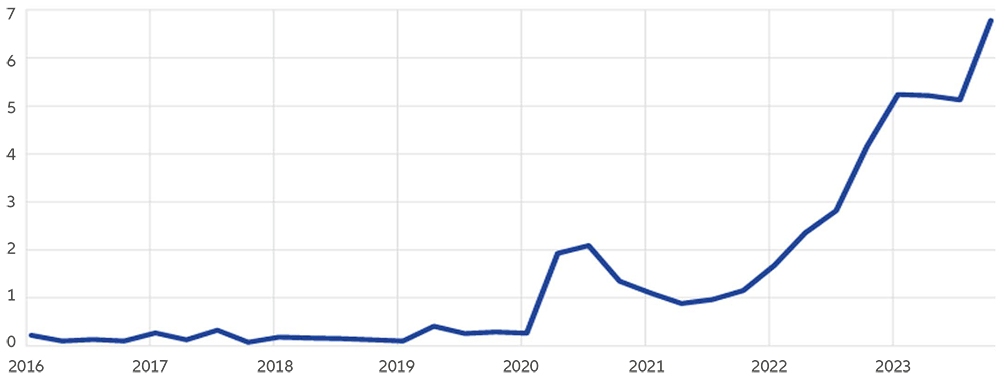

While the pictures of accidents and attacks make the headlines most often, it is also structural trends that have been impacting global trade negatively: Geopolitics have reversed globalisation and have led to a reshoring or friend-shoring of corporate supply chains. The number of companies mentioning the trend in their earnings calls has surged since the start of the Ukraine war.

Exhibit 3: Global incidence of reshoring-related terms in firms’ earnings calls

Note: Sentences containing at least one of the search phrases, as a proportion of all sentences recorded during firms’ earnings calls, percentages. Firm-level incidence rates are averaged across all firms and across each quarter. The search phrases were “friend-shoring”, “near-shoring”, “on-shoring”, and “reshoring”. The latest observation is for the third quarter of 2023. Source: NL Analytics and ECB staff calculations.

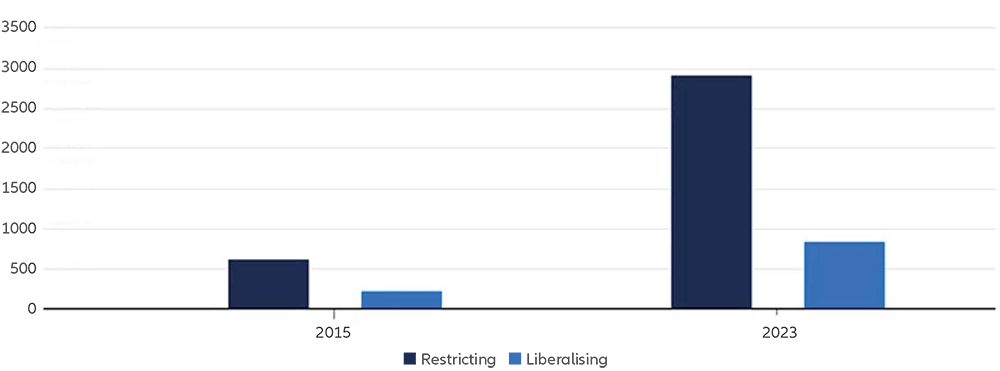

Protectionism has been on the rise for a few years now. As such, the number of policy interventions that restrict goods and services trade has been surging and 2023 saw almost 3000 restricting government actions taking place.

Exhibit 4: Number of trade policy interventions affecting goods and services trade

Note: Restricting (Liberalising) measures are interventions that discriminate against (benefit) foreign commercial interests. Adjusted data for reporting lags as of December 31, 2023. Source: Global Trade Alert; World Bank.

The above trends have set the growth rate of global trade to slow. As such, 2020-2024 was the half-decade with the lowest growth since the early 1990’s.

Demand for trade finance is growing

Despite a slowing growth of global trade, demand for trade finance has been on the rise. The so-called trade finance gap, which measures the difference between demand for trade financing and its supply, has been increasing in past years. It now stands at USD 2.5 trillion – up from USD 1.5 trillion a few years ago1. The reasons why this demand cannot be satisfied are multifold. Limitations for EM and SME risk appetite, KYC onboarding costs; just to name a few.

The World Trade Organization (WTO) estimated that of the USD 17 trillion trade around 80-90% rely on financing2. Others put the size of the trade finance market at around USD 5 trillion3. The banking industry provides the lion share of this financing. Trade Finance provided by asset managers is very small in relative terms. Our estimate places it at approximately USD 15 to 20 billion worldwide – less than 0.5%.

Bank syndication

Irrespective of the direct impact of any trade disruptions, it is the risk appetite of banks that is the major driver for the trade finance asset management industry. Banks syndicate assets to non-bank investors and thereby determine the asset supply, or they compete against nonbanks for financing facilities. If banks want to grow their trade books, competition is fierce irrespective if non-bank investors source directly from corporates or buy syndicated transactions from banks or FinTechs. The factors driving banks’ actions are multifold:

- The availability of credit insurance determines whether banks are able to hold exposure at optimal risk capital charges. Every credit cycle insurers proactively cut credit lines, making banks more willing to syndicate portions of their book to non-bank investors.

- Bank regulation impacts the capital efficiency of the asset class. Basel IV regulatory changes for banks may require banks to reserve more capital for trade finance assets and therefore lead to adjustments of underwriting appetite.

- The general corporate default cycle also impacts bank actions. Rising downgrades or defaults reduce overall risk exposure to a certain company, sector, or country. Very often the riskier longer-term loan businesses of banks are prevented from underwriting new loans. Counterintuitively, this may mean that during those times relatively less-risky short-term trade finance business is able to grow exposure by filling up existing credit lines which leads to less appetite for syndication.

- Many sectors have seasonality. This means that trade finance which is directly linked to revenues and invoices sent is seasonal as well. Some banks may wish to syndicate a fixed percentage amount of a trade finance facility to non-bank investors, while others may want to keep their credit line fully filled thereby syndicating less volume during seasonal lows. Luckily for investors, economic sectors do not have the same seasonality allowing asset managers to rotate between sectors to keep mandates fully invested.

- Many banks have several trade finance business lines/departments/books as well as several syndication desks. A change in responsibilities, employee departures or team restructurings may disrupt syndication activities for a few weeks. Asset managers need to have good relationships to be able to manage through those changes and ensure uninterrupted deal flow.

- Lastly, bank syndication is also driven by operations and systems. As most banks have been active in trade finance for many decades, they typically operate many legacy systems dependent on line of business and country. The ability to connect to every part of a bank is key for asset managers. The continuing growth (and competition) from FinTechs have led banks to improve their systems and partner with platforms to facilitate syndication to non-bank investors.

FinTechs on the rise

The world has seen a huge wave of FinTech start-ups over the past decade. The trend was fueled by ultra-low interest rates and large flows into venture capital. While those trends have reversed over the past two years, there are many FinTechs that have already reached self-sustainability. Their business models center around sourcing, underwriting and operations but most often require funding from third parties. Asset managers are the natural partner for those businesses as they are less seen as direct competition. It is therefore no surprise to see many asset managers partnering/investing/working with FinTech companies.

Contradicting trends – how do investors navigate them?

Slowing macro trends, contradicting bank syndication and growing FinTech market share – where does this leave non-bank investors in the field? Experience drawn from half a decade running a trade finance fund leads us to the following findings:

- Don’t attempt to forecast global macro trends or the supply and demand dynamics of global trade.

- Instead, be prepared for every outcome and establish a robust and resilient sourcing framework that does not depend on a single sector, geography, or isolated segment of the market. Asset managers exhibiting such robustness will source through various channels such as direct, banks, FinTech and others. Their IT and operations setup will be flexible enough to work with as many counterparties as possible. Their decision making will be fast to allow for swift substitution of transaction flows.

- Maintain a very open dialogue with your sourcing partners. Don’t overpromise and underdeliver. Reliability is key in every syndication relationship.

In short: Focus on what you can influence and be prepared for what you cannot.

1 Asian Development Bank, 2022.

2 World Trade Organization, 2024.

3 McKinesy & Company, November 2021, Reconceiving the global trade finance ecosystem.