China is changing

China is reforming and restructuring its economy to leverage its paramount capacity to innovate. Its creative power, particularly in the AI field, remains underappreciated and China currently offers investors a long-term growth story based on deep markets that we believe remain attractively priced.

Now is the time to get ahead of the opportunities as an investor.

Innovation, reform, and investment: key drivers of China’s growth

China is now a leader, not a follower, across many significant industries that fit with today’s global megatrends – AI, renewable energy, and electric vehicles, to name a few. As the economy reforms to reflect this new reality, many Chinese products and services will become the go-to choice for innovation and quality, rather than just price.

What will the “China of the future” look like?

Some of China’s most significant transformational efforts include the success of domestic brands, a growing emphasis on sustainability and a commitment to leadership in advanced technologies. Supported by investments in R&D and infrastructure, these transformations are set to change the face of the Chinese economy over the coming decades.

How can China help diversify your investments?

| China’s markets have historically exhibited low correlations to other major markets – meaning they frequently move in different directions. This means investing in China could potentially bring diversification benefits. |

| Equities are available in a range of exchanges – from Shenzhen and Hong Kong listings to the Nasdaq-like STAR market. |

| Bonds can be accessed in onshore and offshore markets, and denominated in US or Chinese currencies, to help achieve a range of diversification objectives. |

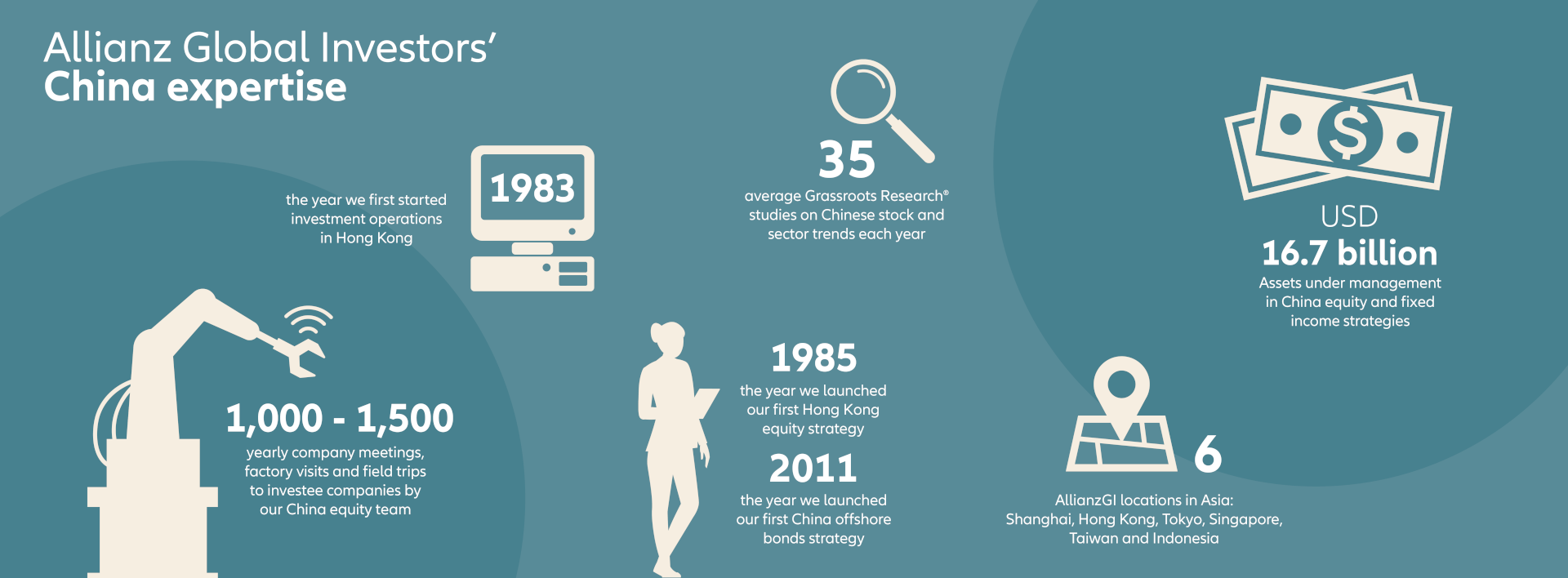

Our China expertise is deep and broad

In many ways a unique market, China is still unfamiliar to many investors. Partnering with someone who understands this dynamic region is critical. At Allianz Global Investors, we have a wealth of research capabilities across our investment platform, including proprietary insights from our Grassroots Research® team, with correspondents in China and across Asia.

Our funds

Allianz China A Opportunities

Allianz China A Opportunities is a concentrated portfolio of the most promising domestic China stocks, built by a team focused on active stock selection and a philosophy of growth at a reasonable price.

Why invest?

-

China A-shares: too big an opportunity to ignore

The China equity market is the second largest in the world. China A-shares account for approximately 70 %1 of all China stocks and are an opportunity for foreign Investors who want to tap into China’s long-term growth potential. -

Diversification benefits

A-shares build a real picture of the economy, significantly broader and more diversified than that of Hong Kong-listed stocks. China A-shares can be a valuable addition to an investor’s portfolio, offering potential diversification benefits through the market’s low correlation to other major equity markets. -

Active management and local expertise

The China A-shares market is dominated by retail investors and is correspondingly inefficient. Active management is required to avoid overly-risky stocks and exploit opportunities. Allianz Global Investors has deep local expertise coupled with a bottom-up fundamental approach and our unique, ‘boots on the ground’ Grassroots Research®.2

Performance Chart

...

...

Calculation basis: Net asset value (excl. front-end load); distributions reinvested. Calculation according to method as defined by BVI, the German Fund Companies Association. Past performance is not a reliable indicator of future results. Any front-end loads reduce the capital invested and the performance stated. Individual costs such as fees, commissions and other charges have not been taken into consideration and would have a negative impact on the performance if they were included.

Experienced portfolio management team

Allianz China A-Shares Equity

Allianz China A-Shares Equity Fund invests purely into China A-shares (no offshore exposure). Our bottom-up stock selection approach helps us build a high conviction portfolio of stocks that offer exposure to China’s long-term economic growth potential across various sectors. This Fund offers investors the opportunity to exclusively access the growing China A-Shares market in a UK domestic fund.

Why invest?

-

China A-shares: too big an opportunity to ignore

The China equity market is the second largest in the world. China A-shares account for approximately 70 %1 of all China stocks and are an opportunity for foreign Investors who want to tap into China’s long-term growth potential. -

Diversification benefits

A-shares build a real picture of the economy, significantly broader and more diversified than that of Hong Kong-listed stocks. China A-shares can be a valuable addition to an investor’s portfolio, offering potential diversification benefits through the market’s low correlation to other major equity markets. -

Active management and local expertise

The China A-shares market is dominated by retail investors and is correspondingly inefficient. Active management is required to avoid overly-risky stocks and exploit opportunities. Allianz Global Investors has deep local expertise coupled with a bottom-up fundamental approach and our unique, ‘boots on the ground’ Grassroots Research®.2 -

Amongst the first of its kind

The Fund is one of the first UK OEIC vehicles offering access to the China A-Shares market.

Performance Chart

...

...

Calculation basis: Net asset value (excl. front-end load); distributions reinvested. Calculation according to method as defined by BVI, the German Fund Companies Association. Past performance is not a reliable indicator of future results. Any front-end loads reduce the capital invested and the performance stated. Individual costs such as fees, commissions and other charges have not been taken into consideration and would have a negative impact on the performance if they were included.

Experienced portfolio management team

Allianz All China Equity

Allianz All China Equity provides investors with unique access to both China’s onshore and offshore markets, employing ‘boots on the ground’ research and local expertise to take advantage of China’s long-term growth opportunity.

Why invest?

-

China: too big an opportunity to ignore

The China equity market is the second largest in the world. China A-shares account for approximately 70 %1 of all China stocks and are an opportunity for foreign Investors who want to tap into China’s long-term growth potential. -

Diversified exposure

Our All China strategy approach provides optimal exposure to China’s economy and financial markets in a single portfolio -a more efficient approach than separate A-share / H-share / ADR allocations. The portfolio encompasses between 55-75 stocks equally split between onshore and offshore markets, providing better access to the China macro growth story. -

Unbiased investment decisions

Our seasoned co-lead Portfolio Managers and their Team hold local expertise and complementary skillsets across sectors, enabling them to take advantage of the breadth of China’s market and generate alpha ideas.

Performance Chart

...

...

Benchmark history

- until 28/11/2019: No Benchmark

Calculation basis: Net asset value (excl. front-end load); distributions reinvested. Calculation according to method as defined by BVI, the German Fund Companies Association. Past performance is not a reliable indicator of future results. Any front-end loads reduce the capital invested and the performance stated. Individual costs such as fees, commissions and other charges have not been taken into consideration and would have a negative impact on the performance if they were included.

Experienced portfolio management team

-

1 Shenzhen Stock Exchange, Shanghai Stock Exchange, Hong Kong Stock Exchange, Bloomberg, Allianz Global Investors, as of December 31, 2023. The total figures are for comparison only, the stocks included may be listed in more than one exchange. Offshore China stocks are defined based on companies with ultimate parent domiciled in China. Suspended stocks, investment funds and unit trusts are excluded.

2 Grassroots Research® is a division of Allianz Global Investors that commissions investigative market research for asset-management professionals. Research data used to generate Grassroots Research® reports are received from independent, third-party contractors who supply research that, subject to applicable laws and regulations, may be paid for by commissions generated by trades executed on behalf of clients.Investing involves risk. The value of an investment and the income from it may fall as well as rise and investors might not get back the full amount invested. Past performance does not predict future returns. If the currency in which the past performance is displayed differs from the currency of the country in which the investor resides, then the investor should be aware that due to the exchange rate fluctuations the performance shown may be higher or lower if converted into the investor’s local currency. This is for information only and not to be construed as a solicitation or an invitation to make an offer, to conclude a contract, or to buy or sell any securities. The products or securities described herein may not be available for sale in all jurisdictions or to certain categories of investors. This is for distribution only as permitted by applicable law and in particular not available to residents and/or nationals of the USA. The investment opportunities described herein do not take into account the specific investment objectives, financial situation, knowledge, experience or specific needs of any particular person and are not guaranteed. The Management Company may decide to terminate the arrangements made for the marketing of its collective investment undertakings in accordance with applicable de-notification regulation. The views and opinions expressed herein, which are subject to change without notice, are those of the issuer companies at the time of publication. The data used is derived from various sources, and assumed to be correct and reliable at the time of publication. The conditions of any underlying offer or contract that may have been, or will be, made or concluded, shall prevail. The duplication, publication, or transmission of the contents, irrespective of the form, is not permitted; except for the case of explicit permission by Allianz Global Investors GmbH.

For investors in the United Kingdom (non-UK domiciled products)

These Funds are authorised overseas, but not in the UK. These funds are domiciled in Luxemburg and are authorised by the Commission de Surveillance du Secteur Financier (CSSF). The funds are recognised in the UK under the Overseas Funds Regime (OFR) but are not UK authorised funds. The funds are managed by Allianz Global Investors GmbH which is domiciled in Germany and is authorised by Bundesanstalt für Finanzdienstleistungsaufsicht (www.bafin.de). The Financial Ombudsman Service is unlikely to be able to consider complaints related to the scheme, its operator or its depositary. Investors in the United Kingdom can submit a complaint about any of the Funds, the Management Company, or the Depositary to the Facilities Agent (Allianz Global Investors UK Limited). A copy of the Management Company’s complaints process leaflet is available on request from the Facilities Agent. Please see the prospectus of the Fund for information on applicable alternative resolution schemes applicable to UK Investors. Any claims for losses relating to the operator and the depositary of the scheme are unlikely to be covered under the UK’s Financial Services Compensation Scheme. Neither the Management Company nor any of the recognised schemes participates in a compensation scheme. The Depositary participates in compensation schemes and Investors may potentially be able to claim compensation if the Depositary was unable to meet its obligations to return money to the Investor. A prospective investor should consider getting financial advice before deciding to invest and should see the prospectus of the Fund for more information. For a free copy of the sales prospectus, incorporation documents, daily fund prices, Key Investor Information Document, latest annual and semi-annual financial reports, or a complete list of OFR Funds, contact the Facilities Agent or the issuer at the addresses indicated below or regulatory.allianzgi.com. Please read these documents, which are solely binding, carefully before investing.