Infrastructure equity

We believe that changes in the infrastructure market, structural shifts in various sectors and investment backlogs are opening up a wide range of investment opportunities. With attractive return potential, steady regular income and a very low correlation with the capital market as a whole, infrastructure equity offers investors an interesting opportunity to improve their portfolio structure1.

At AllianzGI, we can provide the necessary expertise and market access to utilize these opportunities. We enable investors to access the same investment opportunities as Allianz. This ensures that investors in our strategies and Allianz are fully aligned.

Given our very long-term investment horizon, we seek returns for Allianz and additional institutional clients through cash yield and not through exits. As a long-term, buy-and-hold investor, we focus on investments that provide stable, preferably inflation-linked cash flows over the long term.

We invest in assets that provide essential services to the public and are supported by regulated or contracted revenues, or a strong market position. We take construction risk under appropriate contractual or regulatory protection and development risk on a selective basis.

Investing alongside Allianz

Allianz's excellent reputation, capital strength and long-term buy-and-hold investment philosophy frequently results in differentiated deal origination opportunities. Our infrastructure equity strategies offer investors the opportunity to invest jointly with Allianz into these opportunities.

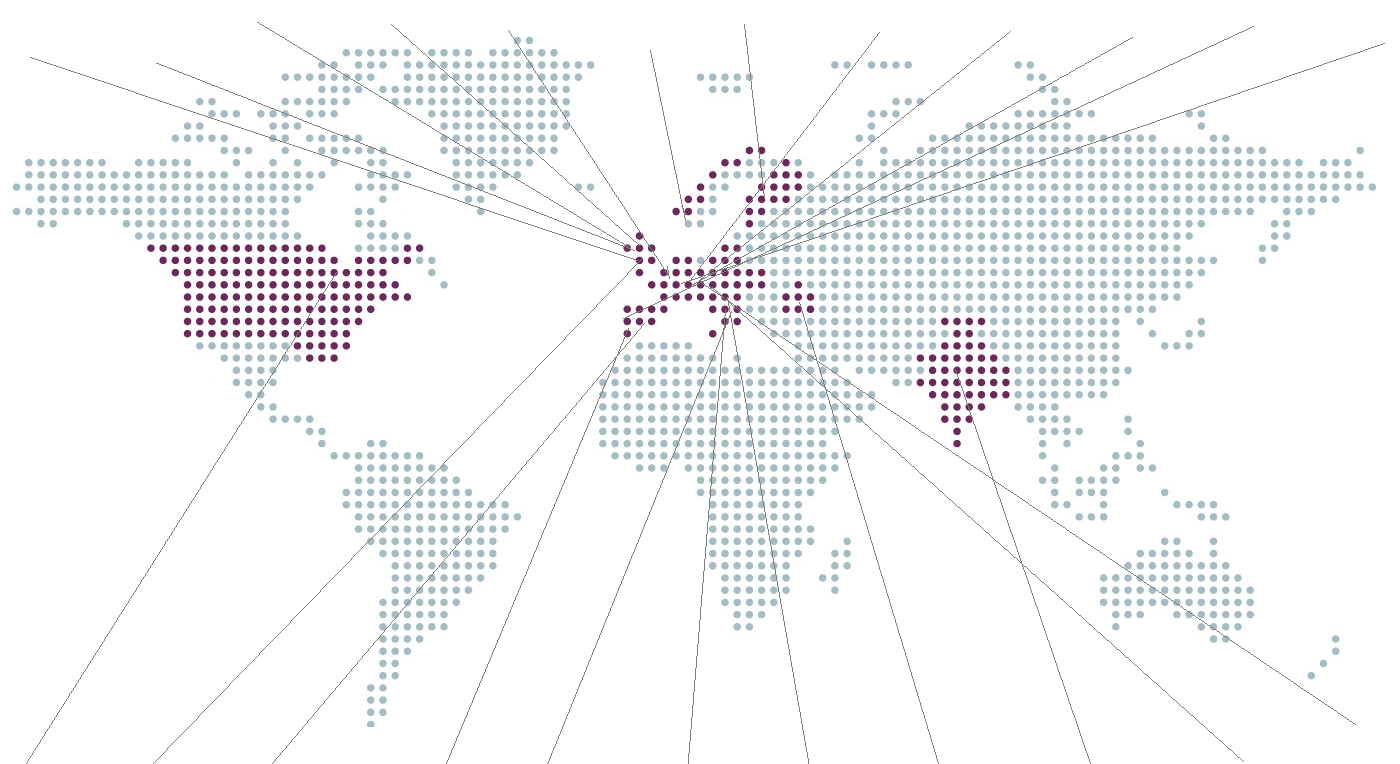

Leveraging Allianz’s deep global networks, technical expertise and a strong understanding of local dynamics, as well as access to and credibility with corporate executives, regulators and policy makers, ensures rigorous execution and asset management.

Diversified investment portfolio

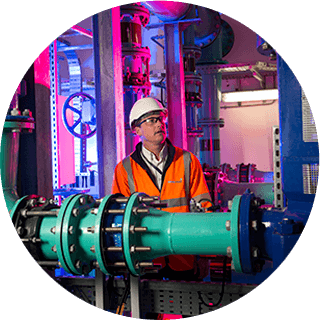

A stable power grid for Finland, an attractive fibre rollout to the home network in Germany and a modern underground network in Spain – these are three examples of long-term infrastructure investments by AllianzGI. The infrastructure team has been building a broadly diversified portfolio since 2007.

Investment examples

Affinity

Water

- Water-only supply company

- United Kingdom

Porterbrook

- Rolling stock leasing company

- United Kingdom

colchester garrison

- Garrison

- United Kingdom

cadent

- Gas network

- United Kingdom

XpFibre

- Fibre-to-the-home infrastructure

- France

GASSLED

- Gas pipeline system

- Norway

Energy

Elenia

- Electricity distribution

- Finland

Tank & Rast

- Network of motorway service areas

- Germany

NET4GAS

- Gas pipeline system

- Czech Republic

GASNET

- Gas distribution network

- Czech Republic

GGND

- Gas distrbutor

- Portugal

UGG

- Broadband rollout

- Germany

- Parking meters

- Chicago – USA

Chicago Parking Meters

- New sewage tunnel

- London – United Kingdom

Thames Tideway Tunnel

- Metro infrastructure

- Madrid and Barcelona – Spain

Queenspoint

- Gas distribution

- Spain

nedgia

- Toll road network

- Italy

Autostrade per l’italia

- Gas pipeline system

- Austria

gas connect austria (gca)

- Broadband rollout

- Austria

nöGIG

- Electricity and gas distribution grid

- Romania

Delgaz grid

- Toll roads and road infrastructure

- India

IndInfravit Trust

- Telecommunictions towers

- pan-European

ATC Europe

- Broadband rollout

- Austria

ÖGIG

Affinity Water

- Water-only supply company

- United Kingdom

Porterbrook

- Rolling stock leasing company

- United Kingdom

colchester garrison

- Garrison

- United Kingdom

cadent

- Gas network

- United Kingdom

SFR ftth (altice)

- Fibre-to-the-home infrastructure

- France

GASSLED

- Gas pipeline system

- Norway

GASNET

- Gas distribution network

- Czech Republic

Energy Elenia

- Electricity distribution

- Finland

Tank & Rast

- Network of motorway service areas

- Germany

NET4GAS

- Gas pipeline system

- Czech Republic

GGND

- Gas distrbutor

- Portugal

UGG

- Broadband rollout

- Germany

Chicago Parking Meters

- Parking meters

- Chicago – USA

Thames Tideway Tunnel

- New sewage tunnel

- London – United Kingdom

Queenspoint

- Metro infrastructure

- Madrid and Barcelona – Spain

nedgia

- Gas distribution

- Spain

Autostrade per l’italia

- Toll road network

- Italy

gas connect austria (gca)

- Gas pipeline system

- Austria

NÖGIG*

- Broadband rollout

- Austria

* Closing expected at the end of 2019

Delgaz grid

- Electricity and gas distribution grid

- Romania

IndInfravit Trust

- Toll roads and road infrastructure

- India

ATC Europe

- Telecommunications towers

- pan-European

ÖGIG

- Broadband rollout

- Austria

Our investment strategies

European Infrastructure Direct Investments

The European Infrastructure strategy seeks to deliver attractive and resilient risk-adjusted long-term returns and cash yields through direct investments in core and core+ infrastructure equity assets across Europe, with limited additional commitments in OECD2 countries outside of Europe. This is a buy-and-hold strategy offering the opportunity to invest alongside Allianz.

The target portfolio will be characterised by long-term cash flow visibility and stability, while providing a degree of inflation linkage and ensuring strong downside protection. Investments will include brownfield and selected greenfield assets.

Global Diversified Infrastructure Equity

The Global Diversified Infrastructure Equity strategy aims to deliver attractive risk-adjusted returns with equity investments in infrastructure globally. It invests alongside Allianz in a diversified global portfolio of core, core+ and selectively value-add infrastructure consisting of primary commitments to infrastructure funds, secondary transactions and co-investments.

The investment portfolio aims to benefit from diversification across sectors and regions, providing access to a large number of underlying investments.

Investing in renewable energy infrastructure

Since 2005, Allianz Capital Partners has been dedicated to renewables and is one of the world's largest financial investors in this asset class. Investments in wind and solar projects offer an attractive annual income stream at an acceptable risk-return profile.

The advantages of the asset class are predictable, long-term cash yields in comparison to investments alternatives with similar risk, a large and growing investment universe, and no correlation with capital markets, providing excellent possibilities for portfolio diversification.

The knowledge and experience of our Renewables team makes ACP a particularly educated investor, greatly facilitating rapid progress through the due diligence and contractual negotiation process. The carefully selected team combines long term experience in project development, financing, construction and operation of both on- and offshore wind and solar parks.

Benefiting from Allianz Capital Partners‘ expertise

Allianz Capital Partners (“ACP”) is one of the Allianz Group's asset managers for private equity and infrastructure equity investments and is part of AllianzGI. ACP focuses on investing into private equity, infrastructure and renewable energy.

What other strategies are available? |

- The performance of the strategy is not guaranteed and losses remain possible.

- Organisation for Economic Co-operation and Development (OECD).

- A recent study of the Infrastructure Investor in June 2021 put AllianzGI/ACP at no. 4 within the “TOP 50 Global Investors” of the 50 biggest institutional investors based on the market value of their private infrastructure portfolio, both though third-party managed vehicles and direct investments.

For professional investors only, strictly private and confidential solely for the intended recipient

Infrastructure equity investments are highly illiquid and designed for professional investors pursuing a long-term investment strategy only.

Investing involves risk. The value of an investment and the income from it may fall as well as rise and investors might not get back the full amount invested. Investing in fixed income instruments may expose investors to various risks, including but not limited to creditworthiness, interest rate, liquidity and restricted flexibility risks. Changes to the economic environment and market conditions may affect these risks, resulting in an adverse effect to the value of the investment. During periods of rising nominal interest rates, the values of fixed income instruments (including positions with respect to short-term fixed income instruments) are generally expected to decline. Conversely, during periods of declining interest rates, the values of these instruments are generally expected to rise. Liquidity risk may possibly delay or prevent account withdrawals or redemptions. Past performance does not predict future returns. If the currency in which the past performance is displayed differs from the currency of the country in which the investor resides, then the investor should be aware that due to the exchange rate fluctuations the performance shown may be higher or lower if converted into the investor’s local currency. The views and opinions expressed herein, which are subject to change without notice, are those of the issuer companies at the time of publication. The data used is derived from various sources, and assumed to be correct and reliable at the time of publication. The conditions of any underlying offer or contract that may have been, or will be, made or concluded, shall prevail. The duplication, publication, or transmission of the contents, irrespective of the form, is not permitted; except for the case of explicit permission by Allianz Global Investors GmbH.

AdMaster 2196812, 2294622