AllianzGI enhances governance and sustainability with new voting rules for 2025

- 2025 Policy updates: New guidelines focus on ESG-linked executive remuneration, dual-class shares and companies’ net-zero strategies, emphasising minority shareholder rights and sustainability.

- Active stewardship: AllianzGI participated in 8,879 shareholder meetings in 2024, voting on around 90,000 proposals, and opposed or abstained on at least one agenda item at 72% of all meetings.

- Board quality: AllianzGI voted against 22% of directors in 2024 due to concerns about tenure, overboarding, and committee independence.

24.02.2025 | Allianz Global Investors (AllianzGI), one of the world’s leading active investment managers, has today published its annual analysis of how it voted at Annual General Meetings (AGMs) globally. This is based on its participation in 8,879 (2023: 9,137) shareholder meetings and voting on around 90,000 shareholder and management proposals. AllianzGI voted against, withheld, or abstained from at least one agenda item at 72% (2023: 71%) of all meetings globally. The firm opposed 19% of capital-related proposals, 22% of director elections, and 41% of remuneration-related proposals, reflecting its high expectations for governance standards.

Matt Christensen, Global Head of Sustainable and Impact Investing: “AllianzGI is committed to driving positive change through proxy voting and responsible investment practices. Our dedication to stewardship and forward-looking approach will ensure that we remain at the forefront of advocating for high governance standards and the protection of minority shareholder rights. We remain committed to delivering pragmatic, real-world sustainability solutions and are excited to advance this in 2025 and beyond.”

UK Deep Dive

Executive Compensation: AllianzGI voted against 13% of all remuneration-related proposals, consistent with the previous year, following a decrease from approximately 20% dissent in 2022. Generally, executive remuneration structures and disclosures in the UK are well-formed. Despite a large number of remuneration policies put to shareholder vote (83), we supported 80% of the plans. Issues leading to dissent included: lack of clear and transparent disclosure of KPIs, insufficient linkage between company performance and compensation outcomes, and companies operating outside their remuneration policy parameters. Support for remuneration reports increased from 80% in 2023 to 86% in 2024, indicating continued improvements in disclosure and implementation of compensation policies.

Capital: While we acknowledge the increased guideline limits supported by the Pre-Emption Group, we have maintained our policy limits regarding the disapplication of pre-emptive rights. As issuers adhere to market best practices, we only partially supported resolutions to disapply pre-emptive rights at these higher limits. This led to a second consecutive increase in dissent levels, from 11% in 2023 to 15% in 2024, significantly higher than the historic dissent of 1% in 2022.

Shareholder Resolutions: The UK saw one shareholder proposal on climate/GHG, which we supported following engagement with the company.

Simon Gergel, CIO UK Equity commented:“Once again, we voted against fewer resolutions in the UK than any other market, demonstrating the generally strong levels of governance among UK listed companies. Whilst we welcome recent UK listing reforms which represent a significant shift towards deregulation, they also raise concerns among investors about the potential erosion of shareholder protections. The balance between fostering a competitive market and maintaining robust investor safeguards will be crucial in determining the success of these reforms and the success of the UK market over the long-term.”

Policy Changes for 2025

AllianzGI reviews its proxy voting guidelines annually to reflect evolving expectations for companies. For 2025, the firm has implemented several new rules, further emphasising the importance of minority shareholder rights and enhancing its approach to sustainability in proxy voting.

- Executive Remuneration: AllianzGI is implementing a rule requiring ESG-related KPIs for small- and mid-cap companies in developed markets (ex Asia) in 2025.

- Net-Zero Strategy: AllianzGI will increasingly hold directors accountable if a company lacks a credible net-zero strategy. Starting in 2025, voting decisions will be based on its proprietary Net-Zero Alignment Share Methodology1, which provides a standardized way to assess companies’ progress on net-zero goals across sectors and markets.

- Gender Diversity: AllianzGI has extended its gender diversity guidelines to small- and mid-cap companies in developed markets (ex-Asia), expecting no more than 70% of any board to be of one gender.

- Shareholder Rights: AllianzGI is strengthening its guidelines on shareholder rights, including opposing dual-class share structures in Europe and the US, which disadvantage minority shareholders, as well as voting against companies exploiting benefits from new capital market regulations like the DDL Capitali law in Italy.

Voting in 2024

Remuneration

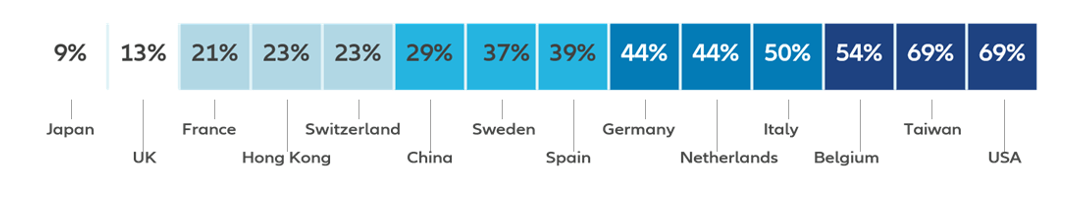

AllianzGI continues to be concerned about remuneration practices in Europe, with the highest rate of opposition to pay-related proposals seen in Belgium (54%), Italy (50%), and Germany (44%), though there has been some progress in transparency and practices. Concerns persist regarding boards’ discretion in granting special payments, as seen in Italy. Despite improvements in remuneration report transparency, particularly in Germany, some companies still hesitate to fully disclose the link between performance, target achievements, and pay-outs which does not allow investors like AllianzGI to assess whether targets were stretching.

In the US, AllianzGI opposed 69% of pay-related proposals in 2024, continuing a trend of declining opposition in recent years. With the US market performing strongly over 2024, especially large companies, those companies who maintained good alignment between pay levels and performance generally avoided controversy, resulting in slightly higher average levels of say on pay support compared with the last two years.

Looking ahead to the 2025 proxy season, AllianzGI is concerned by the increased pay opportunities for executives in several European countries, including the UK, as evidence in many engagement meetings. The firm will monitor developments closely, particularly the relationship between executive compensation and employee pay, in order to make informed voting decisions.

Shareholder Resolutions

The number of proposals at Russell 3000 companies2 rose to another record for the year ending June 30, 2024. However, average support for these proposals remained low, with fewer than 20% of votes in favour. AllianzGI voted on 695 shareholder proposals in the US, including:

- 77 on corporate governance

- 50 on compensation

- 230 on social themes

The remainder on environmental or mixed resolutions.

AllianzGI’s support for climate-related shareholder proposals in the US remained high at 98% in 2024, based on 45 resolutions across four climate-related categories: reporting on climate change, GHG emissions, disclosure of fossil fuel financing, and restricting fossil fuel financing.

Additionally, AllianzGI supported 97% of human rights-related resolutions and 93% of proposals for greater transparency on political contributions and lobbying. A notable new category of shareholder resolutions focused on the responsible development and application of artificial intelligence (Responsible AI). AllianzGI generally supports resolutions asking boards to evolve their risk oversight and demonstrate that associated risks are properly managed.

In Japan, shareholder resolutions remained a key topic, with an increase in both volume and diversity. AllianzGI supported 50% of climate-related shareholder proposals, including a pre-announcement of voting in favour of the climate lobbying resolution at Toyota Motor's AGM. Voting decisions are guided by pre-AGM engagement and internal assessments.

Promoting High-Quality Boards

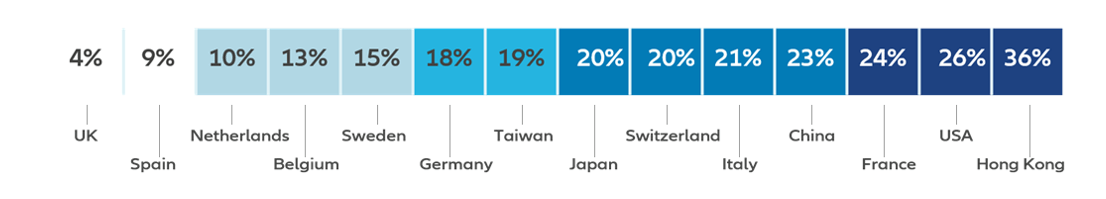

AllianzGI places high importance on board quality, believing that strong governance is closely linked to better financial performance and high sustainability standards. In 2024, AllianzGI voted against 22% of directors standing for election, with long tenure and overboarding continuing to be major concerns in many markets (2023: 24%). The firm also voted against elections where board committees lacked sufficient independence, with audit committees being a particular area of focus. AllianzGI advocates for an independent chair of the audit committee, which led to "against" votes in some markets, such as Switzerland. For example, AllianzGI voted against 34% of board chair elections in Switzerland, mainly due to the fact that many board chairs also serve as chair of the audit committee, which the firm expects to be independent.

AllianzGI also stresses the importance of proactive succession planning. Adequate and proactive succession planning is necessary for board chairs as well as executive directors. Antje Stobbe, Head of Stewardship at AllianzGI: "A particular focus remains on succession plans for the chairperson. We want to understand the key competencies required for the incoming chair to effectively lead the board, as well as how the search process is managed. The incoming chair should possess strong leadership skills, industry experience, unquestionable independence, and enough time to lead the board, especially in times of crisis."

Positive developments were also noted in some markets, including Japan, where nearly all companies AllianzGI invests in have more than one-third independent directors and at least one female director, thanks to Tokyo Stock Exchange reform initiatives and investor engagement efforts. However, the competence of board members as well as director affiliation remain areas the firm scrutinises.

To know more about our corporate policy guidelines, click here.

Total percentage votes against resolutions proposals by location:

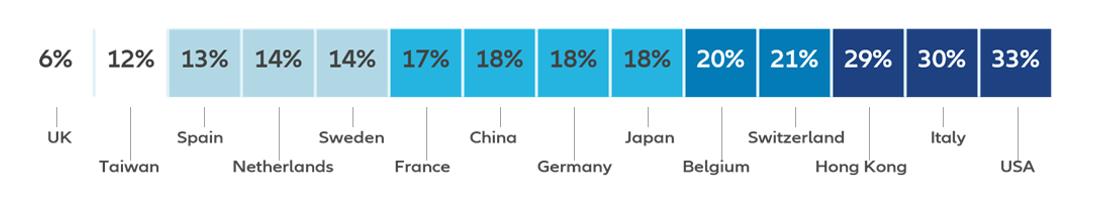

Total percentage votes against compensation related proposals by location:

Total percentage votes against director-related and directors election proposals by location:

Source: AllianzGI Proxy Voting Data

Contact

Sophie Niven

Mobile +07500 785667

sophie.niven@allianzgi.com

1 The Net-Zero Alignment methodology aims to assess the transition plan’s credibility and likely net zero compliant pathway of a company. The methodology is based on the Net Zero Investment Framework from IIGCC’s Paris Aligned Investment Initiative.

2 https://www.lseg.com/en/ftse-russell/indices/russell-us