AllianzGI with over EUR 50 billion AuM in infrastructure

- AllianzGI has surpassed EUR 50bn of Assets under Management (AuM) in infrastructure debt and equity at the end of 2023 accounting for over 50% of the private markets pillar´s AuM

- Since 2009 AllianzGI / Allianz Capital Partners have closed over 200 transactions on 6 continents

- In focus for 2024: energy transition, secondaries, co-investments, and active management across direct and indirect, debt and equity strategies

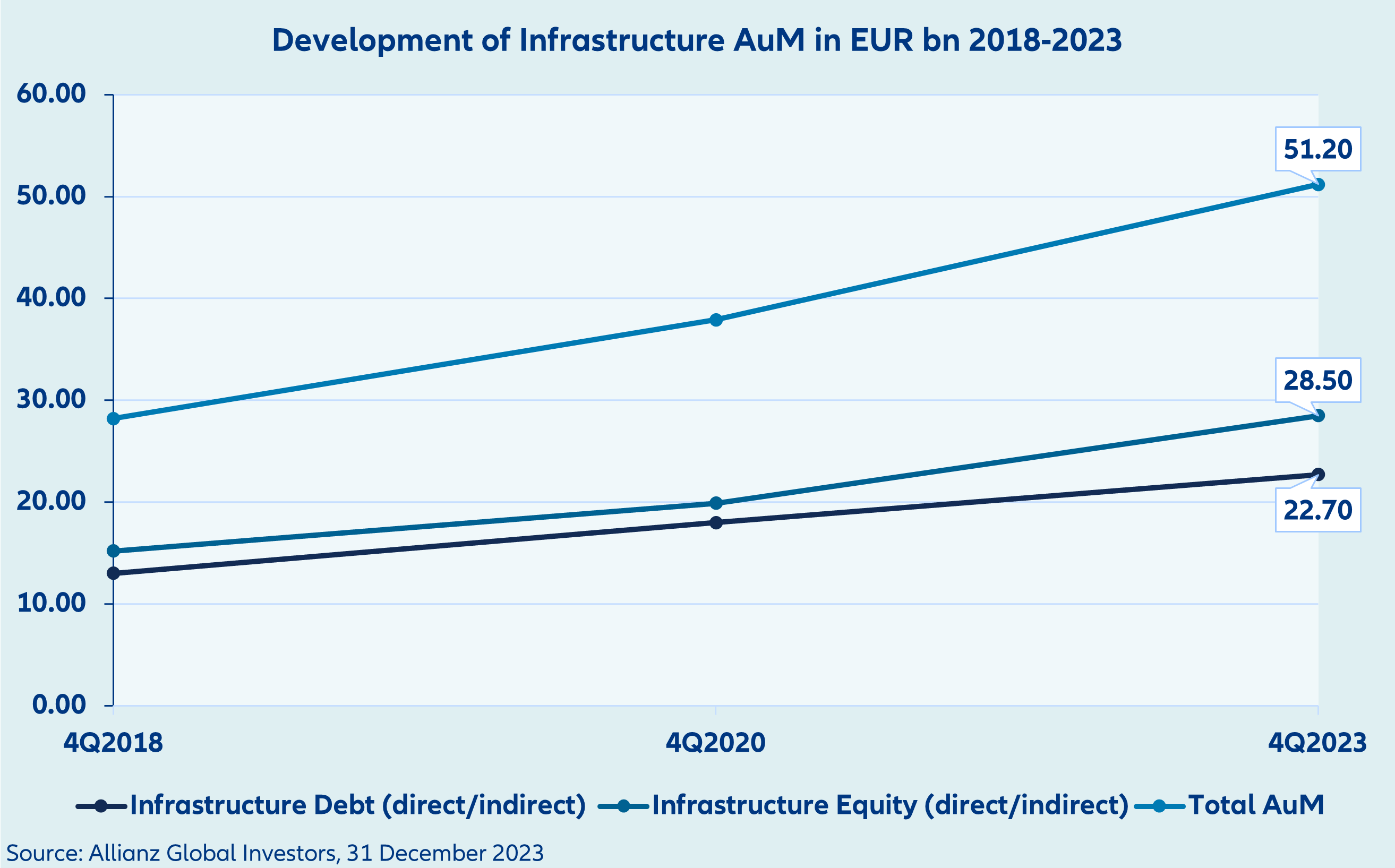

21.03.2024 | Allianz Global Investors (AllianzGI) has announced that its infrastructure business has reached the milestone of over EUR 50bn AuM1 across the debt and equity infrastructure platforms and strategies which accounts for over 50% of AllianzGI´s private markets pillar. Since the launch of the infrastructure business, the infrastructure debt and equity teams both on the direct and indirect side have closed more than 200 transactions in over 50 countries on 6 continents. In the last five years the infrastructure AuM at AllianzGI have grown from EUR 28.2bn (4Q2018) to EUR 51.2bn (4Q23).

The infrastructure debt team has enabled global transactions totalling around EUR 25bn and the infrastructure equity team has over EUR 28bn AuM which makes AllianzGI one of the largest infrastructure investors globally2. The indirect infrastructure equity team has been investing since 2016. In 2023, AllianzGI launched its indirect infrastructure debt strategy, which focusses on energy transition.

Specific emphasis of the infrastructure pillar is on providing capital for the energy transition, social infrastructure, the transport and communications sectors. At today´s end of the Infrastructure Investor Global Summit 2024 in Berlin the infrastructure management team is sharing their views for this year:

Claus Fintzen, CIO Infrastructure Debt, comments: “Uncertainty remains in 2024 –Infrastructure is well positioned to cope with it. While interest rates seem to have reached their peak the geopolitical environment continues to be tense. A diligent and disciplined approach to hedge this volatility is therefore key for long-term infrastructure debt investors who can play a crucial role in financing the energy transition.”

Andrew Cox and Michael Pfennig, Co-Heads of Infrastructure at ACP, say: “With a record low in M&A last year we see valuation expectations beginning to align and expect attractive opportunities over the coming years. In particular, we see high demand for capital for assets and companies that drive energy and digital transformations. These changes will be fundamental for society and will require long-term investors that can provide patient capital and help navigate this critical journey.”

Maria Aguilar-Wittmann and Tilman Mueller, Co-Heads of Infrastructure Fund & Co-Investments at ACP, add: “Energy security and energy transition targets on the one hand and the rapidly increasing digitalization and artificial intelligence investments on the other hand will continue to drive attractive co-investment deal flow during 2024. Access to these opportunities alongside experienced fund partners can help to accelerate deployment, drive sustainability, and boost returns.”

Kulbhushan Kalia and Alexander Schmitt, Co-Portfolio Managers. Infrastructure and Energy Transition, Global Private Debt, say: “Net-zero goals require trillions of euros of investments,3 across infrastructure sub-sectors and supply chains over the next decade. Private capital is playing and will continue to play an ever-larger role in this transition. In our view, 2024 will continue to build on the strength of the last years as regulatory tailwinds will get stronger and risk adjusted returns will remain highly attractive.”

AllianzGI currently manages a wide range of investment solutions and around EUR 90bn in private market assets of which over 50% are invested in infrastructure making AllianzGI one of the largest infrastructure investors globally2.

Contact:

Pia Gröger

Phone: +49 89 1220-8267

Mobil: +49 173 3586167

pia.groeger@allianzgi.com

Hannah Knarr

Mobil: +49 174 1969607

hannah.knarr@allianzgi.com

About Allianz Global Investors

Allianz Global Investors is a leading active asset manager with over 600 investment professionals in over 20 offices worldwide and managing EUR 533 billion in assets. We invest for the long term and seek to generate value for clients every step of the way. We do this by being active – in how we partner with clients and anticipate their changing needs, and build solutions based on capabilities across public and private markets. Our focus on protecting and enhancing our clients’ assets leads naturally to a commitment to sustainability to drive positive change. Our goal is to elevate the investment experience for clients, whatever their location or objectives.

Data as of 31 December 2023. Total assets under management are assets or securities portfolios, valued at current market value, for which Allianz Global Investors companies are responsible vis-á-vis clients for providing discretionary investment management decisions and portfolio management, either directly or via a sub-advisor (these include Allianz Global Investors assets which are now sub-advised by Voya IM since 25 July 2022). This excludes assets for which Allianz Global Investors companies are primarily responsible for administrative services only. Assets under management are managed on behalf of third parties as well as on behalf of the Allianz Group.

1 Q4/2023 Allianz Global Investors https://www.allianzgi.com/en/our-firm

2 https://realassets.ipe.com/top-100-infra-investors/top-100-infrastructure-investors-2023-full-ranking/10068981.article

3 IRENA - World Energy Transitions Outlook, 2022.