Transforming Infrastructure

How infrastructure is driving our digital world

Haven’t you also used ChatGPT, DeepSeek, or some other artificial intelligence (AI) solution recently? As AI continues to transform significant aspects of our lives and work, and while the exact trajectory of this transformation remains uncertain, it is clear that more and more opportunities will arise as use cases become more defined.

The digital infrastructure landscape plays a critical role in supporting modern economies and societies, enabling connectivity, data transfer, and technological advancements. The immediate need for developments in the data center space is apparent, but the scope extends much further. Connectivity between computing and storage facilities, as well as the end users and their devices, must evolve in tandem with renewable power capacity and networks to support these installations. The global AI market alone was estimated at USD 196.63 billion in 2023, projected to grow at a CAGR of 36.6% from 2024 to 20301 showing the extent of the current digital transformation.

Computing power and storage

Recently, we have witnessed significant developments across digital infrastructure presenting various investment opportunities. This includes wireless and fixed communication network infrastructure, with particular emphasis on the data center space and its adjacent areas. The acceleration of AI and machine learning, together with cloud adoption, has been a major driver of this growth, creating vast demand for computing power and storage across diverse applications incl. both large scale core hyperscale facilities as well as latency sensitive installations on the “edge”, that are closer to the customer. While the release of DeepSeek‘s R1 model has drawn considerable attention, most maintain that the need for substantial AI-related investment remains. Both Microsoft and Meta have recently re-iterated their commitments to AI-related spending. In addition, if DeepSeek’s model does prove to be considerably more cost-effective, it could accelerate the widespread adoption of AI applications, given new and improved business cases. This in turn would also necessitate further investments in infrastructure required to support AI inference (the processing of user requests by trained AI models).

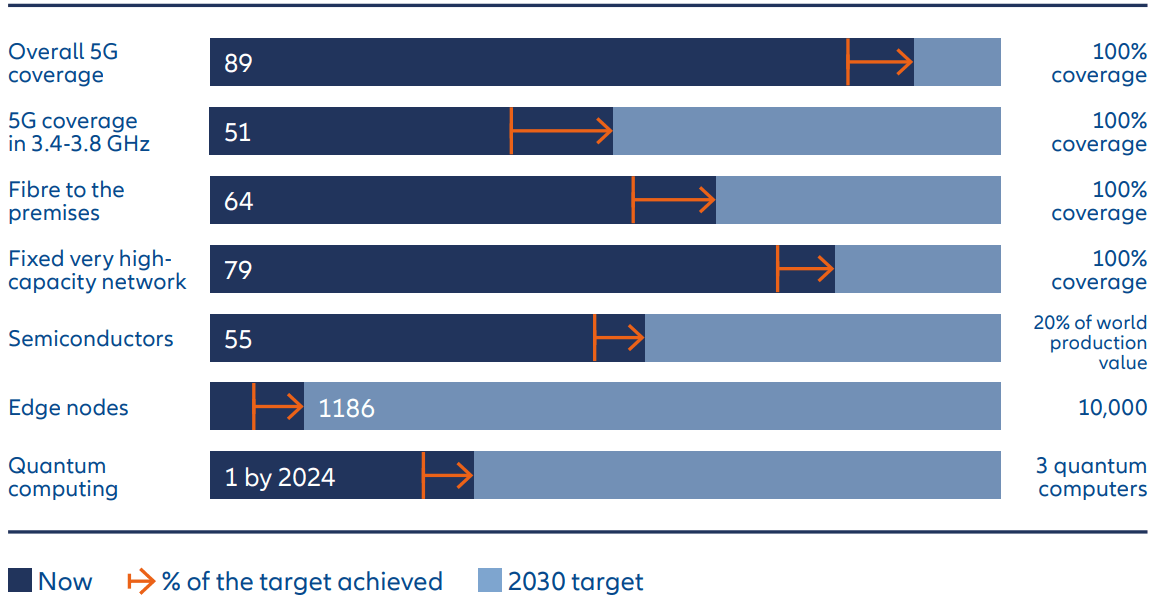

One question that also ChatGPT (or DeepSeek) cannot answer (yet) is which individual technology and application areas will ultimately prevail. Here, regional differences in the possibilities and individual willingness to adopt new technologies are also significant. While Asia but also Africa tend to be more open to new technologies some parts of Europe lag when it comes to the implementation of innovations but also put more emphasis on data privacy and protection aspects. Today, the majority of investments in digital infrastructure is made in Europe (c.30%)2 , North America (c.45%)2 , and parts of the Asia-Pacific region (c.20%)2 . A focus was here in particular on data centers which accounted for almost 60%2 of deal volumes in 2024. This trend is expected to continue in 2025, with ongoing investment in data centers (despite recent noise). However, opportunities are also anticipated in other subsectors. According to the European Commission’s 2024 Digital Decade report, only 64%3 of households have access to fiber and coverage of high quality 5G extends only to merely 50%3 of the EU territory (based on main pioneer band). The investment needed to reach connectivity targets amounts up to EUR 200 billion.3

Taking stock of progress towards 2030

EU KPIs in 2024

Digitisation and decarbonisation

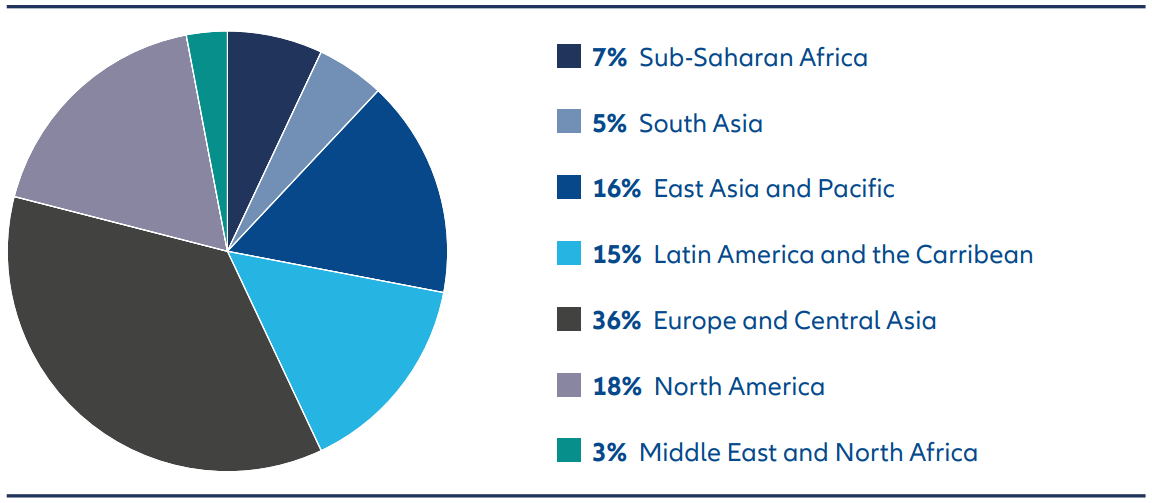

Distribution of IXPs by region (2022)

IXP = An internet exchange point is a location through which internet infrastructure providers connect with each other to exchange and provide data.

Source: Digital Progress and Trends Report 2023, worldbank

Outlook for digital infrastructure

The overarching macro tailwinds for digital infrastructure remain strong, particularly as we navigate the ongoing and fast transformation driven by AI. AI will need faster, lower latency and more secure connections. Furthermore, while AI places increasing demands on digital infrastructure and its investments, it also has the potential to drive necessary changes effectively by using its innovative power. Realizing these advancements relies on having robust digital infrastructure and its interfaces in place. For 2025, we expect that areas which are most imminently needed for AI development, such as hyperscale data centers, could see more competition. As Digitisation varies between regions, we are convinced that a global and diversified approach is key for institutional investors to seize opportunities where they arise.

Digital Infrastructure facts

1 Artificial Intelligence Market Size, Share, Growth Report 2030 (grandviewresearch.com)

2 Inframation, based on global deal volumes for digital infrastructure in 2024

3 European Commission: 2030 digital decade report on the state of the digital decade 2024

4 Digital Progress and Trends Report, World Bank Group. Digital Progress and Trends Report 2023 (worldbank.org)

5 Study by Prof. Dr.-Ing. Kristof Obermann, Technical University of Central Hesse, commissioned by BREKO. Glasfaser ist die digitale Infrastruktur mit dem geringsten Stromverbrauch (brekoverband.de)