Embracing Disruption

Fragmentation in the global village: a new roadmap for investors

A global realignment is occurring as nations adapt to a shifting geopolitical order, shaped by factors such as technology, climate change and China. Understanding the intricacies of the delicate balance of power should be a priority for investors, who should consider how to capture opportunities.

Key takeaways

- We are witnessing a reshaping of the global order as some nations look to reduce their dependency on others, particularly around strategic industries and resources.

- China’s rise has created a multi-polar world, with major powers vying for supremacy in areas like semiconductors, data and artificial intelligence.

- Global challenges such as climate change require collaborative solutions, and new alliances are being forged even as countries express greater self-determination.

- As well as understanding and responding to events, investors will need to identify the strategic investment opportunities that emerge as geoeconomic competition intensifies.

A global realignment is occurring that we believe has significant implications for investors. The accepted view is that globalisation is in retreat for the first time since the Second World War1, and it is true that we are living through a fragmentation of the “global village”. The Brexit vote in the UK in 2016 and the rise of Donald Trump as US president are widely seen as the high watermarks of a revolt against the globalisation drive that was previously the global orthodoxy. Some nations have subsequently taken steps to reduce their dependency on others, particularly around strategic industries and resources. The war in Ukraine exposed previously underappreciated dependencies that nations are now rushing to address.

But we think globalisation isn’t so much dead as being reshaped along “trust lines”. Certainly, the comfortable post-Second World War status quo is fading and trading relationships are being strained by a battle for technological supremacy. But global challenges such as climate change will also involve global solutions. New alliances are being forged and old ones reborn around modern priorities. A new world order is taking shape where geopolitical manoeuvring will have a defining impact and where there may be clear winners and losers – whether these are nations or individual stocks.

Race for technological supremacy

What are the hallmarks of this new environment? Globally we see geopolitical and economic agendas aligning around new “verticals” – themes that are set to define this era. Technology is a prime example. The rise of artificial intelligence (AI) – most recently manifested by chatbots such as ChatGPT – and other game-changing technologies is accelerating the pace of change, arguably moving us from a world where progress has been linear in recent years to one where it becomes exponential.

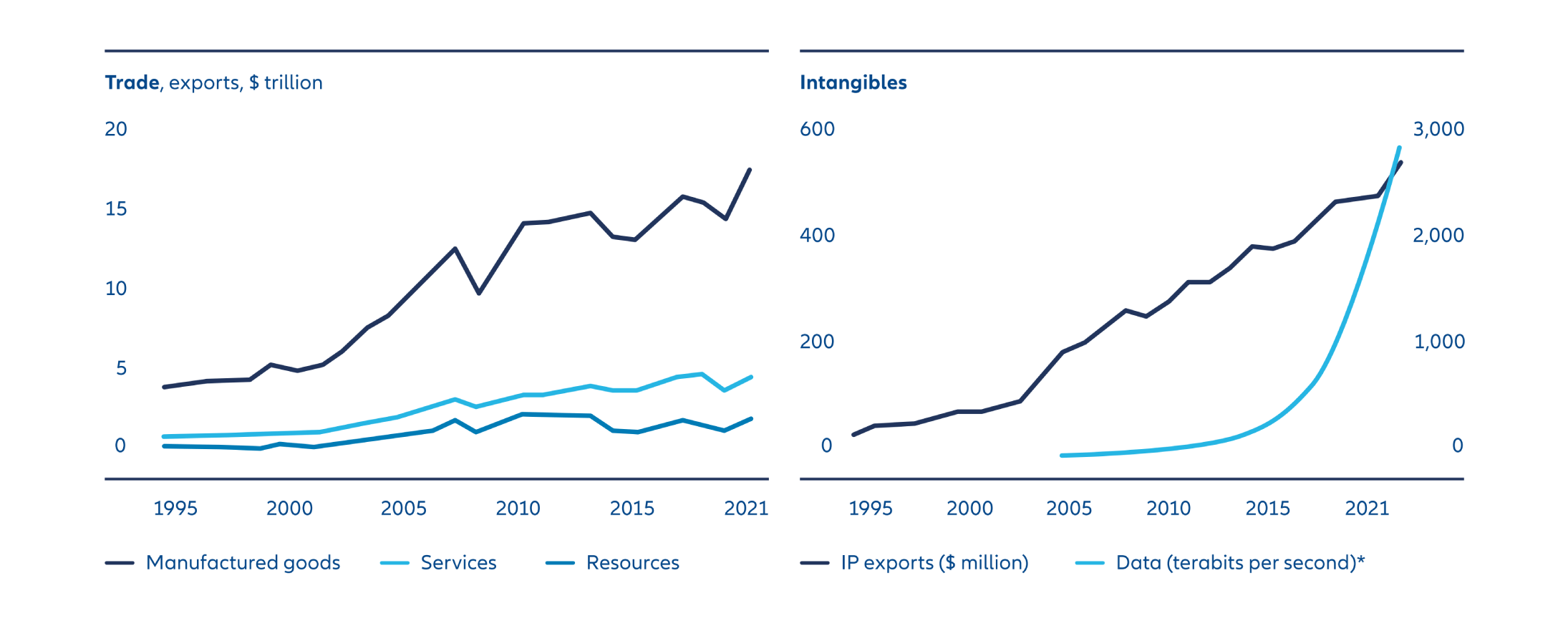

The global economy is being rapidly digitised. Data transfers now contribute USD 2.8 trillion to global GDP – a bigger contribution than global goods trade – and this is expected to grow to USD 11 trillion by 2025.2 Illustrating this shift, Exhibit 1 shows how the flow of goods may have levelled off in the past decade, but the exchange of information – in the form of intellectual property (IP) and data – is surging.

Exhibit 1: Exchange of IP and data surging even as trade growth slows

Source: McKinsey Global Institute, November 2022

The prevalence of transformative technologies, founded on data and insights, is spurring a new digital Darwinism – a survival of the fittest where only those companies most adept at harnessing this technology will win out.3 Every business is potentially impacted – this is no longer a story for the technology sector alone.

But digital Darwinism also plays out on a global geopolitical level, as nations vie for technology supremacy. Arguably, this is a bigger issue than trade in the relationship between the US and China. Control of data – which underpins AI – affords control of power, and as China is estimated to generate more data than the US by 2025, it is making great strides on this score.4 The country also recently established a national data bureau to develop and protect its data resources and harness this data to promote economic growth.5

Indeed, the emergence of China onto the global stage is one of the defining features of the age, as it flexes its soft power as well as economic power. Once considered the “workshop of the world”, China has entered what we have described as phase three of its transformation, where it jostles for global influence while addressing social issues at home and striving for technology dominance.6 To this mission, the country brings a long-term perspective that contrasts with the often shorter-term political cycles of European nations.

Emergence of a “multi-polar” world

With the rise of China, we are seeing the development of a multi-polar world, where power is not dominated by one nation but shared among several centres of power. In such a world, a rising tide lifts all boats and therefore, we believe China’s success will be critical to global stability over the next decade.

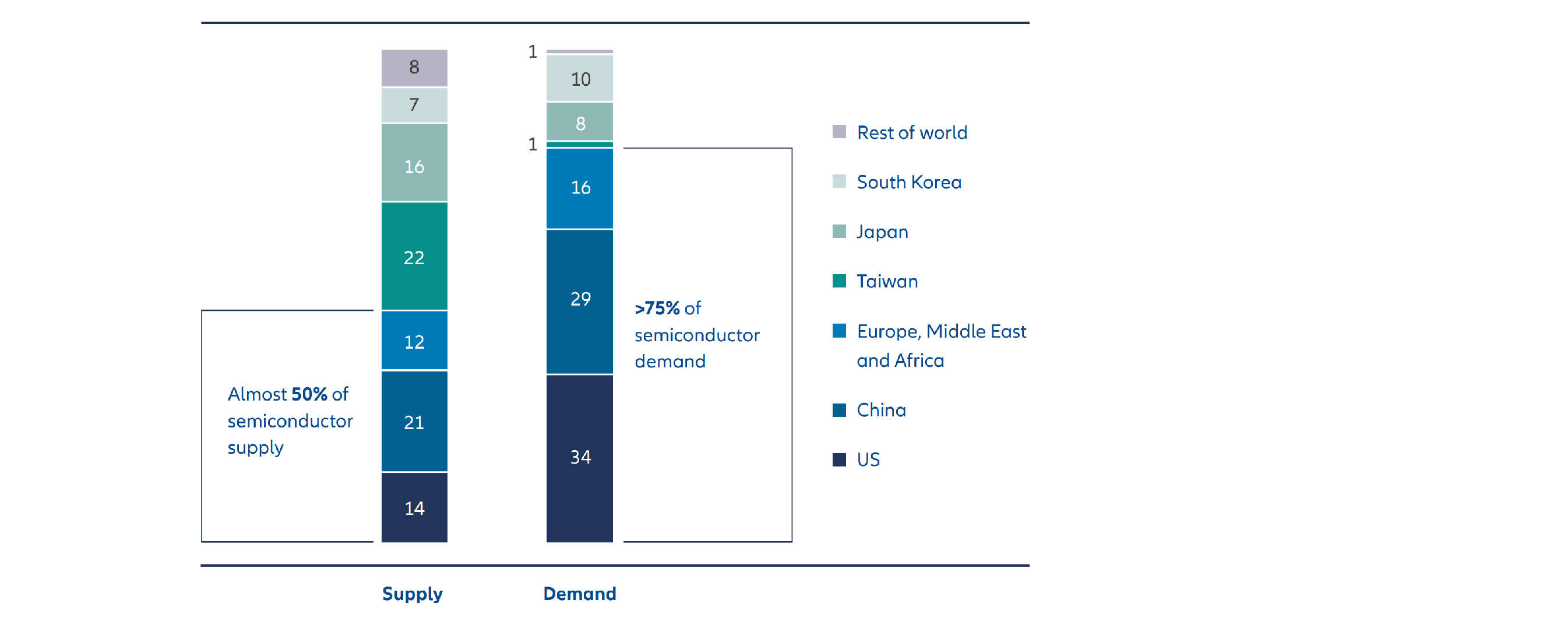

At the same time, some nations are unsurprisingly seeking to become more self-sufficient in key strategic areas such as semiconductor production. Given the critical role of chips and other components in ensuring technological success, countries are looking to ramp up domestic production and reconfigure supply chains to reduce their dependency on other nations. As Exhibit 2 shows, demand for semiconductors has historically outstripped domestic supply in key nations. The US will direct USD 280 billion of funding towards chip manufacturing and research over the next 10 years7, while China is reported to be working on a USD 145 billion support package and the EU has agreed its own EUR 43 billion Chips Act.8

Exhibit 2: Semiconductor supply and demand by region in 2021 (% share)

Source: McKinsey & Company, January 2023

A focus on levelling the playing field, rather than confrontation, is at the heart of the US-China relationship – according to US President Biden’s national security adviser Jake Sullivan. “We’re looking to manage competition responsibly and seeking to work together with China where we can,” said Mr Sullivan in a recent speech, after the US announced new export controls to stop firms selling AI and semiconductor technologies to China. Interestingly, in this shifting world order, Europe is faced with a difficult question: how does it stay aligned with the US while preserving a healthy business relationship with China?

Renewed focus on renewables

Energy – and the green energy transition – is another “vertical” that is preoccupying both economic and foreign policy. The war in Ukraine revealed vulnerabilities in energy supply – and other important commodities such as wheat – that nations are moving to address both individually and bilaterally.

Meanwhile, governments are unveiling huge support packages to ensure their own domestic industries are the main beneficiaries of the energy transition. This sometimes creates tensions – even between traditionally close allies – as national economic and security priorities create frictions.

European Union officials, for example, are concerned that the considerable subsidies of the USD 437 billion US Inflation Reduction Act could drain resources and talent from their own green tech industry.10 They are rushing to build their own package of measures to ensure the bloc can compete with both the US and China on accessing the raw materials required for the green transition.11

For example, rare earth elements are integral to the clean energy industry, and China has a dominant position in both the mining and processing of these minerals. Australia recently called on its trading partners to diversify production as a “global hedge” against China’s position, as well as signing partnerships with Japan and the UK on rare earths.12

Keep allies close, and supply chains closer

Global trade could be redrawn along trust lines over the next decade. US treasury secretary Janet Yellen has called this process “friend-shoring” – as opposed to the “re-shoring” or “near-shoring” efforts of governments post-Covid. Going forward she said the US will favour “trusted countries” with shared values about “how to operate in the global economy”.

In other words, in the race for influence, new alliances are being forged even as countries express greater self-determination. After all, one of the biggest challenges facing mankind – climate change – is a global issue that will require collaborative solutions. This reshaping of the global order suggests a period of heightened uncertainty in which investors should look to understand the shifting priorities and alliances of the major players.

Navigating the new globalisation

As the shape of a new world order begins to sharpen, we believe investors must stay active and informed on multiple fronts. As well as understanding and responding to events, they will need to identify the strategic investment opportunities that emerge as geoeconomic competition intensifies.

- Ensure diversification – Investors will need to rethink portfolio construction to mirror the diversification efforts of companies and governments. This might mean allocating to previously overlooked segments (eg, emerging markets or disruptive technologies being made winners) or considering thematic investing to capture opportunities emerging from this wave of geoeconomic competition. A differently shaped world may need a different approach to investing.

- Embrace sustainability – No longer just a societal imperative, sustainable investing could be one of the driving forces of returns in the coming years. With governments showing intent through huge public funding commitments, investors may be able to “follow the money” to green industries that sit at the apex of the energy transition and geopolitics. The real-world impact of these investments is set to be clearer and more measurable thanks to advances in data.

- Leverage data – Data is not only the new competitive arena, but also key to navigating this environment. Turning data into better and faster insight, by employing new technologies such as AI to mine data for new perspectives, will be the priority. Tracking new metrics such as sustainable investment share will be critical.

- Test for resilience – Investors need to be laser-focused on resilience as cyber threats will likely create increased volatility in various parts of the system. In fact, “systems thinking” – an approach that explores how individual elements and factors work together to shape an outcome – will be an essential skill to understand holistically how countries and companies can thrive. The same will apply for the global supply chain.

1 Davos 2023: a 'cocktail' of globalization is the future | World Economic Forum (weforum.org)

2 Data Flows - ICC - International Chamber of Commerce (iccwbo.org)

3 Read more: Digital Darwinism: the new disruption (allianzgi.com)

4 https://www.cnbc.com/2019/02/14/china-will-create-more-data-than-the-us-by-2025-idc-report.html

5 China just set up National Data Administration to mine data for economic growth | MIT Technology Review

6 China’s Phase 3: a new chapter in its epic story (allianzgi.com)

7 Congress passes $280bn Chips and Science Act | Financial Times (ft.com)

8 EU takes on United States, Asia with chip subsidy plan | Reuters

9 Remarks by National Security Advisor Jake Sullivan on Renewing American Economic Leadership at the Brookings Institution | The White House

10 The Real Reasons Why Europe Is Concerned by the US Inflation Reduction Act | Institut Montaigne

11 EU announces plans to lead green industrial revolution | Reuters

12 Australia aims to boost critical minerals processing to hedge against China’s dominance | Energy | The Guardian