Dividend investing: a renaissance?

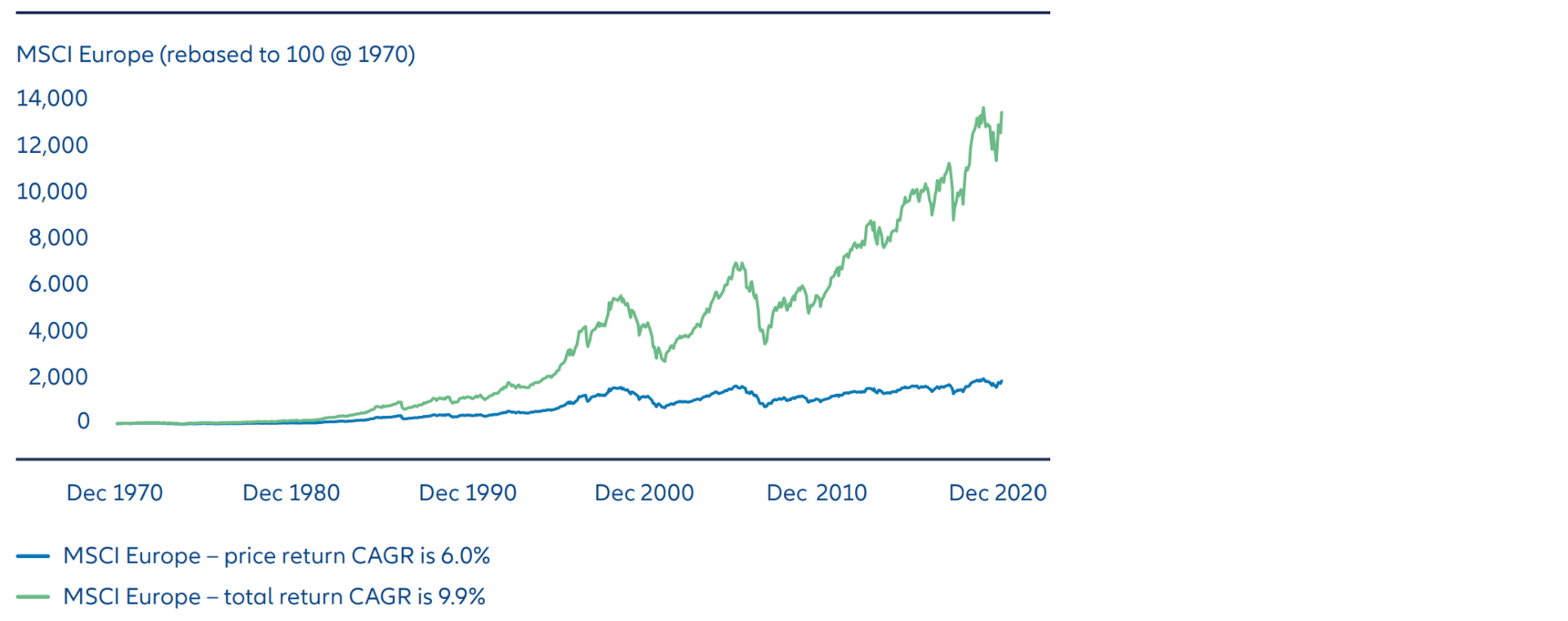

Dividend payments have historically served as an important stabiliser for equity investors in volatile markets, contributing up to 40% of total returns by some measures.1 As interest rates rise, and money has a cost again, we believe we could see a renaissance in dividend investing.

Key takeaways

- In an environment of higher interest rates, high dividend-paying stocks may become more attractive.

- In developed regions such as Europe, dividends’ contribution to total returns over time has been high and should not be overlooked.

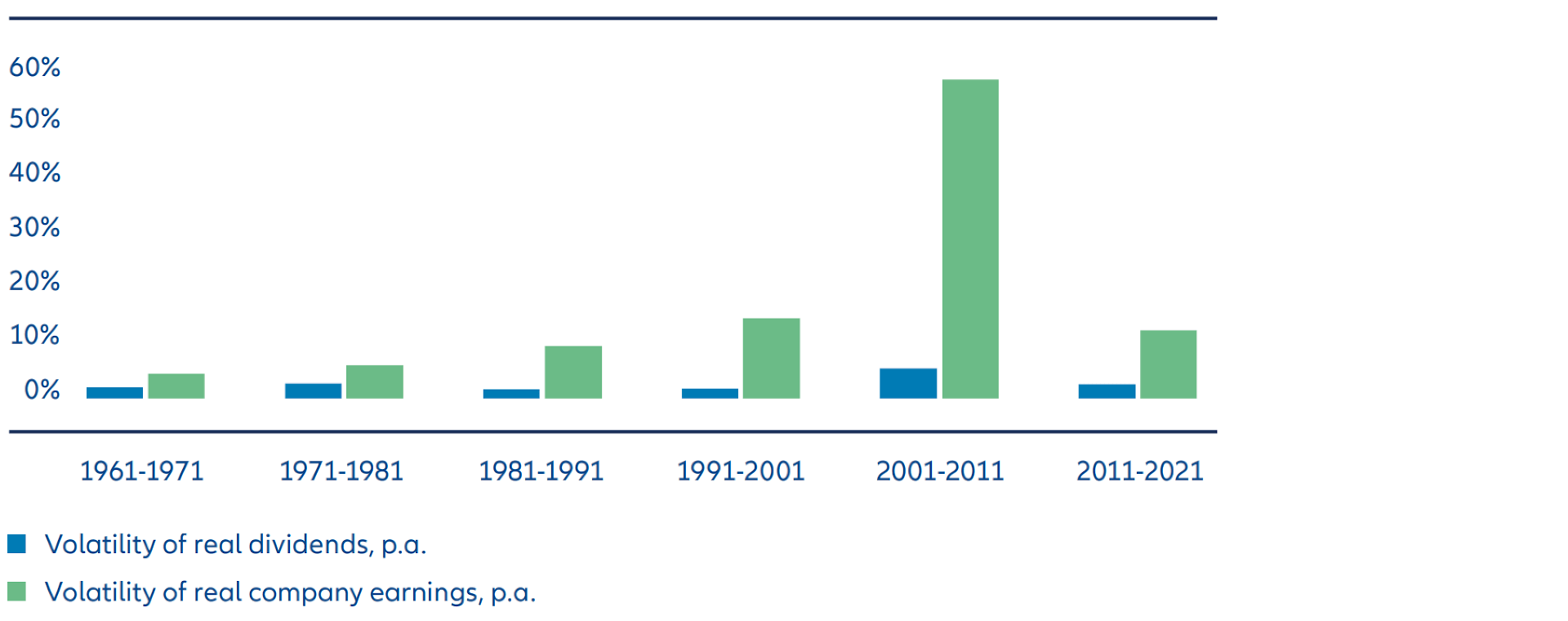

- Our research shows dividends can be even more stable than corporate profits – which can be important at times of economic uncertainty and shifts in the monetary regime globally.

- In our view, bank stocks are an example of both value stocks and high-dividend payers that may prosper in this environment.

We think rising global inflation has significant implications for equity investing. As central banks have raised interest rates to fight inflation, the days when money had low or practically zero cost are gone. Growth stocks typically suffer in this environment.2 A lot of their profit is in the future, and higher rates serve to reduce the value of those earnings at today’s prices. Investors may therefore choose to prize income today rather than the more distant prospect of cashflows tomorrow.

We believe high dividend-paying stocks are, as a result, becoming more attractive and heralding a potential renaissance in dividend investing. At a time of economic uncertainty and a regime shift in monetary policy, investors increasingly recognise the critical role of dividends as an additional return stream.

Notably, company boards are recognising shareholders’ desire for dividend income and responding. The number of companies paying dividends is rising, which we believe shows the importance they give to attracting and rewarding shareholders with a stable and reliable dividend policy.

Dividends can spell stability

Exhibit 1: Dividends can be a crucial part of long-term returns when investing in equities

Source: MSCI, Morgan Stanley Research

Exhibit 2: Dividend payments historically exhibit low volatility

Source: Datastream, AllianzGI Global Capital Markets & Thematic Research. Data as of 3 December 2021

Link to value stocks

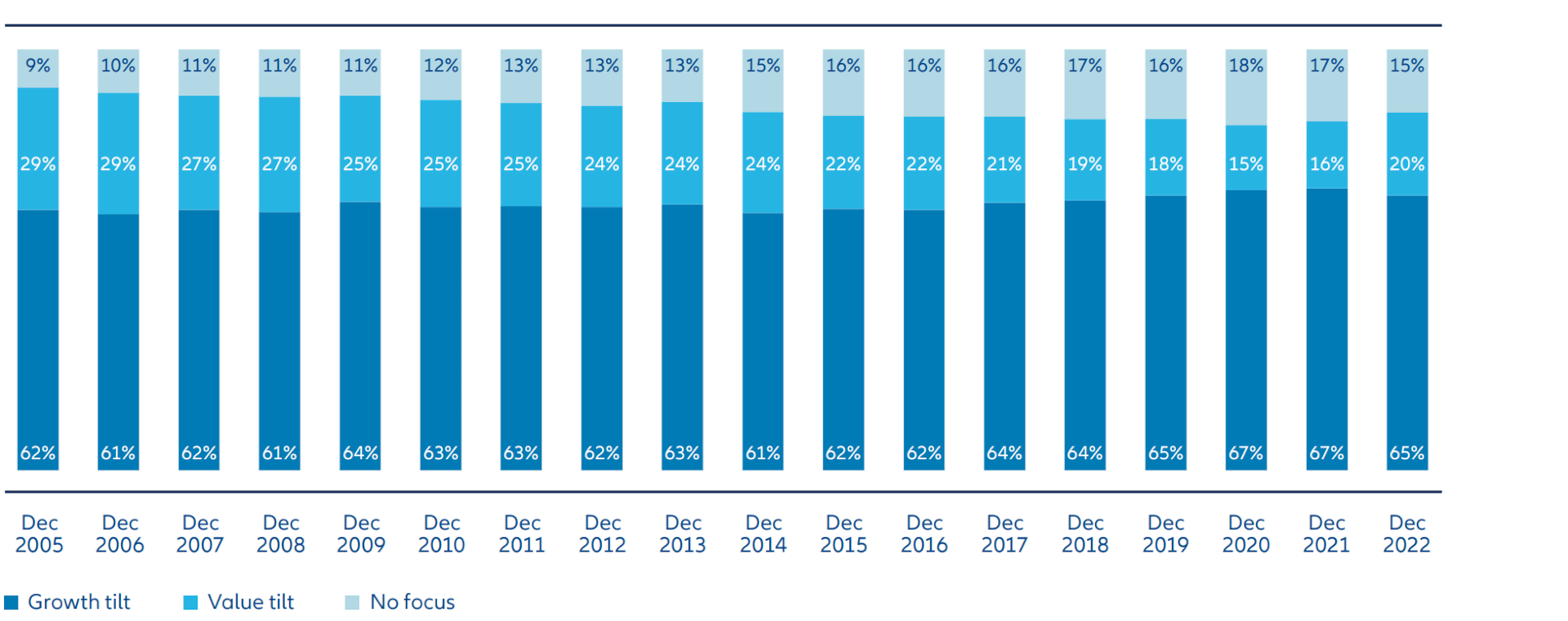

We are of the opinion that a factor supporting the rebirth of dividend investing is the market switch towards the value style – or investing in stocks that appear attractively priced. This link exists because many high-dividend stocks are also classed as value stocks due to their relatively low valuations.

Over the last 10 years, growth stocks have tended to outperform value by a significant margin.4 But viewed over the longer term, this period may be seen as unusual, caused by exceptionally low interest rates. As interest rates revert to levels closer to historical norms, the relative opportunities for value and growth may appear more balanced.

Exhibit 3 shows that the recent pronounced bias to growth stocks has not always been the case, and this recent trend may already be changing, with an increased allocation to value in 2022.

Exhibit 3: The recent pronounced bias to growth stocks has not always been the case

Source: eVestment data covering institutional assets at subscribed asset managers. Data extracted 17 March 2023.

What is the further potential?

Looking forward, we continue to view value and high-dividend stocks favourably. Given the current macroeconomic backdrop, we are reasonably confident dividends will remain resilient. Indeed, it is good news that corporate Europe’s dividends per share (judged by the MSCI Europe index) lag pre-Covid highs while earnings per share are 30% higher. This implies two things: first, Europe’s dividend cover is high relative to history, and second, dividends should prove more resilient than earnings if there is an economic downturn.

When investing for dividends we focus clearly on quality. Starting with individual holdings’ dividend yields, we forecast the stream of dividend payments for every stock. We believe this approach is easily understood by our clients and ensures a portfolio has a reliable source of income from each stock it holds. Overall, we aim to achieve three goals. We look to participate in the potential upside of capital markets, generate income, and manage risk, including by seeking to avoid stocks with high levels of debt.

We think this approach may reap the rewards of dividend investing’s gathering renaissance. Higher interest rates are changing the game, placing a greater value on high dividends once more. This is a renaissance with a lot of catch-up potential that is still in its early days.

1 Source: MSCI, Morgan Stanley Research. See Exhibit 1.

2 Simply speaking, a growth stock – or so-called “long-duration asset” – is given a high price/earnings valuation when rates are low, as its valuation rests on the value of its future cashflows discounted over time. If rates are set to stay low, the value of discounted future cashflows is high. On the other hand, a stock paying a high dividend is judged on the income it pays out now – it’s known as a “short-duration asset”.

3 CS Global Investment Handbook 2017

4 Growth vs. Value Stocks - 44 Year Chart | Longtermtrends