Embracing Disruption

China Equity Outlook 2024 – A Strategic Crossroads

Sentiment towards Chinese equities is very different compared to a year ago. 2023 started with renewed optimism of an economic rebound following the end of China’s strict zero covid policies, but this quickly faded as the recovery remained stubbornly slow. Chinese equities peaked ahead of the Chinese New Year in February and have broadly trended lower since.

Key takeaways

- China’s long-term growth should continue to surpass most Western economies.

- Target GDP growth for 2024 likely to be around 4.5-5% – can only be achieved with further policy stimulus.

- A more coherent framework for restructuring property needed as part of recovery story.

- At the early stages of transitioning to a new growth model based on new technologies.

- Extrapolating this year’s market and macro weakness may end up being as misguided as the unbridled optimism just three years ago.

Having recorded back-to-back down years in equities, and with a well-documented set of macro and geopolitical challenges, it will naturally take time for investor confidence in China to recover. Expectations have completely reversed since the end of 2020, when China’s covid-free economy was riding high. Indeed, recent market performance indicates it is this year’s macro weakness which is now being extrapolated into the future.

As such, a key question is whether this interpretation is correct – are the causes of China’s economic malaise due to deep-seated structural issues that will result in a severe and sustained slowdown in economic growth? Our view is that while China’s growth will be lower in future than the past, nonethless it will continue to surpass most Western economies. And if China’s expected growth target for next year – likely around 5% – is met, then this should also prompt a more supportive environment for equity markets.

Looking back at 2023 – macro headwinds and equity deratings

From the market peak in February 2021, offshore Chinese equities have declined close to 50%. China A-Shares returns are down by around 37% (USD) (Bloomberg, 13 December 2023). This reflects a mix of powerful macro headwinds including Covid lockdowns, property weakness, geopolitics, the clampdown on ecommerce platforms, and the strength of the US dollar.

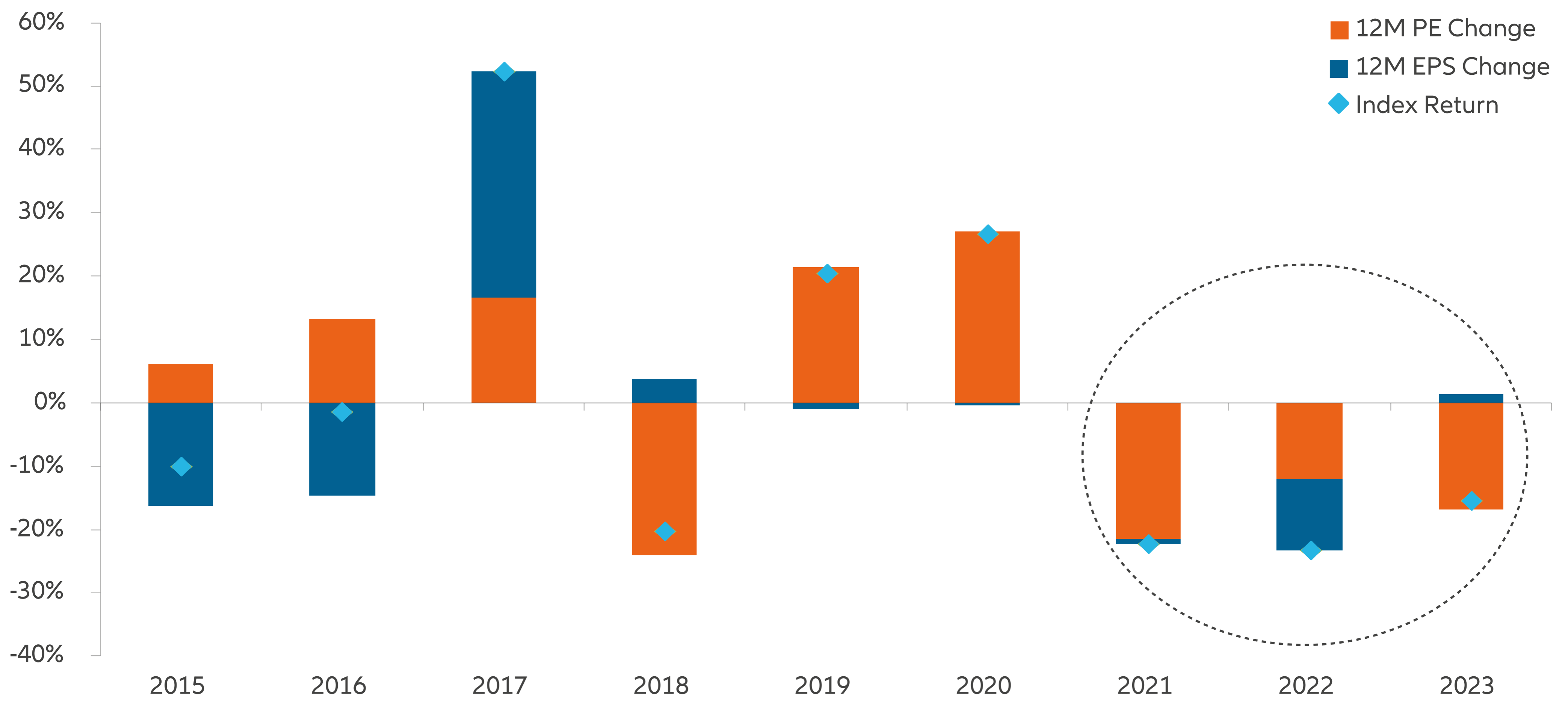

Taking a closer look at the market dynamics, two particular features stand out. The first is that most of the market decline is due to a derating as opposed to weaker corporate earnings. To a large extent, this derating reflects both the higher risk premium placed on the asset class, as well as a loss of confidence across domestic and global investors. For the market to recover, this investor confidence will therefore need to be restored as a crucial first step.

Exhibit 1: MSCI China return breakdown – earnings revisions vs valuation change

Source: Bloomberg, Allianz Global Investors, as of 11 December 2023. Based on forward 12 months PE and EPS Changes. The information above is provided for illustrative purposes only.

A second feature is that as sentiment has deteriorated, so growth stocks have been most severely hit.

From the market peak in 2021, MSCI China Growth has declined by almost 60%. Value stocks, conversely, have outperformed by more than 20% over this period (Bloomberg, 13 December 2023).

In China, ‘value’ stocks include sectors such as financials, energy and utilities which are dominated by State Owned Enterprises (SOEs). These are often seen as relative safe havens, not least because of the higher dividends which are maintained as an important source of funds for local and central governments. So another way of looking at ‘growth’ vs ‘value’ in China is also to compare the performance of private sector stocks and SOEs.

Exhibit 2: MSCI China Index – Growth vs Value since market peak in February 2021

Source: Allianz Global Investors, Bloomberg, as of 13 December 2023. Forecasts are inherently limited and should not be relied upon as an indicator of future results.

Looking ahead to 2024 – managing transition

China is undoubtedly facing a growth challenge. Consumer spending is weak as a result of incomes and jobs being lost during the Covid years, and the government not offering financial support – in stark contrast to the US, for example. Fiscal policy for much of 2023 stayed tight with policymakers reluctant to add further to the country’s debt burden. And, above all, the crackdown on the property sector continues to weigh heavily on economic activity.

While there are some very real structural issues that lie behind the weak economy, in our view there are also cyclical factors at work which, to an extent, can be alleviated by more supportive government policy.

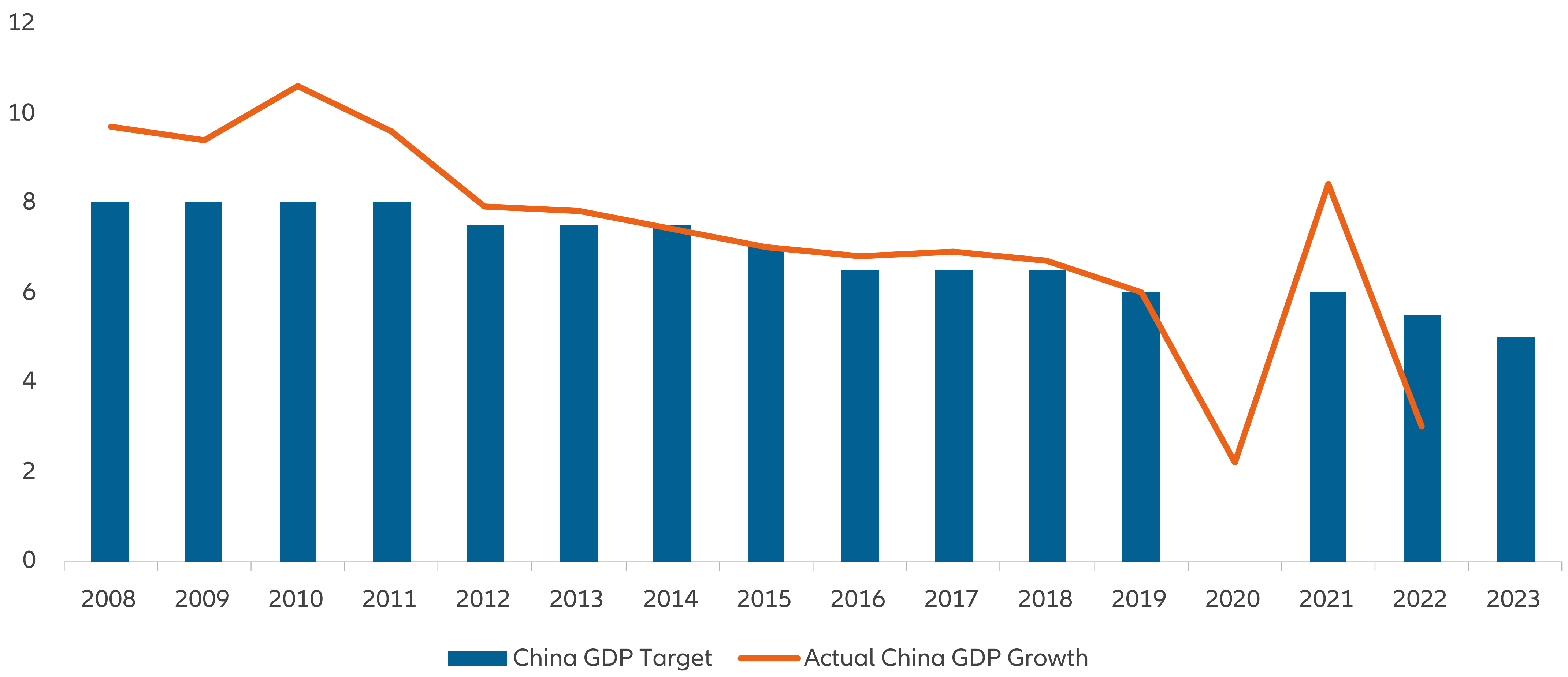

Events in the next few months will provide an increasingly clear signal in this regard. China’s top down planning cycle includes setting closely-watched annual GDP growth targets. The 2023 target was “around 5%” (Reuters, 6 March 2023). Historically, China’s growth targets have typically not moved by more than 0.5% from year-to-year. And given the tone of comments from senior policymakers, it seems likely that the 2024 target will be around 4.5-5%.

Although the growth target is not officially unveiled until March, in practice we should get a good indication before this as each province will release their own growth targets in January and February.

The reason this is important is because China rarely fails to meet its growth targets. It happened in 2022 due to Covid and policymakers will be determined, just as they have been this year, to make sure this is not repeated. However, with the property sector drag persisting, and consumer and business sentiment being so weak, growth next year would almost certainly slow sharply without a policy offset.

Indeed, it is very likely that policy support will need to be larger in 2024 than it has been this year. The government will have little choice but to do more.

In fact the ramp up of policy support, using tried and tested fiscal spending, has already started. A recent, and very unusual, decision in late October to increase the fiscal deficit by issuing RMB 1 trillion of central government bonds to fund infrastructure projects is a likely signpost for how policy will evolve in the new year. This announcement sent a clear message that China’s government is becoming more willing to deploy its balance sheet to achieve economic stability.

Exhibit 3: China Annual GDP Growth: Target vs Actual

Source: Allianz Global Investors, Macrobond as at 13 December 2023.

A word on property

Comparisons are often made between the current property downturn in China and the property crash in Japan around 30 years ago. In our view, these are very different situations.

To begin with, the respective causes of the property ‘bubbles’ are very different – in Japan it was concentrated in commercial properties located in major cities. Japanese corporates, who had invested massively in commercial real estate, suffered severe balance sheet damage, and were subsequently forced to pay down debt aggressively to survive. This urgent need for deleveraging is what led to the long bear market in Japan.

China’s property sector troubles are, in contrast, focused on residential properties, especially in smaller cities. On a relative basis, the damage to corporate balance sheets in China is far more limited when compared to Japan. Beyond local governments and property developers, Chinese companies have not invested in real estate in the same way. There is, therefore, not the same urgent pressure for deleveraging.

That said, having a more coherent framework in place to manage the restructuring of the property sector will be an essential part of the recovery story in China. This will be a complex, multi-year process.

A key issue continues to be the financial health of private real estate developers and whether pre-sold apartments will be constructed and delivered on schedule.

To give a sense of the challenge, it was recently estimated that around RMB 4-6 trillion (approx. USD 500-800 billion) would be needed just to finish building all homes sold before 2020 (Source: Nomura, 25 October 2023).

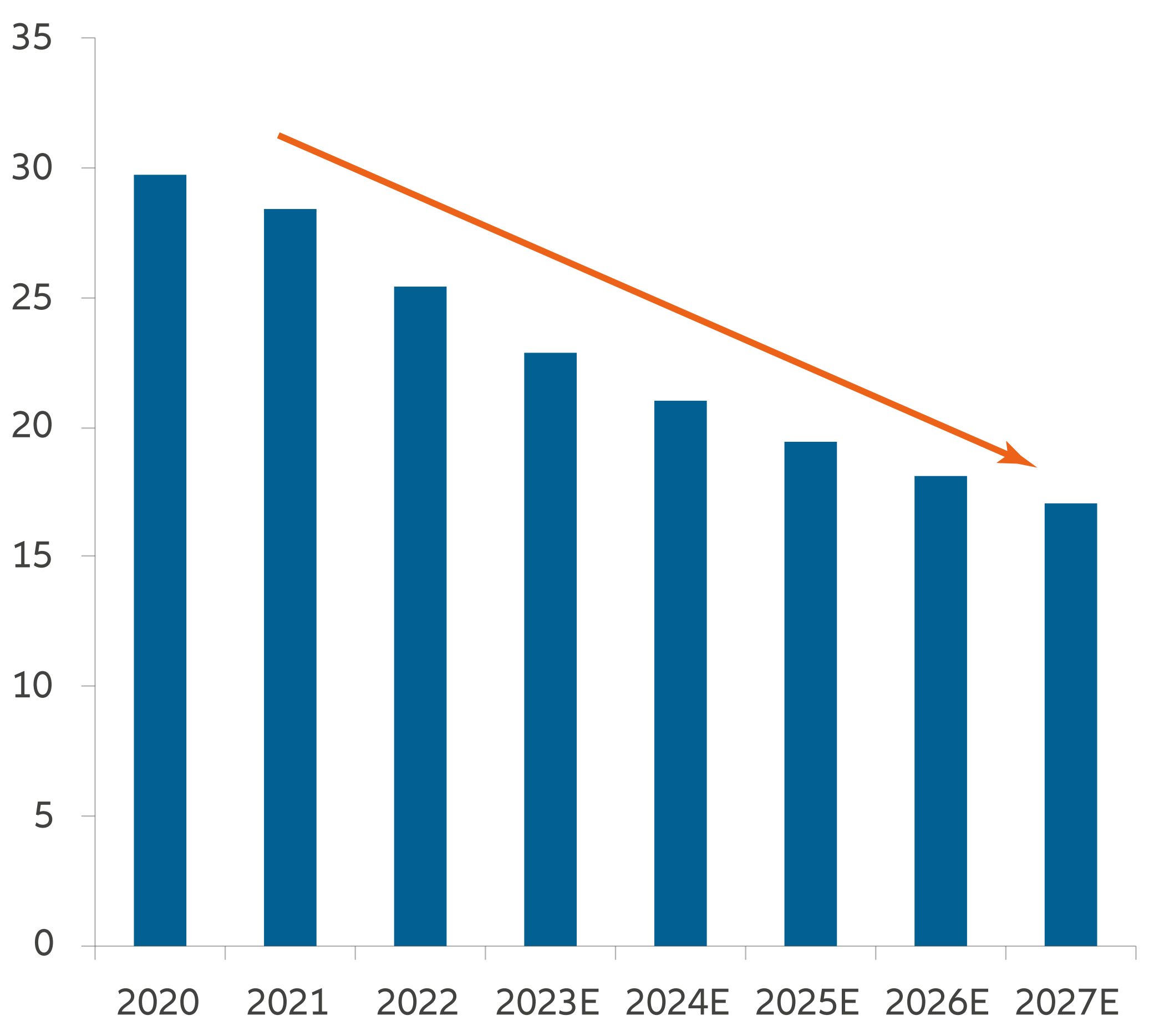

The reason property is such a key factor is because it is such a large part of the economy. Including areas such as construction and the materials involved in the building process, the real estate sector accounts for around 25% of total GDP. Property is also by far the largest component of most people’s wealth, close to 60% of total household assets (Source: Goldman Sachs, October 2023). As such, the ongoing property weakness is an important contributory factor to the subdued level of consumption and high savings rates.

Inevitably, the importance of the property sector is set to decline over time and this “gravity” effect is a key reason why China’s headline GDP growth will continue to slow.

However, there is an important timing issue. China has invested heavily in its high-tech industries and will continue to do so. Yet, the favoured growth sectors of the future are simply too small at this stage to sufficiently offset the decline in the property sector. Additional government support for the property sector will therefore be essential to ensure the relative decline is managed in a way that does not overly impact the broader macro situation.

Exhibit 4: Composite of China household total assets

Source: NFID, CEIC, Wind, Goldman Sachs Global Investment Research, Allianz Global Investors, as of 31 December 2022.

Exhibit 5: Property as proportion of China GDP (%)

Source: Goldman Sachs, October 2023.

Future Technologies – seeking innovation-led growth

A key goal for China is to sustain a high level of economic growth, both in order to generate employment as well as for reasons of national security. US attempts to constrain China’s technological development will result in a greater focus on developing its own domestic capabilities in key industries.

We see China as being at a strategic economic crossroads. On the one hand, China needs to gradually wean itself off the previous growth model based on capital-intensive property and infrastructure. On the other hand, it needs to find replacement growth from other areas, in particular to pivot to higher-value, more innovation-driven sectors.

This, in turn, will be key to addressing a number of the current macro challenges – for example, the high level of youth unemployment – while at the same time boosting productivity and treading a sustainable growth path similar to that taken by Korea and Taiwan.

This change of economic direction can only be achieved with ongoing, high levels of capital investment in critical technologies. In some ways, China is already well advanced. For example, China graduates far more engineers and scientists than any other country in the world (Gavekal 30 November 2023). Significant advances have already been made in a range of areas including industrial automation, robotics, green technology, electric vehicles, autonomous driving, renewable energy, and software.

But overall we view China as being at the relatively early stages of transitioning to a new model based around innovation and the development of new technologies. And it is these areas where we often find some of the most interesting opportunities, especially now many stocks have de-rated to more attractive valuations.

Exhibit 6: Key areas where we see structural growth potential

Photo source: CarbonBrief, The Economist, Cadiz Asset Management, Allianz Global Investors as of 2023. The information above is provided for illustrative purposes only, not an indication of expected results. It should not be considered a recommendation to purchase or sell any particular security or strategy or an investment advice. Because market and economic conditions are subject to rapid change, all opinions and views expressed constitute judgments as of the date of the writing and may change at anytime without notice and with no obligation to update. Past performance, or any prediction, projection or forecast, is not indicative of future performance.

In short – opportunities in depressed valuations

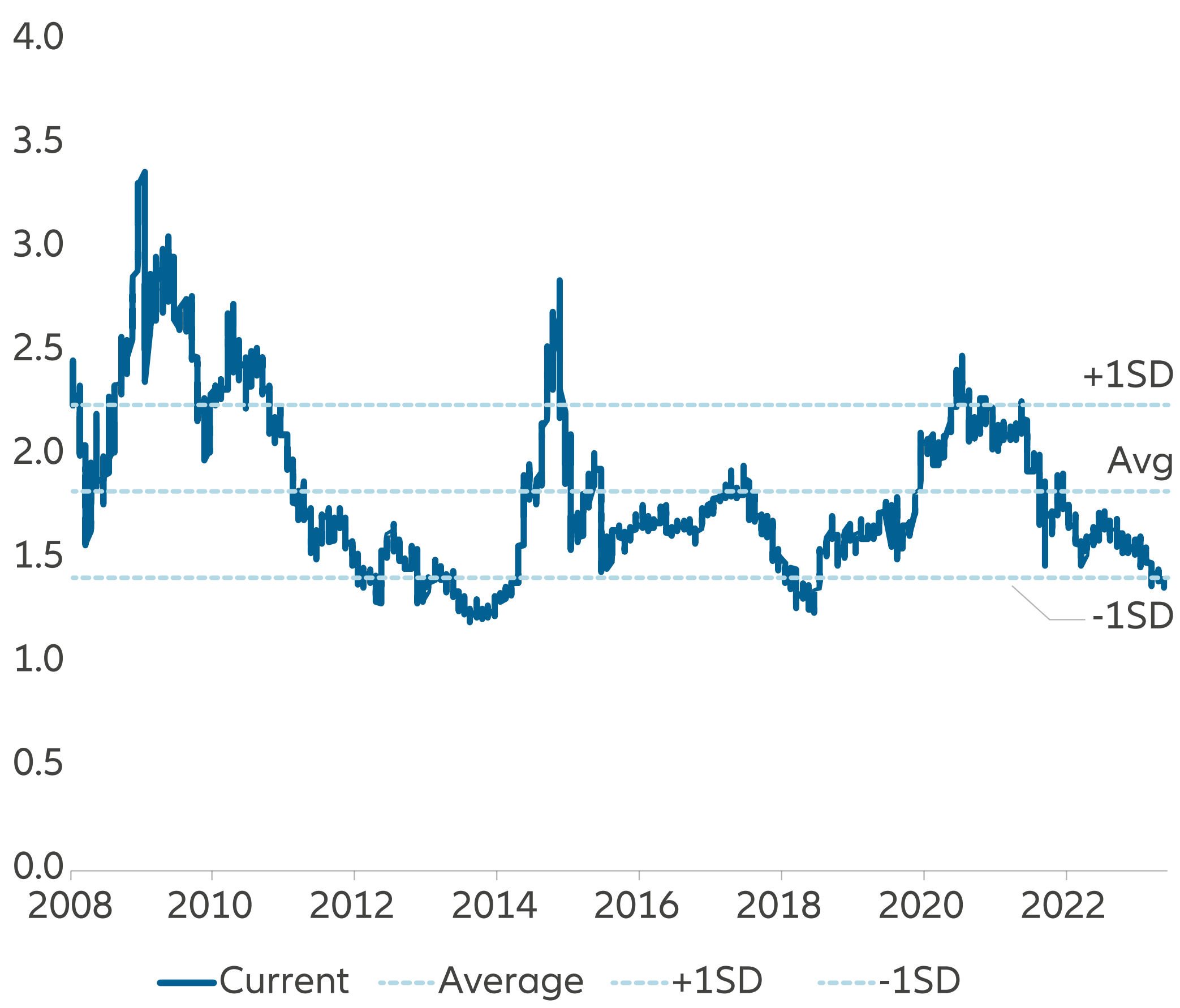

Market valuations are at depressed levels. The MSCI China A Onshore Index trades close to 11x forward PE, well below longer term average levels (Bloomberg, 13 December 2023). This should, in the worst case, provide some downside buffer. And in a more optimistic scenario, where China proves itself to be more economically resilient than expected, then this could trigger a meaningful rerating. Just as expectations about China’s trajectory have flipped before, so they can change again.

Exhibit 7: MSCI China A Onshore – Forward 12 Month P/E Ratio

Source: Bloomberg, Allianz Global Investors, as of 11 December 2023. *The average valuation is calculated over the period of past 15 years, or since data became available.

Exhibit 8: MSCI China A Onshore – Price to Book Ratio

Source: Bloomberg, Allianz Global Investors, as of 11 December 2023. *The average valuation is calculated over the period of past 15 years, or since data became available.

In our view, the very negative narrative on China fails to take into account some of the longer-term growth drivers, which are being masked by the current bout of economuc weakness. The catch-up potential, for example, remains very big – China’s per capita income is less than 20% of the US (Gavekal, 30 November 2023).

While China’s structural problems are very real, extrapolating the current bout of economic weakness as the new status quo is nonetheless likely to be as misguided as the unbridled optimism just three years ago.