Navigating Rates

The case for short duration, high yield bonds

Adding US high yield bonds to a core fixed income allocation has historically improved risk/reward profiles, but short-duration high yield in particular can help expand the efficient frontier.

Key takeaways

- We think the investment case for US high yield is compelling because these bonds can offer an appealing total return potential supported by stable credit fundamentals.

- Adding US high yield bonds to a core fixed income allocation has historically improved risk/ reward profiles.

- Short-duration high yield, in particular, can help expand the efficient frontier – the boundary at which potential risk-adjusted returns are optimised.

- Short-duration high yield bonds have historically offered an impressive trade-off of yield to duration, indicating strong potential returns with lower interest rate risk.

How do high yield bonds work? Issued by companies with credit ratings below BBB-, they pay investors a credit spread over “risk-free” assets (such as US Treasuries) to compensate for expected losses stemming from defaults and to reflect the greater volatility of the asset class. Investor appetite for high yield bonds tends to increase as economic conditions improve, since a stable or growing economy reduces the risk of corporate defaults.

Looking at the broad US high yield market, we see multiple reasons why this is an interesting asset class. With yields over 7%¹, these bonds offer the potential for equity-like returns but with less volatility. When we look at credit fundamentals, we also see strong support for the high yield market.

- Stable balance sheets: Net indebtedness remains below the long-term average, and interest coverage is settling above the long-term average. The result is a high yield bond market that is skewed towards higher credit quality and is better positioned to weather an economic slowdown (should it occur).

- Muted default rate expectations: In addition to stable credit fundamentals among high yield borrowers, near-term refinancing obligations remain low, and we see management teams continuing to exercise balance sheet discipline. Given these factors, the default rate for US high yield has been low and could remain below the long-term historical average in 2025.

Why invest in the short end of the high yield market?

We see three primary benefits to investing in the short duration part of this asset class:

1. A better risk/return ratio

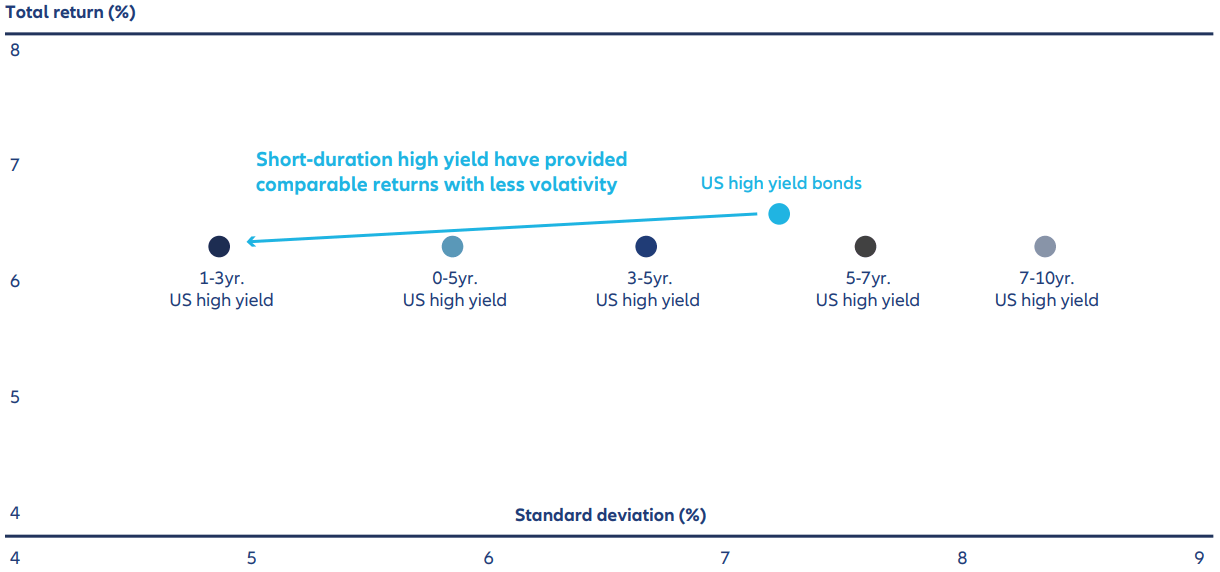

The short end of the US high yield market (as measured by the 1-3 Year US High Yield Index) has provided comparable returns to the broader US high yield market, but with significantly lower volatility (Exhibit 1). One reason for this is a phenomenon known as “pull-to-par”. As a bond approaches its maturity date, its price will “pull” towards its par value as default risk becomes increasingly negligible (this occurs whether the bond has risen or fallen in price since it was issued). This effect is more powerful in shorter maturity bonds since they are closer to the maturity date when bondholders are repaid at par. In other words, shorter maturity high yield bonds are less exposed to a deterioration in economic conditions that would increase default expectations.

Exhibit 1: High yield bonds have historically been less risky closer to maturity, without giving up much return

As of 31/12/2024. Source: Voya Investment Management, FactSet, ICE Data Services. Past performance is not indicative of future results. This statement reflects performance and characteristics for the time period shown; results over a different time period may have been more or less favourable. See index associations and additional disclosures at the end of the document. Investors cannot invest directly in an index. Index returns are presented as net returns, which reflect both price performance and income from dividend payments, if any, but do not reflect fees, brokerage commissions or other expenses of investing.

2. An expanded efficient frontier

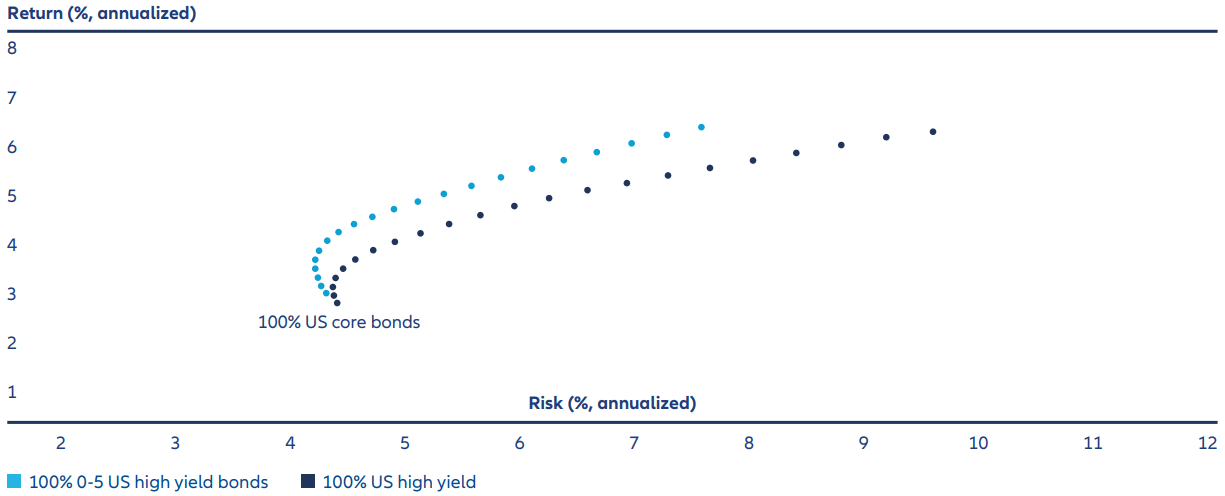

Investors have long known that adding US high yield bonds to their core fixed income allocations can improve outcomes and expand the efficient frontier – the boundary at which potential risk-adjusted returns are optimised. But many investors don’t know that short-duration high yield has been particularly effective in pushing out the efficient frontier. Data from the past 15 years shows that US short-duration high yield bonds have achieved better risk-adjusted returns than US high yield bonds in general (Exhibit 2). In other words, the short end of the high yield market has amplified the expansion of the frontier.

Exhibit 2: Adding short-duration high yield has boosted returns and lowered volatility

As of 31/12/2024. Source: Voya Investment Management, FactSet, ICE Data Services. Past performance is not indicative of future results. This statement reflects performance and characteristics for the time period shown; results over a different time period may have been more or less favourable. See index associations and additional disclosures at the end of the document. Investors cannot invest directly in an index. Index returns are presented as net returns, which reflect both price performance and income from dividend payments, if any, but do not reflect fees, brokerage commissions or other expenses of investing.

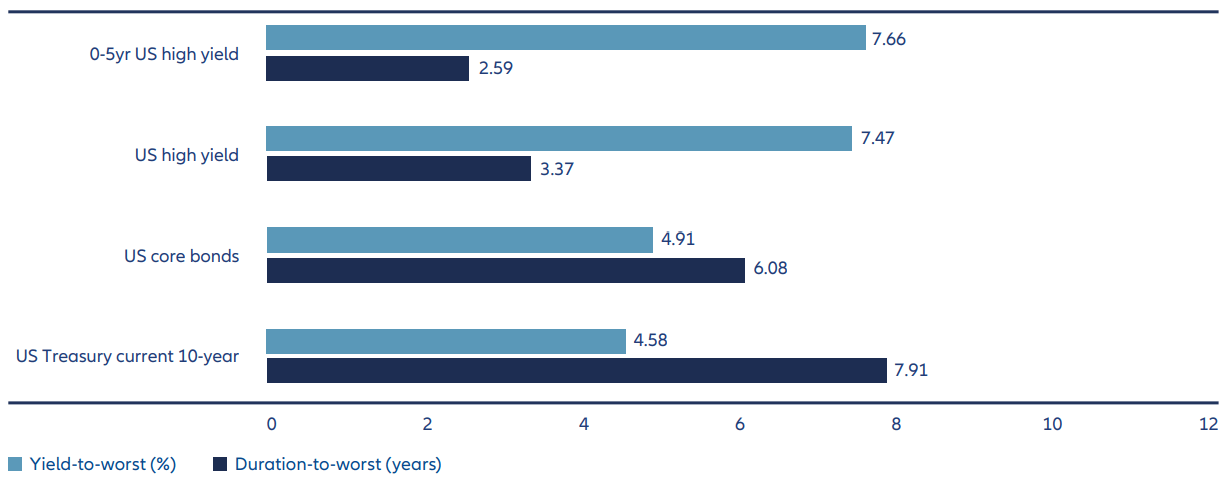

3. A compelling yield-to-duration trade-of

Record-high new issuance and refinancing activity in 2020 and 2021 pushed coupons and interest expense down and maturities out. This creates an even more compelling yield-to-duration trade-off at the short end of the US high yield market (Exhibit 3).

Put simply, yield-duration measures how far a bond’s price would have to fall before wiping out its yield, resulting in a capital loss (this is often called the “breakeven point”). Today’s elevated yields thus provide a cushion against potential price falls in US high yield if recession fears re-emerge.

Exhibit 3: Short-duration high yield has historically offered the greatest yield to duration trade-of

As of 31/12/2024. Source: Voya IM, FactSet, ICE Data Services. Past performance is not indicative of future results. This statement reflects performance and characteristics for the time period shown; results over a different time period may have been more or less favourable. See index associations and additional disclosures at the end of the document. Investors cannot invest directly in an index. Index returns are presented as net returns, which reflect both price performance and income from dividend payments, if any, but do not reflect fees, brokerage commissions or other expenses of investing.

Where do short duration high yield bonds fit into investor portfolios?

Short duration high yield bonds have the potential to generate attractive upside with lower risk than the broader high yield market – including less price volatility, less drawdown and lower interest rate risk.

One way to use these bonds in a portfolio is to complement an allocation to full-market high yield. They can potentially enhance portfolio diversification by offering a narrower range of annual returns, while providing an asymmetric return profile.

Short duration high yield bonds can also be a good complement to a core fixed income allocation. Their returns are generally not closely correlated to those of core bonds, which can help to cushion negative performance outcomes and reduce overall volatility.

Of course, active management and credit selection remains an important factor. The risks in high yield can vary significantly by credit rating, with a significant step-up in risk having been observed in past cycles where bonds are rated B- or lower.

After their strong recent performance high yield spreads may struggle to tighten much further in the medium term. But we think today’s elevated yields – especially at shorter maturities – still offer value.

1 Source: Bloomberg, 09/24. High yield bonds are represented by the ICE BofA U.S. High Yield Index.