Navigating Rates

Sustainable debt moves into the spotlight

The energy crisis gripping Europe in 2022 raised fears about a surge in fossil fuels investment at the expense of a focus on sustainable sources. But there are good reasons to think a long-term focus on the energy transition will persist, spurred by the increasingly pressing need to respond to climate risks. As a result, we expect sustainable debt investing will play a vital role in tackling not just the climate challenge but urgent planetary and social issues too.

Key takeaways

- The energy crisis has turned the spotlight on the energy transition but ultimately, high power prices should hasten a socially responsible transition to a lower carbon economy.

- The yields now offered by sustainability-labelled bonds might appeal to new investors who may have previously struggled to place green, social and other sustainability-related bonds in their strategic allocation.

- The euro investment-grade universe may currently enjoy the broadest opportunity set for high-quality sustainability-labelled debt.

Spiking energy costs in the wake of the war in Ukraine sparked a debate about the energy transition in 2022.

Higher fossil-fuel prices and the cuts in Russian gas supply meant it was cheaper for many power stations in Europe to burn coal instead of gas. Has this move set back the transition to greener sources of energy? In short, we don’t think so. Access to affordable energy became a priority to avert a avert a cost-of-living crisis in the short term. And higher-emitting sources were the most immediate solution. But we would argue that today’s high energy prices have highlighted the need for a more resilient or socially inclusive energy mix, learning from prior boom and bust oil price cycles.

There are also, after all, urgent social aspects to this crisis: volatile oil and gas prices tend to hurt lower-income households disproportionately, because those households spend a greater share of their budget on energy. This is also an energy security issue, as the massive wealth transfer from energy importers to energy exporters tips the balance of power. The crisis exposed weaknesses and geopolitical sensitivities in global economic supply chains.

All of which raises the sense of urgency in the public and private sectors to finance the expansion of cleaner energy generation and storage, as well as carbon capture and utilisation.

Debt issuers and investors are converging on their sustainability goals

The question is how can the clean energy transition be funded? Capital investment globally into lowcarbon energy technology crossed USD 1 trillion for the first time in 2022, according to a new report from research firm BloombergNEF. Nearly half of that investment reportedly flowed into China.1

The World Bank estimates that by 2030 USD 1 trillion annually will be required to finance energy transitions in developing countries, excluding China.2 The majority of that funding would need to come from the private sector, the World Bank says.

In contrast to fossil fuel plants, the cost structure for renewable energy tends to be skewed more to upfront capital investment than to running expenditure. The fear is that higher interest rates could have a disproportionately negative impact on the cost of funding the green transition.

The cost-efficiency gains of renewable energy are sizeable enough, however, that even the higher financing and raw materials costs do little to harm the investment case.

Research from the International Renewable Energy Agency (IRENA) shows that in 2021 about two-thirds of newly installed renewable power had lower costs than the cheapest coal-fired power generation in G20 countries.3

Investor appetite in renewable energy projects seems undimmed: financing from private markets set a record high in 2022 for the first six months of a year, reaching USD 226 billion, according to Bloomberg’s Renewable Energy Investment Tracker report.4

By contrast, funding from public markets was more challenged. The aggregate volume of new green, social and other sustainability-labelled bonds in 2022 was down to about USD 860 billion, compared to over USD 1 trillion in 2021, according to the Climate Bonds Initiative.5 Much of this green or social “use-of-proceeds” debt is relatively long in duration and issued by corporates, so both rates and spread-driven losses hurt market sentiment.

Yields reset to boost sustainablebonds appeal

On the bright side, sustainability-labelled bond issuance was down by less than the broader bond market, lifting its quarterly share of global bond issuance to the highest on record – 16% – in the third quarter of 2022.6 The underlying trend of debt issuers and investors converging on their sustainability goals looks set to continue. Even central banks are joining in. For example, the European Central Bank plans to decarbonise its corporate bond holdings in accordance with the goals of the landmark 2015 Paris Agreement.

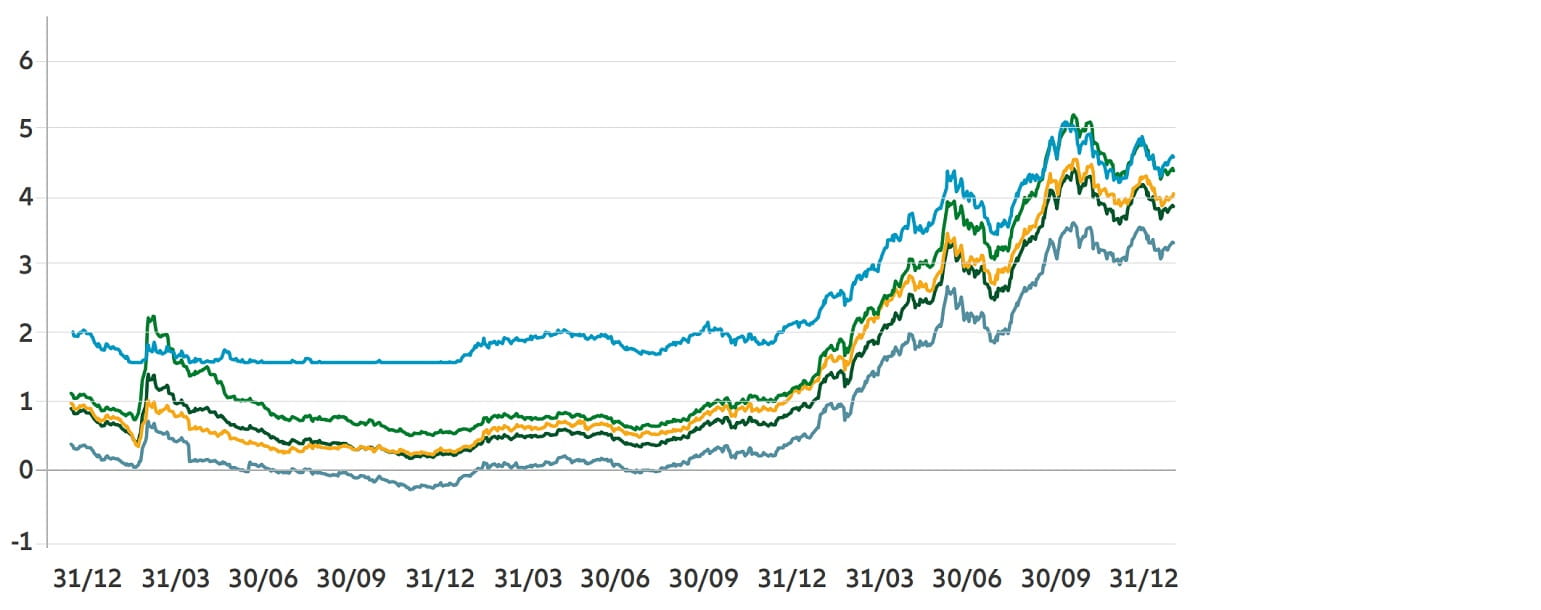

Another reason to be optimistic is that the yields offered by sustainability-labelled bonds have now reset to much more competitive levels, as shown in Exhibit 1. Such yields may appeal to new investors who may have previously struggled to place green, social and sustainable bonds in their strategic allocation. Higher rates have also helped reduce the yield spread with private infrastructure debt, which has historically provided investors with higher income.

According to Bank of America, issuance of green, social, sustainability and sustainability-linked bonds is expected to reach USD 1.1 trillion in 2023 – a return to 2021 levels.3 The growth within this category away from green bonds allows investors to better direct their investments to social or Sustainable Development Goals (SDGs).

Exhibit 1: yields have picked up for sustainability-labelled bonds

Source: Bloomberg, Allianz Global Investors. Data as at 31 January 2023. The yields for the ICE BofAindices represent the weighted average of the yields of the constituent bonds denominated in theirlocal currency. The yield for investment-grade infrastructure private debt is an approximation,composed of the EUR 15-year mid-swap as a reference rate (with a floor at zero when it goesnegative) + 170 basis points. Past performance does not predict future returns. See the disclosure atthe end of the document for the underlying index proxies.

Tailwinds for the euro investment-grade universe

Recent concerns surrounding “greenwashing” risks in sustainable bond strategies do not seem to have curtailed investor interest. Flows into (environmental, social and governance) ESG funds held up in 2022 in contrast to the large outflows from non-ESG funds, according to the Institute of International Finance.7 A Morningstar report showed that sustainable bond funds netted inflows of USD 30.6 billion in the second half of last year, whereas conventional bond funds shed USD 29.7 billion.8 European bond funds accounted for all the inflows into sustainable bond funds in the fourth quarter.

A helping factor may be tougher regulation in Europe: new standards that have already come into effect – or are close to being finalised – define which financial products and instruments can be considered truly “sustainable”. For example, the rules will require companies operating in the EU to report on how and to what degree their economic activities include sustainability considerations.

Under new “green bond” standards currently being negotiated, there will be stricter disclosure and transparency requirements around how green proceeds contribute to an issuer’s “overall transition”. The EU’s lead over other regions in setting robust sustainability standards should bode well for euro investment-grade credit strategies.

We believe the euro investment-grade universe may currently enjoy the broadest opportunity set for highquality sustainability-labelled debt. The asset class is also geared well to building portfolios aligned with the 17 UN Sustainable Development Goals (SDGs) by helping to underwrite and engage with businesses – those which can contribute as much to the “social” transition as they do to the “green” transition while following good governance practices and avoiding controversies. We expect the future of sustainable debt to increasingly address social topics while continuing a focus on the green transition, as debt issuers and investors gradually align on their sustainability goals.

1 Source: Global Low-Carbon Energy Technology Investment Surges Past $1 Trillion for the First Time, BloombergNEF, 26 January 2023.

2 Source: Scaling up to phase down: How to overcome the energy transition triple penalty for developing countries, World Bank, 14 February 2023

3 Source: Renewable Power Remains Cost-Competitive amid Fossil Fuel Crisis, International Renewable Energy Agency, 13 July 2022.

4 Source: BloombergNEF - Renewable Energy Sector Defies Supply Chain Challenges to Hit a Record First-Half For New Investment | BloombergNEF

(bnef.com), 2 August 2022.

5 Source: Green and other Labelled Bonds Held Market Share in 2022 Amidst Fall of Global Fixed-Income, Climate Bonds Initiative,

31 January 2023.

6 Source: Sustainable bonds fare better than broader market, despite third quarter decline, Moody’s Investors Service, 2 November 2022.

7 Source: ESG Flows and Markets, Institute of Internal Finance, December 2022.

8 Source: Morningstar Manager Research, Global Sustainable Fund Flows: Q4 2022 in Review, Morningstar, 26 January 2023.