Global Equities Outlook: A garden of forking paths

As we move towards the final quarter of 2023, we are faced with three key questions for the remainder of the year and beyond. First, how pronounced will divergence in markets and economic performance be – mainly between Europe and the US, and also between China and the rest of the world. Second, what will be the impact of the rising cost of debt, both for the corporate world and governments? And third, what will come next? Of course, the overriding consideration for us is what the impact of these issues will be for equity markets and investors.

Diverging paths

Central banks have now been tightening for nearly 18 months in the US and little over a year in Europe, with raises of 500 basis points (bps) and 400bps, respectively. Yet the US economy is currently looking much more resilient than Europe’s. So, what explains the divergence between these economies? Covid support in the US – about USD 5 trillion, or 18% of GDP, around USD 2 trillion of which went to supporting consumers – was generally much stronger than in Europe. Furthermore, support packages in the US over the past 12 months (such as the Inflation Reduction Act (IRA)), which corresponded to about USD 1.9 trillion, were broadly targeted, across infrastructure, healthcare, energy, climate, and local government. Support in Europe, by necessity, had a much greater focus on mitigating the impact of the energy crisis.

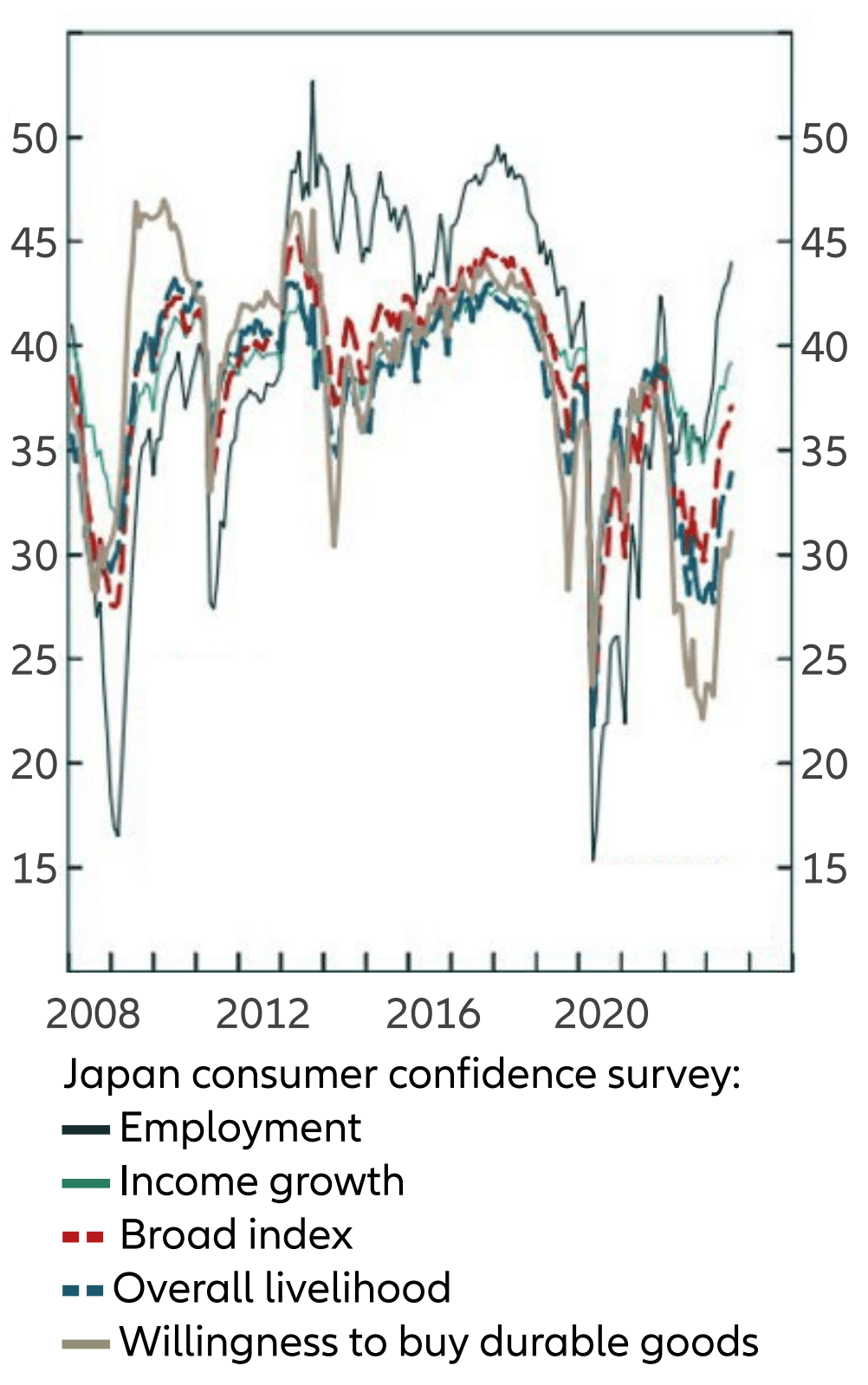

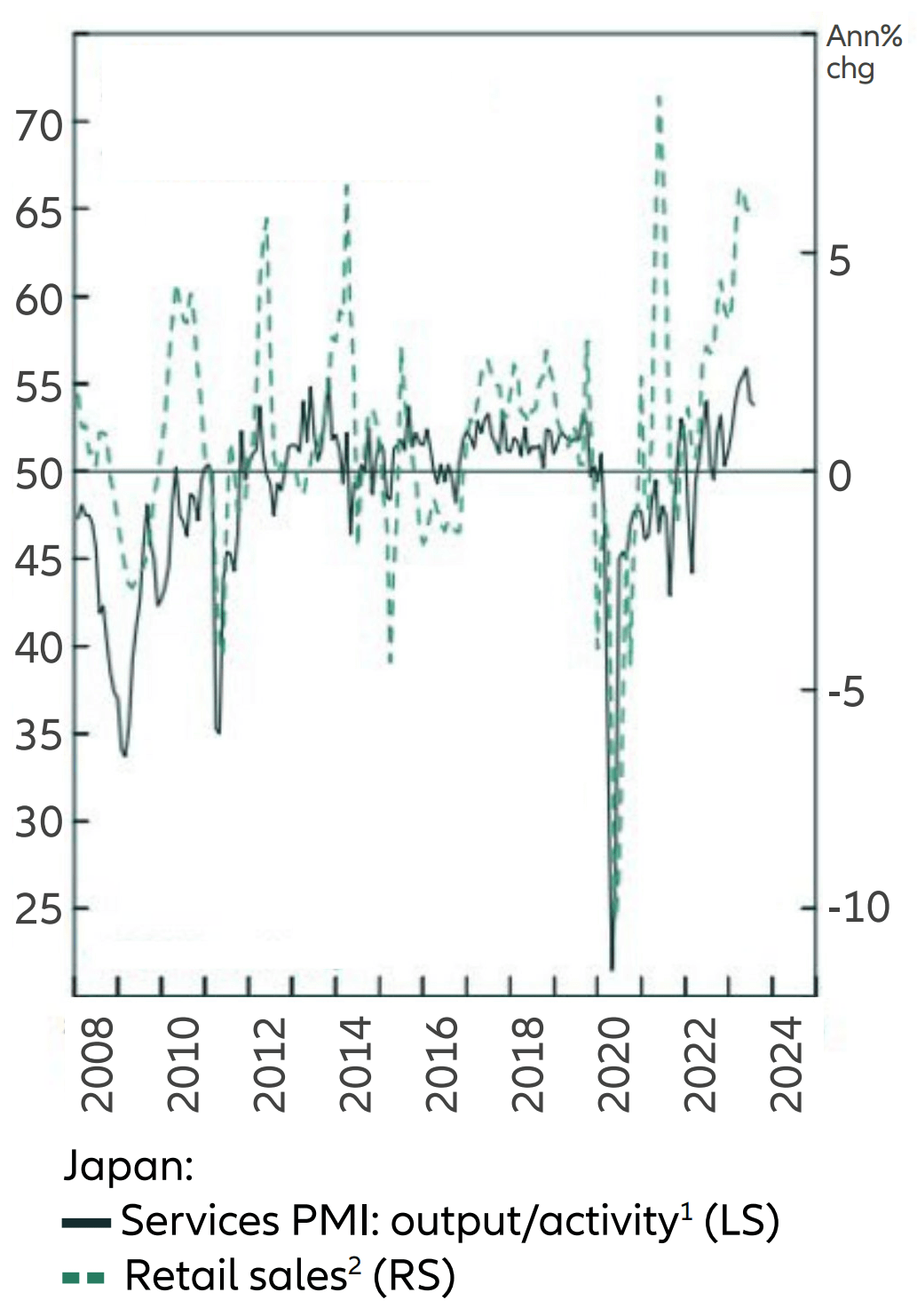

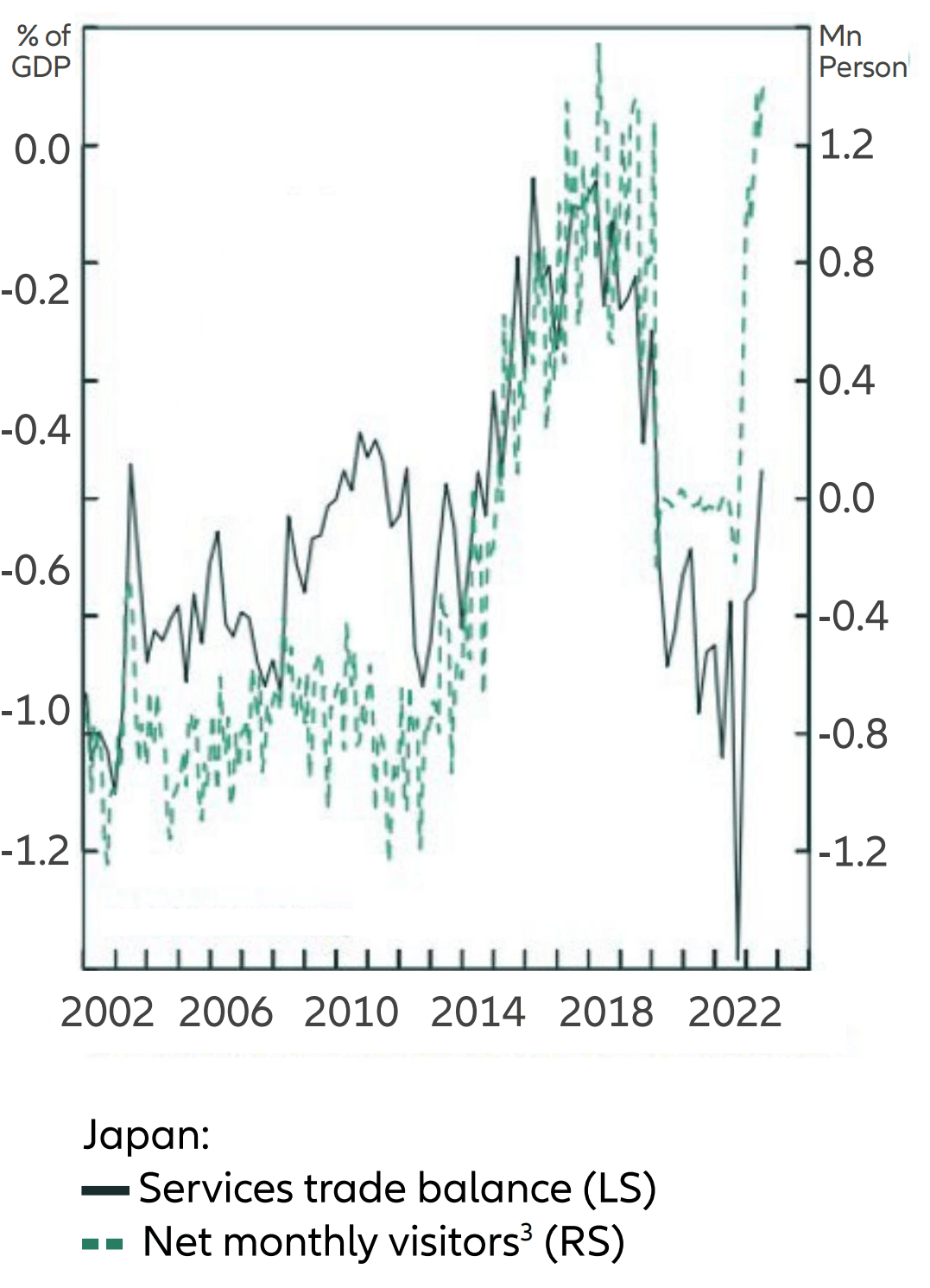

The relatively rosier situation in the US, compared to Europe, is somewhat mirrored across the Pacific in Japan, where pent up demand and a strong savings base support a strong growth rebound in late 2023 and beyond. Indeed, three key indicators point support the bull case for Japan; consumer confidence is growing after years of deflationary trends and muted demand, consumption is rebounding, and a tourism boom will boost its external balance and GDP.

Consumer confidence in hooking up in Japan

Strong evidence of a consumption rebound

A tourism boom will boost the external balance

The second key area of divergence will be between China and the rest of the world. In contrast to most of the latter, China is in a loosening mode as it faces several headwinds. Crucial here is the transition from a debt-driven economy where property is a dominant force, to a more mature one that is innovation-led. This transition will play to China’s strengths, focusing on industries – such as renewables, computer hardware, and electric vehicles (EVs) – where it is already enjoying success and emerging as a global leader.

For China, consumer sentiment will be crucial, and this has also been impacted by the travails of the property market. What happens to China’s excess savings, and what measures the authorities will take to encourage consumers to return to spending, will have a strong determining effect on the path of the Chinese economy in the coming years.

Debt has a cost again

The cost of debt has clearly increased rapidly over recent months, but its impact has been uneven. For US and European corporates, since 2000, non-financial debt has grown from USD 12.7 trillion to USD 38.1 trillion, yet recent default rates have been low (around 3%) due to resilient corporate profits and fixed rate debt. Indeed, 75% of non-financial debt in the US and Europe is on fixed rates. A recent estimate by The Economist suggests that, at current debt levels, each percentage point rise in rates wipes out roughly 4% of the combined earnings of S&P 500 firms. While this is certainly not insignificant, it suggests that the rising cost of debt is perhaps taking less of a toll on the corporate world than many feared.

Turning to governments and looking at the sovereign debt profiles of some of the world’s major developed economies, we can see that the US and Germany look worst placed.

| Country | Weighted average maturity (years) | % maturing before end 2027 | Weighted average coupon (%) |

|---|---|---|---|

| USA | 7.6 | 53% | 2.2% |

| USA including municipals | 6.0 | 63% | 2.1% |

| UK | 14.3 | 29% | 1.9% |

| Germany | 6.6 | 51% | 1.2% |

| France | 8.4 | 41% | 1.5% |

| Japan | 8.3 | 47% | 0.7% |

| Spain | 7.8 | 44% | 2.1% |

| Italy | 7.0 | 48% | 2.5% |

Source: Allianz Global Investors

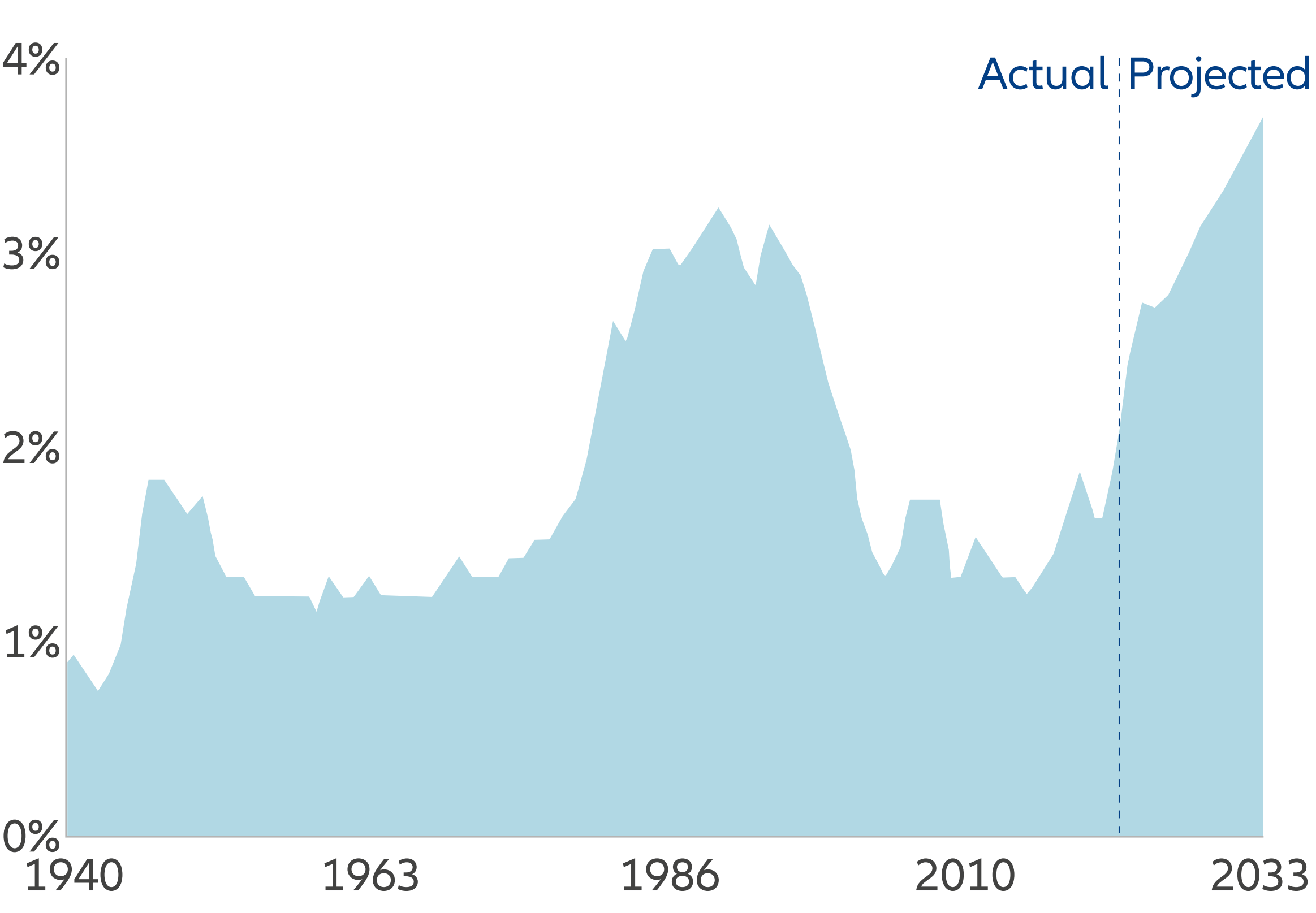

Indeed, looking more closely at net interest costs in the US shows us what governments across the world are currently up against in terms of the impact of higher rates.

Net interest costs are projected to exceed the previous high relative to the size of the eonomy by 2030

Sources: Congressional Budget Office, The Budget and Economic Outlook: 2023 to 2033, February 2023; and Office of Management and Budget, Historical Tables, Budget of the United States Government, Fiscal Year 2023, March 2022. Peter G. Peterson Foundation, PGPF.ORG.

We thus believe that the corporate world is, so far, largely performing relatively well despite increased costs of borrowing, while the pain is being felt by government and policy makers dealing with rapidly growing interest costs. Within the corporate world the impact of rising debt cost might of course differ between large corporations with easy access to financing tools and smaller companies.

Charting a course in a world of forking economic paths

The key metric for investors over the coming months is inflation as this will guide central banks and governments. Indeed, while we have seen some disinflationary trends, supporting factors for this may be beginning to disappear and the impact of weather events such as El Niño, as well as geopolitical factors, on food and energy supplies is yet to be seen. While demand destruction may also play a part in mitigating inflation, this is something what will need to be closely monitored.

Alongside inflation, job numbers should also be keenly observed. Given the importance of services in most developed economies, costs of labour (around 70-80% of input costs here) will be crucial; indeed, in the US, job openings fell to 8.8 million in July, the lowest since March 2021, and this was on the heels of a 417,000 downward revision in the June data. This points to a general easing in labour market conditions with respect to potential wage inflation.

In terms of economic growth, we are tilted towards a relatively mild contraction in Europe and a flat environment in the US. In China, we expect a range of policy initiatives to both support and transition within the economy. Reaching the 5% target set by the government may be a challenge, however. The property market will need support, but the focus here should move away from speculation and towards “homes for living”. In addition, we expect targeted support for key growth sectors, reform of capital markets, and reform to the LGFV (local government financing vehicle) system of local municipal debt.

One further unknown is the US election and its preceding primary cycle, and the legal perils faced by the leading Republican candidate. Market sentiment will certainly be impacted by views on the likely outcome of the November 2024 ballot.

So, in conclusion, we expect overall equity market volatility to continue and perhaps increase. As economies and companies embark on divergent paths, being selective and attentive to disruptive pressure points will be key for investors. Our strategy will be to remain vigilant with regards to earnings and specifically around pressure points such as cost of debt and pricing power. Market volatility should be used to consolidate and accumulate positions in areas where we see the outlook as brightest, as part of a well-structured and quality equity portfolio across styles and themes.