Navigating Rates

Divergence is back. Time for multi asset?

Increasing divergence in the performance of different regions, asset classes and sectors is broadening the opportunity set for multi asset strategies. The dynamic approach inherent in such strategies can make them an essential part of investors’ toolkit in what remains an environment of high macro uncertainty.

Key takeaways

- Major economies such as the US, China and the euro area face different challenges and their central banks are starting to take different paths.

- As interest rates start to level off, investors’ focus will turn back to growth and this should lead to more normalised correlations between stocks and bonds.

- We think this more balanced market environment will present opportunities for active multi asset strategies to target alpha via informed allocation and selection decisions.

- Elevated macro and geopolitical uncertainty will favour a dynamic approach that can build in protection by adding option strategies, short positions and liquid alternatives.

As investors contemplate a more balanced market environment but with a global economic outlook that remains challenging, we believe the ability of multi asset strategies to identify and harvest pockets of potentially significant outperformance is growing once again.

With the steamroller effect of rate hikes largely behind us, we expect to see increased performance dispersion between regions, asset classes and sectors in the coming months as economic prospects diverge and traditional correlations are restored.

But with uncertainty still high, the diversification of multi asset strategies – combined with their risk management capabilities such as option strategies, short positions and liquid alternatives – could also prove vital in mitigating further bouts of volatility in 2024.

Regional divergence: US, Europe and China on different paths

As the monetary tightening cycle matures, the outlook across major economies is diverging as countries face different challenges and respond to them in different ways. After months of major central banks following broadly the same path as they tackled surging inflation, differences in how each might respond to incoming data are becoming increasingly apparent.

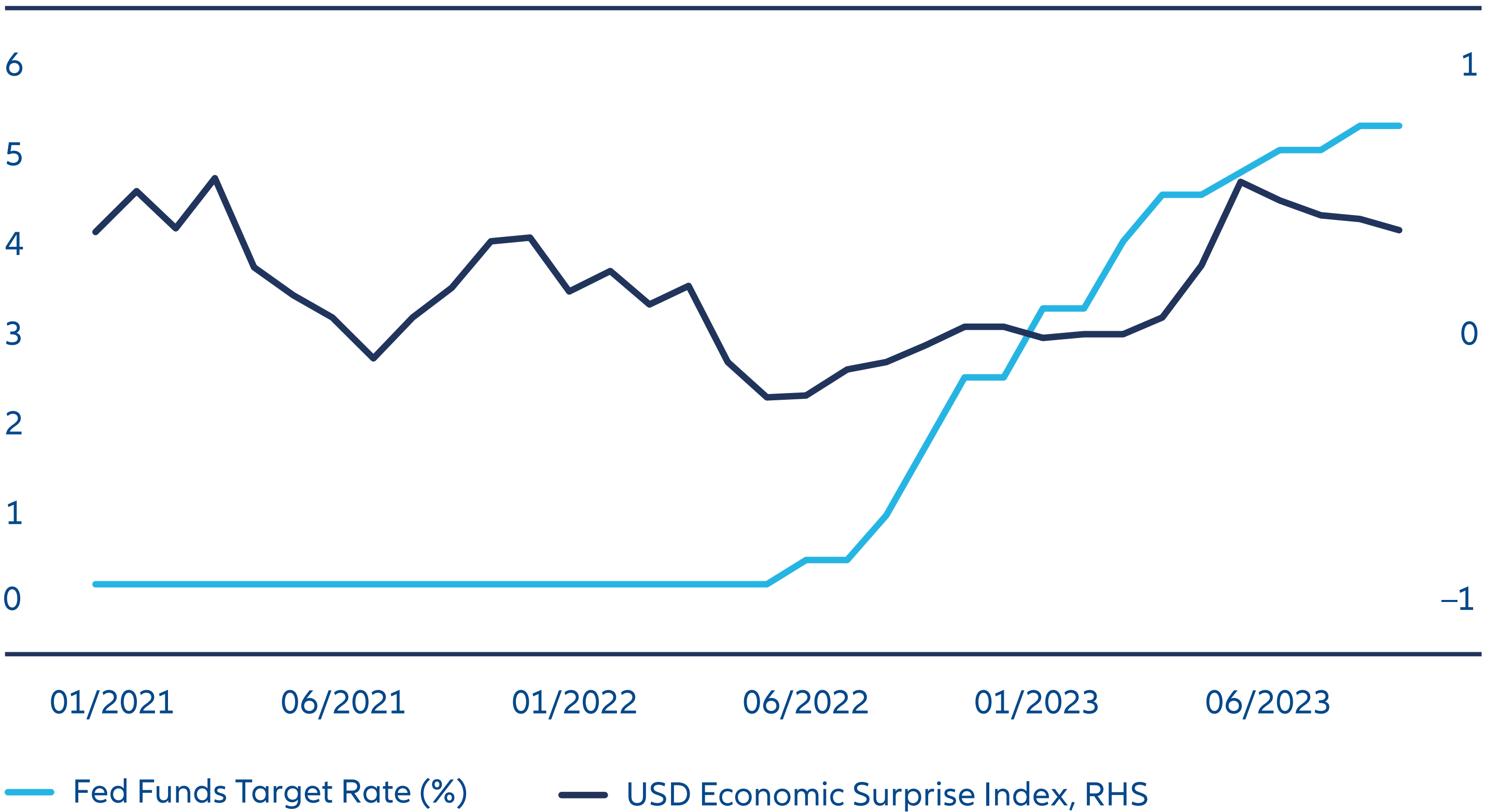

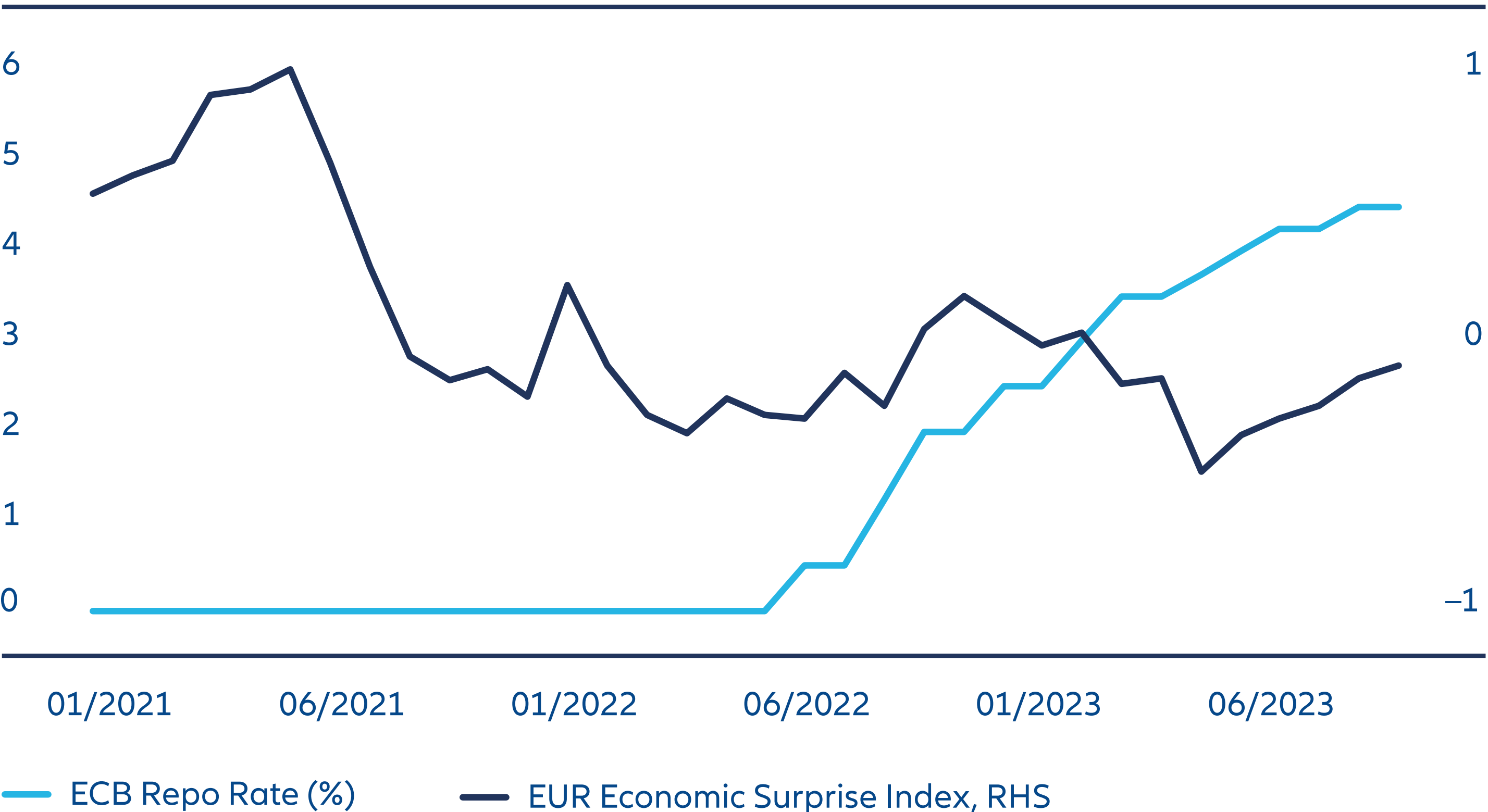

Perhaps the most marked difference in strategy can be seen between the US and the euro area (see Exhibits 1 and 2). Having been more aggressive than the European Central Bank (ECB) on rate hikes, the US Federal Reserve (Fed) slowed its pace of tightening over the summer even as the economy has shown signs of rebounding from its weakness at the turn of the year. By contrast, the ECB has extended its own tightening cycle in the face of sticky core inflation. Whereas the Fed appears happy to allow the economy to adjust steadily back towards target inflation, the ECB seems likely to adopt a more conservative approach to combatting inflation in the coming months.

Exhibit 1: US policy rates versus economic momentum

Source: Bloomberg, AllianzGI, data as at 31 October 2023. Past performance, or any prediction, projection or forecast, is not indicative of future performance

Exhibit 2: Euro area policy rates versus economic momentum

Source: Bloomberg, AllianzGI, data as at 31 October 2023. Past performance, or any prediction, projection or forecast, is not indicative of future performance.

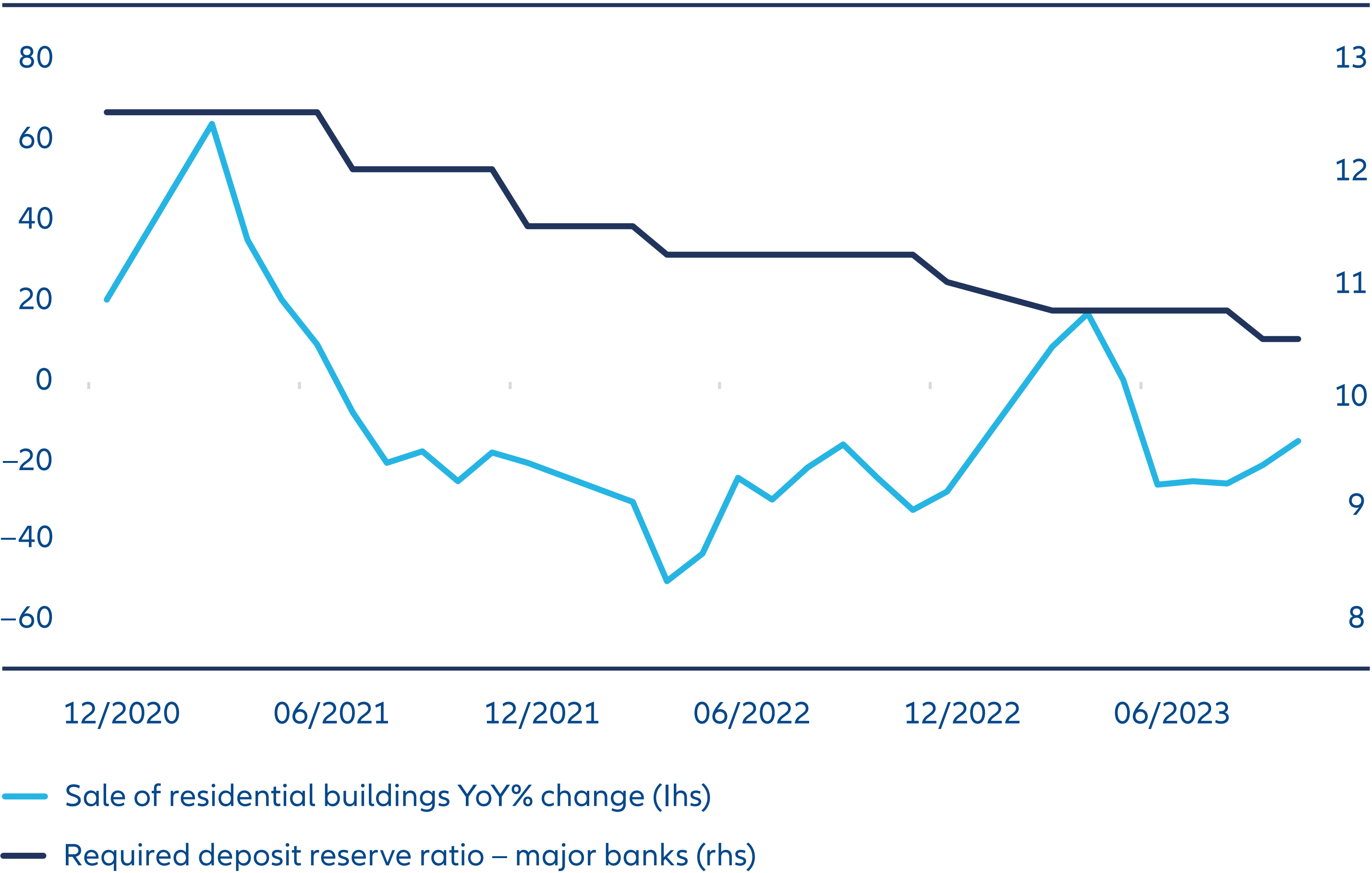

For China, the economic realities are such that the People’s Bank of China (PBOC) has been compelled to ease its monetary stance. China’s troubled property sector still accounts for about 25% of the country’s GDP, a clear indication that while prices have fallen meaningfully from their peak and sales have plunged (see Exhibit 3), there is still potential for further deleveraging. Paired with painful memories of the COVID-19 lockdowns, this has left Chinese investors in a confidence crisis, with savings rates increasing steadily as result. The PBOC and the Chinese authorities face a delicate balancing act: refocusing the economy on critical sectors such as technology, artificial intelligence and renewables while at the same time supporting the banking system, which will likely be expected to absorb some of the losses emanating from the property sector.

Exhibit 3: China residential property sales, required banking reserve ratio

Source: Bloomberg, AllianzGI, data as at 31 October 2023. Past performance, or any prediction, projection or forecast, is not indicative of future performance.

To have the US and Europe going through a desynchronised tightening cycle, while China is in pronounced easing mode, is a stark example of the greater economic divergence that we expect to see going forward. Geopolitical fragmentation, driven by the push for “onshoring” and the “localisation” of supply chains postpandemic, has the potential to fuel this economic decoupling further.

Looking ahead, we are conscious that regional divergence lends itself to greater performance dispersion in asset markets, which for multi asset investors is an opportunity to target pockets of outperformance. In fixed income, the sharp rate hike cycle has restored the appeal of safe haven segments such as US Treasuries. Government bond yields have touched multi-year highs on expectations that the Fed may keep interest rates higher for an extended period to fight inflation. With those expectations moderating but the risk of recession still present, we believe the backdrop is supportive for Treasuries. By contrast, US high yield spreads do not leave much room for protection if growth continues to deteriorate and volatility rises.

Asset class divergence: historical correlations to return as focus turns to growth

Diversification is a core principle of multi asset investing, but diversification is a greater benefit to portfolios when individual investment returns are not well correlated.

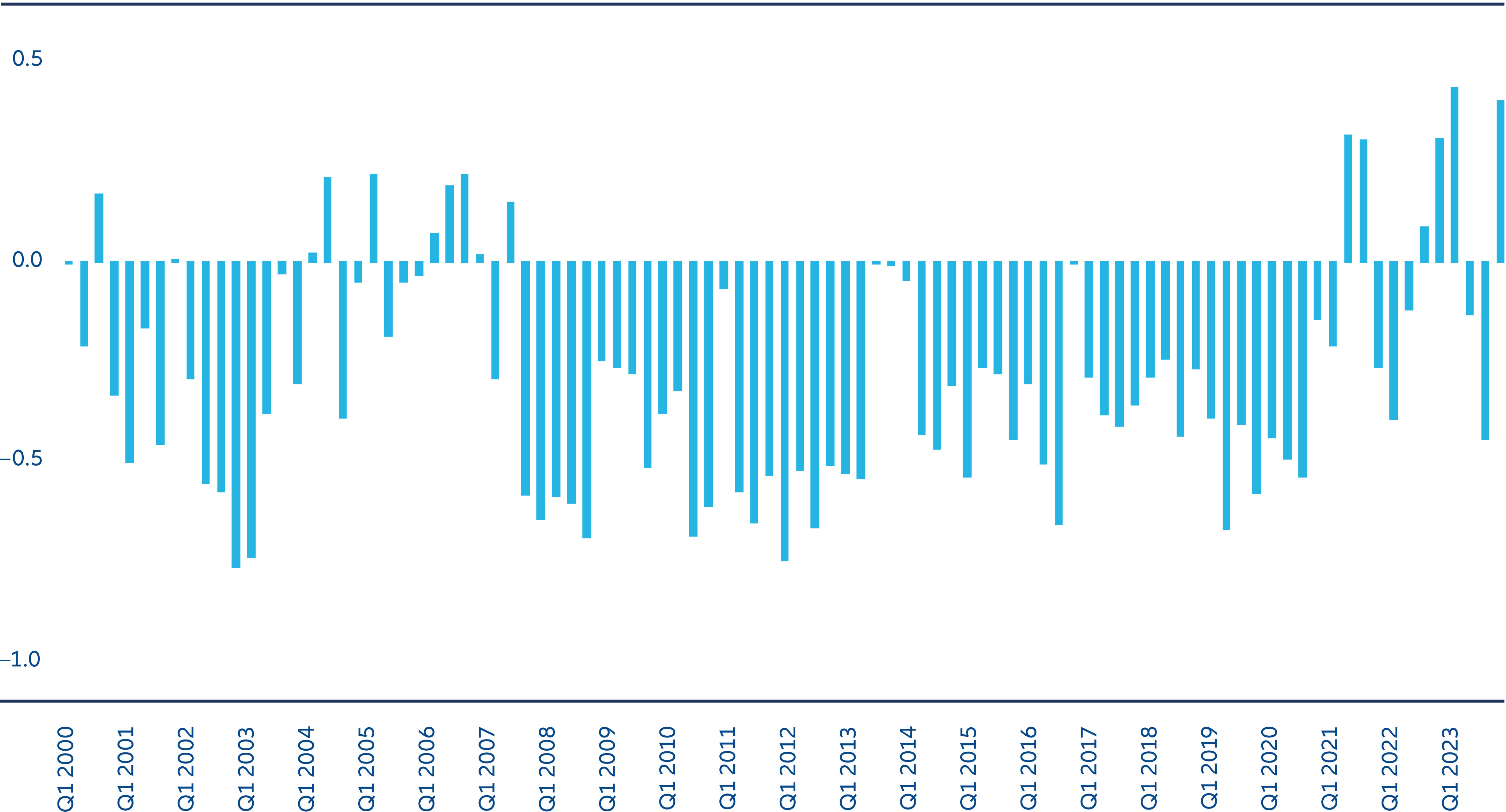

Since the turn of the millennium, the vast majority of individual quarters have seen negatively correlated returns between US bonds and US equities, leading to great diversification benefits for multi asset portfolios which tend to invest predominantly in these two asset classes. However, the recent central bank liquidity-driven bull markets of 2021, and the sharp market corrections of 2022, featured strong positive correlations between stocks and bonds (see Exhibit 4). This made finding opportunities for absolute returns a major challenge, even for very active and flexible multi asset investors. Naturally, multi asset investors have been excited by the re-emergence of negative correlations between stocks and bonds in 2023. However, the third quarter was once again characterised by positive correlations.

Exhibit 4: Quarterly correlations of US stocks and US bonds

Source: Bloomberg, AllianzGI, data as at 30 September 2023. Past performance, or any prediction, projection or forecast, is not indicative of future performance. Stocks represented by S&P 500 index, bonds by 10-year US Treasury future. Correlation calculated using the daily returns occurring in each quarter.

In our view, the recent positive correlations between stocks and bonds were largely driven by secular post-pandemic inflation risks and central bank actions that tended to push these markets in the same direction. With the inflation threat receding and central banks’ tightening cycle levelling off, we believe market participants’ focus will increasingly shift away from inflation data back to economic growth, which should mean markets follow more typical risk-on and risk-off patterns. This should result in correlations that are more in line with the environment observed pre-2020.

In 2023, the 60:40 portfolio – investing 60% in equities and 40% in bonds – has staged a modest comeback after one of the worst years in history in 2022 when both asset classes underperformed, challenging the notion that the split provides decorrelation benefits. But with risk assets (particularly equities) facing a potentially testing outlook, other asset allocations (such as 30:70) and less traditional asset classes, including commodities and certain private markets, could be more appropriate for the current environment.

Sector divergence: cautious on “magnificent 7”, positive on Japan, energy and banking

This new economic environment – with concerns around growth overtaking concerns around inflation and the path of interest rates – may lead to increasing divergence within asset classes as well as between them.

In equities, we see opportunities to target alpha through sector and stock selection. At the same time, we think monetary conditions could act as a trigger for revaluations in the coming months and quarters. While within our multi asset portfolios we are moderately constructive on equities overall, we tactically favour Japanese equities. Japanese companies are among the few in developed economies still receiving support from lower interest rates, a legacy of years battling deflation. With company earnings staying resilient thanks to positive macro data and corporate reforms, we think valuations are attractive at current levels.

We also hold a favourable outlook for equities in the energy, banking and basic materials sectors. For the energy sector, we observe a favourable mix of reasonable valuations, recent positive earnings revisions and strong momentum. In the banking sector we see attractive valuations supported by the increased earnings capacity afforded by higher interest rates. European banks seem less vulnerable than their US counterparts thanks to more stringent regulation post-2008, though the sector overall could face headwinds should the economic weakness in Europe persist for much longer than expected. For basic materials, we believe recession risks are priced in more adequately for this sector than others, and we observe long-term underinvestment and increasing demand in a world with growing reliance on electric vehicles.

By contrast, our multi asset portfolios have recently become more defensive on “magnificent 7” tech stocks given what we think are very rich valuations and their extreme concentration within the NASDAQ index. Tech’s impressive year-to-date rally (particularly in H1 2023) has been driven by hype around artificial intelligence (AI) and in particular the new generation of chatbots. History has demonstrated that the path from initial use cases to broad commercialisation can be marked by significant time lags, even though this time could be different thanks to the nowadays digitalised world. A crucial question arising in this context is which firms will be able to convert the expectation of an AI-driven productivity surge into near-term earnings potential.

Dynamic approach crucial amid uncertainty

Across the investment spectrum, we think a nuanced approach to asset selection will be important in the coming months and quarters. In an era where money has a cost again, not all assets will perform. The excess liquidity that has helped keep many assets buoyant since the global financial crisis is now retreating as central banks unwind stimulus. Geopolitical tensions provide a difficult backdrop as wars rage in the Middle East and Ukraine. Prolonged dollar strength in the face of sustained economic divergence as growth slows may also prove to be a stress inducer in a wide range of assets.

As a result, markets might still experience volatility spikes and diversification will be essential. Investors may need to be sufficiently agile to look for opportunities beyond the key pillars of fixed income and equities, as well as scrutinising the efficacy of a 60:40 portfolio against other asset mixes. During periods of elevated uncertainty, a dynamic approach will be important. That may mean scanning for equity and fixed income opportunities as valuations adjust, or building in protection by adding option strategies, allowing for short positions and liquid alternatives in case of sudden market movements – as offered by multi asset strategies.

However, we think the more balanced market environment is overall good news for multi asset strategies as we head into 2024. The long overdue reset of fixed income yields, combined with the likelihood of increased divergence by region, asset class and sector, may pave the way for a more active approach to asset management where opportunities for alpha may emerge.