Interpreting China

China Outlook – Navigating structural change

A great deal of recent coverage of China has been on its slower than expected economic recovery and the risk of deflation. The Politburo meeting in July originally ignited some hopes as it signaled a more supportive policy backdrop, but the subsequent equity rally was dampened by the news of the property developer Country Garden’s delayed coupon payment and Evergrande’s US bankruptcy filing. These events renewed concerns regarding the broader risk to China’s economy posed by the property sector.

Property – a sector set for structural decline

We understand why investors are concerned about the property sector as it accounts for a significant part of the Chinese economy. The worry is, following the longest downturn in housing prices on record, if the downward spiral between confidence and sales continues then the credit cycle will further deteriorate, and economic growth will suffer.

The challenge is how to strike a balance between boosting the property sector and avoiding fueling another asset bubble. While there is good reason for the Chinese government to be cautious in announcing a bazooka-like stimulus package that may rekindle leverage in the sector, the key now is nevertheless to deliver a clear signal with strong and meaningful support to turn around the market expectations and pull the housing market out of the downward spiral. The property sector has been instrumental to China’s economic success, but it is now set for a period of structural decline. This is largely a result of aging demographics and slowing growth in the urban population. In a nutshell, fewer houses are needed to support the population. From a long-term perspective, China needs to wean itself off the leverage-heavy housing sector and look towards a more diversified set of future growth drivers – in areas such as technology – and the further development of a more modern, self-sufficient manufacturing base.

In the near term, we do not expect an extreme downturn in the property market – we believe resources will continue to be mobilized to prevent this. For example, over the last two years, a number of concrete initiatives have been implemented to boost the ailing sector, such as lower mortgage rates, the easing of previous curbs on property transactions, and direct financing support for developers. As such, our view on the possibility of a major systemic risk to the overall economy remains low. In the medium- to longer-term, the question is whether, during the process of weaning off real estate, the country can successfully close the contribution gap between the housing market and other sectors.

Private and service sector in the spotlight

Private enterprise, and particularly the services sector, lies at the core of replacing property in China’s long-term growth ambitions. In our view, the private sector has an important role to play in correcting the structural imbalances in China – with the youth unemployment situation being of key concern. In the latest disclosure from National Bureau of Statistics of China, youth unemployment stood at 21% in June for ages 16-24, a number that will no longer be publicly reported given its pessimistic implications and a proclivity to misunderstanding given China’s nuanced reporting metrics.

While government support is part of the solution here, the private sector is critical in creating not just more jobs, but higher skilled and better paying jobs that appeal to China’s highly educated, young talent pool. China’s pivot to higher-value, more innovation-driven sectors will thus be key to addressing its challenges in the labour market, while at the same time boosting productivity and treading a sustainable growth path similar to that taken by Korea and Taiwan.

Over the last couple of months, policymakers have signaled a more supportive stance towards internet platforms, an area that is dominated by private entrepreneurs and a proven strength of China’s innovative and industrious minds. Indeed, by bolstering private entrepreneurs, not only in the internet sector, but also encouraging private entrepreneurs in innovation-related areas like new energy vehicles (NEVs), green energy and technology, biotech / drug innovations, and so on, China could see scalable productivity improvements that ultimately help boost sluggish growth across the entire economic value chain. This first needs to play out in the domestic market but could later also extend into global markets, as China is able to innovate and deliver products and services that satisfy the needs and wants of an increasingly connected global population.

Shadow banking and local government leverage

The recent report of missed payments for maturing trust products by Zhongrong Trust has triggered concern over contagion effects from the property situation to the broader economy. Trust products are a key component of Chinese shadow banking sector, which has been a source of financing for lower-quality developers and local government financing vehicles (LGFVs). Zhongrong Trust’s liquidity issues of may be related to the underlying assets of developer loans and the related financing difficulties of LGFVs.

Overall, China’s trust industry’s AUM is around RMB 21 trillion (EUR 2.6 trillion), with around 8% invested in real estate (RMB 1.7 trillion/EUR 214 billion) and around 11% is believed to be in LGFVs (RMB 2.2 trillion/ EUR 277 billion). While the trust industry is sizable, it represents only around 5% of China’s Rmb400trn financial system. Also, at this stage, the missed amount reported is not significant (RBM 90 million/EUR 11 million) when viewed in context. We believe the regulators have been monitoring the risks in the trust market and will help mitigate retail investors’ losses if needed.

The broader concern is on further financing difficulties for LGFVs if there are more trust product defaults. While we estimate that China’s local government debt reached RMB 108 trillion (EUR 13.6 trillion), or 90% of GDP as of end-2022, the silver lining is that central government leverage remains low. This could provide a thick buffer for local governments and households to repair their balance sheets. Another positive development on this topic was in the July Politburo meeting, where a major policy takeaway is a call for implementation of a comprehensive solution for local government debt, implying a shift of focus from previously addressing moral hazards for local officials to preventing a further crisis of confidence triggered by debt defaults.

The Chinese government will seek to create a strong and sustainable growth path that relies less on debt fuel. Indeed, meaning targeted measures that support the long-term transformation of both capital and property markets. Key here is what happens to excessive savings, with Chinese households currently sitting on a record pool of bank deposits – and this is linked to where confidence lies going forward.

Implications for the broader economy

China’s economic recovery will likely not progress in a straight line, and equity market volatility is set to continue. Despite this, we think the government is moving in the right direction, and we expect the trend towards recovery to continue, especially as more concrete government support measures are unfolded. Indeed, in our view, these measures will ultimately lead to significant improvements in market confidence.

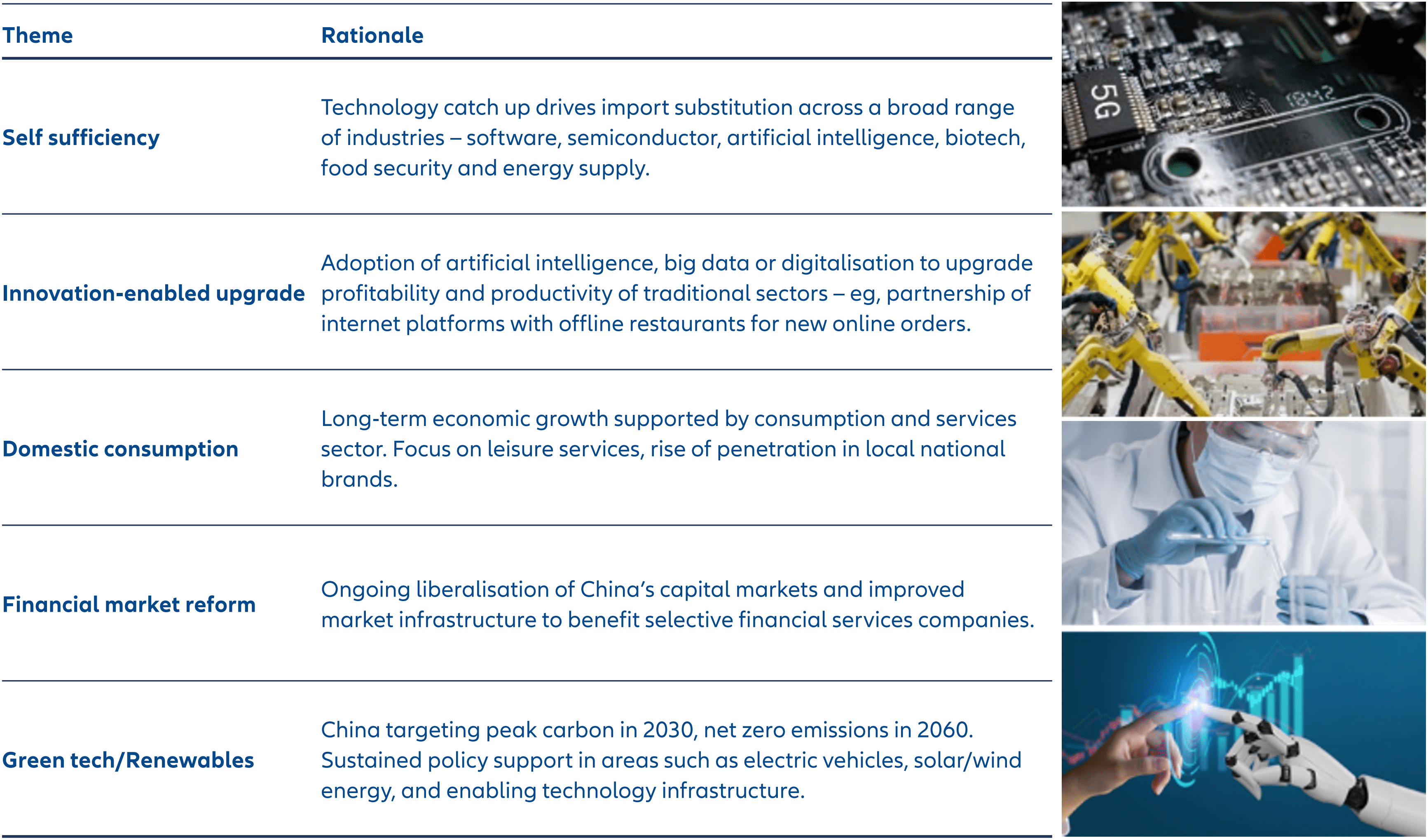

As investors, we continue to focus on those areas of the market where we find structural growth tailwinds. Despite macro headwinds in China, these areas are plentiful at the bottom-up level and include artificial intelligence (AI), big data & digitalization, electric vehicles (EVs), industrial upgrading, certain domestic consumption trends, beneficiaries of financial market reform, and green technology and renewables.

Valuations are hovering around depressed levels – the China A market is trading around 11.5x forward P/E relative to its 15-year average of 13.6x. The China offshore market is trading around 9.7x forward P/E relative to its 15-year average of 11.1x.1 As an active manager, this is certainly a time when we can take advantage of market weakness to build selective positions with medium- to longterm conviction. When so much of the market sells on sentiment, we maintain our focus on quality businesses that should be able to deliver sustainable earnings growth through the cycle and benefit from investments in innovation and productivity gains along the way.

Active management remains key as we look for bottom-up ideas in potential structural growth areas