Embracing Disruption

Breaking down India’s budget: Prioritizing long-term structural measures over short-term stimulus

The recently announced Fiscal Year 2025 (FY25) India budget demonstrates a commendable balance between fostering economic growth and maintaining fiscal prudence. This budget, unveiled amid global economic uncertainties, reflects the government’s strategic approach to ensuring long-term sustainable development while addressing immediate fiscal challenges. Concerns around potential populism and increased welfare payments following weaker-thanexpected election results for the Bharatiya Janata Party (BJP) were proven unfounded.

Positive surprise on fiscal prudence

One of the notable aspects of the FY25 budget is its fiscal prudence. The government has managed to strike a delicate balance between spending for growth and not expanding the fiscal deficit excessively. The projected fiscal deficit target for FY25 is set at 4.9% of GDP, which is tighter than the market had expected. This target is deemed achievable due to fiscal support of approximately INR 1.5 trillion (17.9 bn USD), primarily from an excess Reserve Bank of India (RBI) dividend of INR 1.2 trillion (14.3 bn USD) and better than expected tax buoyancy being experienced in recent quarters.

With the inclusion of India in JP Morgan’s global emerging markets bond index and associated inflow of capital, this further positive trend in the fiscal deficit creates an encouraging outlook for India’s cost of capital.

Increasing capital gains tax and mitigation of market speculation

Amidst ongoing efforts to simplify and rationalize tax rates, the budget introduced an increase in the long-term capital gains tax rate from 10% to 12.5%. This came as an unexpected development, especially given the revenue buoyancy and perceived benefits of long-term capital investment. Additionally, the short-term capital gains tax was raised from 15% to 20%.

Changes to capital gains tax reflect a concerted effort by policymakers to curb excessive speculative trading and prevent undue market volatility. India has witnessed a significant surge in derivative trading among retail investors, an unintended consequence of rising equity markets. Regulators and the government have expressed concerns regarding this trend, highlighting the potential risks of unchecked speculative activities. To address these concerns, an increase in the Securities Transaction Tax (STT) has been implemented. Given the policy papers on this subject, one should anticipate further steps to reinforce market stability and ensure a more balanced trading environment.

On a positive note, other tax changes include reductions in the corporate tax rate for foreign companies and the angel tax on startup investments for all classes of investors.

Accelerating economic growth: government’s medium-term focus announced

- Prioritizing productive capex over revenue expense

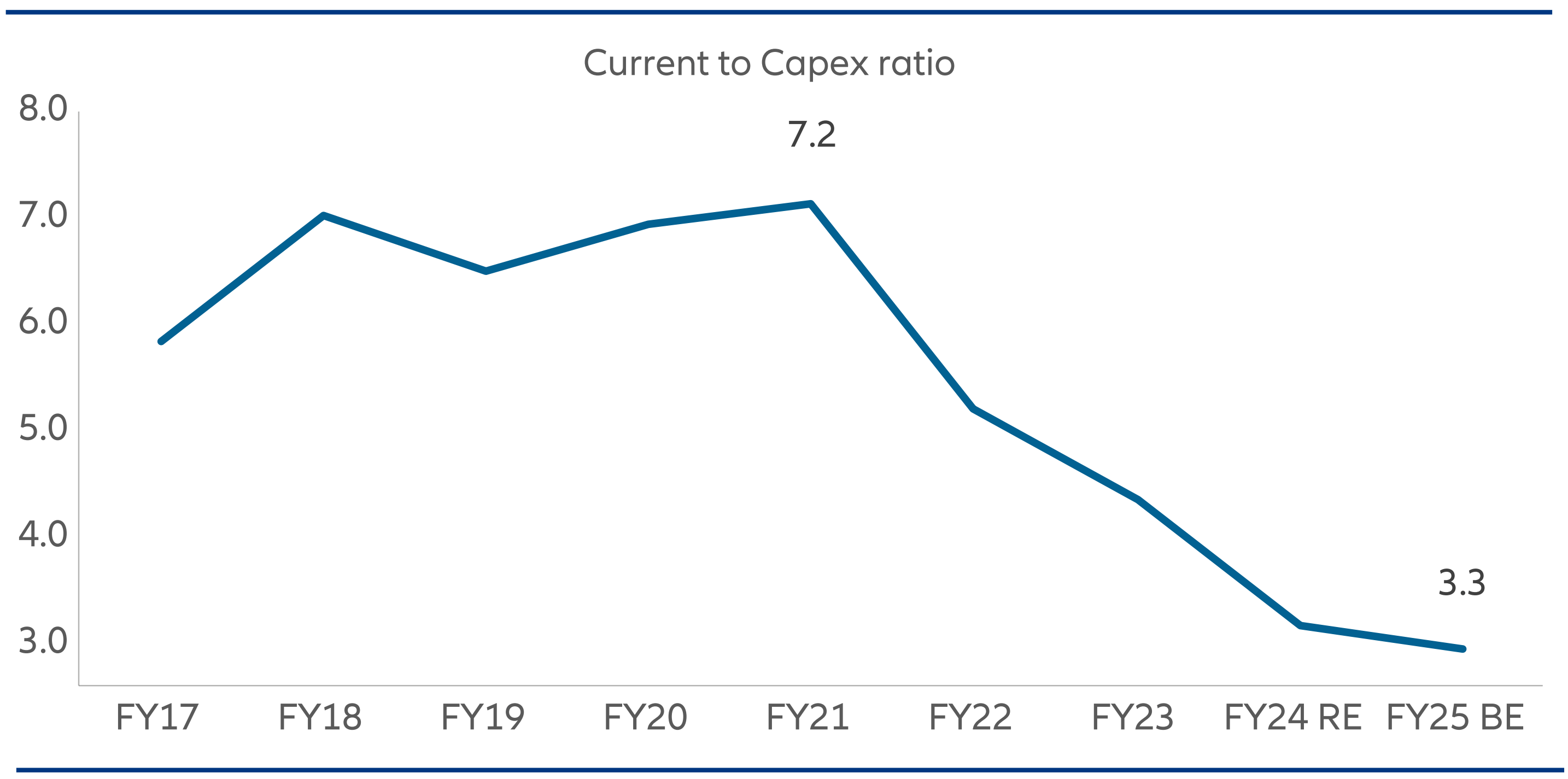

A significant highlight of the budget is the prioritization of productive capital expenditure (capex) over revenue expense. The capex allocation has been increased by 17.1% year-on-year, raising it to 3.4% of GDP in FY25. This focus on capex, which began back in FY20, is improving India’s quality of spend. State governments are also being encouraged to increase their capex through USD 18 billion in long-term interest-free loans.

The emphasis on modernizing infrastructure is particularly evident from the increase in allocations for railway and road capex. Another notable feature was the spotlight on newer industries like shipping and critical minerals - important areas where India can respond to global challenges around freight transit and the need for more renewable sources of energy.

Specifically on the environment, there were several mentions of sustainable development in the budget, supporting India’s ongoing climate commitments and green transition. This included the development of a taxonomy for climate finance to enhance the availability of capital for climate adaptation and mitigation, along with the formulation of a policy document on appropriate energy transition pathways that balance the imperatives of employment, growth, and environmental sustainability.

Improving quality of spend

Source: HSBC, as of 24 July 2024.

- Boosting production and partnerships

To invigorate the manufacturing sector, the budget has introduced several measures, including tax breaks for new manufacturing units. These incentives are designed to enhance production capacity, attract investment, and create job opportunities, thereby driving industrial growth. The emphasis on manufacturing is part of the broader strategy to make India a global manufacturing hub.

Parallel to this, the government emphasized a focus on developing investment-ready “plug and play” industrial parks with complete infrastructure in or near 100 cities, in partnership with state governments and the private sector. Private sector investment in infrastructure will be promoted through viability gap funding and enabling policies and regulations. A market-based framework will also be introduced to facilitate financing.

- Boosting consumption via income tax adjustments and job creation

The budget places a significant emphasis on employment and skilling programs as a means of boosting consumption in the long term. The Prime Minister’s package includes five schemes and initiatives to provide employment and upskilling opportunities to 41 million youths over five years with a central outlay of INR 2 trillion (USD 24 bn).

Scheme A provides a one-month salary of up to INR 15,000 (180 USD) in three installments to first-time employees registered in the Employees’ Provident Fund Organization (EPFO). Scheme B focuses on job creation in manufacturing, offering incentives for EPFO contributions for the first four years of employment. Scheme C supports employers by reimbursing EPFO contributions of up to INR 3,000 (36 USD) per month for two years for each additional employee hired.

Moreover, the government has allocated substantial resources to important education and training initiatives, with INR 1.48 trillion (17.7 bn USD) set aside for these areas. This includes a new centrally-sponsored skilling scheme to train 2 million youths over five years and upgrade 1,000 Industrial Training Institutes (ITIs). An internship program aims to provide opportunities for 10 million youths in 500 top companies over five years. These initiatives are designed to enhance the skill sets of the workforce, making them more competitive and employable, which in turn is expected to drive higher consumption as more individuals gain stable employment and higher incomes.

Furthermore, there are tweaks in income tax slabs and rebates, which will leave more money in the pockets of lower-income consumers. These adjustments include an increased standard deduction for salaried employees and enhancements in deductions on family pensions. By reducing the tax burden on lower-income groups, these measures aim to boost disposable incomes, encouraging higher spending and thus driving consumption growth. These strategic steps reflect a comprehensive approach to fostering long-term economic stability and growth by empowering consumers and enhancing their purchasing power.

Conclusion

The FY25 budget presents a spectrum of opportunities across various industries, driven by a strategic blend of fiscal prudence and growthoriented measures. We see stock-picking opportunities across diverse sectors as reforms accelerate recovery in traditional economic areas, while digitalization enhances productivity gains across consumer, corporate, and government enterprises. With consumption normalizing post-COVID and the economy on a path to recovery, the budget’s strategic measures are poised to support this positive momentum.

In summary, the FY25 budget reflects a prudent yet growthoriented approach, focusing on fiscal discipline, strategic capex investment, and targeted measures to boost production, employment, and consumption. These efforts collectively aim to steer the economy towards sustained recovery and long-term growth, positioning India favorably on the global economic stage.