2023 UK equity outlook: Go your own way

Key Takeaways

- UK equities remain cheap on an absolute basis and a relative basis to international sector peers

- This is even after a strong relative year in 2022, driven by the FTSE 100 Index’s tilt towards Energy, Defence and Consumer Staples

- In today’s lower growth and higher interest rate environment, we believe a value-driven approach to mispricing offers a clearer a source of alpha

- In 2023 we see opportunities in the small/mid cap segment given their poor performance in 2022 and the overly discounted nature of cyclical risk

- While many remain expensive, some higher quality/growth names have also excessively derated, offering an attractive risk/reward balance

A standout year for UK equities

It’s been a long time since the UK experienced a “normal” year. Britain’s decision to leave the European Union in 2016 has been variously followed by the prospect of a hard left-wing government, a global pandemic, a European land war and inflation’s vengeful return. Last year alone gave us three Prime Ministers and four Chancellors of the Exchequer. According to the International Monetary Fund, recession will compound these woes further in 2023, with a 0.6% hit to gross domestic product (GDP) meaning even Russia’s economy will outpace that of the UK1.

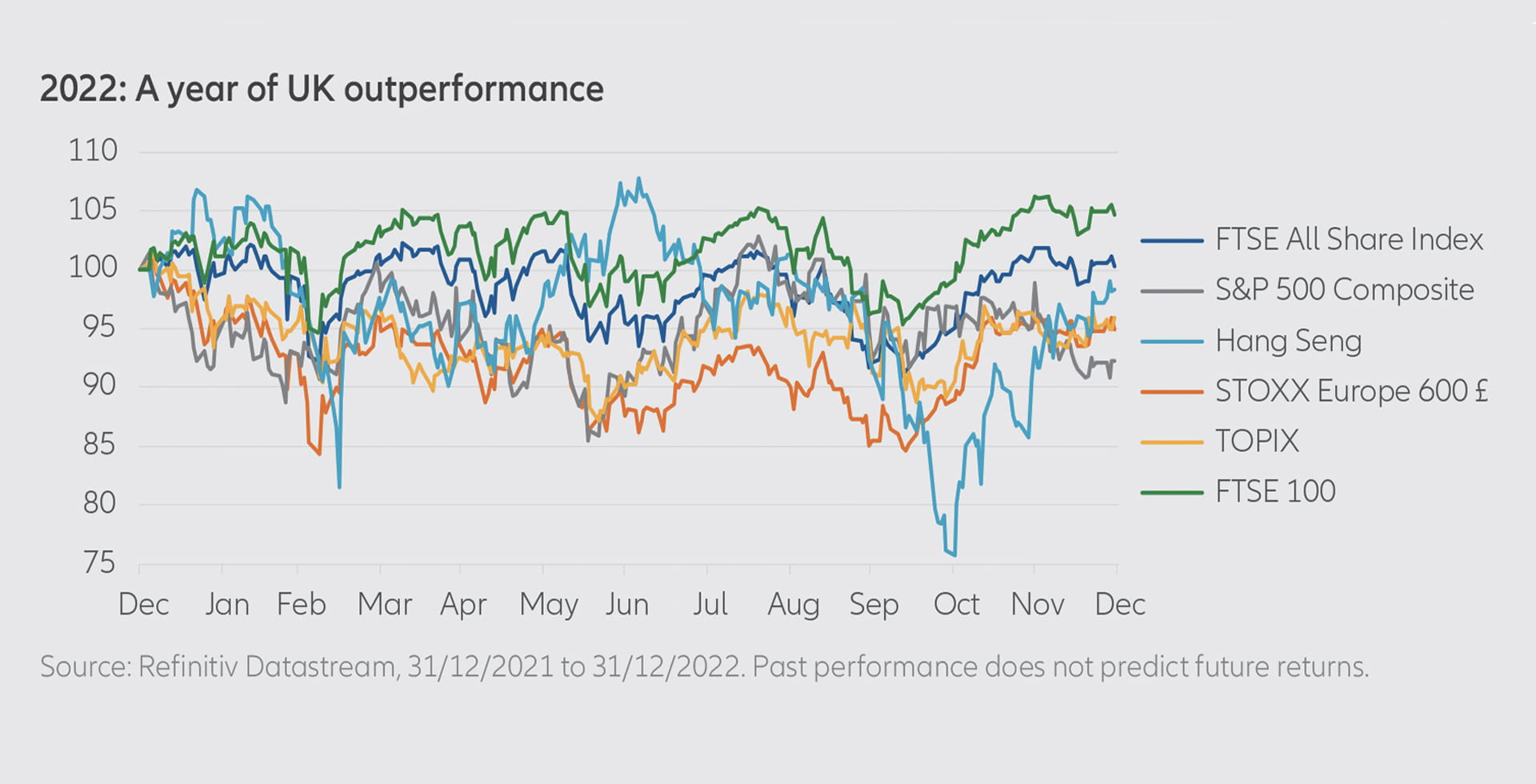

Yet last year, UK equities were one of the strongest performing at a regional level. In a year which saw the US’ S&P 500 Index, Europe’s STOXX 600 and Japan’s TOPIX deliver total returns of -9.0%, -5.0% and -4.4%2 respectively, the FTSE All Share Index was almost flat. The more internationally-focused FTSE 100 Index meanwhile actually managed a positive return, posting gains of 4.3% over the same period.

This divergence between news headlines and equity returns speaks to two features of the UK stock market which are typically overlooked. First, the UK stock market is not tied to the performance of the UK economy. Around 60% of the FTSE All Share Index’s revenues come from abroad, and last year’s weakening pound will have boosted any underlying earnings strength.

Second, the composition of the UK stock market is very different from most global markets. With 23% in Financials, 15% in Consumer Staples and 11% in Energy, the FTSE All Share was structurally well-positioned to benefit from a year that saw Russia invade Ukraine, while inflation drove up interest rates and pushed consumers to prioritise basic goods over more discretionary items.

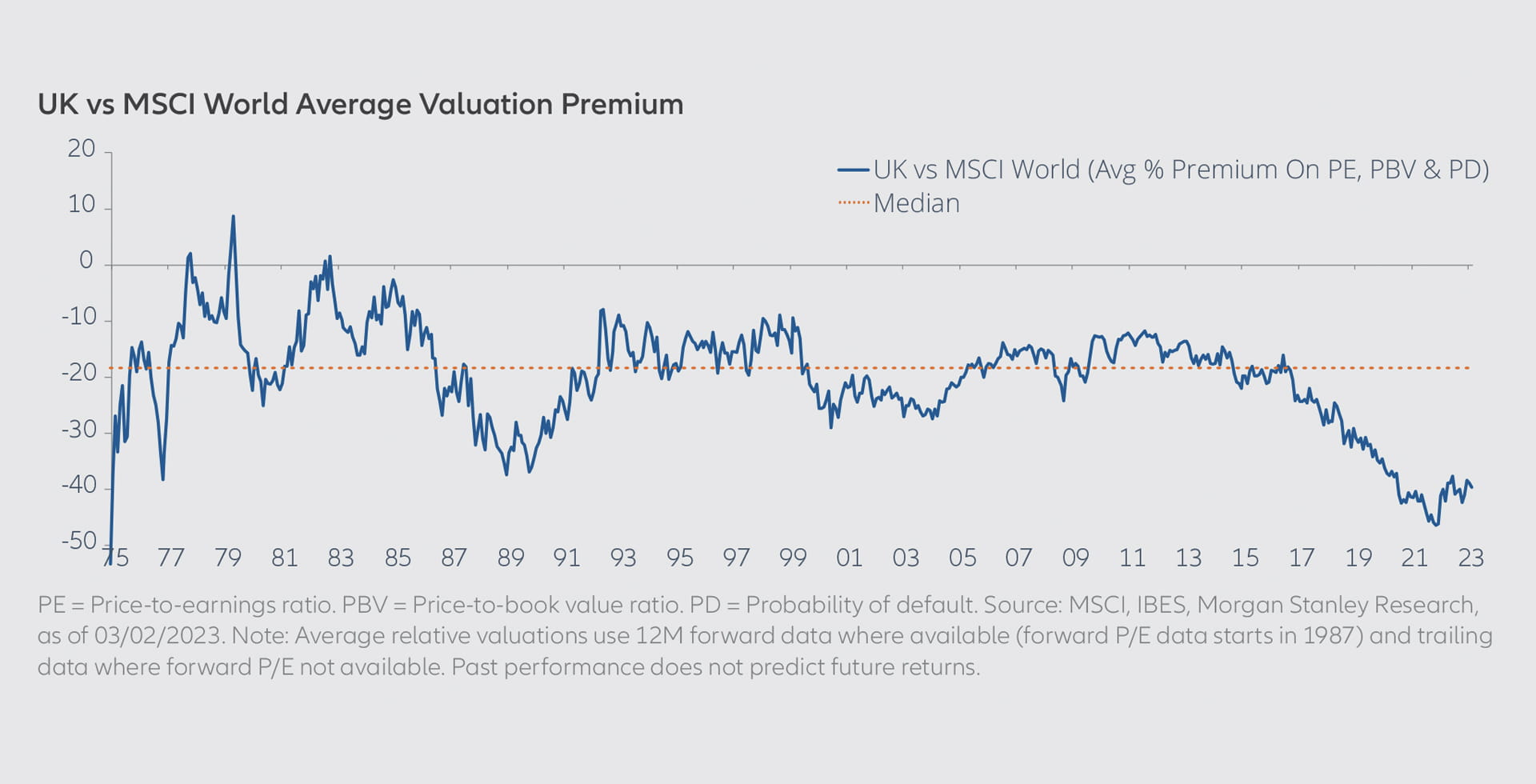

(Still) cheap at the price

This combination of recent socio-economic turmoil and unusual market structure means that, even after 2022’s relatively good performance, UK equities remain staggeringly cheap. This is true both in a relative and absolute sense. Taken as a whole, UK equities trade at a discount of c.40% relative to their MSCI World peers – see chart below.

By way of illustration, the UK-listed (but internationally operating) energy company Shell currently trades at a forward price-to-earnings (P/E) ratio ratio of around 6x. Its US peer Exxon, trades at almost double this, on 11x P/E. Shell is also widely regarded to be a leader in the energy transition among peers.

As investors with a value-driven approach, this can be both highly frustrating and a source of great opportunity. Many market participants are acutely focused on the short-term, often trading in baskets and extrapolating macro datapoints like inflation to make broad conclusions about entire sectors. What the Bank of England says about consumer spending can be a bigger driver of a company’s share prices than its own results. Having the courage of your convictions in such an environment can be tough.

Go your own way

However, at a time when economic growth is expected to slow globally (not just in the UK), exploiting market mispricing remains one of the few clear avenues to drive meaningful alpha generation. To unpack this, it is helpful to think about the constituent parts of a share price. At their most basic level, shares represent a claim on the residual profits (earnings) of a company. These are discounted to their net present value, such that the price is a multiple thereof. If share prices are to rise, either the pool of earnings that can be distributed to shareholders must grow, or the multiple investors are willing to pay for them must increase.

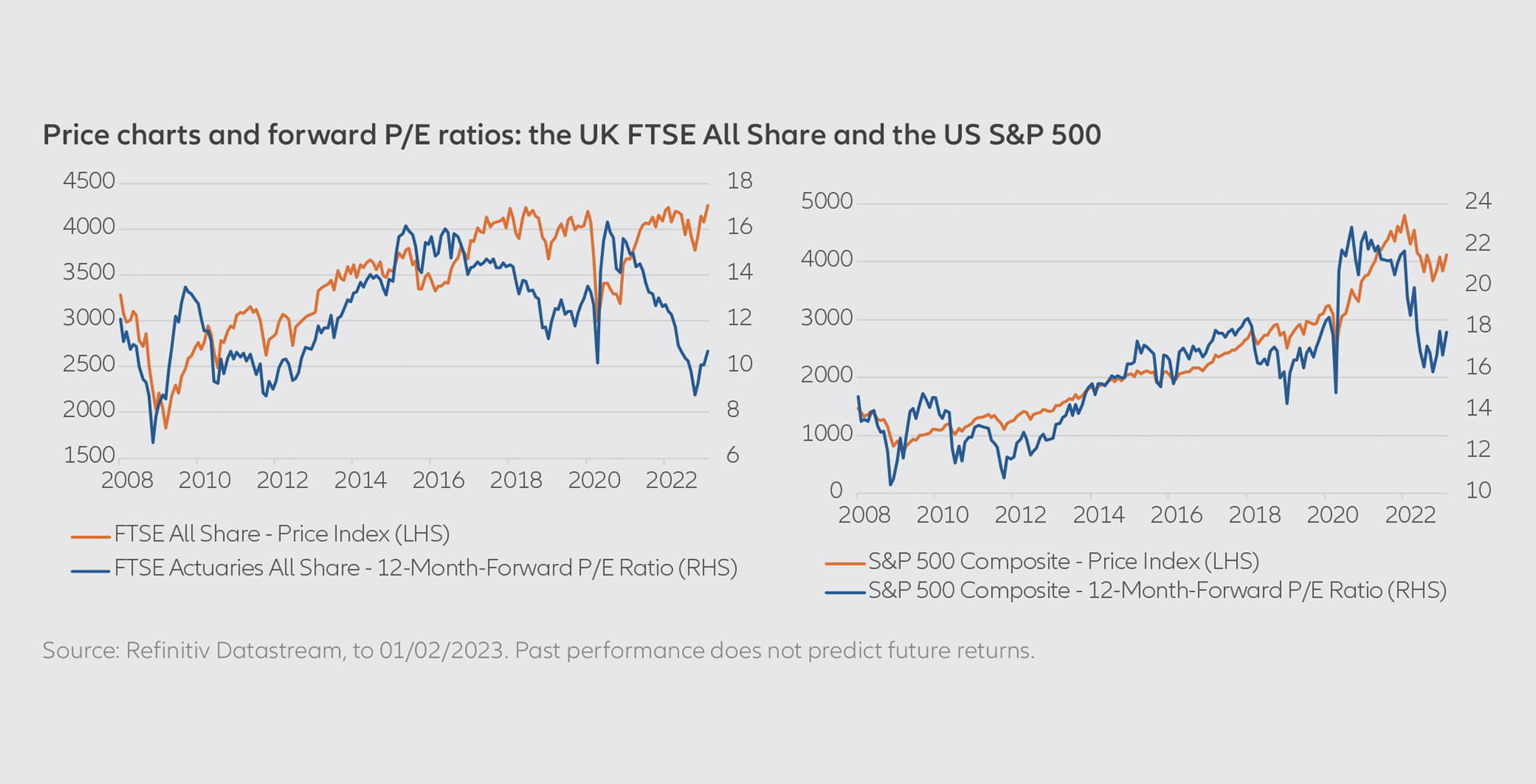

The bull market which followed the 2008 financial crisis saw both of these things happen. Recovering global economic growth and accommodative monetary policy meant investors had a good chance of buying a stock that could either grow its earnings or see its multiple inflate. The latter in particular, drove valuations upwards, especially for stocks with a high rate of growth. While the US S&P 500 became the poster child for expensive multiples, the UK also saw P/E ratios rise steadily up to 2016. Even after the Brexit vote, UK valuations remained at higher than historic levels. As the saying goes, a rising tide lifts all boats. Portfolios in turn could be rewarded for their exposure to the market as a whole (Beta), as much as idiosyncratic securities.

Fast forward to 2023 and the world is a very different place. Global economic growth is slowing. At the same time, monetary policy has tightened at its fastest rate in 40 years, and looks set to remain higher than at any point in the preceding decade, even if rates find a peak as expected relatively soon. The market has been paying ever higher multiples for company earnings, and investors cannot rely on either earnings or multiples continuing to grind upwards.

The price a stock picker pays today therefore, is of paramount importance. In the current environment, multiples can shrink and there is no guarantee that earnings will grow for the market in aggregate. By contrast, a stock whose valuation already overly discounts the earnings it generates today offers a clear path to outperformance: the multiple need only correct to reasonable compensation for the normalised earnings power, which in many cases today in the UK is an appreciation either to average valuations in the past or that of a group of peers.

However, neither our philosophy or process is designed around the assumption that the market will be characterised by more variable rates of growth and interest. Indeed, our track record has largely been generated against a significant headwind of market polarisation. Until 2022, investors appeared willing to pay ever high premiums for growth stocks, while the rest of the market languished on bargain multiples.

Uncut gems3

In UK equities at present, we have identified several clear areas of mispricing. The first is in small and mid-caps. This more domestic-facing segment of the market derated significantly in 2022, with some companies falling far beyond that which their fundamentals deserved. The package holiday company Jet2 for example, expects to deliver year on year revenue growth of 300% defying recessionary fears thanks to post-pandemic demand, while its operational advantages relative to peers has enabled it to sustain a net income margin of c.5%. The stock currently trades at a forward P/E of c.10x.

The second, almost polar opposite segment, is high quality, large cap companies with a track record of strong growth. While many quality growth darlings have derated due to the rising interest rate environment, some have seen this compounded further as a result of idiosyncratic issues. The consumer health giant Haleon for example, was spun out of GSK. Its shares fell sharply as residual holders exited their positions and short-sellers targeted the stock, alleging its involvement with Zantac (a treatment for stomach acid) posed significant litigation risk. At the time of purchase, we believed these concerns to be overstated and the stock has rallied strongly since. For a company targeting 4-6% sales long-term growth, as well as margin gains, a forward P/E of 17x continues to look compelling.

Finally, even after their strong performance last year, large weight sectors in the UK such as energy and banks continue to offer a strong balance of risk and reward. For example, stocks such as Shell and NatWest respectively, have been structurally under-owned for many years. A renewed focus on energy security and a higher interest rate regime has reversed this, at the same time as creating compelling margin expansion potential. For as long as these businesses trade at a discount to their fundamental value and global peers, meaningful upside remains on the table.

1. https://www.imf.org/en/Publications/WEO/Issues/2023/01/31/world-economic-outlook-update-january-2023.

2. All figures are total return, in GBP covering 31.12.2021 to 31.12.2022.

3. Source: Bloomberg estimates and company reports as of 31.01.2023.